SI International Reports Financial Results for Third Quarter FY08

November 05 2008 - 4:16PM

PR Newswire (US)

RESTON, Va., Nov. 5 /PRNewswire-FirstCall/ -- SI International,

Inc. (NASDAQ:SINT), an information technology and network solutions

(IT) company, today announced financial results for its third

quarter ended September 27, 2008. SI International's Quarterly

Report on Form 10-Q for the third quarter of fiscal year 2008 has

been filed with the SEC and can be viewed by going to the SEC's

website at http://www.sec.gov/ or SI International's website,

http://www.si-intl.com/, and selecting "SEC Filings" on the

"Investors" webpage. Revenue for the third quarter of fiscal year

2008 (FY08) was $149.0 million. Income from operations for the

third quarter of FY08 was $6.8 million. Net income for the third

quarter of FY08 was $3.1 million or $0.23 per diluted share. In the

third quarter, SI International recorded $1.5 million of pre-tax

expenses for third-party services related to the pending merger

with Serco, Inc. The impact of these expenses resulted in $0.08

reduction of fully diluted earnings per share for the current

quarter. Adjusting for the expenses associated with the pending

merger, SI International's adjusted net income is $4.0 million, or

$0.31 per diluted share. (Adjusted net income and adjusted earnings

per share are non-GAAP financial measures; please refer to the

discussion below entitled, "Non-GAAP Financial Measures.") As

adjusted for these expenses, the Company's results are in line with

financial guidance provided on July 29, 2008, in which SI

International stated that it expected revenues for the third

quarter be in the range of $147-153 million, with net income in the

range of $3.9-4.3 million, or $0.30-0.33 per fully diluted share.

Non-GAAP Financial Measures Adjusted net income is a non-GAAP

financial measure, which we define as net income plus after-tax

transaction costs associated with the pending merger with Serco

Inc. Adjusted earnings per share is a non-GAAP financial measure,

which we define as earnings per share, plus the per-share after-tax

transaction costs relating to the pending merger. Adjusted net

income and adjusted earnings per share are not intended to replace

net income or earnings per share. Rather, we consider adjusted net

income and adjusted earnings per share to be important financial

measures of our operating performance for the third quarter of

fiscal year 2008 related to the operation of our business without

taking into account expenditures that are related to the pending

merger and which are not expected to recur. We believe adjusted net

income and adjusted earnings per share provides investors with an

alternative means to evaluate the results of our operations.

Adjusted net income and adjusted earnings per share as used in this

document may not be comparable to similarly titled measures

reported by other companies due to differences in accounting

policies and differences in definitions of adjusted net income and

adjusted earnings per share. The following table reconciles

reported net income and earnings per share to adjusted net income

and adjusted earnings per share, as defined above, for the three

months ended September 27, 2008: Three Months Ended September 27,

2008 Actual Adjustment for Transaction Costs As Adjusted Revenue

$148,952,000 -- $148,952,000 Operating Income $6,780,000 $1,500,000

$8,280,000 Tax $2,087,000 $607,000 $2,694,000 Net Income 3,066,000

$893,000 $3,959,000 Earnings Per Share $0.23 $0.08 $0.31 About SI

International: SI International, a member of the Russell 2000 and

S&P SmallCap 600 indices, is a provider of information

technology and network solutions (IT) primarily to the Federal

government. SI International combines technology and industry

expertise to provide a full spectrum of state-of-the-practice

solutions and services, from design and development to

documentation and operations, to assist clients in achieving their

missions. SI International is ranked as the 44th largest Federal

Prime IT Contractor by Washington Technology and has approximately

4,500 employees. More information about SI International can be

found at http://www.si-intl.com/. Additional Information and Where

to Find It In connection with the pending merger referred to in

this press release, SI International filed a proxy statement with

the Securities and Exchange Commission on October 8, 2008 which was

first mailed to SI International's stockholders on or about October

13, 2008. SI INTERNATIONAL's stockholders are urged to read THE

PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC

BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PENDING

MERGER. Investors and stockholders are able to obtain the documents

free of charge at the SEC's web site, http://www.sec.gov/. Requests

for additional copies of SI International's proxy statement should

be directed to SI International's proxy solicitor, Innisfree

M&A Incorporated, 501 Madison Avenue, 20th Floor, New York, New

York 10022, or by telephone at (877) 456- 3510, or to SI

International at 12012 Sunset Hills Road, Suite 800, Reston,

Virginia 20190-5869, Attention: Secretary, or by telephone at (703)

234-7000. Participants in Solicitation SI International and its

directors and executive officers and certain other members of

management may be deemed to be participants in the solicitation of

proxies in connection with the pending merger referred to in this

press release. Information concerning SI International's

participants is set forth in SI International's proxy statement for

its 2008 Annual Meeting of Stockholders, which was filed with the

SEC on April 18, 2008. Investors may obtain additional information

regarding the interest of such participants by referring to the

proxy statement regarding the pending merger filed on October 8,

2008. Cautionary Language Concerning Forward-Looking Statements The

above-referenced statements may contain forward-looking statements

that are made pursuant to the safe-harbor provisions of the Private

Securities Litigation Reform Act of 1995. Expressions of future

goals, financial information or reporting, and similar expressions

reflecting something other than historical fact are intended to

identify forward-looking statements, but are not the exclusive

means of identifying such statements. These forward- looking

statements may involve a number of risks and uncertainties, which

are described in SI International's filings with the Securities and

Exchange Commission. These risks and uncertainties include: changes

in Federal government (or other applicable) procurement laws,

regulations, policies and budgets; risks relating to contract

performance; changes in the competitive environment (including as a

result of bid protests); and the important factors discussed in the

risk factors described from time to time in reports filed by SI

International with the Securities and Exchange Commission,

including its Annual Report on Form 10-K for the year ended

December 29, 2007 and its quarterly reports on Form 10-Q, all of

which are available directly from the SEC at http://www.sec.gov/.

The actual results may differ materially from any forward- looking

statements due to such risks and uncertainties. SI International

undertakes no obligations to revise or update any forward-looking

statements in order to reflect events or circumstances that may

arise after the date of this release. Alan Hill SI International,

Inc. 703-234-6854 DATASOURCE: SI International, Inc. CONTACT: Alan

Hill of SI International, Inc., +1-703-234-6854, Web site:

http://www.si-intl.com/

Copyright

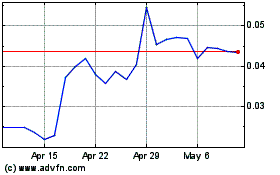

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jun 2024 to Jul 2024

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jul 2023 to Jul 2024