UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

(Mark One)

ý Annual Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934

For the year ended December 31, 2021

or

o Transition Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934

For the transition period from to .

COMMISSION FILE NUMBER: 000-26076

SINCLAIR BROADCAST GROUP, INC.

401(k) RETIREMENT SAVINGS PLAN

(Full Title of Plan)

SINCLAIR BROADCAST GROUP, INC.

(Exact name of Registrant as specified in its charter)

10706 Beaver Dam Road

Hunt Valley, Maryland 21030

(Address of principal executive office, zip code)

FINANCIAL STATEMENTS AND SUPPLEMENTAL

SCHEDULE AND REPORT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

SINCLAIR BROADCAST GROUP, INC.

401(K) RETIREMENT SAVINGS PLAN

DECEMBER 31, 2021 AND 2020

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

TABLE OF CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Administrator, Plan Participants, and Audit Committee of Sinclair Broadcast Group, Inc. 401(k) Retirement Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Sinclair Broadcast Group, Inc. 401(k) Retirement Savings Plan (the "Plan") as of December 31, 2021 and 2020, and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, and the related notes and schedule (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the year ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for purposes of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan's auditor since 2007.

/s/ CohnReznick LLP

Baltimore, Maryland

June 28, 2022

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | | | | | | |

| December 31, |

| 2021 | | 2020 |

| ASSETS | | | |

| Investments, at fair value | $ | 636,787,418 | | | $ | 560,808,749 | |

| Investments, at contract value | 46,023,125 | | | 51,915,231 | |

| | | |

| Total investments | 682,810,543 | | | 612,723,980 | |

| | | |

| Receivables | | | |

| Participant contributions | 1,149,987 | | 1,269,736 |

| Employer contributions | 19,970,327 | | 20,273,542 |

| Participant notes receivable | 7,403,178 | | 7,655,747 |

| | | |

| Total receivables | 28,523,492 | | 29,199,025 |

| | | |

| Total assets | 711,334,035 | | 641,923,005 |

| | | |

| LIABILITIES | | | |

| Excess contributions refundable | 16,559 | | 2,944 |

| | | |

| Net assets available for benefits | $ | 711,317,476 | | | $ | 641,920,061 | |

See notes to the financial statements.

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

Year ended December 31, 2021

| | | | | |

| Additions: | |

| Gain on investments and participant notes receivable: | |

| Net appreciation in value of investments | $ | 65,988,743 | |

| Dividend income | 4,775,507 |

| Interest on participant notes receivable | 361,128 |

| |

| |

| Gain on investments and participant notes receivable | 71,125,378 |

| |

| Contributions: | |

| Participants | 39,607,463 |

| Employer | 20,079,252 |

| Rollovers | 6,685,079 |

| |

| Total contributions | 66,371,794 |

| |

| Total additions | 137,497,172 |

| |

| Deductions: | |

| Benefit payments | 58,390,102 |

| Administrative expenses | 167,519 |

| Purchase of annuity contract | 371,734 | |

| |

| Total deductions | 58,929,355 |

| |

| Net increase, prior to transfer out, net | 78,567,817 |

| |

| Transfer to The Triangle Group Plan, net | 9,170,402 |

| |

| Net assets available for benefits: | |

| Beginning of the year | 641,920,061 |

| |

| End of the year | $ | 720,487,878 | |

See notes to the financial statements.

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

NOTES TO FINANCIAL STATEMENTS

December 31, 2021 and 2020

NOTE 1 - PLAN DESCRIPTION

The following description of Sinclair Broadcast Group, Inc. 401(k) Retirement Savings Plan (the “Plan”) provides only general information. Participants should refer to the Summary Plan Description for a more complete description of the Plan's provisions. Copies of this summary are available from Sinclair Broadcast Group, Inc. (the “Company” or “Employer”), Human Resources Department.

