UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2015

Regulus Therapeutics Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35670 |

|

26-4738379 |

(State

of incorporation) |

|

(Commission

File No.) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

| 3545 John Hopkins Court

Suite 210 San Diego,

CA |

|

92121 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 202-6300

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2015, we issued a press release announcing our financial results for the quarter ended March 31, 2015. A copy of the press

release is attached hereto as Exhibit 99.1. The information in this Item 2.02 and the attached Exhibit 99.1 are being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of

1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item 2.02 and the attached exhibit shall not be incorporated by reference into any registration statement or other document pursuant to the

Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press release issued by Regulus Therapeutics Inc. on May 7, 2015 relating to financial results |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Regulus Therapeutics Inc. |

|

|

|

|

| Date: May 7, 2015 |

|

|

|

By: |

|

/s/ Kleanthis G. Xanthopoulos |

|

|

|

|

|

|

Kleanthis G. Xanthopoulos, Ph.D. |

|

|

|

|

|

|

President and Chief Executive Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press release issued by Regulus Therapeutics Inc. on May 7, 2015 relating to financial results |

Exhibit 99.1

Regulus Reports First Quarter 2015 Financial Results and Recent Highlights

- Advanced ‘Clinical Map Initiative’ with Positive Results on RG-101 and Selection of RG-125 as 3rd Clinical Candidate –

- Maintained Strong Financial Position Ending Q1 2015 with $148.8 Million in Cash –

LA JOLLA, Calif., May 7, 2015 – Regulus Therapeutics Inc. (NASDAQ:RGLS), a biopharmaceutical company leading the discovery and

development of innovative medicines targeting microRNAs, today reported financial results for the first quarter ended March 31, 2015, including a summary of recent corporate highlights.

“The highlights during the first quarter and recent period of 2015 demonstrate our ability to continually execute on our ‘Clinical Map

Initiative’ goals and increase our confidence in our approach to treating disease with microRNA therapeutics,” said Kleanthis G. Xanthopoulos, Ph.D., President and CEO of Regulus. “Most notably, we reported impressive results with

RG-101, our wholly-owned anti-miR-122 for the treatment of HCV, advanced our clinical portfolio with AstraZeneca’s selection of RG-125, a novel insulin sensitizer, and pursued new microRNA targets to maintain our scientific leadership. All

told, these accomplishments have positioned us for an exciting year that will showcase the breadth of our opportunity with microRNAs.”

Paul Grint,

M.D., Chief Medical Officer of Regulus, added, “Our recent progress has positioned us for an exciting period focused on the growth of our clinical portfolio and we have several key catalysts fast-approaching. Specifically, we are preparing to

initiate Phase II studies for RG-101 and our first clinical study for RG-012, an anti-miR-21 to treat Alport syndrome, and we intend to advance additional programs into clinical development.”

First Quarter 2015 and Recent Highlights

| |

• |

|

Strengthened Profile of RG-101 with Data at The International Liver Congress™ (ILC 2015). Regulus presented results highlighting the

favorable preclinical and clinical profile of RG-101 at ILC 2015 in Vienna, Austria in multiple posters and an oral late-breaking session. Extended follow-up results evaluating a single subcutaneous administration of either 2 mg/kg or

4 mg/kg of RG-101 as monotherapy in HCV patients with varied genotypes, liver fibrosis status and treatment history showed that 10/22 patients had HCV RNA levels below the limit of quantification (“BLOQ”) at 12 weeks and 70 percent of

those patients remained BLOQ at 20 weeks (7/10). Previously, Regulus reported results from the completed clinical study evaluating a single administration of either 2 mg/kg or 4 mg/kg of RG-101 in the same patient population over 8 weeks (57 days).

These results demonstrated that at day 57, 15 out of 28 patients had HCV RNA levels BLOQ and RG-101 was well tolerated with no serious adverse events or discontinuations reported in the treated HCV patients. Under the ‘Clinical Map

|

1

| |

Initiative’, Regulus expects to initiate Phase II studies investigating RG-101 in combination with oral direct-acting antiviral agents, and further as a single agent, with interim data

expected by the end of 2015. |

| |

• |

|

Advanced Clinical Portfolio with Selection of RG-125(AZD4076) by AstraZeneca; Earned $2.5M Milestone. Regulus achieved a key ‘Clinical Map Initiative’ goal for 2015 with the selection of its third

candidate for clinical development, RG-125 (AZD4076), a GalNAc-conjugated anti-miR targeting microRNA-103/107 (“miR-103/107”) for the treatment of Non Alcoholic Steatohepatitis (“NASH”) in patients with type 2

diabetes/pre-diabetes. Regulus and AstraZeneca aim to present key preclinical data on RG-125 (AZD4076) at a scientific meeting later this year and expect to initiate a Phase I study of RG-125 (AZD4076) in humans by the end of 2015.

|

| |

• |

|

Achieved Orphan Drug Status for RG-012 in Europe. The European Commission granted orphan medicinal product designation for RG-012, an anti-miR targeting microRNA-21 (“miR-21”) for the treatment of

