UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of September 2014 (Report No. 3)

Commission File Number: 0-29452

RADCOM LTD.

(Translation of registrant’s name into English)

24 Raoul Wallenberg Street, Tel Aviv 69719, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form:40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): N/A

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): N/A

THIS FORM 6-K IS HEREBY INCORPORATED BY REFERENCE INTO RADCOM LTD.’S REGISTRATION STATEMENTS ON FORM S-8 (REGISTRATION STATEMENT NOS. 333-13250, 333-111931, 333-123981, 333-190207 AND 333-195465) AND FORM F-3 (REGISTRATION STATEMENT NOS. 333-170512 AND 333-189111), AND SHALL BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FILED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

CONTENTS

This report on Form 6-K of the registrant consists of the following document, which is attached hereto and incorporated by reference herein:

|

Exhibit 99.1

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

|

Exhibit 99.2

|

Interim Consolidated Financial Statements, as of June 30, 2014.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

RADCOM LTD.

|

|

| |

|

|

|

|

Date: September 17, 2014

|

By:

|

/s/ Uri Birenberg

|

|

| |

Name:

|

Uri Birenberg

|

|

| |

Title:

|

CFO

|

|

| |

|

|

|

EXHIBIT INDEX

|

Exhibit 99.1

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

|

Exhibit 99.2

|

Interim Consolidated Financial Statements, as of June 30, 2014.

|

Exhibit 99.1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement Regarding Forward-Looking Statements

Except for the historical information contained in the following sections, the statements contained in the following sections are “forward-looking statements” within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Statements preceded by, followed by, or that otherwise include the words "believes", "expects", "anticipates", "intends", "estimates", "plans", and similar expressions or future or conditional verbs such as "will", "should", "would", "may" and "could" are generally forward-looking in nature and not historical facts. Because such statements deal with future events, they are subject to various risks and uncertainties and actual results could differ materially from our current expectations.

General

You should read the following discussion and analysis in conjunction with our interim unaudited consolidated financial statements for the six months ended June 30, 2014 and notes thereto, and together with our audited consolidated financial statements for the year ended December 31, 2013 filed on March 26, 2014, with the Securities and Exchange Commission ("SEC") as part of the Company’s annual report on form 20-F for the year ended December 31, 2013.

Unless indicated otherwise by the context, all references below to:

|

·

|

“we”, “us”, “our”, “Radcom”, or the “Company” are to Radcom Ltd and its subsidiaries;

|

|

·

|

“dollars” or “$” are to United States dollars; and

|

|

·

|

“NIS” or “shekel” are to New Israeli Shekels.

|

Overview

We provide innovative service assurance and customer experience management solutions for leading telecom operators and communications service providers. We specializes in solutions for next-generation mobile and fixed networks, including LTE, VoLTE, IMS, VoIP, UMTS/GSM and mobile broadband. Our comprehensive, carrier-grade solutions are designed for big data analytics on terabit networks, and are used to prevent service provider revenue leakage and to enhance customer care management. Our products interact with policy management to provide self-optimizing network solutions.

Financial Highlights

Total revenues in the first six months of 2014 increased by 4.2% to approximately $10.4 million from approximately $10.0 million in the first six months of 2013. The increase reflects the Company’s execution of its backlog and continued momentum in the emerging markets of Latin America and Asia.

Operating Income for the first six months of 2014 was approximately $60,000, compared to an Operating Loss of $270,000 for the same period of 2013. The positive change from operating loss to operating income is explained by a combination of growth in the revenues and decreases in the cost of product expenses, as a result of initial sales of MaveriQ, the Company’s new NFV-ready software-based solution, as part of the company's transition to a software-driven business model.

Net Income for the first six months of 2014 was approximately $0.3 million, or $0.04 per share, compared to a Net Loss of approximately $0.4 million, or ($0.06) per share, in the same period last year.

Cash and cash equivalents were approximately $3.9 million as of June 30, 2014, compared to $1.2 million as of December 31, 2013 (excluding restricted bank deposits of approximately $1.5 million as of December 31, 2013), due to improvement in collection and maturity of restricted bank deposits in the first six months of 2014.

Shareholders' equity increased to $8.6 million as of June 30, 2014, compared to $7.5 million as of December 31, 2013, as a result of net profit of approximately $0.3 million, options exercise of approximately $0.2 million, increase in foreign currency translation capital fund of approximately $0.2 million and share-based compensation of approximately $0.3 million.

| |

|

Six month periods ended June 30,

(U.S. dollars in thousands)

UNAUDITED

|

|

|

% Change

2014 vs. 2013

|

|

| |

|

2014

|

|

|

2013

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

Products

|

|

$

|

9,002

|

|

|

$

|

8,733

|

|

|

|

3.1

|

%

|

|

Services

|

|

|

1,439

|

|

|

|

1,283

|

|

|

|

12.2

|

%

|

| |

|

|

10,441

|

|

|

|

10,016

|

|

|

|

4.2

|

%

|

|

Cost of Products

|

|

|

2,844

|

|

|

|

3,173

|

|

|

|

(10.4)

|

%

|

|

Cost of services

|

|

|

181

|

|

|

|

143

|

|

|

|

26.6

|

%

|

| |

|

|

3,025

|

|

|

|

3,316

|

|

|

|

(8.8)

|

%

|

|

Gross Profit

|

|

|

7,416

|

|

|

|

6,700

|

|

|

|

10.7

|

%

|

|

Research and Development

|

|

|

3,086

|

|

|

|

2,871

|

|

|

|

7.5

|

%

|

|

Less royalty-bearing participation

|

|

|

587

|

|

|

|

669

|

|

|

|

(12.3)