General

The Plan was adopted on January 1, 1988 and has since had multiple amendments or restatements pursuant to an Empower Retirement ("Empower"), previously known as Massachusetts Mutual Life Insurance Company, Non-standardized 401(k) Profit Sharing Plan Volume Submitter Plan Document. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”). The Plan is a participatory defined contribution plan covering substantially all the Company’s employees. Empower is the third party administrator of the Plan. Reliance Trust Company is the trustee of the Plan. Empower is the administrator of the Plan and operates the plan in accordance with the Plan documents. The Board of Directors is responsible for oversight of the Plan. The Investment Committee determines the appropriateness of the Plan’s investment offerings, monitors investment performance and reports to the Plan’s Board of Directors. An employee is eligible to participate in the Plan on the first day of the month following the completion of 30 days of employment. Rehires, if eligible to participate in the Plan on their date of termination, are eligible to enter the Plan on the date of rehire. Although employees may participate in the Plan, they will not be eligible to receive the Company match until they have completed one year of service. An employee will earn a year of service if they are credited 1,000 hours during the 12-month period immediately following their date of hire or if they are credited 1,000 hours during any Plan year beginning after their date of hire. Employees are credited 45 hours of service a week towards their eligibility. In addition, once a participant completes a year of service they are eligible to receive the Company match. The Plan's service requirement for participation is 30 days.

Contributions

Employees contribute to the Plan through payroll deductions, up to a maximum of 85% of their total compensation. Participants who have attained age 50 before the end of the Plan year are eligible to make catch-up contributions. Participants may also contribute amounts representing distributions from other qualified plans (rollovers). Each participant’s account is credited with the participant’s contribution, Company’s matching contribution, and the participant’s pro rata share of earnings or losses on invested assets of the trust funds. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

The Company's matching contribution for all participating employees is 100% of the first 3% of contributions made by an eligible employee plus 50% match up to the next 2%. All matching contributions are 100% vested immediately. The maximum Company match is 4% for participants who elect to contribute 5% or greater. Participants who received the Company match prior to the Safe Harbor Match amendment are subject to the vesting schedule in place at the time of the earned match. Participants subject to prior vesting schedule become 20% vested in Employer contribution amounts credited to their account after two years of service, 40% vested after three years of service, 60% vested after four years of service, 80% vested after five years of service and 100% vested after six years of service. Contributions to the Plan are invested in the available investment options in accordance with the participant’s election. Contributions are subject to certain Internal Revenue Service (“IRS”) limitations.

A terminating member of the Plan has the option to maintain their account (if the balance is over $5,000) or be paid the current value of their contributions and any vested Employer contributions to the Plan, reduced by any outstanding loan balances. The terminating member must forfeit the current unvested value of the Employer’s contribution to their account. In accordance with the terms of the Plan, such forfeitures are first applied to pay administrative expenses of the Plan, if any, and then to reduce future contributions required of the Employer. Participants are fully vested in their contribution to the Plan and related earnings.

Unallocated assets which consist of forfeited amounts and unapplied loan payments in the Plan were $595,421 and $449,471 as of December 31, 2021 and 2020, respectively. During 2021, forfeitures of $85,000 were used to fund Employer contributions. Unallocated assets relating to forfeited amounts are invested in the guaranteed investment contract.

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

NOTES TO FINANCIAL STATEMENTS - CONTINUED

December 31, 2021 and 2020

The December 31, 2021 and 2020 Employer contributions consist of a receivable that was funded subsequent to the Plan’s year end with the Company’s common stock. The Company may also make additional discretionary profit sharing contributions each year. There were no additional discretionary contributions during the years ended December 31, 2021 and 2020.

Upon enrollment, a participant may direct employee contributions to any of the Plan’s available fund options except the Sinclair Broadcast Group, Inc. Common Stock Fund (the "Common Stock Fund"). Employer contributions are invested in the Common Stock Fund, but may be redirected by participants to other fund options immediately. Participants may subsequently redirect invested balances back into the Common Stock Fund up to the amount previously included in the Common Stock Fund.

Excess Contributions Refundable

As of December 31, 2021 and 2020, the plan refunded participants $16,559 and $2,944, respectively, in excess contributions as limited by the IRS. The refund was recorded as a liability to certain employees with a corresponding reduction to contributions.