Alport syndrome, a life-threatening genetic kidney disease with no approved therapy. The European designation adds to the orphan drug status received for RG-012 in the United States in 2014. Under the ‘Clinical Map Initiative’, Regulus

plans to enroll up to 120 Alport syndrome patients in a global natural history of disease study called ATHENA, which was initiated in September 2014 and is designed to characterize the natural decline of renal function as measured by established

renal markers in Alport syndrome patients over time. In the near term, Regulus plans to initiate a Phase I study to evaluate the safety and tolerability of RG-012 in healthy volunteers and a Phase II proof-of-concept study thereafter.

|

| |

• |

|

Advanced Preclinical microRNA Portfolio, Independently and with Strategic Partners. Regulus continued to pursue several undisclosed microRNA targets, mainly for oncology and orphan disease indications. In

addition to its internal research efforts, Regulus advanced several programs with its strategic alliance partners, miR-103/107 for the treatment of metabolic diseases (RG-125 (AZD4076)) and microRNA-19 for oncology indications with AstraZeneca,

microRNA-221 and miR-21 for hepatocellular carcinoma and miR-21 for renal fibrosis (RG-012) with Sanofi. |

Neil W. Gibson, Ph.D., Chief

Scientific Officer of Regulus, added, “Our recent scientific progress highlights the productivity of Regulus’ technology platform and the applicability of microRNA therapeutics to potentially treat a wide range of diseases. We believe that

new approaches like microRNA may provide innovative treatment options in areas of unmet medical need and we look forward to advancing our research.”

First Quarter 2015 Financial Results & Highlights

Regulus reported a net loss of $14.5 million for the quarter ended March 31, 2015, compared to a net loss of $12.7 million for the quarter ended

March 31, 2014. Basic and diluted net loss per share was $0.29 for the quarter ended March 31, 2015, compared to net loss per share of $0.30 for the quarter ended March 31, 2014.

2

Regulus recognized revenue of $4.2 million for the quarter ended March 31, 2015, compared to $1.6 million

for the quarter ended March 31, 2014. Revenue for the quarter ended March 31, 2015 included a $2.5 million pre-clinical milestone upon AstraZeneca’s selection of RG-125 (AZD4076) as a clinical candidate. Other revenue during

these periods consisted primarily of amortization of up-front payments received, which is recognized over the estimated period of performance, and payments for other research services under our strategic alliances and collaborations.

Research and development expenses were $13.4 million for the quarter ended March 31, 2015, compared to $9.6 million for quarter ended March 31,

2014. This increase was primarily driven by Phase I clinical study costs for RG-101, IND-enabling costs for RG-125 (AZD4076) and an increase in personnel and research costs to support the growth of the pipeline.

General and administrative expenses were $3.6 million for the quarter ended March 31, 2015, compared to $2.7 million for the quarter ended March 31,

2014. This increase was primarily driven by an increase in salaries and related employee costs, including stock-based compensation.

Net loss for the

quarter ended March 31, 2015 included a non-cash charge of $1.8 million from the change in value of our convertible note payable, compared to a non-cash charge of $2.1 million for the quarter ended March 31, 2014. In January 2015, the

principal balance of the convertible note payable of $5.4 million was converted into 1,356,738 shares of common stock at a conversion price of $4.00 per share.

As of March 31, 2015, Regulus had $148.8 million in cash, cash equivalents and short-term investments and 50,762,489 shares of common stock outstanding.

2015 Financial Guidance

Regulus’ cash guidance

remains unchanged and the company expects to end 2015 with greater than $100.0 million in cash, cash equivalents and short-term investments.

“Regulus continues to maintain a solid financial balance sheet, ending the first quarter 2015 with approximately $148 million in cash, which includes

milestone payments received from our strategic alliance partners and collaborators,” said David Szekeres, Chief Business Officer and General Counsel of Regulus. “We believe that these relationships will provide opportunities to recognize

additional revenues as we develop our microRNA therapeutics through clinical studies and eventually toward the market.”

Conference

Call & Webcast Information

Regulus will host a conference call and webcast at 5:00 p.m. Eastern Standard Time today to discuss its first

quarter 2015 financial results, recent company highlights and its expectations for the remainder of the year. A live webcast of the call will be available online at www.regulusrx.com. To access the call, please dial (877) 257-8599

(domestic) or (970) 315-0459 (international) and refer to conference ID 40363416. To access the telephone replay of the call, dial (855) 859-2056 (domestic) or (404) 537-3406 (international), passcode 40363416. The webcast and

telephone replay will be archived on the company’s website following the call.

