~ Third Quarter Net Sales Increase 23.2% ~ LONG ISLAND CITY, N.Y.,

Nov. 1 /PRNewswire-FirstCall/ -- Steven Madden, Ltd. (NASDAQ:SHOO),

a leading designer and marketer of fashion footwear and accessories

for women, men and children, today announced financial results for

the third quarter and nine months ended September 30, 2006. Net

sales for the third quarter increased 23.2% to $123.2 million from

$100.1 million last year. Gross margin increased significantly to

41.4% from 35.2% in the comparable period last year, reflecting

margin improvement in both the wholesale and retail divisions.

Operating expenses were 26.8% of sales compared to 28.5% of sales

last year due to the Company's ability to leverage costs against

the increased sales base. Third quarter operating income grew to

$21.9 million, or 17.7% of sales, compared to $9.0 million, or 9.0%

of sales, last year. Net income increased to $12.6 million, or

$0.57 per diluted share, versus $5.5 million, or $0.26 per diluted

share, in the third quarter of fiscal 2005. Revenues from the

wholesale business were up 29.2% to $91.8 million from $71.0

million last year. The Company recorded particular strength in the

Steve Madden Women's and Steven by Steve Madden divisions, and also

benefited from sales contributions from the recently acquired

Daniel M. Friedman & Associates and the recently launched SM

New York division. Strong consumer demand for the Company's

products helped drive a 790 basis point improvement in wholesale

gross margin, which increased to 37.9% from 30.0% last year. Retail

revenues rose 8.4% to $31.5 million compared to $29.1 million last

year. The Company generated a 10.5% same store sales increase, on

top of a 12.3% increase last year. Retail gross margin increased to

51.7% from 48.1% last year, a 360 basis point improvement. During

the third quarter, the Company opened one and closed one retail

store, ending the quarter with 95 locations. For the first nine

months of fiscal 2006, net sales increased 27.0% to $361.1 million

from $284.4 million last year. Net income grew to $36.2 million, or

$1.64 per diluted share, compared to $11.8 million, or $0.57 per

diluted share, in the first nine months of fiscal 2005. "Our design

team, led by Steve, continued to deliver compelling, trend- right

product that fueled consumer demand and solidified the strength of

our brands in the marketplace. As a result, we delivered strong

sales growth in our wholesale and retail businesses as well as

substantial margin improvement, which resulted in record

bottom-line results in the third quarter," stated Jamieson Karson,

Chairman and Chief Executive Officer. "We also continued to

diversify our business and build a platform for future growth.

Specifically, we signed a license agreement for a collection of

Steve Madden and Steven by Steve Madden dresses, and our

subsidiary, Daniel M. Friedman & Associates, entered into a

licensing agreement to manufacture and distribute handbags and

belts under the Tracy Reese brand. We also continued to work on

developing and growing new wholesale divisions such as SM New York

and Natural Comfort." Arvind Dharia, Chief Financial Officer,

commented, "We continue to maintain a pristine balance sheet,

ending the quarter with $112.5 million in cash, cash equivalents,

and marketable securities, no debt, and $221.3 million in

stockholders' equity." Company Outlook Based upon results to-date,

the Company is increasing its outlook for the year and now

anticipates fiscal 2006 net sales will increase approximately 25%

to 26% over fiscal 2005. With respect to the bottom line, the

Company currently expects that earnings per diluted share will

range between $2.05 and $2.10. Based on current visibility, the

Company is estimating 2007 net sales will increase in the

mid-single digits on a percentage basis over 2006 and earnings per

diluted share will range between $2.20 and $2.30. Mr. Karson

stated, "As we announced in a separate press release today, our

Board of Directors has approved a special one-time dividend of

$1.00 per share. We are very pleased with our ability to return

value directly to our shareholders while at the same time

delivering record operating results and investing in future

growth." "We remain focused on executing the fundamentals that have

driven our business thus far," Mr. Karson concluded. "We will

continue our evolution into a global lifestyle branded company by

developing our existing license agreements as well as seeking

strategic new opportunities to leverage our strong brands. Most

importantly, we will remain focused on delivering the trend-right

footwear that is the core of our success." Conference Call

Information Interested shareholders are invited to listen to the

third quarter earnings conference call scheduled for today,

Wednesday, November 1, 2006, at 10 a.m. Eastern Time. The call will

be broadcast live over the Internet and can be accessed by logging

onto http://www.stevemadden.com/. An online archive of the

broadcast will be available within one hour of the conclusion of

the call and will be accessible until November 15, 2006.