Payment of Benefits

Participants may elect one of several methods to receive their vested benefits including: (a) a joint and survivor option whereby the employee receives a reduced monthly benefit during his/her lifetime and, upon death, the surviving spouse will receive a monthly benefit for his/her lifetime; (b) the purchase of a life annuity; (c) equal installments over a period of not more than the participant’s assumed life expectancy (or participant’s and participant’s beneficiary’s assumed life expectancy) at the time of distribution; (d) a lump sum distribution; or (e) partial distributions. In the absence of such election by the participant, the method of distribution shall be determined by the Plan. Upon termination of employment before normal retirement, a lump sum distribution may also be made.

Participant Notes Receivable

Participants have the option to borrow from the vested portion of their account. The minimum loan amount is $1,000 and the maximum loan permitted is the lesser of: (1) $50,000; or (2) one-half of their vested balance, and is secured by the balance in the participant’s account with interest charged based on the prime rate at the time of borrowing plus 1%. Participants may have two loans outstanding at one time. Generally, the term of the loans may not exceed five years. Interest income from these loans is treated as income to the Plan. Principal and interest are paid ratably through bi-weekly payroll deductions.

Plan Termination

Although the Company has not expressed any intent to do so, the Company has the right under the Plan to discontinue contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become 100% vested in their accounts.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts in the financial statements and accompanying notes. Actual results could differ from those estimates.

Basis of Accounting

The accompanying financial statements are presented on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America. The Company has evaluated subsequent events for recognition and disclosure through the date of this filing.

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

NOTES TO FINANCIAL STATEMENTS - CONTINUED

December 31, 2021 and 2020

Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value, except for certain investment contracts discussed below. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. For further information see Note 3 - Fair Value Measurements.

Investment contracts held by a defined contribution plan are required to be reported at fair value, except for fully benefit-responsive investment contracts. Contract value is the relevant measure for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants normally would receive if they were to initiate permitted transactions under the terms of the Plan.

Purchases and sales of securities are recorded on a trade-date basis. The net appreciation of the fair value of investments consists of realized and unrealized gains and losses. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

Participant Notes Receivable

Notes receivable from participants are valued at the outstanding principal balance plus accrued interest, which represents the exit value upon collection, either by repayment or by deemed distribution if not repaid. Interest income is recorded on the accrual basis. No allowance for credit losses has been recorded as of December 31, 2021 or 2020. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Benefit Payments

Benefit payments are recorded when paid.

Expenses

Certain expenses of maintaining the Plan are paid directly by the Company and are excluded from these financial statements. Fees related to notes receivable from participants are charged directly to the participant’s account and are included in administrative expenses. Investment related expenses are included in net appreciation in fair value of investments.

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

NOTES TO FINANCIAL STATEMENTS - CONTINUED

December 31, 2021 and 2020

NOTE 3 - FAIR VALUE MEASUREMENTS

Accounting guidance provides for valuation techniques, such as the market approach (comparable market prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement cost). A fair value hierarchy using three broad levels prioritizes the inputs to valuation techniques used to measure fair value. The following is a brief description of those three levels:

•Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities;

•Level 2: Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active; or

•Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions.

Investments measured at fair value on a recurring basis consisted of the following types of instruments as of December 31, 2021 (Level 1, 2 and 3 inputs are defined above):

| | | | | | | | | | | | | | |

| Fair Value Measurements

Using Input Type | |

| Level 1 | Level 2 | Level 3 | Total |

| Mutual Funds | $ | 165,867,018 | | $ | — | | $ | — | | $ | 165,867,018 | |

| Money Market Fund | — | | 35,840 | | — | | 35,840 | |

| Common Stock Fund | — | | 59,126,586 | | — | | 59,126,586 | |

| Investments measured at fair value | 165,867,018 | | 59,162,426 | | — | | 225,029,444 | |

| | | | |

| Pooled Separate Accounts | — | | 338,827,775 | | — | | 338,827,775 | |

| Common Collective Trust | — | | 72,930,199 | | — | | 72,930,199 | |

| Investments measured at net unit value | — | | 411,757,974 | | — | | 411,757,974 | |

| | | | |

| Total investments | $ | 165,867,018 | | $ | 470,920,400 | | $ | — | | $ | 636,787,418 | |

