Skyworks Solutions, Inc. (NASDAQ: SWKS), an innovator of high

reliability analog and mixed signal semiconductors enabling a broad

range of end markets, today announced second fiscal quarter 2009

results. Revenue for the quarter was $173.0 million, a 14 percent

decrease from $201.7 million in the year-ago period and versus

guidance of $168.0 million.

Non-GAAP operating income was $21.2 million in the second fiscal

quarter with diluted earnings per share of $0.12, $0.02 better than

consensus estimates. On a GAAP basis, operating loss for the second

fiscal quarter was $3.7 million and diluted loss per share was

$0.03, including $19.4 million of previously disclosed charges

relating to the Company�s operating expense reduction

initiatives.

�Despite the challenging economic backdrop, Skyworks delivered

solid financial results in the second fiscal quarter of 2009 driven

by our diversification, scale advantages, fab-lite strategy and

improved cost structure,� said David J. Aldrich, president and

chief executive officer of Skyworks. �Offsetting general market

weakness, our performance was highlighted by strength in energy

management and smart grid technologies, China 3G base stations,

smart phones and push-to-talk applications. At a higher level, we

believe our results demonstrate that Skyworks is gaining share in

the broader analog semiconductor market and is creating a highly

differentiated business model.�

Business Highlights

- Maintained non-GAAP gross margin

of 40 percent (38 percent on a GAAP basis)

- Reduced operating expenses by

more than $25 million on an annualized basis

- Partnered with Itron, a leading

energy technology provider, to meet increasing demand for smart

meter technology

- Captured key design wins at

Huawei and ZTE for 3G and 4G base station solutions

- Unveiled a suite of low noise

amplifiers targeting ultra-high performance infrastructure, GPS and

satellite radio applications

- Supported an increasingly

popular e-book reading platform developed by one of the world�s

largest online retailers

- Expanded Qualcomm baseband

partnership leveraging higher value front-end modules and

encompassing a growing number of 2G, 3G and HSDPA reference

designs

- Named Supplier of the Year for

the second consecutive time by LG Electronics

Third Fiscal Quarter 2009 Outlook

�Although we remain cautious on the macro-economy, Skyworks

intends to resume top and bottom line growth in the current quarter

through share gains and participation in new markets,� said Donald

W. Palette, vice president and chief financial officer of Skyworks.

�Specifically, we expect June quarterly revenue to be up 5 percent

sequentially with expanding margins driving non-GAAP diluted

earnings per share of $0.14 - - - a 15 percent sequential

improvement in profitability.�

Estimated non-GAAP diluted earnings per share for the third

fiscal quarter excludes approximately $4.6 million of FASB

Statement No. 123(R) - related expenses.

Non-GAAP results, which are a supplement to financial results

based on GAAP, exclude certain charges including but not limited to

share-based compensation, business restructuring charges,

amortization of intangible assets, tax valuation allowance

reversals, and non-recurring items. The Company believes these

non-GAAP financial measures provide useful information to both

management and investors by excluding certain charges and

non-recurring items that may not be indicative of Skyworks� ongoing

operations and financial performance.

Skyworks' Second Fiscal Quarter 2009 Conference Call

Skyworks will host a conference call with analysts to discuss

its second fiscal quarter 2009 results and business outlook today

at 5:00 p.m. Eastern Daylight Time (EDT). To listen to the

conference call via the Internet, please visit the investor

relations section of Skyworks' Web site. To listen to the

conference call via telephone, please call 888-397-5350 (domestic)

or 719-325-2208 (international), confirmation code: 5805435.

Playback of the conference call will begin at 9:00 p.m. EDT on

April 23, and end at 9:00 p.m. EDT on April 30. The replay will be

available on Skyworks' Web site or by calling 888-203-1112

(domestic) or 719-457-0820 (international), pass code: 5805435.

About Skyworks

Skyworks Solutions, Inc. is an innovator of high reliability

analog and mixed signal semiconductors. Leveraging core

technologies, Skyworks offers diverse standard and custom linear

products supporting automotive, broadband, cellular infrastructure,

energy management, industrial, medical, military and mobile handset

applications. The Company�s portfolio includes amplifiers,

attenuators, detectors, diodes, directional couplers, front-end

modules, hybrids, infrastructure RF subsystems,

mixers/demodulators, phase shifters, PLLs/synthesizers/VCOs, power

dividers/combiners, receivers, switches and technical ceramics.

Headquartered in Woburn, Mass., Skyworks is worldwide with

engineering, manufacturing, sales and service facilities throughout

Asia, Europe and North America. For more information, please visit

Skyworks� Web site at: www.skyworksinc.com.

