UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE

SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant |

☒ |

| Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☒ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

SILVERSUN TECHNOLOGIES,

INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SUPPLEMENT TO THE PROXY

STATEMENT FOR

THE SPECIAL MEETING

OF STOCKHOLDERS

TO BE HELD MAY 30,

2024

SUPPLEMENT TO DEFINITIVE

PROXY STATEMENT

This supplement (this

“Supplement”) amends and supplements the definitive proxy statement on Schedule 14A, dated April 30, 2024 (the “Definitive

Proxy Statement”), filed by SilverSun Technologies, Inc., a Delaware corporation (which we refer to as the “Company,”

“SilverSun,” “we,” or “our”) with the U.S. Securities and Exchange Commission

(the “SEC”) on April 30, 2024 and made available to our stockholders in connection with a special meeting of our stockholders

to be held at the Company’s corporate offices located at 120 Eagle Rock Avenue, East Hanover, New Jersey 07936 on May 30, 2024,

at 9:00 a.m. Eastern time (the “Special Meeting”). This Supplement is being filed with the SEC and made available to

stockholders on May 28, 2024. Capitalized terms used in this Supplement that are not defined herein have the meanings given to them in

the Definitive Proxy Statement.

This Supplement amends

and supplements the Definitive Proxy Statement with respect to the timing of the effectiveness of the Amended and Restated Certificate

of Incorporation, including the Reverse Stock Split contemplated thereby. Subject to receipt of the Stockholder Approvals, the effectiveness

of the Amended and Restated Certificate of Incorporation, including the Reverse Stock Split, will be at 9:00 a.m. on the Closing Date,

and not at 11:59 p.m. two days prior to the Closing Date as previously contemplated by the Investment Agreement. Subject to receipt of

the Stockholder Approvals, the Closing Date is expected to occur on June 6, 2024.

The form of the Amended

and Restated Certificate of Incorporation has been modified to effectuate the foregoing. Annex B to the Definitive Proxy Statement is

hereby amended and restated in its entirety with the form of the Amended and Restated Certificate of Incorporation attached as Annex

A to this Supplement.

The Investment Agreement

has also been modified by a letter agreement to effectuate the foregoing, which letter agreement is attached as Annex B to this

Supplement.

These changes will not

affect the aggregate amount of the Cash Dividend. The exact amount of the Cash Dividend on a per share basis will be equal to $17,400,000

divided by the number of shares of Common Stock issued and outstanding as of the close of business on the Cash Dividend Record Date, which

record date has been set as June 5, 2024, and will occur one day prior to the expected effective time of the Amended and Restated Certificate

of Incorporation (including the Reverse Stock Split). The per share Cash Dividend is expected to be approximately $3.27, based on 5,315,581

shares of Common Stock expected to be outstanding as of the Cash Dividend Record Date.

Except as specifically

supplemented and revised by the information contained in this Supplement, this Supplement does not modify, amend, supplement, or otherwise

affect any matter presented for consideration in or other information set forth in the Definitive Proxy Statement.

If any stockholders

have not already submitted a proxy for use at the Special Meeting, they are urged to do so promptly. No action in connection with this

Supplement is required by any stockholder who has previously delivered a proxy and who does not wish to revoke or change that proxy.

The information contained

herein speaks only as of May 28, 2024, unless the information specifically indicates that another date applies. This Supplement should

be read in conjunction with the Definitive Proxy Statement, which should be read in its entirety. From and after the date of this Supplement,

any references to the “Definitive Proxy Statement” are to the Definitive Proxy Statement as supplemented hereby.

Forward-Looking Statements

This Supplement contains forward-looking statements.

Statements that are not historical facts, including statements about beliefs or expectations, are forward-looking statements. These statements

are based on plans, estimates, expectations and projections at the time the statements are made, and readers should not place undue reliance

on them. In some cases, readers can identify forward-looking statements by the use of forward-looking terms such as “may,”

“will,” “should,” “expect,” “opportunity,” “intend,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “target,” “goal”

or “continue,” or the negative of these terms or other comparable terms. Forward-looking statements involve inherent risks

and uncertainties and readers are cautioned that a number of important factors could cause actual results to differ materially from those

contained in any such forward-looking statements. Factors that could cause actual results to differ materially from those described in

this Supplement include, among others, uncertainties as to the completion of the Equity Investment and the other transactions contemplated

by the Investment Agreement, including the risk that one or more of the transactions may involve unexpected costs, liabilities or delays.

Forward-looking statements herein speak only as

of the date each statement is made. Neither the Company nor any person undertakes any obligation to update any of these statements in

light of new information or future events, except to the extent required by applicable law.

Additional Information

and Where to Find It

In connection with the

Equity Investment, SilverSun filed with the SEC the Definitive Proxy Statement on April 30, 2024. SilverSun commenced mailing the Definitive

Proxy Statement and a form of proxy card to its stockholders on or about April 30, 2024. SilverSun may also file other relevant documents

with the SEC regarding the Equity Investment, and has filed this Supplement with the SEC. SILVERSUN’S STOCKHOLDERS ARE URGED TO

READ THE DEFINITIVE PROXY STATEMENT, THIS SUPPLEMENT AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED EQUITY INVESTMENT. SilverSun’s

stockholders are able to obtain, without charge, a copy of the Definitive Proxy Statement, this Supplement and other relevant documents

filed with the SEC from the SEC’s website at http://www.sec.gov. SilverSun’s stockholders are also able to obtain, without

charge, a copy of the Definitive Proxy Statement, this Supplement and other relevant documents from SilverSun’s website at https://www.silversuntech.com

or by written request to SilverSun at 120 Eagle Rock Avenue, East Hanover, New Jersey 07936.