Investments measured at fair value on a recurring basis consisted of the following types of instruments as of December 31, 2020 (Level 1, 2 and 3 inputs are defined above):

| | | | | | | | | | | | | | |

| Fair Value Measurements

Using Input Type | |

| Level 1 | Level 2 | Level 3 | Total |

| Mutual Funds | $ | 127,693,350 | | $ | — | | $ | — | | $ | 127,693,350 | |

| Money Market Fund | — | | 3,438 | | — | | 3,438 | |

| Common Stock Fund | — | | 63,359,673 | | — | | 63,359,673 | |

| Investments measured at fair value | 127,693,350 | | 63,363,111 | | — | | 191,056,461 | |

| | | | |

| Pooled Separate Accounts | — | | 369,752,288 | | — | | 369,752,288 | |

| | | | |

| | | | |

| | | | |

| Total investments | $ | 127,693,350 | | $ | 433,115,399 | | $ | — | | $ | 560,808,749 | |

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

NOTES TO FINANCIAL STATEMENTS - CONTINUED

December 31, 2021 and 2020

The following is a description of the valuation methodologies for assets measured at fair value. There have been no changes to the methodologies used as of December 31, 2020.

Pooled Separate Accounts

The pooled separate accounts are valued using the net unit value, which is based on the fair value of the underlying assets of the account. Redemptions may occur on a daily basis. The use of net unit value as fair value is deemed appropriate as the pooled separate accounts do not have a finite life, unfunded commitments relating to investments, or restrictions on redemptions.

Mutual Funds

The Mutual Funds are valued at the daily closing price as reported by the fund. The Mutual Funds held by the plan are open-end Mutual Funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value ("NAV") and to transact at that price. The Mutual Funds held by the plan are deemed to be actively traded.

Common Collective Trust

The common collective trust funds are valued at the net asset value, as a practical expedient, based on the last reported sales price of the underlying investments held by the fund less its liabilities. The Plan’s interest in the collective trust is based on information reported by the investment advisor using the audited financial statements of the collective trust.

Common Stock Fund

The Common Stock Fund is tracked on a unitized basis. The Common Stock Fund consists of the Company’s common stock which is valued at its quoted market price and funds held in the Investors Bank and Trust Money Market Fund sufficient to meet the Fund’s daily cash needs. The Common Stock Fund is unitized to allow for daily trades. The value of a unit reflects the combined market value of the Company’s common stock and the cash investments held by the Common Stock Fund. As of December 31, 2021, 1,375,747 units were outstanding with a unitized value of approximately $42.98 per unit. As of December 31, 2020, 1,274,832 units were outstanding with a unitized value of approximately $49.7 per unit. The market value of the Company’s Class A common stock as of December 31, 2021 and 2020 was $26.43 and $31.85, respectively. For the year ended December 31, 2021, the Plan purchased and sold $20,703,391, and $13,509,180 of the Company's common stock, respectively. For the year ended December 31, 2020, the Plan purchased and sold $17,847,507 and $6,327,308 of the Company's common stock, respectively. The money market fund is valued at net asset value of the units held at year end

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

NOTES TO FINANCIAL STATEMENTS - CONTINUED

December 31, 2021 and 2020

Fair value of investments in entities that use net unit value

The following table summarizes investments for which fair value is measured using net unit value per share practical expedient as of December 31, 2021 and 2020, respectively. There are no participant redemption restrictions for these investments; the redemption notice period is applicable only to the Plan.

