SI International Reports Record Revenue of $69.6 Million and

Diluted EPS of 26 Cents for Fourth Quarter FY04 FY04 Revenue Growth

of 56 Percent; FY04 Net Income Increase of 47 Percent; FY05

Guidance Issued RESTON, Va., Feb. 14 /PRNewswire-FirstCall/ -- SI

International, Inc. (NASDAQ:SINT), an information technology and

network solutions (IT) company, today announced strong results for

its fourth quarter and fiscal year ended December 25, 2004. Revenue

for the fourth quarter of fiscal year 2004 (FY04) increased 58

percent and net income increased by 28 percent as compared to the

fourth quarter of the prior year. FY04 revenue increased 56

percent, while net income increased 47 percent as compared to FY03.

The Company's FY04 results were driven by organic growth in

high-priority Federal government assignments in the key areas of:

Federal IT modernization, defense transformation, homeland defense,

and mission-critical outsourcing; and the acquisition of MATCOM in

January 2004. Fourth Quarter, FY04 Financial Results Revenue for

the fourth quarter of FY04 was $69.6 million, an increase of 58

percent over fourth quarter FY03 revenue of $44.2 million. Federal

government contract revenue, which represents 98 percent of fourth

quarter FY04 total revenue, grew by 63 percent to $67.9 million

from $41.6 million for the fourth quarter of FY03. Revenue growth

in the fourth quarter was primarily the result of new task orders

and the expansion of work on current mission-critical information

technology and network solutions contracts. Net income for the

fourth quarter of FY04 was $3.0 million, an increase of 28 percent

over fourth quarter FY03 net income of $2.3 million. Diluted

earnings per share for the fourth quarter of FY04 was $0.26. Income

from operations for the fourth quarter of FY04 was $5.6 million, an

increase of 44 percent over operating income of $3.9 million

reported a year earlier. Operating margin for the fourth quarter of

FY04 was 8.1 percent. Backlog as of December 25, 2004 was $711

million, including $125 million in funded backlog and $586 million

in unfunded backlog. Funded backlog is up 116 percent from the $58

million reported at the year end of 2003. "We are pleased with our

outstanding results providing tangible evidence that our Company

continues to play a leading role in transforming Federal IT," said

Ray Oleson, SI International's Chairman and CEO. "Our record

financial performance throughout 2004 demonstrated that our

strategic focus is directly aligned with the most important

imperatives of the Federal government -- protecting the homeland,

transforming America's military stance to counter emerging global

threats, and fostering information sharing among agencies and joint

operational capabilities." FY04 Financial Results For the fiscal

year ended December 25, 2004, revenue increased 56 percent to

$262.3 million, compared to $168.3 million for FY03. Net income for

FY04 was $10.9 million, an increase of 47 percent, as compared to a

$7.4 million for FY03. Diluted earnings per share for FY04 was

$1.14. Income from operations for FY04 was $20.7 million, an

increase of 62 percent over operating income of $12.8 million

reported for FY03. Operating margin for FY04 was 7.9 percent, as

compared to 7.6 percent for FY03. "Our annual operating margins hit

a new record high of 7.9% in 2004," said Oleson. "We expect that

operating margin will continue to improve over time as we gain

operating leverage." For FY04, approximately 97 percent of revenues

were generated from services provided to the Federal government as

compared to 94 percent in FY03. Prime contractor revenues for FY04

were approximately 81 percent of total revenues as compared to 84

percent in FY03. As of December 25, 2004, SI International had a

solid balance sheet with $5.8 million in cash and $29 million in

debt. FY04 Business Highlights During FY04, SI International's 2000

employees made important contributions supporting mission-critical

priorities of the Department of Defense and civilian Federal

government agencies: * Supported the Defense Information Systems

Agency (DISA) in defining, establishing and developing the

solutions and procedures for the Department of Defense (DoD)