Participants in Solicitation

JPE and SilverSun and its directors and executive

officers may be deemed to be participants in the solicitation of proxies from SilverSun’s stockholders with respect to the Equity

Investment and the other transactions contemplated by the Investment Agreement. The interests of SilverSun and its directors and executive

officers with regard to the Equity Investment may differ from the interests of SilverSun’s stockholders generally, and stockholders

may obtain additional information by reading the Definitive Proxy Statement and other relevant documents (including the Current Report

on Form 8-K filed with the SEC on May 28, 2024 and this Supplement) regarding the Equity Investment and the other transactions contemplated

by the Investment Agreement, when filed with the SEC. Information regarding the names of SilverSun’s directors and executive officers

and their respective interests in SilverSun by security holdings or otherwise is set forth in SilverSun’s proxy statement for its

2023 Annual Meeting of Stockholders, filed with the SEC on November 27, 2023, in the sections captioned “Executive Compensation”

and “Director Compensation”, and in the Definitive Proxy Statement, filed with the SEC on April 30, 2024, in the section

captioned “Security Ownership of Certain Beneficial Owners and Executive Officers and Directors of the Company.”

Annex A

FORM

OF

FIFTH AMENDED and

restated

CERTIFICATE OF INCORPORATION

OF

SILVERSUN TECHNOLOGIES, INC.

SilverSun Technologies, Inc. (the “Corporation”),

a corporation organized and existing under the laws of the State of Delaware, pursuant to Sections 242 and 245 of the General Corporation

Law of the State of Delaware, as it may be amended (the “DGCL”), hereby certifies as follows:

| 1. | The name of this Corporation is SilverSun Technologies, Inc.

The original Certificate of Incorporation was filed with the office of the Secretary of State of the State of Delaware on October 3,

2002 under the name iVoice Acquisition 1, Inc. |

| 2. | A Certificate of Amendment to the original Certificate of

Incorporation was filed with the office of the Secretary of State of the State of Delaware on April 24, 2003 under the name Trey Industries,

Inc. |

| 3. | An Amended and Restated Certificate of Incorporation was

filed with the office of the Secretary of State of the State of Delaware on May 30, 2003 under the name Trey Industries, Inc. |

| 4. | A Second Amended and Restated Certificate of Incorporation

was filed with the office of the Secretary of State of the State of Delaware on September 5, 2003. |

| 5. | A Third Amended and Restated Certificate of Incorporation

was filed with the office of the Secretary of State of the State of Delaware on February 11, 2004. |

| 6. | A Fourth Amended and Restated Certificate of Incorporation

was filed with the office of the Secretary of State of the State of Delaware on June 27, 2011 under the name SilverSun Technologies,

Inc. |

| 7. | A Certificate of Amendment to the Fourth Amended and Restated

Certificate of Incorporation was filed with the office of the Secretary of State of the State of Delaware on January 29, 2015. |

| 8. | Certificates of Elimination with respect to the Corporation’s

previously issued Series A Preferred Stock and the Corporation’s previously issued Series B Preferred Stock were filed with the

office of the Secretary of State of the State of Delaware on November 30, 2023 and September 9, 2019, respectively. |

| 9. | In connection with the transactions contemplated by the Amended

and Restated Investment Agreement, dated as of April 14, 2024 (the “Investment Agreement”), by and among the Corporation,

Jacobs Private Equity II, LLC (the “Principal Investor”) and the other parties thereto, this Fifth Amended and Restated

Certificate of Incorporation (this “Amended and Restated Certificate of Incorporation”) was duly adopted by the Board

of Directors of the Corporation (the “Board of Directors”) in accordance with the provisions of Sections 242 and 245

of the DGCL, and by the affirmative vote of a majority of its stockholders at a special meeting in accordance with Section 211 of the

DGCL, and is to become effective as of 9:00 a.m., Eastern time, on June 6, 2024. |

| 10. | This Amended and Restated Certificate of Incorporation restates and amends the Fourth Amended and Restated Certificate of Incorporation

(as amended) to read in its entirety as follows: |

ARTICLE 1

NAME OF CORPORATION

The name of the Corporation is SilverSun Technologies, Inc.

ARTICLE 2

REGISTERED OFFICE; REGISTERED AGENT

The address of the registered office of the Corporation in the State

of Delaware is Corporation Trust Center, 1209 Orange Street, Wilmington, County of New Castle, Delaware 19801. The name of the registered

agent of the Corporation at such address is The Corporation Trust Company. The Corporation may have such other offices, either inside

or outside of the State of Delaware, as the Board of Directors may designate or as the business of the Corporation may from time to time

require.

ARTICLE 3

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity

for which a corporation may be organized under the DGCL.

