UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

| QXO, Inc. |

| (Name of Issuer) |

| |

| Common Stock, par value $0.00001 per share |

| (Title of Class of Securities) |

| |

| 82846H 405 |

| (CUSIP Number) |

| |

|

Jacobs Private Equity II, LLC

Bradley S. Jacobs

Five American Lane

Greenwich, CT 06831

Tel: 203-413-4000 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

| |

| June 13, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

* The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Exchange Act (however,

see the Notes).

| CUSIP

No. 82846H405 |

SCHEDULE 13D |

Page 1

of 4 |

| 1 |

NAME OF REPORTING PERSONS

Jacobs Private Equity II, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

394,218,1321 |

| 8 |

SHARED VOTING POWER

None |

| 9 |

SOLE DISPOSITIVE POWER

394,218,132 |

| 10 |

SHARED DISPOSITIVE POWER

None |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY EACH REPORTING PERSON

394,218,132 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT

IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS):

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED

BY AMOUNT IN ROW (11)

89.86%2 |

| 14 |

TYPE OF REPORTING PERSON

OO |

| 1 | Represents (i) 900,000 shares of Preferred Stock (as defined

below), which are initially convertible into an aggregate of 197,109,067 Shares (as defined below) at an initial conversion price of

$4.566, subject to customary anti-dilution adjustments, and (ii) 197,109,065 warrants to purchase Shares (“Warrants”), which

are initially exercisable for an aggregate of 197,109,065 Shares, at an exercise price of $4.566 per share with respect to 50% of the

Warrants, $6.849 per share with respect to 25% of the Warrants, and $13.698 per share with respect to the remaining 25% of the Warrants,

in each case subject to customary anti-dilution adjustments. Reflects an additional 4,858 Shares that were unintentionally omitted from Amendment No. 2 to Schedule 13D of the Reporting Persons (as

defined below) due to rounding. |

| 2 | Calculated based on (i) 664,284 Shares outstanding, as reported

by the Company (as defined below) in its Current Report on Form 8-K filed with the SEC (as defined below) on June 6, 2024, plus (ii)

438,020,148 Shares issuable upon conversion of all outstanding Preferred Stock and exercise of Warrants, of which 394,218,132 Shares

are issuable upon conversion of Preferred Stock and exercise of Warrants by the Reporting Persons (as defined below). |

| CUSIP

No. 82846H405 |

SCHEDULE 13D |

Page 2

of 4 |

| 1 |

NAME OF REPORTING PERSON

Bradley S. Jacobs |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

394,218,1323 |

| 8 |

SHARED VOTING POWER

None |

| 9 |

SOLE DISPOSITIVE POWER

394,218,132 |

| 10 |

SHARED DISPOSITIVE POWER

None |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY EACH REPORTING PERSON

394,218,132 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT

IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS):

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED

BY AMOUNT IN ROW (11)

89.86%4 |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

| 3 | Bradley S. Jacobs has indirect beneficial ownership of such

Shares as a result of being the Managing Member of JPE (as defined below). |

| CUSIP

No. 82846H405 |

SCHEDULE 13D |

Page 3

of 4 |

This Amendment No. 3 amends the Schedule 13D previously filed

with the U.S. Securities and Exchange Commission (the “SEC”) by Jacobs Private Equity II, LLC, a Delaware limited liability

company (“JPE”), and Bradley S. Jacobs (“Jacobs” and, together with JPE, the “Reporting Persons”)

on December 13, 2023, as amended by Amendment No. 1, dated as of April 15, 2024 and Amendment No. 2, dated as of June 6,

2024 (collectively, the “Schedule 13D”), relating to the common stock, par value $0.0001 per share (the “Shares”),

of QXO, Inc., a Delaware corporation (the “Company”). Except as specifically provided herein, this Amendment No. 3

does not modify any of the information previously reported in the Schedule 13D, which remains unchanged.