Additionally, a replay of the call can be accessed by dialing

877-519-4471, passcode 8040947. A replay will be available one hour

after the completion of the call until November 8, 2006. Steven

Madden, Ltd. designs and markets fashion-forward footwear and

accessories for women, men and children. The shoes and accessories

are sold through company-owned retail stores, department stores,

apparel and footwear specialty stores, and online at

http://www.stevemadden.com/. The Company has several licenses for

its brands, including dresses, watches, outerwear, eyewear, girls

apparel, and hosiery and owns and operates 96 retail stores,

including its online store. The Company is also the licensee for

Candie's Footwear and UNIONBAY Men's Footwear, and through its

wholly-owned subsidiary, Daniel M. Friedman & Associates, is

the licensee for Betsey Johnson handbags and belts, Ellen Tracy

belts, and Tracy Reese handbags and belts. Statements in this press

release that are not statements of historical or current fact

constitute "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements involve known and unknown risks,

uncertainties and other unknown factors that could cause the actual

results of the Company to be materially different from the

historical results or from any future results expressed or implied

by such forward-looking statements. In addition to statements which

explicitly describe such risks and uncertainties readers are urged

to consider statements labeled with the terms "believes", "belief",

"expects", "intends", "anticipates" or "plans" to be uncertain and

forward-looking. The forward looking statements contained herein

are also subject generally to other risks and uncertainties that

are described from time to time in the Company's reports and

registration statements filed with the Securities and Exchange

Commission. STEVEN MADDEN LTD CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share data) - Unaudited Three Months

Ended Nine Months Ended Sep 30, Sep 30, Sep 30, Sep 30,

Consolidated: 2006 2005 2006 2005 Net Sales $123,240 $100,067

$361,055 $284,361 Cost of Sales 72,217 64,805 209,194 184,137 Gross

Profit 51,023 35,262 151,861 100,224 Commission and licensing fee

income 3,850 2,217 10,437 5,241 Operating Expenses 32,999 28,478

100,654 86,067 Impairment of cost in Excess of Fair Value of net

assets acquired 0 0 519 Income from Operations 21,874 9,001 61,644

18,879 Interest and other Income, Net 715 504 1,628 1,398 Income

Before provision for Income Taxes 22,589 9,505 63,272 20,277

Provision for Income Tax 9,942 3,992 27,069 8,516 Net Income

$12,647 $5,513 $36,203 $11,761 Basic income per share $0.61 $0.27

$1.74 $0.59 Diluted income per share $0.57 $0.26 $1.64 $0.57

Weighted average common shares outstanding - Basic 20,880 20,255

20,850 19,908 Weighted average common shares outstanding - Diluted

22,136 21,068 22,028 20,664 BALANCE SHEET HIGHLIGHTS Sep 30, 2006

Dec 2005 Sep 30, 2005 Consolidated Consolidated Consolidated

(Unaudited) (Unaudited) Cash and cash equivalents $43,356 $42,842

$55,081 Investment Securities 69,100 66,249 43,919 Total Current

Assets 202,561 140,972 146,558 Total Assets 264,779 211,728 203,868

Total Current Liabilities 39,984 26,906 21,204 Total Stockholder

Equity 221,260 182,065 180,291 DATASOURCE: Steven Madden, Ltd.

CONTACT: Ed Rosenfeld, Senior Vice President, Strategic Planning

& Finance of Steven Madden, Ltd., +1-718-446-1800; or Investor

Relations: Cara O'Brien, or Melissa Myron, both of Financial

Dynamics, +1-212-850-5600, for Steven Madden, Ltd. Web site:

http://www.stevemadden.com/

Copyright

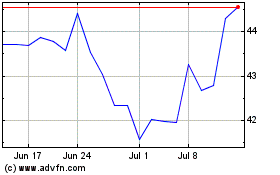

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jun 2024 to Jul 2024

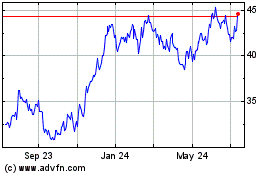

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jul 2023 to Jul 2024