ARTICLE 4

STOCK

Section 1. Authorized Stock. The total

number of authorized shares of capital stock of the Corporation shall be 2,010,000,000 shares, consisting of (i) 2,000,000,000 shares

of common stock, par value $0.00001 per share (the “Common Stock”), and (ii) 10,000,000 shares of preferred stock,

par value $0.001 per share (the “Preferred Stock”). For the avoidance of doubt, this Section 1 gives effect to, and

will not be affected by, the reverse stock split contemplated by Section 4 of this ARTICLE 4.

Section 2. Common Stock.

(a) Except

as otherwise provided by law, by this Amended and Restated Certificate of Incorporation, or by the resolution or resolutions adopted by

the Board of Directors designating the rights, powers and preferences of any series of Preferred Stock, the holders of outstanding shares

of Common Stock shall have the right to vote on all matters, including the election of directors, to the exclusion of all other stockholders,

and holders of Preferred Stock shall not be entitled to receive notice of any meeting of stockholders at which they are not entitled to

vote (except where otherwise provided in the certificate of designations governing such series). Each holder of record of Common Stock

shall be entitled to one vote for each share of Common Stock standing in the name of the stockholder on the books of the Corporation.

(b) Subject

to any rights granted to holders of shares of any class or series of Preferred Stock then outstanding, the holders of shares of Common

Stock shall be entitled to receive such dividends and other distributions in cash, property, stock or otherwise as may be declared thereon

by the Board of Directors at any time and from time to time out of assets or funds of the Corporation legally available therefor and shall

share equally on a per share basis in such dividends and distributions.

(c) In the

event of any voluntary or involuntary liquidation, dissolution or winding-up of the Corporation, after payment or provision for payment

of the debts and other liabilities of the Corporation, and subject to any rights granted to holders of shares of any class or series of

Preferred Stock then outstanding, the holders of shares of Common Stock shall be entitled to receive all of the remaining assets of the

Corporation available for distribution to its stockholders, ratably in proportion to the number of shares of Common Stock held by them.

Section 3. Preferred Stock. Shares of

Preferred Stock may be authorized and issued in one (1) or more series. The Board of Directors (or any committee to which it may

duly delegate the authority granted in this ARTICLE 4) is hereby empowered, by resolution or resolutions, to authorize the

issuance from time to time of shares of Preferred Stock in one (1) or more series, for such consideration and for such corporate

purposes as the Board of Directors (or such committee thereof) may from time to time determine, and by filing a certificate pursuant

to applicable law of the State of Delaware as it presently exists or may hereafter be amended to establish from time to time for

each such series the number of shares to be included in each such series and to fix the designations, powers, rights and preferences

of the shares of each such series, and the qualifications, limitations and restrictions thereof to the fullest extent now or

hereafter permitted by this Amended and Restated Certificate of Incorporation and the laws of the State of Delaware, including,

without limitation, voting rights (if any), dividend rights, dissolution rights, conversion rights, exchange rights and redemption

rights thereof, as shall be stated and expressed in a resolution or resolutions adopted by the Board of Directors (or such committee

thereof) providing for the issuance of such series of Preferred Stock. Each series of Preferred Stock shall be distinctly

designated. The authority of the Board of Directors with respect to each series of Preferred Stock shall include, but not be limited

to, determination of the following:

(a) the

designation of the series, which may be by distinguishing number, letter or title;

(b) the

number of shares of the series, which number the Board of Directors may thereafter (except where otherwise provided in the certificate

of designations governing such series) increase or decrease (but not below the number of shares thereof then outstanding);

(c) the

amounts payable on, and the preferences, if any, of shares of the series in respect of dividends, and whether such dividends, if any,

shall be cumulative or noncumulative;

(d) the

dates at which dividends, if any, shall be payable;

(e) the

redemption rights and price or prices, if any, for shares of the series;

(f) the

terms and amount of any sinking fund provided for purchase or redemption of shares of the series;

(g) the

amounts payable on, and the preferences, if any, of shares of the series in the event of any voluntary or involuntary liquidation, dissolution

or winding up of the affairs of the Corporation;

(h) whether

shares of the series shall be convertible into or exchangeable for shares of any other class or series, or any other security, of the

Corporation or any other corporation, and, if so, the specification of such other class or series or such other security, the conversion

or exchange price or prices or rate or rates, any adjustments thereof, the date or dates at which such shares shall be convertible or

exchangeable and all other terms and conditions upon which such conversion or exchange may be made;

(i) the

restrictions on the issuance of shares of the same series or of any other class or series; and

(j) the

voting rights, if any, of the holders of shares of the series.

Section 4. Reverse Stock Split. Upon

effectiveness of this Amended and Restated Certificate of Incorporation (the “Effective Time”), each eight (8)

shares of the Common Stock then issued and outstanding or held by the Corporation as treasury stock shall, automatically and without

any action on the part of the respective holders thereof, be combined and converted into one (1) share of Common Stock, without

increasing or decreasing the par value of each share of Common Stock. No fractional shares shall be issued in connection with the

foregoing combination and conversion and, in lieu thereof, any holder of Common Stock otherwise entitled to a fraction of a share of

Common Stock shall, (i) in the case of a registered holder who holds Common Stock in book-entry form with the Corporation’s

transfer agent, without further action on the part of such holder, and (ii) in the case of a registered holder who holds Common

Stock in certificated form, upon delivery of a properly completed and duly executed transmittal letter from such holder and the

surrender of such holder’s stock certificates, be entitled to receive cash for such holder’s fractional share based upon

the net proceeds attributable to the sale of such fractional share following the aggregation and sale by the Corporation’s

exchange agent of all fractional shares otherwise issuable. Each certificate and book-entry notation that immediately prior to the

Effective Time represented shares of Common Stock (“Old Certificates”) shall thereafter represent that number of

whole shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined,

subject to the treatment of fractional share interests as described above.