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 is hereby amended and supplemented to include the following:

Lock-Up Agreement

On June 13,

2024, JPE entered into a “lock-up” agreement (the “Lock-Up Agreement”) with Goldman Sachs & Co.

LLC and Morgan Stanley & Co. LLC (collectively, the “Agents”). Pursuant to the terms of the Lock-Up Agreement,

JPE has agreed, without the prior consent of the Agents, to not, during the period commencing on June 13, 2024 and ending 180 days

after the date of public announcement of the private placement (the “Private Placement”) of Shares of the Company and

warrants to purchase Shares of the Company (the “Lock-Up Period”), (i) offer, pledge, sell, contract to sell,

sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase,

lend, or otherwise transfer or dispose of, directly or indirectly, any Shares or shares of the Company’s preferred stock, par value

$0.001 per share (“Preferred Stock”), in each case, beneficially owned (as such term is used in Rule 13d-3 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), or any other securities so owned convertible

into or exercisable or exchangeable for Shares or Preferred Stock or (ii) enter into any swap or other arrangement that transfers

to another, in whole or in part, any of the economic consequences of ownership of the Shares or Preferred Stock, whether any such transaction

described in clause (i) or (ii) above is to be settled by delivery of Shares, Preferred Stock or such other securities,

in cash or otherwise. Such restrictions in the Lock-Up Agreement are subject to customary exceptions.

The foregoing summary of the Lock-Up Agreement does not purport to

be complete and is qualified in its entirety by reference to the full text of the Lock-Up Agreement, a copy of which is attached as Exhibit 99.11

hereto and is incorporated by reference into this Item 6.

Item 7. Material to Be Filed

as Exhibits.

Item 7 is hereby amended and supplemented to include the following:

After reasonable inquiry and

to the best of my knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and

correct.

Date: June 17, 2024

| |

JACOBS PRIVATE EQUITY II, LLC |

| |

By: |

/s/ Bradley S. Jacobs |

| |

|

Name: Bradley S. Jacobs

Title: Managing Member |

| |

By: |

/s/ Bradley S. Jacobs |

| |

|

Name: Bradley S. Jacobs |

EXHIBIT 99.11

LOCK-UP AGREEMENT

June 13, 2024

Goldman Sachs & Co. LLC

Morgan Stanley & Co. LLC

| c/o | Goldman Sachs & Co. LLC

200 West Street

New York, NY 10282 |

| c/o | Morgan Stanley & Co. LLC

1585 Broadway

New York, NY 10036 |

Ladies and Gentlemen:

The undersigned understands that Goldman Sachs &

Co. LLC (“Goldman Sachs”) and Morgan Stanley & Co. LLC (“Morgan Stanley”) are acting as

placement Agents (collectively, the “Agents”) in connection with a proposed private placement (the “Placement”)

of shares of common stock, par value $0.00001 per share (the “Common Stock”), of QXO, Inc., a Delaware corporation

(the “Company”), and warrants to purchase Common Stock of the Company.

To induce the Agents to continue their efforts

in connection with the Placement, the undersigned hereby agrees that, without the prior written consent of the Agents, it will not, and

will not publicly disclose an intention to, during the period commencing on the date hereof and ending 180 days after the date of public

announcement of the Placement (the “Restricted Period”), (1) offer, pledge, sell, contract to sell, sell any option

or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer

or dispose of, directly or indirectly, any shares of Common Stock or shares of the Company’s preferred stock, par value $0.001 per

share (“Preferred Stock”), in each case, beneficially owned (as such term is used in Rule 13d-3 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”)), by the undersigned or any other securities so owned convertible

into or exercisable or exchangeable for Common Stock or Preferred Stock or (2) enter into any swap or other arrangement that transfers

to another, in whole or in part, any of the economic consequences of ownership of the Common Stock or Preferred Stock, whether any such

transaction described in clause (1) or (2) above is to be settled by delivery of Common Stock, Preferred Stock or such

other securities, in cash or otherwise. The foregoing sentence shall not apply to:

| (a) | transactions relating to shares of Common Stock or other securities acquired in open market transactions after the completion of the