3

About Regulus

Regulus Therapeutics Inc. (NASDAQ:RGLS) is a biopharmaceutical company leading the discovery and development of innovative medicines targeting

microRNAs. Regulus has leveraged its oligonucleotide drug discovery and development expertise to develop a well-balanced microRNA therapeutics pipeline complemented by a maturing

microMarkersSM biomarkers platform and a rich intellectual property estate to retain its domain dominant leadership in the microRNA field. Under its ‘Clinical Map Initiative’,

Regulus is developing RG-101, a GalNAc-conjugated anti-miR targeting microRNA-122 for the treatment of chronic hepatitis C virus infection, and RG-012, an anti-miR targeting microRNA-21 for the treatment of Alport syndrome, a life-threatening kidney

disease driven by genetic mutations with no approved therapy. In addition, RG-125, a GalNAc-conjugated anti-miR targeting microRNA-103/107 for the treatment of NASH in patients with type 2 diabetes/pre-diabetes, has been selected for clinical

development. Regulus is also advancing several programs toward clinical development in orphan disease indications, oncology and fibrosis. Regulus’ commitment to innovation has resulted in multiple peer-reviewed publications in notable

scientific journals and has resulted in the formation of strategic alliances with AstraZeneca and Sanofi and a research collaboration with Biogen focused on microRNA biomarkers. Regulus maintains its corporate headquarters in La Jolla, CA. For more

information, please visit http://www.regulusrx.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including statements associated with financial estimates (including Regulus’ projected cash at the end of 2015), the projected sufficiency of Regulus’ capital position for future periods,

the expected ability of Regulus to undertake certain activities and accomplish certain goals (including with respect to development and other activities related to RG-101, RG-012 and RG-125), the projected timeline of clinical development

activities, and expectations regarding future therapeutic and commercial potential of Regulus’ business plans, technologies and intellectual property related to microRNA therapeutics or the Regulus microMarkersSM division being discovered and developed by Regulus. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such

forward-looking statements. Words such as “believes,” “anticipates,” “plans,” “expects,” “intends,” “will,” “goal,” “potential” and similar expressions are intended to

identify forward-looking statements. These forward-looking statements are based upon Regulus’ current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could

differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, risks associated with the process of discovering, developing and commercializing drugs

that are safe and effective for use as human therapeutics, and in the endeavor of building a business around such drugs. These and other risks concerning Regulus’ financial position and programs are described in additional detail in

Regulus filings with the Securities and Exchange

4

Commission. All forward-looking statements contained in this press release speak only as of the date on

which they were made. Regulus undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

Regulus Therapeutics Inc.

Selected Financial Information

Condensed Statement of Operations

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

| Revenues: |

|

|

|

|

|

|

|

|

| Revenues under strategic alliances and collaborations |

|

$ |

4,200 |

|

|

$ |

1,631 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Research and development |

|

|

13,427 |

|

|

|

9,604 |

|

| General and administrative |

|

|

3,644 |

|

|

|

2,732 |

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

17,071 |

|

|

|

12,336 |

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(12,871 |

) |

|

|

(10,705 |

) |

| Other expense, net |

|

|

(1,620 |

) |

|

|

(2,305 |

) |

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(14,491 |

) |

|

|

(12,740 |

) |

| Income tax (benefit) expense |

|

|

(4 |

) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(14,487 |

) |

|

$ |

(12,741 |

) |

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per share |

|

$ |

(0.29 |

) |

|

$ |

(0.30 |

) |

|

|

|

|

|

|

|

|

|

| Shares used to compute basic and diluted net loss per share |

|

|

50,071,165 |

|

|

|

42,690,200 |

|

|

|

|

|

|

|

|

|

|

Regulus Therapeutics Inc.

Condensed Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

| |

|

March 31,

2015 |

|

|

December 31,

2014 |

|

| |

|

(Unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Cash, cash equivalents and short-term investments |

|

$ |

148,791 |

|

|

$ |

159,743 |

|

| Other current assets |

|

|

9,726 |

|

|

|

5,208 |

|

| Non-current assets |

|

|

6,331 |

|

|

|

6,529 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

164,848 |

|

|

$ |

171,480 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

9,044 |

|

|

$ |

8,698 |

|

| Total deferred revenue |

|

|

8,076 |

|

|

|

6,349 |

|

| Convertible notes payable, at fair value |

|

|

— |

|

|

|

23,397 |

|

| Other long-term liabilities |

|

|

903 |

|

|

|

1,022 |

|

| Stockholders’ equity |

|

|

146,825 |

|

|

|

132,014 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

164,848 |

|

|

$ |

171,480 |

|

|

|

|

|

|

|

|

|

|

5

Investor Relations Contact:

Amy Conrad

Senior Director, Investor Relations and Corporate

Communications

Regulus Therapeutics Inc.

858-202-6321

aconrad@regulusrx.com

Media Contact:

Liz Bryan

Spectrum Science

lbryan@spectrumscience.com

202-955-6222 x2526

6

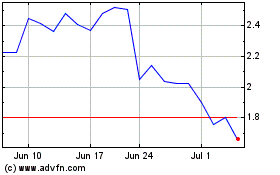

Regulus Therapeutics (NASDAQ:RGLS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Regulus Therapeutics (NASDAQ:RGLS)

Historical Stock Chart

From Jul 2023 to Jul 2024