ARTICLE 5

TERM

The term of existence of the Corporation shall be perpetual.

ARTICLE 6

BOARD OF DIRECTORS

Section 1. Number of Directors. Subject

to any rights of the holders of any series of Preferred Stock and the rights set forth in Section 7 of this ARTICLE 6, the

number of directors which shall constitute the Board of Directors shall be fixed from time to time exclusively pursuant to a

resolution adopted by the affirmative vote of a majority of the total number of directors that the Corporation would have if there

were no vacancies (the “Whole Board”).

Section 2. Term; Election of Directors.

Subject to the rights of the holders of any series of Preferred Stock and the rights set forth in Section 7 of this ARTICLE

6, at each annual meeting of stockholders, the directors shall be elected for terms expiring at the next annual meeting of

stockholders. Each director shall hold office for the term for which he or she is elected or appointed and until his or her

successor shall be elected and qualified or until his or her earlier death, resignation, retirement, disqualification, or removal

from office. Unless and except to the extent that the Amended and Restated Bylaws of the Corporation (as may hereafter be amended,

the “Bylaws”) shall so require, the election of directors of the Corporation need not be by written ballot.

Advance notice of stockholder nominations for the election of directors shall be given in the manner and to the extent provided in

the Bylaws.

Section 3. Newly Created Directorships and

Vacancies. Subject to applicable law and the rights of the holders of any series of Preferred Stock with respect to such series

of Preferred Stock and the rights set forth in Section 7 of this ARTICLE 6, and unless the Board of Directors otherwise

determines, vacancies resulting from death, resignation, retirement, disqualification, removal from office or other cause, and newly

created directorships resulting from any increase in the authorized number of directors, may be filled only by the affirmative vote

of a majority of the remaining directors, though less than a quorum of the Board of Directors, or by a sole remaining director, and

directors so chosen shall hold office until the next annual meeting of stockholders and until his or her successor shall have been

duly elected and qualified or until any such director’s earlier death, resignation, removal, retirement or disqualification.

No decrease in the number of authorized directors constituting the Whole Board shall shorten the term of any incumbent director.

Section 4. Removal of Directors. Subject

to the rights of the holders of any series of Preferred Stock and the rights set forth in Section 7 of this ARTICLE 6, any

director(s) of the Corporation may be removed from office, with or without cause, at any time by the affirmative vote of the holders

of at least a majority of the voting power of all outstanding shares of capital stock of the Corporation entitled to vote generally

in the election of directors, voting together as a single class (the “Voting Stock”).

Section 5. Rights of Holders of Preferred

Stock. Notwithstanding the provisions of this ARTICLE 6, whenever the holders of one (1) or more series of Preferred

Stock issued by the Corporation shall have the right, voting separately or together by series, to elect directors at an annual or

special meeting of stockholders, the election, term of office, filling of vacancies and other features of such directorship shall be

governed by the rights of such Preferred Stock as set forth in the certificate of designations governing such series.

Section 6. No Cumulative Voting. Except

as may otherwise be set forth in the resolution or resolutions of the Board of Directors providing the issuance of a series of Preferred

Stock, and then only with respect to such series of Preferred Stock, cumulative voting in the election of directors is specifically denied.

Section 7. Board Representation

Rights.

(a) Effective

as of the Closing (as defined in the Investment Agreement), the Board of Directors shall be reconstituted (and the Corporation and the

Board of Directors shall cause such reconstitution to occur) such that (i) the number of seats on the Board of Directors shall be as directed

by the Principal Investor, (ii) each of such directors (including Brad Jacobs) shall be a person designated by the Principal Investor,

(iii) each standing committee of the Board of Directors shall be reconstituted in a manner designated by the Principal Investor and

(iv) Brad Jacobs shall be appointed as the Chairman of the Board of Directors and Chief Executive Officer of the Corporation. The foregoing

designations shall be made such that a majority of the Board of Directors and the members of each standing committee of the Board of Directors

shall be independent as required in accordance with Nasdaq Stock Market LLC rules (or the rules of any other exchange on which the Corporation’s

securities are then listed) and applicable securities laws. Each director designated by the Principal Investor in accordance with this

Section 7 of this ARTICLE 6 is referred to herein as an “Principal Investor Appointee.”

(b) Subject

to Sections 7(d), 7(e) and 7(f) of this ARTICLE 6, in connection with each meeting of stockholders at which

directors are to be elected to serve on the Board of Directors, the Corporation shall take all necessary steps to nominate each Principal

Investor Appointee (or such alternative persons who are proposed by the Principal Investor and notified to the Corporation on or prior

to any date set forth in applicable law with respect to the nomination of directors) and to use its reasonable best efforts to cause the

Board of Directors to unanimously recommend that the stockholders of the Corporation vote in favor of each Principal Investor Appointee

for election to the Board of Directors. If, for any reason, a candidate designated as an Principal Investor Appointee is determined to

be unqualified to serve on the Board of Directors because such appointment would constitute a breach of the fiduciary duties of the Board

of Directors or applicable law or stock exchange requirements, the Principal Investor shall have the right to designate an alternative

Principal Investor Appointee to be so appointed, and the provisions of this Section 7(b) of this ARTICLE 6 shall apply,

mutatis mutandis, to such alternative Principal Investor Appointee.