| | | | | | | | | | | | | | |

| December 31, 2021 |

| Fair Value | Unfunded Commitments | Redemption Frequency (if currently eligible) | Redemption Notice Period |

| Pooled Separate Accounts | $ | 338,827,775 | | None | Daily | 12 months |

| Common Collective Trust | $ | 72,930,199 | | None | Daily | 12 months |

| | | | |

| December 31, 2020 |

| Fair Value | Unfunded Commitments | Redemption Frequency (if currently eligible) | Redemption Notice Period |

| Pooled Separate Accounts | $ | 369,752,288 | | None | Daily | 12 months |

| | | | |

NOTE 4 - INCOME TAX STATUS

The underlying prototype plan has received an opinion letter from the IRS dated March 31, 2014 stating that the form of the Plan is qualified under Section 401 of the IRC and, therefore, the related trust is tax-exempt. In accordance with Revenue Procedure 2002-6 and Announcement 2001-77, the Plan sponsor has determined that it is eligible to, and has chosen to, rely on the current IRS prototype plan opinion letters. Once qualified, the Plan is required to operate in conformity with the IRC to maintain its qualification. The Plan Administrator believes the Plan is being operated in compliance with the applicable requirements of the IRC and, therefore, believes that the Plan is qualified and the related trust is tax-exempt.

Accounting principles generally accepted in the United States of America require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. No such tax positions were taken as of December 31, 2021 and 2020. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

No events are probable of occurring that might limit the ability of the Plan to transact at contract value with the contract issuers and that also would limit the ability of the Plan to transact at contract value with the participants. In addition, certain events allow the issuer to terminate the contract with the Plan and settle at an amount different from contract value. Examples of such events include the following: (1) The IRS determines that the Plan no longer meets the requirements of Code section 401(a), 403(a0, 414(d), 414(e) or any other applicable provision (2) There is a termination or partial termination of the Plan; (3) The trustee breaches a provision of the agreement.

NOTE 5 - FULLY BENEFIT-RESPONSIVE GUARANTEED INVESTMENT CONTRACT

The Plan invests in a guaranteed investment contract, the Guaranteed Interest Account, with an insurance company that qualifies as a fully benefit-responsive investment contract.

The Guaranteed Interest Account investment option is provided through a group annuity contract in which the Plan is invested. Under the terms of a group annuity contract, a crediting rate is established for amounts invested in the guaranteed interest account and participants may direct permitted withdrawal and/or transfer transactions of all or a portion of their account balance at contract value. Contract value represents contributions plus credited interest less participant withdrawals and fees. The Plan considers this investment option to be fully benefit-responsive notwithstanding the liquidation value events under the contract that limit the ability of the Plan to transact at contract value.

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

NOTES TO FINANCIAL STATEMENTS - CONTINUED

December 31, 2021 and 2020

The Guaranteed Interest Account investment option is a traditional investment contract. The contract issuer is contractually obligated to repay the principal and interest at a specified interest rate that is guaranteed to the Plan. The crediting rate is based on a formula established by the contract issuer but may not be less than 3%. The crediting rate is reviewed on a semi-annual basis for resetting. The contract cannot be terminated before the scheduled maturity date.

The average yield earned is calculated by dividing the annual interest credited to the Plan during the Plan year by the average annual fair value. The average interest rate credited to participants is calculated by dividing the annual interest credited to the participants during the Plan year by the average annual fair value. The average yield earned by the Plan and the average interest rate credited to participants is the same, therefore, no adjustment is needed. As of December 31, 2021 and 2020, there were no reserves against contract values for credit risk of contract issuers or otherwise.

Certain events may limit the ability of the Plan to transact at contract value. Such events include but may not be limited to the following: (1) temporary absence; (2) change in position or other occurrence qualifying as a temporary break in service under the Plan; (3) transfer or other change of position resulting in employment by an entity controlling, controlled by, or under other common control with the Employer; (4) cessation of an employment relationship resulting from a reorganization, merger, layoff or the sale or discontinuance of all or any part of the Plan sponsor's business; (5) removal from the Plan of one or more groups or classifications of participants; (6) partial or complete Plan termination; or (7) Plan disqualification.