Internet Protocol version 6 (IPv6) Transition Office; * Developed

and deployed biometric-based smart identification cards to support

the Coalition Forces in Iraq; * Provided Ballistic Missile Defense

(BMD) engineering and technical services to the Air Force Space

Command (AFSPC); * Designed a Learning Management System (LMS) and

a Learning Content Management System (LCMS) to support on-going and

future web-based training initiatives for the Defense Ammunition

Center; * Assisted the U.S. Department of Energy's (DOE) National

Nuclear Security Administration (NNSA)'s Second Line of Defense

(SLD) Program in identifying, prioritizing, and implementing

improved security measures for the 2004 Summer Olympics in Athens,

Greece; * Contributed to military intelligence agencies'

transformation to network-centric warfare with scientific and

engineering services; * Built and deployed a web-based solution to

track international imports/exports and interstate movement of live

animals and animal products; * Deployed worldwide Defense Red

Switch Network Timing and Synchronization upgrades; * Supported

defense intelligence agency Transformational Programs that are

developing the next generation signal intelligence operational

capabilities; * Deployed one of the largest Microsoft SharePoint

applications in the Federal government with over 650,000 users; *

Supported first successful operation test and evaluation of

F-16/Link-16 operations for the European Participating Air Force

nations; * Expanded use and deployments within the Air Force with

Combat Operational Picture architectures world-wide including

forward operating locations in current conflict areas; * Designed

and implemented the USNORTHCOM Operations Center and communications

systems for the USNORTHCOM Annex, an integral element of the

homeland defense mission; * Supported the Defense Information

Systems Agency (DISA) in deploying MILSTAR satellite-based secure

voice systems in support of worldwide military operations; *

Developed the operational architecture for NORAD's new Low Altitude

Air Threat Defense mission. The major contract vehicles awarded to

the Company during FY04 included: * $9 billion, 5-year NETCENTS

ID/IQ to provide IT services to the Air Force (team member on 2 of

8 winning contracts); * $8 billion, 5-year COMMITS NexGen ID/IQ to

modernize IT used by Dept. of Commerce and other Federal agencies

(1 of 8 primes on Tier 3); * $800 million, 9 1/2-year Air Force

Space Command C4I2TSR ID/IQ to modernize space assets, optimize

network and telecommunications resource, and promote interoperable

command and control systems (sole prime); * $610 million, 5-year

CAASETA ID/IQ to assist the Air Force Space Command in the

modernization of space-based intelligence (1 of 4 primes); * $500

million, 5-year BPA to provide technical support/services to the

Air Force Space and Missile Center (1 of 10 primes); * $458

million, 5-year Army HRSolutions ID/IQ to provide HR personnel

services and support to the U.S. Army (1 of 3 primes). Business

Outlook Based on the Company's current backlog and management

estimates as to future tasking and contract awards, SI

International issued the following guidance ranges for the first

quarter and full fiscal year 2005. The guidance provided includes

the anticipated contributions of the acquisitions of Bridge

Technology and SEI to SI International's 2005 results. The Company

projects annual organic revenue growth of 10 to 15 percent for

fiscal year 2005. Q1 2005 Full Year 2005 Revenue $74 - $77 million

$380 - $390 million Net Income $2.9 - $3.1 million $15.1 - $15.6

million Diluted Earnings Per Share $0.25 - $0.27 $1.30 - $1.34

"With our continued focus on mission-critical initiatives as

demonstrated by our two recent acquisitions serving the defense

intelligence and homeland security sector, our success in expanding

our existing client relationships, and our ability to win new

customers, we believe SI International is well positioned for

another outstanding year in 2005," said Oleson. Conference Call SI

International has scheduled a conference call to discuss its

results and business outlook for 10 AM EST, tomorrow, February 15,

2005. Participating in the conference call will be SI

International's Chairman and CEO, Ray Oleson, President and COO,

Brad Antle, and Executive Vice President and CFO, Ted Dunn. A

question and answer session will be included to further discuss the

results and the Company's future performance expectations.