(c) Each

appointed or elected Principal Investor Appointee will hold his or her office as a director of the Corporation for such term as is provided

in Section 2 of this ARTICLE 6 or until his or her death, resignation or removal from the Board of Directors or until his

or her successor has been duly elected and qualified in accordance with the provisions of this Article VI. If any Principal Investor

Appointee ceases to serve as a director of the Corporation for any reason during his or her term, the Corporation will use its reasonable

best efforts to cause the Board of Directors to fill the vacancy created thereby with a replacement designated by the Principal Investor.

(d) Following

the Closing, subject to applicable law and applicable stock exchange requirements, the Principal Investor shall have the right to designate

persons to the Board of Directors, who shall be Principal Investor Appointees hereunder, as follows: (i) all of the members of the Board

of Directors for so long as the Investors (as defined in the Investment Agreement) collectively own or control (together with their affiliates)

Preferred Stock, Company Common Stock (as defined in the Investment Agreement) or other voting securities, or Warrants (as defined in

the Investment Agreement) exercisable for such securities, representing, in the aggregate, at least eighty percent (80%) of the total

voting power of the capital stock of the Corporation, calculated on a fully-diluted, as-converted basis, (ii) seventy-five percent (75%)

of the total number of seats (rounded up to the nearest whole number) on the Board of Directors for so long as the Investors collectively

own or control (together with their affiliates) Preferred Stock, Company Common Stock or other voting securities, or Warrants exercisable

for such securities, representing, in the aggregate, at least sixty-five percent (65%) (but less than eighty percent (80%)) of the total

voting power of the capital stock of the Corporation, calculated on a fully-diluted, as-converted basis, (iii) a majority of the total

number of seats (rounded up to the nearest whole number) on the Board of Directors for so long as the Investors collectively own or control

(together with their affiliates) Preferred Stock, Company Common Stock or other voting securities, or Warrants exercisable for such securities,

representing, in the aggregate, at least forty-five percent (45%) (but less than sixty-five percent (65%)) of the total voting power of

the capital stock of the Corporation, calculated on a fully-diluted, as-converted basis, (iv) forty percent (40%) of the total number

of seats (rounded up to the nearest whole number) on the Board of Directors for so long as the Investors collectively own or control (together

with their affiliates) Preferred Stock, Company Common Stock or other voting securities, or Warrants exercisable for such securities,

representing, in the aggregate, at least thirty percent (30%) (but less than forty-five percent (45%)) of the total voting power of the

capital stock of the Corporation, calculated on a fully-diluted, as-converted basis, (v) thirty-three percent (33%) of the total number

of seats (rounded up to the nearest whole number) on the Board of Directors for so long as the Investors collectively own or control (together

with their affiliates) Preferred Stock, Company Common Stock or other voting securities, or Warrants exercisable for such securities,

representing, in the aggregate, at least fifteen (15%) (but less than thirty percent (30%)) of the total voting power of the capital stock

of the Corporation, calculated on a fully-diluted, as-converted basis, and (vi) two members of the Board of Directors for so long as the

Investors collectively own or control (together with their affiliates) Preferred Stock, Company Common Stock or other voting securities,

or Warrants exercisable for such securities, representing, in the aggregate, at least five percent (5%) (but less than fifteen percent

(15%)) of the total voting power of the capital stock of the Corporation, calculated on a fully-diluted, as converted basis.

(e) The

Board of Directors shall have no obligation to appoint or nominate any Principal Investor Appointee if such appointment or nomination

would violate applicable Law or stock exchange requirements or result in a breach by the Board of Directors of its fiduciary duties to

its stockholders; provided, that the foregoing shall not affect the right of the Principal Investor to designate an alternate Principal

Investor Appointee.

(f) The

rights of the Principal Investor set forth in this Section 7 of this ARTICLE 6 shall be in addition to, and not in limitation

of, such voting rights that the Principal Investor may otherwise have as a holder of capital stock of the Corporation (including any shares

of Preferred Stock held by the Principal Investor).

ARTICLE 7

STOCKHOLDER ACTION

Section 1. Stockholder Action by Written Consent.

Subject to the rights of the holders of any series of Preferred Stock with respect to such series of Preferred Stock, any action required

or permitted to be taken by the stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders

of the Corporation and may not be effected by any consent in writing by such stockholders; provided that, if the Investors and

their Affiliates (as such terms are defined in the Investment Agreement) collectively beneficially own at least 30% of the voting power

of the outstanding shares of Voting Stock, then stockholders of the Corporation may act by written consent in

lieu of a meeting to the extent permitted by the DGCL and in the manner provided in the Bylaws.

Section 2. Special Meetings of Stockholders.