NOTE 6 - RISKS AND UNCERTAINTIES

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

The World Health Organization declared COVID-19 a global pandemic on March 11, 2020. As of June 2022, the national state of emergency is still in effect, however states have reopened their economies as various levels and various timings and COVID-19 vaccinations are being distributed in mass quantities. However, with new variants of COVID-19 being detected across multiple countries, the impact to the Plan remains unclear and the extent of the impact cannot be predicted at this time.

NOTE 7 - DIFFERENCES BETWEEN FINANCIAL STATEMENTS AND FORM 5500

The financial statements are prepared on an accrual basis whereas the Form 5500 is prepared on a modified cash basis.

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500:

| | | | | | | | |

| December 31, |

| 2021 | 2020 |

| Net assets available for benefits per the financial statements | $ | 711,317,476 | | $ | 641,920,061 | |

| | |

| Employee contributions receivable | (1,149,987) | | (1,269,736) | |

| Employer contribution receivable | (19,970,327) | | (20,273,542) | |

| Excess contributions refundable | 16,559 | | 2,944 | |

| | |

| Net assets available for benefits per the Form 5500 | $ | 690,213,721 | | $ | 620,379,727 | |

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

NOTES TO FINANCIAL STATEMENTS - CONTINUED

December 31, 2021 and 2020

The following is a reconciliation of employer contributions per the financial statements to the Form 5500 for the year ended December 31, 2021:

| | | | | |

| Employer contributions per financial statements | $ | 20,079,252 | |

| Less: Employer contribution receivable at end of year | (19,970,327) | |

| Add: Employer contribution receivable at beginning of year | 20,273,542 | |

| |

| Employer contributions per the Form 5500 | $ | 20,382,467 | |

The following is a reconciliation of employee contributions per the financial statements to the Form 5500 for the year ended December 31, 2021:

| | | | | |

| Employee contributions per financial statements | $ | 39,607,463 | |

| Less: employee contributions receivable at end of year | (1,149,987) | |

| Add: employee contributions receivable at beginning of year | 1,269,736 | |

| Add: corrective distributions for the year ended December 31, 2021 | 16,559 | |

| Less: corrective distributions for the year ended December 31, 2020 | $ | (2,944) | |

| |

| Employee contributions per the Form 5500 | $ | 39,740,827 | |

The following is a reconciliation of corrective distributions per the financial statements to the Form 5500 for the year ended December 31, 2021:

| | | | | |

| Corrective distributions included within employee contributions per financial statements | $ | 20,291 | |

| Less: excess contributions refundable at end of year | (16,559) | |

| Add: excess contributions refundable at beginning of year | 2,944 | |

| |

| Corrective distributions per the Form 5500 | $ | 6,676 | |

NOTE 8 - RELATED PARTY AND PARTIES-IN-INTEREST TRANSACTIONS

The Employer matching contributions are made in shares of the Sinclair Broadcast Group, Inc. common stock. During 2021, the Employer matching contributions amounted to $19,970,327. Dividends received on Sinclair Broadcast Group, Inc. common stock during 2021 were $1,827,001. As the Employer is the Plan Sponsor, these transactions qualify as exempt party-in-interest transactions.

Certain Plan investments are pooled separate accounts and a guaranteed investment contract managed by Empower Financial Group, an affiliate of Empower. Empower is the third party administrator as defined by the Plan. Therefore, these transactions qualify as exempt party-in-interest transactions. In addition, notes receivable from participants are considered to be exempt party-in-interest transactions.

Fees incurred by the Plan for the investment management services are included in net appreciation in fair value of the investment, as they are paid through revenue sharing, rather than a direct payment. The Plan made direct payments to Empower of $167,519 for the year ended December 31, 2021, which were not covered by revenue sharing. The Employer pays directly any other fees related to the Plan's operations.

NOTE 9 - SUBSEQUENT EVENTS

The Plan has evaluated subsequent events through June 28, 2022, which is the date the financial statements were issued.

SUPPLEMENTAL INFORMATION

Sinclair Broadcast Group, Inc.

