- EPS Increased 51.4% to $0.39 - LONG ISLAND CITY, N.Y., Nov. 2

/PRNewswire-FirstCall/ -- Steven Madden, Ltd. (NASDAQ:SHOO), a

leading designer, wholesaler and marketer of fashion footwear for

women, men and children, today announced financial results for the

third quarter and nine months ended September 30, 2005. In line

with recently updated expectations, third quarter net sales

increased 12.9% to $100.1 million compared with $88.6 million

reported in the same period last year. The Company's overall gross

margin increased 70 basis points to 36.2% from 35.5% in the

comparable quarter last year. This reflects margin improvement in

nearly all wholesale divisions that was partially offset by a

planned margin decline in the retail division. Operating expenses

as a percent of sales also improved to 29.4% versus 30.2% in the

same period of last year. Taken together, this resulted in a 53.4%

increase in operating income to $9.0 million compared with $5.9

million in the same period last year. Net income increased 49.6% to

$5.5 million, or $0.39 per diluted share, versus $3.7 million, or

$0.26 per diluted share, in the prior year period. Revenues from

the wholesale division, comprised of the Company's six primary

brands, Steve Madden Womens, Steve Madden Mens, Stevies, l.e.i.,

Steven, and Candie's, increased 9.5% to $71.0 million for the

quarter compared to $64.9 million reported in the year-ago period.

During the quarter, retail revenues increased 22.3% to $29.1

million versus $23.8 million in the comparable period. Same-store

sales were up 12.3% for the quarter. The Company opened four new

stores and closed one permanent outlet store, ending the quarter

with 98 Company-owned retail locations, including the Internet

store. The Company remains on track to open a total of 12 stores

during fiscal 2005. For the first nine months of 2005, net sales

increased 12.1% to $284.4 million compared to $253.6 million in the

same period last year. Net income was $11.8 million, or $0.85 per

diluted share, versus $11.9 million, or $0.83 per diluted share, in

the comparable period last year. The Company separately announced

today that its Board of Directors has authorized a special one-time

dividend of $1.00 per outstanding share of common stock that will

be paid on November 23, 2005. "Our recent performance highlights

significant progress on initiatives to increase sales and improve

margins and profitability," stated Jamieson Karson, Chairman and

Chief Executive Officer. "Solid top line growth in both the

wholesale and retail divisions reflects the broad-based strength in

our business and our brand. These factors, coupled with our efforts

to improve operating efficiencies and inventory management during

the quarter, enabled us to deliver a significant increase in our

bottom line versus the prior year." Arvind Dharia, Chief Financial

Officer, said, "We continue to be very pleased with the strong

financial foundation that is in place. Our solid balance sheet

boasts $99.6 million in cash, cash equivalents, and investment

securities, no short- or long-term debt, and $180.3 million in

total stockholders' equity." With respect to the current outlook,

the Company anticipates annual 2005 net sales will increase in the

low double digits over 2004, based on strong year-to-date

performance across many of the Company's divisions and the

Company's expectations for the remainder of the year. The Company

also expects to achieve continued improvements in gross margin

reflecting better inventory management and lower inventory

markdowns. Taking these factors into account, the Company currently

anticipates that full year earnings will be between $1.20 and $1.22

per diluted share. Mr. Karson commented, "As we move into the final

quarter of fiscal 2005, we are confident that our business is in an

optimal position to achieve even further operating improvements and

overall growth. Further, as we announced in a separate press

release today, our Board of Directors has approved a special

one-time dividend which highlights the strength of our operations,

our solid financial foundation, and the fact that we remain keenly

focused on delivering enhanced value to our shareholders." The

Company also announced that Richard Olicker, President, will be

leaving the Company in conjunction with the expiration of his

employment agreement on December 31, 2005. The Company has

initiated a search to fill the role of President. However, as a

result of recent hires and internal promotions there is significant

breadth and depth in experience at the senior management level. The

current team is well positioned to absorb Mr. Olicker's

responsibilities in the near term and cover all management

functions of the business until a permanent replacement is named.