Subject to the rights of the holders of any series of Preferred Stock with respect to such series of Preferred Stock, special meetings

of stockholders may only be called by or at the direction of (1) the Chair of the Board of Directors, (2) the Lead Independent Director

(if one has been appointed), or (3) the Board of Directors pursuant to a resolution adopted by a majority of the Whole Board, and any

power of stockholders to call a special meeting is specifically denied. At any special meeting of stockholders, only such business shall

be conducted or considered as shall have been properly brought before the meeting pursuant to the Corporation’s notice of meeting.

ARTICLE 8

DIRECTOR AND OFFICER LIABILITY

To the fullest extent permitted by the DGCL, as the same exists or

may hereafter be amended, a director or officer of the Corporation shall not be personally liable either to the Corporation or to any

of its stockholders for monetary damages for breach of fiduciary duty as a director or officer. If the DGCL is amended after the filing

of this Amended and Restated Certificate of Incorporation to authorize corporate action further eliminating or limiting the personal liability

of directors or officers, then the liability of a director or officer of the Corporation, in addition to the limitation on personal liability

provided herein, will be limited to the fullest extent permitted by that law, as so amended. Any repeal or modification of this ARTICLE

8 by the stockholders of the Corporation will be prospective only and will not adversely affect any limitation on the personal liability

of a director or officer of the Corporation existing at the time of that repeal or modification.

ARTICLE 9

INDEMNIFICATION

Section 1. In General. Each person who

was or is a party or is otherwise threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether

civil, criminal, administrative or investigative (hereinafter, a “Proceeding”), by reason of the fact that he or she

or a person of whom he or she is the legal representative is or was, at any time during which this ARTICLE 9 is in effect (whether

or not such person continues to serve in such capacity at the time any indemnification or advancement of expenses pursuant hereto is sought

or at the time any Proceeding relating thereto exists or is brought), a director or officer of the Corporation or, while serving as a

director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer, trustee, employee

or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to employee

benefit plans maintained or sponsored by the Corporation (hereinafter, a “Covered Person”), shall be (and shall be

deemed to have a contractual right to be) indemnified and held harmless by the Corporation (and any successor of the Corporation by merger

or otherwise) to the fullest extent authorized by the DGCL as the same exists or may hereafter be amended or modified from time to time

(but, in the case of any such amendment or modification, only to the extent that such amendment or modification permits the Corporation

to provide greater indemnification rights than said law permitted the Corporation to provide prior to such amendment or modification),

against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts

paid or to be paid in settlement) actually and reasonably incurred or suffered by such person in connection with such Proceeding if the

person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the Corporation, and,

with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. The termination

of any Proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself,

create a presumption that the person did not act in good faith and in a manner which the person reasonably believed to be in or not opposed

to the best interests of the corporation, and, with respect to any criminal action or proceeding, had reasonable cause to believe that

the person’s conduct was unlawful. Such indemnification shall continue as to a person who has ceased to be a director or officer

of the Corporation or ceased serving at the request of the Corporation as a director, officer, trustee, employee or agent of another corporation

or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans maintained or

sponsored by the Corporation, and shall inure to the benefit of his or her heirs, executors and administrators; provided that,

except as provided in Section 3 of this ARTICLE 9, the Corporation shall indemnify any such person seeking indemnification in connection

with a Proceeding (or part thereof) initiated by such person only if such Proceeding (or part thereof) was authorized by the Board of

Directors.

Section 2. Mandatory Advancement of Expenses.

To the fullest extent authorized by the DGCL as the same exists or may hereafter be amended or modified from time to time (but, in the

case of any such amendment or modification, only to the extent that such amendment or modification permits the Corporation to provide

greater rights to advancement of expenses than said law permitted the Corporation to provide prior to such amendment or modification),

each Covered Person shall have (and shall be deemed to have a contractual right to have) the right, without the need for any action by

the Board of Directors, to be paid by the Corporation (and any successor of the Corporation by merger or otherwise) the expenses incurred

in connection with any Proceeding in advance of its final disposition, such advances to be paid by the Corporation within twenty (20) days

after the receipt by the Corporation of a statement or statements from the claimant requesting such advance or advances from time to time;

provided that if the DGCL requires, the payment of such expenses incurred by a director or officer in his or her capacity as a

director or officer (and not, except to the extent specifically required by applicable law, in any other capacity in which service was

or is rendered by such person while a director or officer, including, without limitation, service to an employee benefit plan) shall be

made only upon delivery to the Corporation of an undertaking (hereinafter, the “Undertaking”) by or on behalf of such

director or officer, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there

is no further right of appeal (a “final disposition”) that such director or officer is not entitled to be indemnified for

such expenses under this ARTICLE 9 or otherwise.