Interested parties should contact Alan Hill at 703-234-6854 for

dial-in information. The conference call will be webcast

simultaneously to the public through a link on the Investor

Relations section of SI International's web site,

http://www.si-intl.com/. A replay of the webcast will be available

on the SI International web site beginning two hours after the

conclusion of the conference call. In addition, a replay of the

conference is available by telephone beginning on Tuesday, February

15, 2005 at 12:00 PM ET through Tuesday, February 22, 2005 at 5:00

PM ET by calling 1-888-286-8010 and entering the conference

passcode 83678622. About SI International: SI International, a

member of the Russell 2000 index, is a provider of information

technology and network solutions (IT) primarily to the federal

government. The Company combines technological and industry

expertise to provide a full spectrum of state-of-the-practice

solutions and services, from design and development to

documentation and operations, to assist clients in achieving their

missions. More information about SI International can be found at

http://www.si-intl.com/. The above-referenced statements may

contain forward-looking statements that are made pursuant to the

safe-harbor provisions of the Private Securities Litigation Reform

Act of 1995. Expressions of future goals and similar expressions

reflecting something other than historical fact are intended to

identify forward-looking statements, but are not the exclusive

means of identifying such statements. These forward-looking

statements involve a number of risks and uncertainties, which are

described in the Company's filings with the Securities and Exchange

Commission. These risks and uncertainties include: differences

between authorized amounts and amounts received by the Company

under government contracts; government customers' failure to

exercise options under contracts; changes in federal government (or

other applicable) procurement laws, regulations, policies and

budgets; the Company's ability to attract and retain qualified

personnel; and the important factors discussed in the Risk Factors

section of the annual report on Form 10-K/A filed by the Company

with the Securities and Exchange Commission and available directly

from the Commission at http://www.sec.gov/. The actual results may

differ materially from any forward-looking statements due to such

risks and uncertainties. The Company undertakes no obligations to

revise or update any forward-looking statements in order to reflect

events or circumstances that may arise after the date of this

release. SI International, Inc. and Subsidiaries Consolidated

Statements of Operations (amounts in thousands, except per share

data) Three Months Ended Twelve Months Ended

------------------------- ------------------------- December 25,

December 27, December 25, December 27, ----------- ----------- 2004

2003 2004 2003 ----------- ----------- Unaudited Unaudited

----------- ----------- ------------ ----------- Revenue $69,596

$44,157 $262,306 $168,287 Costs and expenses: Direct costs 45,339

26,813 166,774 101,940 Indirect costs 17,943 12,921 71,917 51,569

Depreciation and amortization 527 514 2,231 2,009 Amortization of

intangible assets 171 - 648 - ----------- ----------- ------------

----------- Total operating expenses 63,980 40,248 241,570 155,518

----------- ----------- ------------ ----------- Income from

operations 5,616 3,909 20,736 12,769 Other income (expense) 61 -

(1) - Interest expense (796) (137) (2,760) (606) -----------

----------- ------------ ----------- Income before provision for

income taxes 4,881 3,772 17,975 12,163 Provision for income taxes

1,926 1,470 7,098 4,784 ----------- ----------- ------------

----------- Net income $2,955 $2,302 $10,877 $7,379 ===========

=========== ============ =========== Earnings per common share:

Basic net income per common share $0.27 $0.27 $1.20 $0.87

=========== =========== ============ =========== Diluted net income

per common share $0.26 $0.27 $1.14 $0.87 =========== ===========

============ =========== Basic weighted-average shares outstanding

10,749 8,449 9,041 8,446 =========== =========== ============

=========== Diluted weighted-average shares outstanding 11,325

8,679 9,507 8,488 =========== =========== ============ ===========

EBITDA (1) $6,314 $4,423 $23,615 $14,778 Notes: (1) EBITDA is

defined as GAAP net income (loss) plus other expense (income),

interest expense,income taxes, and depreciation and amortization.

EBITDA as calculated by us may be calculated differently than

EBITDA for other companies. We have provided EBITDA because we

believe it is a commonly used measure of financial performance in

comparable companies and is provided to help investors evaluate

companies on a consistent basis, as well as to enhance an

understanding of our operating results. EBITDA should not be

construed as either an alternative to net income as an indicator of

our operating performance or as an alternative to cash flows as a

measure of liquidity. Reconciliation of Net Income to EBITDA is as

follows: Three Months Ended Twelve Months Ended

------------------------- ------------------------- December 25,

December 27, December 25, December 27, ----------- ----------- 2004

2003 2004 2003 ------------ ----------- ------------ -----------

Net Income $2,955 $2,302 $10,877 $7,379 Other expense (income) (61)