Placement, provided that no filing under Section 16(a) of the Exchange Act shall be required or shall be voluntarily

made in connection with subsequent sales of Common Stock or other securities acquired in such open market transactions; |

| (b) | transfers of shares of Common Stock, Preferred Stock or any security convertible into Common Stock or Preferred Stock as a bona fide

gift; |

| (c) | transfers of shares of Common Stock, Preferred Stock or any security convertible into Common Stock or

Preferred Stock to any immediate family member of the undersigned or any trust for the direct or indirect benefit of the undersigned

or the immediate family of the undersigned (for this purpose, “immediate family” means any relationship by blood, marriage,

domestic partnership or adoption, not more remote than first cousin); |

| (d) | distributions of shares of Common Stock, Preferred Stock or any security convertible into Common Stock or Preferred Stock to limited

partners, members or stockholders of the undersigned; |

| (e) | transfers of shares of Common Stock, Preferred Stock or any security convertible into Common Stock or Preferred Stock (x) by

will, other testamentary document or intestate succession to the legal representative, heir, beneficiary or a member of the immediate

family of the undersigned upon the death of the undersigned, or (y) by operation of law, such as pursuant to a domestic order or

negotiated divorce settlement; |

| (f) | transfers of shares of Common Stock, Preferred Stock or any security convertible into Common Stock or Preferred Stock to another corporation,

partnership or limited liability company that is a direct or indirect affiliate (as defined under Rule 12b-2 of the Exchange Act)

of the undersigned, or to an investment fund or other entity that controls or manages, or is under common control with, the undersigned; |

| (g) | transfers of shares of Common Stock, Preferred Stock or any security convertible into Common Stock or Preferred Stock to the Company

in connection with the repurchase of such securities upon the termination of the undersigned's employment with the Company; |

provided that in the case

of any transfer, disposition or distribution (i) pursuant to clause (b), (c), (d), (e) or (f), each transferee, donee or distributee

shall sign and deliver to the Agents a lock-up agreement substantially in the form of this agreement and (ii) pursuant to clause

(b), (c), (d), (e), (f) or (g), no filing under Section 16(a) of the Exchange Act reporting a reduction in beneficial ownership

of shares of Common Stock, shall be required or shall be voluntarily made during the Restricted Period;

| (h) | transfers (including through a “cashless” exercise or on a “net exercise” basis)

of shares of Common Stock, Preferred Stock or any security convertible into Common Stock or Preferred Stock to the Company solely

as a result of the automatic vesting or settlement of any security convertible into Common Stock or Preferred Stock (including to satisfy

withholding obligations or the payment of taxes in connection therewith); provided that (i) any securities received by the

undersigned shall be subject to the terms of this agreement and (ii) no filing under Section 16(a) of the Exchange Act

reporting a reduction in beneficial ownership of shares of Common Stock shall be required or shall be voluntarily made during the Restricted

Period; |

| (i) | transfers of shares of Common Stock pursuant to a bona fide third-party tender offer, merger, consolidation

or other similar transaction, in each case, that is approved by the Company’s board of directors and made to all holders of the