Section 3. Claims. If a claim for indemnification

under this ARTICLE 9 is not paid in full by the Corporation within thirty (30) days after a written claim has been received by

the Corporation, or if a request for advancement of expenses under Section 2 of this ARTICLE 9 is not paid in full by the Corporation

within twenty (20) days after a statement pursuant to Section 2 of this ARTICLE 9 and the required Undertaking, if any, have been

received by the Corporation, the claimant may at any time thereafter bring suit against the Corporation to recover the unpaid amount of

the claim for indemnification or request for advancement of expenses and, if successful, in whole or in part, the claimant shall be entitled

to be paid also the expense of prosecuting such claim. It shall be a defense to any such action that, under the DGCL, the claimant has

not met the standard of conduct which makes it permissible for the Corporation to indemnify the claimant for the amount claimed or that

the claimant is not entitled to the requested advancement of expenses, but (except where the required Undertaking, if any, has not been

tendered to the Corporation) the burden of proving such defense shall be on the Corporation. Neither the failure of the Corporation (including

its Disinterested Directors (as defined in the Bylaws of the Corporation), Independent Counsel (as defined in the Bylaws of the Corporation)

or stockholders) to have made a determination prior to the commencement of such action that indemnification of the claimant is proper

in the circumstances because he or she has met the applicable standard of conduct set forth in the DGCL, nor an actual determination by

the Corporation (including its Disinterested Directors, Independent Counsel or stockholders) that the claimant has not met such applicable

standard of conduct, shall be a defense to the action or create a presumption that the claimant has not met the applicable standard of

conduct.

Section 4. Contract Rights; Amendment and Repeal;

Non-Exclusivity of Rights.

(a) All

of the rights conferred in this ARTICLE 9, as to indemnification, advancement of expenses and otherwise, shall be contract rights

between the Corporation and each Covered Person to whom such rights are extended that vest at the commencement of such Covered Person’s

service to or at the request of the Corporation and: (x) any amendment or modification of this ARTICLE 9 that in any way diminishes

or adversely affects any such rights shall be prospective only and shall not in any way diminish or adversely affect any such rights with

respect to such person; and (y) all of such rights shall continue as to any such Covered Person who has ceased to be a director or

officer of the Corporation or ceased to serve at the Corporation’s request as a director, officer, trustee, employee or agent of

another corporation, partnership, joint venture, trust or other enterprise, as described herein, and shall inure to the benefit of such

Covered Person’s heirs, executors and administrators.

(b) All

of the rights conferred in this ARTICLE 9, as to indemnification, advancement of expenses and otherwise: (i) shall not be

exclusive of any other rights to which any person seeking indemnification or advancement of expenses may be entitled or hereafter acquire

under any statute, provision of this Amended and Restated Certificate of Incorporation, Bylaws, agreement, vote of stockholders or Disinterested

Directors or otherwise both as to action in such person’s official capacity and as to action in another capacity while holding such

office; and (ii) cannot be terminated or impaired by the Corporation, the Board of Directors or the stockholders of the Corporation

with respect to a person’s service prior to the date of such termination.

Section 5. Insurance, Other Indemnification

and Advancement of Expenses.

(a) The

Corporation may maintain insurance, at its expense, to protect itself and any current or former director, officer, employee or agent of

the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss,

whether or not the Corporation would have the power to indemnify such person against such expense, liability or loss under the DGCL.

(b) The

Corporation may, to the extent authorized from time to time by the Board of Directors or the Chief Executive Officer, grant rights to

indemnification and rights to advancement of expenses incurred in connection with any Proceeding in advance of its final disposition,

to any current or former officer, employee or agent of the Corporation to the fullest extent permitted by applicable law.

Section 6. Severability. If any provision

or provisions of this ARTICLE 9 shall be held to be invalid, illegal or unenforceable for any reason whatsoever: (1) the validity,

legality and enforceability of the remaining provisions of this ARTICLE 9 (including, without limitation, each portion of any paragraph

of this ARTICLE 9 containing any such provision held to be invalid, illegal or unenforceable, that is not itself held to be invalid,

illegal or unenforceable) shall not in any way be affected or impaired thereby; and (2) to the fullest extent possible, the provisions

of this ARTICLE 9 (including, without limitation, each such portion of any paragraph of this ARTICLE 9 containing any such

provision held to be invalid, illegal or unenforceable) shall be construed so as to give effect to the intent manifested by the provision

held invalid, illegal or unenforceable.

ARTICLE 10

AMENDMENTS

The Corporation reserves the right to amend, alter, change or repeal

any provision contained in this Amended and Restated Certificate of Incorporation, in the manner now or hereafter prescribed by the DGCL,

and all rights herein are granted subject to this reservation.

ARTICLE 11

AMENDMENTS TO BYLAWS

In furtherance and not in limitation of the powers conferred by applicable

law, the Board of Directors is expressly authorized to adopt, amend, alter or repeal the Bylaws of the Corporation, without the assent

or vote of stockholders of the Corporation.

ARTICLE 12

EXCLUSIVE FORUM

Unless the Corporation consents in writing to the selection of an alternative

forum, the sole and exclusive forum for: (a) any derivative action or proceeding brought on behalf of the Corporation, (b) any action

asserting a claim for or based on a breach of a fiduciary duty owed by any current or former director or officer or other employee of

the Corporation to the Corporation or to the Corporation’s stockholders, including a claim alleging the aiding and abetting of such

a breach of fiduciary duty, (c) any action asserting a claim against the Corporation or any current or former director or officer or other

employee of the Corporation arising pursuant to any provision of the DGCL or this Certificate of Incorporation or the Bylaws (as either

may be amended from time to time), (d) any action asserting a claim related to or involving the Corporation that is governed by the internal

affairs doctrine, or (e) any action asserting an “internal corporate claim” as that term is defined in Section 115 of the

DGCL, shall be a state court located within the State of Delaware (or, if no state court located within the State of Delaware has jurisdiction,

the federal court for the District of Delaware). Unless the Corporation consents in writing to the selection of an alternative forum,

the federal district courts of the United States shall be the exclusive forum for the resolution of any complaint asserting a cause of

action arising under the Securities Act of 1933, as amended. This exclusive forum provision does not apply to claims arising under the

Securities Exchange Act of 1934, as amended.

