Report of Foreign Issuer (6-k)

April 01 2015 - 6:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2015

Commission File Number 000-20181

SAPIENS INTERNATIONAL CORPORATION N.V.

(Translation of Registrant’s name

into English)

c/o Landhuis Joonchi

Kaya Richard J.

Beaujon z/n

P.O. Box 837

Willemstad,

Curaçao

(Address of Principal

Executive Office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Sapiens

International Corporation N.V. |

| |

|

|

| |

By: /s/ Roni Giladi |

|

| |

Roni Giladi |

|

| |

Chief Financial Officer |

|

Dated: April 1, 2015

Exhibit 99.1

Sapiens Launches Closed Books Solution

for the Greater European Insurance Market

Closed Books is an end-to-end system

specifically designed for

cost- and process-efficient legacy portfolio administration

Holon, Israel – April 1, 2015 – Sapiens

International Corporation, (NASDAQ and TASE: SPNS), a leading global provider of software solutions for the insurance industry,

with an emerging focus on the broader financial services sector, today announced the official launch and general availability

of its Sapiens Closed Books solution for the European life and pension (L&P) insurance market.

Already successfully in production at Wesleyan Assurance Society

in the UK, the Closed Books offering from Sapiens is now generally available across Europe. Sapiens Closed Books is a unique solution

for L&P insurers that is designed to provide a modern and cost-efficient platform for the administration of insurers’

legacy portfolios. Whether the platform is chosen as part of an “Old-Co/New-Co” strategy or as an Old-Co consolidation

platform, Sapiens Closed Books is ideal for addressing the administration of legacy portfolio challenges shared by most insurers.

Insurer benefits following the implementation of Sapiens Closed

Books include significant cost reductions through legacy decommissioning and increased in-force policy to FTE ratios; improved

operational and reporting consistency across all products; a single view of the customer, along with a consistent and quality customer

experience; and significantly reduced reliance on a rapidly retiring legacy system skill-set. A variety of deployment and pricing

options are available, offering flexibility to meet each insurer’s specific needs, budgets and preferences.

“When looking to make processing our legacy portfolio

much more efficient, we turned to Sapiens and the Closed Books solution,” commented Liz McKenzie, Wesleyan’s Group

Corporate Services director. “Not only is the system a complete and modern solution to manage our closed books of business,

but the expertise of the Sapiens team and the commitment to work with us through our closed books implementation demonstrated a

true partnership between our organizations.”

Highlights of the Sapiens Closed Book solution’s capabilities

include:

| · | Full

support for post-new business functionality |

| · | A

product-agnostic approach supporting over 400 products across the insurance business |

| · | Support

for multi-jurisdiction and legislation |

| · | Company

layers, enabling multiple books of business to be logically split, or simply branded individually |

| · | A

unique, sophisticated and proven migration capability that deals with dirty data, minimizing the need for an expensive and time-consuming

data clean-up effort |

"Our Closed Book offering comes at a time when legacy

portfolio management is becoming more and more expensive for insurers,” said Henry Ainouze, vice president of sales and

operations, Sapiens Europe. “The impact of portfolio attrition

and the ongoing need to support legislative requirements continue to drive up the unit costs per policy. Consolidation of legacy

platforms on our Closed Books solutions enables insurers to reduce these costs and realize significant reserve release through

de-commissioning of out-of-date, inefficient and increasingly expensive legacy environments.”

About Sapiens

Sapiens International Corporation (NASDAQ and TASE: SPNS) is

a leading global provider of software solutions for the insurance industry, with an emerging focus on the broader financial services

sector. Sapiens offers core, end-to-end solutions to the global general insurance, property and casualty, life, pension and annuities,

reinsurance and retirement markets, as well as business decision management software. The company has a track record of over 30

years in delivering superior software solutions to more than 130 financial services organizations. The Sapiens team of over 1,000

professionals operates through our fully-owned subsidiaries in North America, the United Kingdom, EMEA and Asia Pacific. For more

information: www.sapiens.com.

Investors and Media Contact

Yaffa Cohen-Ifrah

Chief Marketing Officer and Head of Corporate Communications

Sapiens International

Mobile: +1-201-250-9414

Phone: +972-3-790-2026

Email: Yaffa.cohen-ifrah@sapiens.com

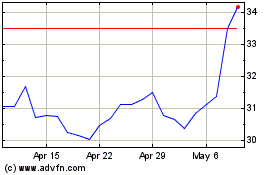

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

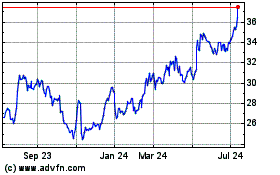

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From Jul 2023 to Jul 2024