Company’s capital stock after the consummation of the Placement, involving a change of control of the Company; provided that

in the event that such tender offer, merger, consolidation or other such transaction is not completed, the undersigned’s shares

of Common Stock shall remain subject to the provisions of this agreement (for this purpose, “change of control” means

the transfer (whether by tender offer, merger, consolidation or other similar transaction), in one transaction or a series of related

transactions, to a person or group of affiliated persons, of shares of capital stock if, after such transfer, such person or group of

affiliated persons would hold at least a majority of the outstanding voting securities of the Company (or the surviving entity)); |

| (j) | the establishment of a trading plan pursuant to Rule 10b5-1 under the Exchange Act for the transfer of shares of Common Stock;

provided that (i) such plan does not provide for the transfer of shares of Common Stock during the Restricted Period and (ii) to

the extent a public announcement or filing under the Exchange Act is required of or voluntarily made by or on behalf of the undersigned

or the Company regarding the establishment of such plan, such announcement or filing shall include a statement to the effect that no transfer

of shares of Common Stock may be made under such plan during the Restricted Period; |

| (k) | the pledge, hypothecation or other granting of a security interest (each, a “Pledge”)

in shares of Common Stock, Preferred Stock or any security convertible into Common Stock or Preferred Stock owned by the undersigned

to a to one or more nationally or internationally recognized financial institution as collateral or security for any bona fide loan, advance

or extension of credit and any transfer upon any foreclosure upon such securities pursuant to such loan, advance or extension of credit;

provided, however, that (i) the undersigned and its affiliates shall not Pledge shares of Common Stock, Preferred Stock

or securities convertible into Common Stock or Preferred Stock resulting in a loan to value in excess of 50% and (ii) the undersigned

or the Company, as the case may be, shall provide Goldman Sachs and Morgan Stanley prior written notice informing them of any public filing,

report or announcement made by or on behalf of the undersigned or the Company with respect thereto; and |

| (l) | the conversion of shares of Preferred Stock into shares of Common Stock; provided that any securities received by the undersigned

shall be subject to the terms of this agreement. |

In addition, the

undersigned agrees that, without the prior written consent of the Agents, it will not, during the Restricted Period, make any demand for

or exercise any right with respect to, the registration of any shares of Common Stock, Preferred Stock or any security convertible

into or exercisable or exchangeable for Common Stock or Preferred Stock, other than with respect to any piggyback rights in accordance

with the terms of the Registration Rights Agreement, dated as of June 6, 2024, among the Company, Jacobs Private Equity II, LLC and

the other holders party thereto; provided that, for the avoidance of doubt, any securities of the undersigned so registered shall

remain subject to the restrictions set forth in this agreement. The undersigned also agrees and consents to the entry of stop transfer

instructions with the Company’s transfer agent and registrar against the transfer of the undersigned’s securities except in

compliance with the foregoing restrictions.

The undersigned understands that the Company and

the Agents are relying upon this agreement in proceeding toward consummation of the Placement. The undersigned further understands that

this agreement is irrevocable and shall be binding upon the undersigned’s heirs, legal representatives, successors and assigns.

The undersigned acknowledges and agrees that the

Agents have not provided any recommendation or investment advice nor have the Agents solicited any action from the undersigned with respect

to the Placement and the undersigned has consulted their own legal, accounting, financial, regulatory and tax advisors to the extent deemed

appropriate. The undersigned further acknowledges and agrees that, although the Agents may provide certain Regulation Best Interest and

Form CRS disclosures or other related documentation to you in connection with the Placement, the Agents are not making a recommendation

to you to participate in the Placement, and nothing set forth in such disclosures or documentation is intended to suggest that any Agent

is making such a recommendation.

This agreement shall be governed by and construed

in accordance with the laws of the State of New York.

Very truly yours,

| Jacobs Private Equity II, LLC |

|

| |

|

| By: |

/s/ Brad Jacobs |

|

| |

Name: |

Brad Jacobs |

|

| |

Title: |

Managing Member |

|

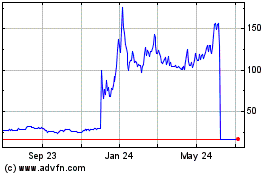

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Jun 2024 to Jul 2024

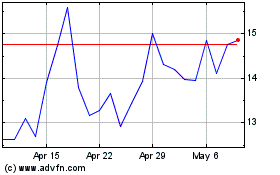

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Jul 2023 to Jul 2024