Safe Harbor Statement

This news release includes "forward-looking statements" intended

to qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include information relating to future

results and expectations of Skyworks (including certain projections

and business trends). Forward-looking statements can often be

identified by words such as "anticipates," "expects," "forecasts,"

"intends," "believes," "plans," "may," "will," "continue," similar

expressions, and variations or negatives of these words. All such

statements are subject to certain risks and uncertainties that

could cause actual results to differ materially and adversely from

those projected, and may affect our future operating results,

financial position and cash flows.

These risks and uncertainties include, but are not limited to:

unprecedented uncertainty regarding global economic and financial

market conditions; the susceptibility of the wireless semiconductor

industry and the markets addressed by our, and our customers',

products to economic downturns; the timing, rescheduling or

cancellation of significant customer orders and our ability, as

well as the ability of our customers, to manage inventory; losses

or curtailments of purchases or payments from key customers, or the

timing of customer inventory adjustments; changes in laws,

regulations and/or policies in the United States that could

adversely affect financial markets and our ability to raise

capital; our ability to develop, manufacture and market innovative

products in a highly price competitive and rapidly changing

technological environment; economic, social and political

conditions in the countries in which we, our customers or our

suppliers operate, including security and health risks, possible

disruptions in transportation networks and fluctuations in foreign

currency exchange rates; fluctuations in our manufacturing yields

due to our complex and specialized manufacturing processes; delays

or disruptions in production due to equipment maintenance, repairs

and/or upgrades; our reliance on several key customers for a large

percentage of our sales; fluctuations in the manufacturing yields

of our third party semiconductor foundries and other problems or

delays in the fabrication, assembly, testing or delivery of our

products; the availability and pricing of third party semiconductor

foundry, assembly and test capacity and raw materials; our ability

to timely and accurately predict market requirements and evolving

industry standards, and to identify opportunities in new markets;

uncertainties of litigation, including potential disputes over

intellectual property infringement and rights, as well as payments

related to the licensing and/or sale of such rights; our ability to

rapidly develop new products and avoid product obsolescence; our

ability to retain, recruit and hire key executives, technical

personnel and other employees in the positions and numbers, with

the experience and capabilities, and at the compensation levels

needed to implement our business and product plans; lengthy product

development cycles that impact the timing of new product

introductions; unfavorable changes in product mix; the quality of

our products and any remediation costs; shorter than expected

product life cycles; problems or delays that we may face in

shifting our products to smaller geometry process technologies and

in achieving higher levels of design integration; and our ability

to continue to grow and maintain an intellectual property portfolio

and obtain needed licenses from third parties, as well as other

risks and uncertainties, including but not limited to those

detailed from time to time in our filings with the Securities and

Exchange Commission.

These forward-looking statements are made only as of the date

hereof, and we undertake no obligation to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise.

Note to Editors: Skyworks, Skyworks Solutions are trademarks or

registered trademarks of Skyworks Solutions, Inc. or its

subsidiaries in the United States and in other countries. All other

brands and names listed are trademarks of their respective

companies.

SKYWORKS SOLUTIONS, INC. UNAUDITED CONSOLIDATED STATEMENT

OF OPERATIONS � � � � � � � � � � � Three Months Ended Six

Months Ended � � April 3, March 28, April 3, March 28, (in

thousands, except per share amounts) 2009 � 2008 � 2009 � 2008 �

Net revenues $ 172,990 $ 201,708 $ 383,218 $ 412,241 Cost of goods

sold 108,115 � 121,341 � 234,476 � 249,536 � Gross profit 64,875

80,367 148,742 162,705 � Operating expenses: Research and

development 28,596 36,581 63,240 70,675 Selling, general and

administrative 22,794 23,346 49,895 48,633 Restructuring &

other charges 15,982 - 15,982 - Amortization of intangibles 1,246 �

1,871 � 2,395 � 3,803 � Total operating expenses 68,618 61,798

131,512 123,111 � Operating (loss) income (3,743 ) 18,569 17,230

39,594 � Interest expense (808 ) (1,769 ) (1,947 ) (3,977 ) Gain on

early retirement of convertible debt - - 2,035 - Other (expense)

income, net (13 ) 1,883 � 1,389 � 3,933 � (Loss) income before

income taxes (4,564 ) 18,683 18,707 39,550 Provision for income

taxes 25 � 2,010 � 1,272 � 3,799 � Net (loss) income $ (4,589 ) $

16,673 � $ 17,435 � $ 35,751 � � Earnings per share: Basic $ (0.03

) $ 0.10 $ 0.11 $ 0.22 Diluted $ (0.03 ) $ 0.10 $ 0.11 $ 0.22

Weighted average shares: Basic 165,997 161,165 165,426 160,742

Diluted 165,997 162,982 165,981 162,740

SKYWORKS SOLUTIONS,

INC. UNAUDITED RECONCILIATION OF NON-GAAP MEASURES � � �

� � � � � � � � � Three Months Ended Six Months Ended � � April 3,

March 28, April 3, March 28, (in thousands) 2009 2008 2009 2008 �

GAAP gross profit $ 64,875 $ 80,367 $ 148,742 $ 162,705

Share-based compensation expense

(a)

