Skyworks Expands Smartphone Content - Analyst Blog

August 22 2012 - 12:00PM

Zacks

Skyworks Solutions, Inc. (SWKS) has added more

content in its smartphone platforms based on its industry-leading

light emitting diode (LED) camera flash driver solutions.

There is a growing need for high

quality photographs among smartphone users, which in turn is

driving implementation of camera flash drivers in mobile devices.

These driver solutions from Skyworks enable longer battery life for

consumers along with a simplified design, reduced component count

and decreased overall solution size for Original Equipment

Manufacturers (OEMs).

According to research, mobile

phone cameras will grow to approximately 2.2 billion units by

2015 from 1.6 billion units in 2011.

Meanwhile, the colossal demand

for smartphones continues to drive momentum for Skyworks,

particularly at Nokia Corporation and Apple. Skyworks has

partnerships with leading smartphone vendors, such as RIMM,

Motorola and Samsung. With a diversified customer base, Skyworks is

strongly placed in this market.

Apart from smartphones, growth

will be propelled by high resolution tablets, USB modems, home

networks and yet-to-be-introduced Internet connective devices. The

rising RF dollar content and increasing complexity associated with

the proliferation of smartphones is fueling growth in the total

available market (TAM), providing a unique expansion opportunity

for Skyworks.

Management expects smartphone

adoption to increase in the developing countries, such as China and

India.

Earlier, Skyworks posted a net

income of $49.3 million or 26 cents per diluted share in the third

quarter of fiscal 2012, down from net income of $51.5 million or 27

cents per diluted share in the year-ago.

Excluding acquisition-related

charges but including stock-based compensation expense, Skyworks

reported net income of 35 cents per share, in line with the Zacks

Consensus Estimate.

However, earnings estimates have

been more or less static after the company reported third quarter

results. Hence, we maintain a Neutral recommendation on Skyworks.

Our recommendation is supported by a Zacks #3 Rank, which

translates into a short-term rating of Hold.

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

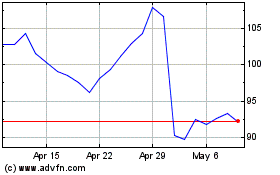

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Jun 2024 to Jul 2024

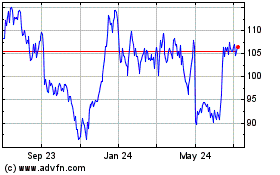

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Jul 2023 to Jul 2024