- 1 - Interest expense 796 137 2,760 606 Provision for income taxes

1,926 1,470 7,098 4,784 Depreciation 527 514 2,231 2,009

Amortization 171 - 648 - -------------------------

------------------------ EBITDA $6,314 $4,423 $23,615 $14,778 SI

International, Inc. Revenue Segmentation Data (unaudited) (In

thousands) -----------------------------------------------------

Three months ended

----------------------------------------------------- Dec. 25, 2004

Dec. 27, 2003 Growth $ % $ % $ % Core federal government 67,941

97.6% 41,626 94.3% 26,315 63.2% Commercial and other 1,655 2.4%

2,531 5.7% (876) (34.6%)

----------------------------------------------------- Total revenue

69,596 100.0% 44,157 100.0% 25,439 57.6% Prime contracts 56,516

81.2% 38,027 86.1% 18,489 48.6% Subcontracts 13,080 18.8% 6,130

13.9% 6,950 113.4%

----------------------------------------------------- Total revenue

69,596 100.0% 44,157 100.0% 25,439 57.6% Cost reimbursable 25,313

36.4% 16,783 38.0% 8,530 50.8% Time and materials 30,016 43.1%

14,872 33.7% 15,144 101.8% Fixed price 14,267 20.5% 12,502 28.3%

1,765 14.1% -----------------------------------------------------

Total revenue 69,596 100.0% 44,157 100.0% 25,439 57.6% Department

of defense 38,327 55.1% 25,115 56.9% 13,212 52.6% Federal civilian

agencies 29,614 42.5% 16,511 37.4% 13,103 79.4% Commercial entities

1,655 2.4% 2,531 5.7% (876) (34.6%)

----------------------------------------------------- Total revenue

69,596 100.0% 44,157 100.0% 25,439 57.6% Major contracts: C4I

15,380 22.1% 9,353 21.2% 6,027 64.4% NVC/KCC 6,423 9.2% 5,676 12.8%

747 13.2% All other 47,793 68.7% 29,128 66.0% 18,665 64.1%

----------------------------------------------------- Total revenue

69,596 100.0% 44,157 100.0% 25,439 57.6%

----------------------------------------------------- Twelve months

ended ----------------------------------------------------- Dec.

25, 2004 Dec. 27, 2003 Growth $ % $ % $ % Core federal government

253,426 96.6% 157,632 93.7% 95,794 60.8% Commercial and other 8,880

3.4% 10,655 6.3% (1,775) (16.7)%

----------------------------------------------------- Total revenue

262,306 100.0% 168,287 100.0% 94,019 55.9% Prime contracts 211,450

80.6% 141,844 84.3% 69,606 49.1% Subcontracts 50,856 19.4% 26,443

15.7% 24,413 92.3%

----------------------------------------------------- Total revenue

262,306 100.0% 168,287 100.0% 94,019 55.9% Cost reimbursable 80,221

30.6% 64,425 38.3% 15,796 24.5% Time & materials 121,919 46.5%

59,051 35.1% 62,868 106.5% Fixed price 60,166 22.9% 44,811 26.6%

15,355 34.3% -----------------------------------------------------

Total revenue 262,306 100.0% 168,287 100.0% 94,019 55.9% Department

of defense 138,488 52.8% 91,416 54.3% 47,072 51.5% Federal civilian

agencies 114,938 43.8% 66,246 39.4% 48,692 73.5% Commercial

entities 8,880 3.4% 10,625 6.3% (1,745) (16.4%)

----------------------------------------------------- Total revenue

262,306 100.0% 168,287 100.0% 94,019 55.9% Major contracts: C4I

45,303 17.3% 37,107 22.1% 8,196 22.1% NVC/KCC 24,080 9.2% 23,411

13.9% 669 2.9% All other 192,923 73.5% 107,769 64.0% 85,154 79.0%

----------------------------------------------------- Total revenue

262,306 100.0% 168,287 100.0% 94,019 55.9% SI International, Inc.

and Subsidiaries Consolidated Balance Sheets (amounts in thousands,

except share and per share data) December 25, December 27, 2004

2003 ------------ ------------ (unaudited) Assets Current assets:

Cash and cash equivalents $5,754 $23,252 Accounts receivable, net

65,710 34,007 Deferred income tax 2,740 2,100 Other current assets

3,503 2,497 ------------ ------------ Total current assets 77,707

61,856 Property and equipment, net 4,971 3,768 Goodwill 119,912

39,829 Intangible assets, net 7,375 - Other assets 2,142 1,174

------------ ------------ Total assets $212,107 $106,627

============ ============ Liabilities and stockholders' equity

Current liabilities: Accounts payable and accrued expenses $25,554

$17,708 Line of credit 28,954 - Current portion of operating lease

obligations 864 - Deferred revenue 289 3,975 Other current

liabilities 121 465 ------------ ------------ Total current

liabilities 55,782 22,148 ------------ ------------ Former owner

payable 2,280 - Long-term operating lease obligations 910 -

Deferred compensation 1,228 - Deferred income tax 5,046 1,832 Other

long-term liabilities 1,791 1,100 Commitments and contingencies

Stockholders' equity: Common stock-$0.01 par value per share;

50,000,000 shares authorized; 11,047,533 and 8,451,507 shares

issued and outstanding as of December 25, 2004 and December 27,

2003, respectively 111 85 Additional paid-in capital 128,192 75,704

Deferred compensation (208) (340) Retained earnings 16,975 6,098

------------ ------------ Total stockholders' equity 145,070 81,547

------------ ------------ Total liabilities and stockholders'

equity $212,107 $106,627 ============ ============ SI

International, Inc. and Subsidiaries Consolidated Statements of

Cash Flows (amounts in thousands) Twelve Months Ended December 25,

December 27, 2004 2003 ------------ ------------ Unaudited Cash

flows from operating activities: Net income $10,877 $7,379

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: Depreciation and amortization 2,231 2,009

Amortization of intangible assets 648 - Loss on disposal of fixed

assets 14 178 Deferred income tax provision 2,826 (98) Stock-based

compensation 132 132 Amortization of deferred financing costs 416

379 Non-cash loss due to early repayment of debt 584 - Changes in

operating assets and liabilities, net of effect of business

combination: Accounts receivable, net (16,096) (2,106) Other

current assets 116 (266) Other assets (668) (106) Accounts payable

and accrued expenses 1,226 4,996 Deferred revenue (3,686) 2,901

Operating lease obligations (735) -- Other long term liabilities

1,600 681 ------------ ------------ Net cash provided by (used in)

operating activities (515) 16,079 Cash flows from investing

activities: Purchase of property and equipment (1,225) (1,291) Cash

paid for acquisition of MATCOM (66,058) - Cash paid for acquisition

of BRIDGE, net of cash assumed (29,472) - ------------ ------------

Net cash used in investing activities (96,755) (1,025) Cash flows

from financing activities: Proceeds from exercise of stock options

927 59 Proceeds from issuance of common stock, net 51,239 -

Repayments from bank overdrafts - (2,201) Net borrowings under line

of credit 28,954 - Proceeds from long-term debt 30,000 - Repayments

of long-term debt (30,000) - Payments of debt issuance fees (1,202)

- Repayments of notes payable - (140) Repayments of capital lease

obligations (146) (110) ------------ ------------ Net cash provided

by (used in) financing activities 79,772 (2,392) ------------

------------ Net change in cash and cash equivalents (17,498)

12,396 Cash and cash equivalents, beginning of period 23,252 10,856

------------ ------------ Cash and cash equivalents, end of period

$5,754 $23,252 ============ ============ Supplemental disclosures

of cash flow information: Cash payments for interest $1,857 $339

Cash payments for income taxes $6,181 $3,920 Purchases of assets

under capital lease $289 $122 CONTACT: Alan Hill of SI

International, Inc., +1-703-234-6854, DATASOURCE: SI International,

Inc. CONTACT: Alan Hill of SI International, Inc., +1-703-234-6854,

Web site: http://www.si-intl.com/

Copyright

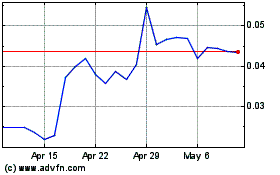

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jun 2024 to Jul 2024

SiNtx Technologies (NASDAQ:SINT)

Historical Stock Chart

From Jul 2023 to Jul 2024