IN WITNESS WHEREOF, the undersigned has duly executed this Amended

and Restated Certificate of Incorporation, this 6th day of June.

| |

By: |

|

| |

Name: |

Mark Meller |

| |

Title: |

Chief Executive Officer |

Annex B

Jacobs Private Equity II, LLC

Five American Lane

Greenwich, CT 06831

Email: Austin.Landow@jpe.com

Attention: Austin Landow

May 28, 2024

| RE: | Amended and Restated Investment Agreement |

Ladies and Gentlemen:

Reference is made to that

certain Amended and Restated Investment Agreement (the “Agreement”), dated as of April 14, 2024, by and among SilverSun

Technologies, Inc. (the “Company”), Jacobs Private Equity II, LLC (the “Principal Investor”) and

the other investors party thereto (including any additional investors made party thereto by joinder) (collectively, together with the

Principal Investor, the “Investors”). For good and valuable consideration, and intending to be legally bound, the parties

agree that, notwithstanding anything to the contrary contained in the Agreement:

| 1. | Section 2.03(a) of the Agreement is hereby amended and restated in its entirety as follows: |

“As early as practicable on the

Closing Date and prior to the Closing, the Company shall file with the Secretary of State of the State of Delaware in accordance with

the Laws of the State of Delaware (i) the Fifth A&R Certificate of Incorporation, with effectiveness as of 9:00 a.m., New York Time,

on the Closing Date, and (ii) the Certificate of Designation, with effectiveness as of 9:02 a.m., New York Time, on the Closing Date.”

| 2. | The first sentence of Section 3.01(dd) of the Agreement is hereby amended and restated in its entirety

as follows: |

“Each of the Fifth A&R Certificate

of Incorporation and the Certificate of Designation with respect to the Preferred Stock (the “Certificate of Designation”)

has been duly adopted by the Company and the Board of Directors of the Company, and will be duly filed with the Secretary of State of

the State of Delaware in accordance with this Agreement and the Laws of the State of Delaware on the Closing Date. The Fifth A&R Certificate

of Incorporation will be effective as of 9:00 a.m., New York Time, on the Closing Date, and the Certificate of Designation will be effective

as of 9:02 a.m., New York Time, on the Closing Date.”

| 3. | Exhibit D of the Agreement is hereby amended and restated to be in the form of Annex A attached

to this letter agreement. |

Except as expressly provided

herein, the Agreement is not amended, supplemented, modified, revised or otherwise affected by this letter agreement. All references in

the Agreement to “this Agreement,” “the Agreement,” “hereunder,” “hereof,” “herein”

or words of like import, and each reference to the Agreement in any other agreements, documents or instruments executed and delivered

pursuant to or in connection with the Agreement shall be deemed to mean and be a reference to the Agreement as amended by this letter

agreement.

Sections 8.07, 8.10, 8.11

and 8.12 of the Agreement are incorporated by reference herein, mutatis mutandis.

Please acknowledge your understanding

of our agreement as set forth herein by signing this letter agreement in the space provided below and returning a copy to the undersigned.

This letter agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together

shall constitute one and the same instrument.

[Remainder of page left intentionally blank]

| |

Very truly yours, |

| |

|

| |

SILVERSUN TECHNOLOGIES, INC. |

| |

|

| |

By: |

/s/ Mark Meller |

| |

Name: |

Mark Meller |

| |

Title: |

Chief Executive Officer |

| Accepted and agreed to as of |

|

| the date set forth above: |

|

| |

|

| JACOBS PRIVATE EQUITY II, LLC |

|

| |

|

| By: |

/s/ Brad Jacobs |

|

| Name: |

Brad Jacobs |

|

| Title: |

Managing Member |

|

| |

|

| PRINCIPAL INVESTOR: |

|

| |

|

| JACOBS PRIVATE EQUITY II, LLC |

|

| (on behalf of the other Investors) |

|

| |

|

| By: |

/s/ Brad Jacobs |

|

| Name: |

Brad Jacobs |

|

| Title: |

Managing Member |

|

CC:

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, NY 10019

Email: AOEmmerich@wlrk.com; VSapezhnikov@wlrk.com

Attention: Adam O. Emmerich; Viktor Sapezhnikov

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Woodbridge, NJ 08830

Email: jlucosky@lucbro.com; chaunschild@lucbro.com

Attention: Joseph Lucosky; Chris Haunschild

Annex A

(See Annex A to the Proxy Supplement)

B-4

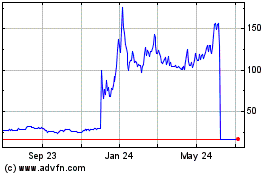

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Jun 2024 to Jul 2024

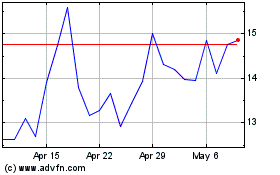

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Jul 2023 to Jul 2024