828 677 1,737 1,511

Cost of goods sold adjustments

(d)

3,458 - 3,458 -

Acquisition related expense

(c)

- � 336 � - � 951 � Non-GAAP gross profit $ 69,161 � $ 81,380 � $

153,937 � $ 165,167 � � Non-GAAP gross margin % 40.0 % 40.3 % 40.2

% 40.1 % � � � � � � � � Three Months Ended Six Months Ended �

April 3, March 28, April 3, March 28, (in thousands) 2009 2008 2009

2008 � GAAP operating (loss) income $ (3,743 ) $ 18,569 $ 17,230 $

39,594

Share-based compensation expense

(a)

4,264 5,643 10,853 10,650

Cost of goods sold adjustments

(d)

3,458 - 3,458 -

Selling, general and

administrative adjustments (b)

(150 ) (502 ) (399 ) (502 )

Acquisition related expense

(c)

- 336 - 951

Amortization of intangible assets

(c)

1,246 1,871 2,395 3,803 Deferred executive compensation 163 - 326 -

Restructuring & other charges

(d)

15,982 � - � 15,982 � - � Non-GAAP operating income $ 21,220 � $

25,917 � $ 49,845 � $ 54,496 � � � � � � � � � Three Months Ended

Six Months Ended � April 3, March 28, April 3, March 28, (in

thousands) 2009 2008 2009 2008 � GAAP net (loss) income $ (4,589 )

$ 16,673 $ 17,435 $ 35,751

Share-based compensation expense

(a)

4,264 5,643 10,853 10,650

Cost of goods sold adjustments

(d)

3,458 - 3,458 -

Selling, general and

administrative adjustments (b)

(150 ) (502 ) (399 ) (502 )

Acquisition related expense

(c)

- 336 - 951

Amortization of intangible assets

(c)

1,246 1,871 2,395 3,803 Deferred executive compensation 163 - 326 -

Restructuring & other charges

(d)

15,982 - 15,982 -

Gain on early retirement of

convertible debt (e)

- - (2,035 ) -

Tax adjustments (f)

(369 ) 1,313 � (369 ) 2,534 � Non-GAAP net income $ 20,005 � $

25,334 � $ 47,646 � $ 53,187 � � � � � � � � � Three Months Ended

Six Months Ended � April 3, March 28, April 3, March 28, 2009 2008

2009 2008 � GAAP net (loss) income per share, diluted $ (0.03 ) $

0.10 $ 0.11 $ 0.22

Share-based compensation expense

(a)

0.02 0.04 0.06 0.07

Cost of goods sold adjustments

(d)

0.02 - 0.02 -

Selling, general and

administrative adjustments (b)

- - - (0.01 )

Acquisition related expense

(c)

- - - 0.01

Amortization of intangible assets

(c)

0.01 0.01 0.01 0.02

Restructuring & other charges

(d)

0.10 - 0.10 -

Gain on early retirement of

convertible debt (e)

- - (0.01 ) -

Tax adjustments (f)

- � 0.01 � - � 0.02 � Non-GAAP net income per share, diluted $ 0.12

� $ 0.16 � $ 0.29 � $ 0.33 �

(a)

�

These charges represent expense

recognized in accordance with FASB Statement No. 123(R),

Share-Based Payment. Approximately $0.8 million, $1.2 million and

$2.3 million were included in cost of goods sold, research and

development expense and selling, general and administrative

expense, respectively, for the three months ended April 3, 2009.

Approximately $1.7 million, $2.8 million and $6.3 million were

included in cost of goods sold, research and development expense

and selling, general and administrative expense, respectively, for

the six months ended April 3, 2009.