In particular, recently appointed Chief Operating Officer Awadhesh

Sinha will be responsible for operations across the Company's

various divisions and for generating additional efficiencies and

enhancements to the business model. Additionally, Amelia Newton,

recently named Executive Vice President of Wholesale Sales, will

continue to be responsible for managing the Company's wholesale

customer base as well as overseeing key accounts to improve

profitability. Mr. Karson concluded, "Richard has been a valued

collaborator and business partner during his five-year tenure at

Steven Madden, Ltd. His knowledge and management skills have added

significantly to the success of our Company and we thank him for

his contribution during a variety of transitions in the business

and through many industry challenges. We wish him great success in

his future endeavors. "We will now begin the search for a new

President, however, we are fortunate to have a strong and

experienced management team securely in place that will continue to

support, strengthen, and grow the business. As our recent

performance indicates, we are collectively achieving great success

and will remain focused on improving the profitability of our

various divisions, expanding and diversifying the business,

building the Steven Madden, Ltd. brand, and positioning the Company

for long-term success." Conference Call Information Interested

shareholders are invited to listen to the third quarter earnings

conference call scheduled for today, Wednesday, November 2, 2005 at

10:00 a.m. Eastern Time. The call will be broadcast live over the

Internet and can be accessed by logging onto:

http://phx.corporate-ir.net/phoenix.zhtml?p=irol-

eventDetails&c=113367&eventID=1146022 An online archive of

the broadcast will be available within one hour of the conclusion

of the call and will be accessible until November 16, 2005.

Additionally, a replay of the call can be accessed by dialing

877-519-4471, pin number 6663118 and will be available through

November 4, 2005. Steven Madden, Ltd. designs and markets

fashion-forward footwear for women, men and children. The shoes are

sold through Steve Madden retail stores, department stores, apparel

and footwear specialty stores, and on-line at

http://www.stevemadden.com/. The Company has several licenses for

the Steve Madden brand, including handbags, eyewear, hosiery, and

belts, and owns and operates 95 retail stores under its Steve

Madden brand and two retail stores under its Steven brand. The

Company is also the licensee for l.e.i. Footwear, Candie's Footwear

and UNIONBAY Men's Footwear. Statements in this press release that

are not statements of historical or current fact constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements involve known and unknown risks, uncertainties and other

unknown factors that could cause the actual results of the Company

to be materially different from the historical results or from any

future results expressed or implied by such forward-looking

statements. In addition to statements which explicitly describe

such risks and uncertainties readers are urged to consider

statements labeled with the terms "believes," "belief," "expects,"

"intends," "anticipates" or "plans" to be uncertain and

forward-looking. The forward looking statements contained herein

are also subject generally to other risks and uncertainties that

are described from time to time in the Company's reports and

registration statements filed with the Securities and Exchange

Commission. CONSOLIDATED STATEMENT OF OPERATIONS (in thousands,

except per share data) (unaudited) Three Months Ended Nine Months

Ended Sept 30, Sept 30, Sept 30, Sept 30, 2005 2004 2005 2004 Net

Sales $100,067 $88,610 $284,361 $253,612 Cost of sales 63,836

57,160 181,302 158,178 Gross profit 36,231 31,450 103,059 95,434

Commission and licensing fee income - net 2,217 1,175 5,241 3,224

Operating expenses 29,447 26,758 88,902 79,635 Impairment of cost

in excess of fair value of net assets acquired - - (519) - Income

from operations 9,001 5,867 18,879 19,023 Interest and other

income, net 504 488 1,398 1,497 Income before provision for income

tax 9,505 6,355 20,277 20,520 Provision for income tax 3,992 2,669

8,516 8,618 Net income $5,513 $3,686 $11,761 $11,902 Basic income

per share $0.41 $0.28 $0.89 $0.90 Diluted income per share $0.39

$0.26 $0.85 $0.83 Weighted average common shares outstanding -

Basic 13,503 13,177 13,272 13,243 Weighted average common shares

outstanding - Diluted 14,045 14,220 13,776 14,328 BALANCE SHEET

HIGHLIGHTS (in thousands) Sept 30, 2005 Dec 31, 2004 Sept 30, 2004

Consolidated Consolidated Consolidated (Unaudited) (Unaudited) Cash

and cash equivalents $55,708 $30,853 $18,128 Investment securities

43,919 49,124 50,408 Total current assets 146,558 121,094 112,445

Total assets 203,868 186,430 181,154 Total current liabilities

21,204 19,677 12,264 Total stockholder's equity $180,291 $164,665

$166,749 DATASOURCE: Steven Madden, Ltd. CONTACT: Ed Rosenfeld,

Vice President of Strategic Planning-Finance of Steven Madden,

Ltd., +1-718-446-1800; or Investor Relations, Cara O'Brien, or

Lauren Puffer, or Media, Melissa Merrill, all of Financial

Dynamics, +1-212-850-5600, for Steven Madden, Ltd. Web site:

http://www.stevemadden.com/

Copyright

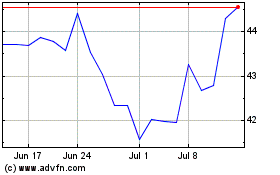

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jun 2024 to Jul 2024

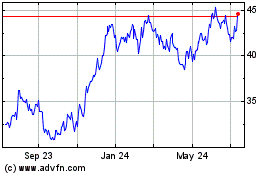

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jul 2023 to Jul 2024