401(k) Retirement Savings Plan

EIN: 52-1494660 Plan # 001

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

DECEMBER 31, 2021 | | | | | | | | | | | | | | |

(a) | (b)

Identity of Issuer, Borrower,

Lessor or Similar Party | (c)

Description of Investments, Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value |

(d)

Cost(1) |

(e)

Current Value |

| * | Guaranteed Interest Account (contract value) | 2,655,783 units | | $ | 46,023,125 | |

| | | | |

| * | Premier Money Market Fund | 264 units | | 35,841 | |

| * | Select Wellington/OFI Small Cap Growth | 11,556 units | | 10,609,072 | |

| * | Select EQ Opps (Wellington/TRP) | 26,525 units | | 33,151,072 | |

| * | Select Mid Cap Growth (TRP/Frontier) | 10,009 units | | 13,160,361 | |

| * | Sel Overseas (MFS/Harris) | 35,815 units | | 12,112,251 | |

| * | Select Small Company Value (Clover/TRP/INVSC) | 11,935 units | | 7,078,446 | |

| * | Select Fundamental Value (Wlgn/Brw Hnly) | 57,530 units | | 25,847,315 | |

| * | RetireSMART in Retirement III | 16,611 units | | 2,491,695 | |

| * | RetireSMART 2020 | 195,525 units | | 30,816,405 | |

| * | RetireSMART 2030 | 413,851 units | | 73,468,904 | |

| * | RetireSMART 2040 | 295,802 units | | 56,094,963 | |

| * | RetireSMART 2050 | 250,512 units | | 49,326,818 | |

| * | RetireSMART in Retirement | 8,746 units | | 1,285,080 | |

| * | Premier Core Bond (Barings) | 119,784 units | | 18,309,625 | |

| * | Premier Global (OFI) | 5,242 units | | 5,075,768 | |

| Vanguard Developed Markets Ind Fd | 405,148 units | | 6,660,628 | |

| MFS International New Discover | 129,147 units | | 4,890,799 | |

| Vanguard 500 Index Fund | 155,008 units | | 68,177,063 | |

| Vanguard Mid Cap Index Fund | 40,943 units | | 12,915,975 | |

| Vanguard Small Cap Index Fund | 172,744 units | | 18,720,221 | |

| Vanguard Total Bond Market Index | 1,259,891 units | | 14,098,185 | |

| Vanguard Equity Income Fund | 58,624 units | | 5,406,302 | |

| American Funds EuroPacific Growth | 153,926 units | | 9,963,633 | |

| American Funds Washington Mut. | 239,443 units | | 14,488,666 | |

| Columbia Select Mid Cap Value Fund | 343,592 units | | 5,037,060 | |

| Dodge & Cox Global Bond Fund | 477,338 units | | 5,508,485 | |

| * | MassMutual Blue Chip Gr CIT | 3,303,535 units | | 59,298,452 | |

| * | MassMutual Growth Opprtnts CIT | 724,707 units | | 13,631,747 | |

| | | | |

| * | Sinclair Broadcast Group, Inc. Common Stock Fund | 1,375,748 units | | 59,126,586 | |

| * | Participant loans | Interest at 4.25% - 10.00%, maturing on various dates, secured by the participant’s account balance | | 7,403,178 | |

| Total | | | $ | 690,213,721 | |

* Party-in-interest

(1) Historical cost has not been presented as all investments are participant directed.

See Report of Independent Registered Public Accounting Firm

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SINCLAIR BROADCAST GROUP, INC.

401(K) RETIREMENT SAVINGS PLAN

By: /s/ David R. Bochenek

David R. Bochenek

Senior Vice President / Chief Accounting Officer

Dated: June 28, 2022

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

|

|

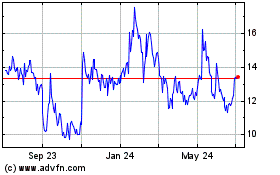

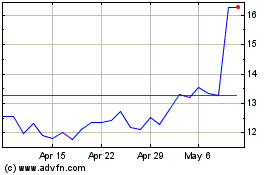

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Jul 2023 to Jul 2024