� For the three months ended March 28, 2008, approximately $0.7

million, $2.6 million and $2.3 million were included in cost of

goods sold, research and development expense and selling, general

and administrative expense, respectively. For the six months ended

March 28, 2008, approximately $1.5 million, $3.8 million and $5.3

million were included in cost of goods sold, research and

development expense and selling, general and administrative

expense, respectively. �

(b)

On October 2, 2006, the Company announced that it was exiting its

baseband product area. For the three months and six months ended

April 3, 2009, selling, general and administrative adjustments of

$0.2 million and $0.4 million, respectively, represent a recovery

of bad debt expense on specific accounts receivable associated with

baseband product. � For the three months and six months ended March

28, 2008, selling, general and administrative adjustments of $0.5

million represent a recovery of bad debt expense on specific

accounts receivable associated with baseband product. �

(c)

During the first quarter of fiscal 2008, Skyworks acquired

Freescale Semiconductor's power amplifier and front-end module

product line. The purchase accounting charges recognized during the

three months ended April 3, 2009 include $0.6 million amortization

of acquisition related intangibles. Amortization expense of $0.6

million primarily relates to a previous business combination. � The

purchase accounting charges recognized during the six months ended

April 3, 2009 include $1.2 million amortization of acquisition

related intangibles. Amortization expense of $1.2 million primarily

relates to a previous business combination. � The purchase

accounting charges recognized during the three months ended March

28, 2008 include $1.6 million amortization of acquisition related

intangibles. Of the $1.6 million, $0.3 million was included in cost

of sales. Amortization expense of $0.6 million relates to a

previous business combination. � The purchase accounting charges

recognized during the six months ended March 28, 2008 include a

$0.6 million charge to cost of sales related to the sale of

acquisition related inventory and $2.9 million amortization of

acquisition related intangibles. Of the $2.9 million, $0.3 million

was included in cost of sales. Amortization expense of $1.2 million

relates to a previous business combination. �

(d)

On January 22, 2009, the Company implemented a restructuring plan

to realign its costs given current business conditions. The plan

reduced global headcount by approximately 4%, or 150 employees. �

The total charges related to the plan were $19.4 million. Due to

accounting classifications, the charges associated with the plan

are recorded in various lines and are summarized as follows: � Cost

of goods sold adjustments include approximately $3.5 million of

inventory write-downs. � Restructuring and other charges primarily

consisted of $4.5 million related to severance and benefits, $5.6

million related to the impairment of long-lived assets, $2.0

million related to lease obligations, $2.3 million related to the

impairment of technology licenses and design software and $1.5

million related to other charges. �

(e)

The gain recorded during the first quarter of fiscal 2009 relates

to the early retirement of $40.5 million of the Company's 1.50%

convertible subordinated notes. The notes were retired at a gain of

approximately $2.9 million offset by a $0.9 million write-off of

deferred financing costs. �

(f)

During the three months and six months ended April 3, 2009, this

charge primarily relates to the Company's application of its annual

cash tax rate to non-GAAP income. � During the three months and six

months ended March 28, 2008, these charges primarily represent a

non-cash tax charge related to the utilization of pre-merger

deferred tax assets. � �

�

The above non-GAAP measures are

based upon our unaudited consolidated statements of operations for

the periods shown. These non-GAAP financial measures are provided

to enhance the user's overall understanding of our current

financial performance and our prospects for the future.

Specifically, we believe the non-GAAP financial measures provide

useful information to both management and investors by excluding

certain charges and non-recurring items that we believe are not

indicative of our ongoing operations and financial performance.

Additionally, since we have historically reported non-GAAP results

to the investment community, the inclusion of non-GAAP financial

measures provides consistency in our financial reporting. Further,

these non-GAAP financial measures are one of the primary indicators

management uses for planning and forecasting in future periods. The

presentation of this additional information should not be

considered in isolation or as a substitute for results prepared in

accordance with accounting principles generally accepted in the

United States.

SKYWORKS SOLUTIONS, INC. UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEET � � � � April 3, Oct. 3, (in thousands) 2009 2008

Assets Current assets: Cash and cash equivalents $ 267,913 $

231,066 Accounts receivable, net 112,130 146,710 Inventories 91,753

103,791 Prepaid expenses and other current assets 14,838 13,089

Property, plant and equipment, net 163,576 173,360 Goodwill and

intangible assets, net 502,242 503,417 Other assets 61,852 64,666

Total assets $ 1,214,304 $ 1,236,099 �

Liabilities and

Equity Current liabilities: Credit facility $ 50,000 $ 50,000

Convertible notes 50,000 - Accounts payable 48,098 58,527 Accrued

liabilities and other current liabilities 35,195 40,213 Long-term

debt 47,116 137,616 Other long-term liabilities 4,965 5,527

Stockholders' equity 978,930 944,216 Total liabilities and equity $

1,214,304 $ 1,236,099

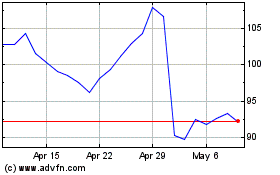

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Jun 2024 to Jul 2024

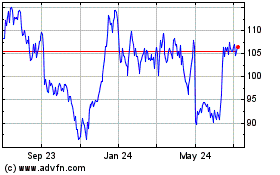

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Jul 2023 to Jul 2024