|

%

|

|

Research and Development, net

|

|

|

2,499

|

|

|

|

2,202

|

|

|

|

13.5

|

%

|

|

Selling and Marketing, net

|

|

|

3,721

|

|

|

|

3,790

|

|

|

|

(1.8)

|

%

|

|

General and Administrative

|

|

|

1,136

|

|

|

|

978

|

|

|

|

16.2

|

%

|

|

Total Operating Expenses

|

|

|

7,356

|

|

|

|

6,970

|

|

|

|

5.5

|

%

|

|

Operating Income (Loss)

|

|

|

60

|

|

|

|

(270)

|

|

|

|

122.2

|

%

|

|

Financial Income (Expenses), net

|

|

|

257

|

|

|

|

(120)

|

|

|

|

314.2

|

%

|

|

Net Income (Loss)

|

|

$

|

317

|

|

|

$

|

(390)

|

|

|

|

181.3%

|

%

|

Revenues. Total revenues in the first six months of 2014 increased by 4.2% to approximately $10.4 million from approximately $10.0 million in the first six months of 2013. Revenues from Products increased by 3.1% to $9.0 million in the first six months of 2014 from $8.7 million in the first six months of 2013, reflecting the Company’s execution of its backlog and continued momentum in the emerging markets of Latin America and Asia. Revenues from Services increased by 12.2% from approximately $1.3 million in the first six months of 2013 to $1.4 million in the first six months of 2014.

Cost of sales. Our cost of sales decreased by 8.8% from $3.3 million in the first six months of 2013 to $3.0 million in the first six months of 2014. Cost of sales from products decreased by 10.4% from $3.2 million in the first six months of 2013 from $2.8 million in the first six months of 2014, reflecting the transition to a software-driven business model and initial sales of MaveriQ, the Company’s new NFV-ready software-based solution which reduces our material costs. Cost of sales from services increased by 26.6% to $181,000 in the first six months of 2014 from $143,000 in the first six months of 2013. This increase is attributable mainly to the ongoing increases in our customer base over the last few years, while maintaining a high rate of customer warranty renewals.

Gross margin increased to 71.0% in the first six months of 2014 from 66.9% in the first six months of 2013, reflecting higher margins and lower fixed costs.

Research and Development, net. Research and development expenses increased by 7.5% to $3.1 million in the first six months of 2014 from $2.9 million in the first six months of 2013, mainly due to an increase in sub-contractor expenses and payroll and payroll accrual costs (which resulted from the strengthening of the shekel against the dollar).

Selling and Marketing, net. Selling and Marketing expenses decreased by 1.8% to $3.7 million in the first six months of 2014 from $3.8 million in the first six months of 2013, mainly due to a reduction of the expenses in our offices abroad.

General and Administrative. General and Administrative expenses increased by 16.2% to $1.1 million in the first six months of 2014 from $1.0 million in the first six months of 2013, due to an increase in payroll and payroll accruals costs.

Financial Income (Expenses), Net. In the first six months of 2014 we recorded Financial Income of approximately $257,000, compared to financial expenses of approximately $120,000 in the first six months of 2013. The positive change is mainly due to exchange rate differences and interest income on deposits in Brazil.

LIQUIDITY AND CAPITAL RESOURCES

In the past few years, we financed our operations through cash generated by operations, private equity investments, short-term loans and credit facilities.

Financing Activities

On April 23, 2013, the Company entered into a share purchase agreement (the “Purchase Agreement”) with several investors relating to a private placement transaction (the “2013 PIPE”). Pursuant to the terms of the Purchase Agreement, the Company issued 1,239,639 ordinary shares to investors at a purchase price of $2.79 per ordinary share. Certain existing shareholders participated in the 2013 PIPE, including Mr. Zohar Zisapel, our chairman, who entered into the Purchase Agreement through two Israeli entities wholly owned by him. Mr. Zisapel’s participation in the transaction through the entities wholly owned by him required our shareholders’ approval, which was obtained on June 30, 2013. The Company also issued to the investors warrants to purchase one ordinary share for every three ordinary shares purchased by them (a total of 413,213 shares), for an exercise price of $ 3.49 per ordinary share. The warrants are exercisable for three years from the closing of the Purchase Agreement. As of June 30, 2014, 79,307 warrants have been exercised.

Working Capital and Cash Flows

Liquidity refers to liquid financial assets available to fund our business operations and pay for near-term obligations. These liquid financial assets mostly consist of cash and cash equivalents. As of June 30, 2014, we had approximately $3.9 million in cash and cash equivalents, compared to $1.2 million as of December 31, 2013 (excluding restricted bank deposit of approximately $1.5 million as of December 31, 2013).

In September 2012, we obtained a credit facility from the First International Bank of Israel in the amount of $1.5 million. Under this facility, as of June 30, 2014, we had no outstanding balance, compared to a $629,000 outstanding short-term bank credit as of December 31, 2013.

Net cash provided by operating activities was approximately $1.5 million in the first six months of 2014 compared to $1.5 million net cash used by operating activities in the first six months of 2013. The positive net cash flow in the first six months of 2014 was primarily due to a decrease of approximately $1.5 million in trade receivables, which was partially offset by a decrease of $1.1 million in trade payables. The negative net cash flow in the first six months of 2013 was primarily due to an increase of approximately $2.2 million in trade receivable and a decrease of $0.7 million in trade payables. This was partially offset by a decrease of $1 million in inventories and an increase of $0.5 million in deferred revenue and advances from customers.

Net cash provided in investing activities was approximately $1.4 million in the first six months of 2014 compared to $0.3 million net cash used in the first six months of 2013. In the first six months of 2013 we invested in short-term restricted bank deposits which were required in order to secure bonds provided to certain customers. Those restricted bank deposits were repaid in full during the first six months of 2014.

Net cash used by financing activities was approximately $0.4 million in the first six months of 2014 compared to $1.7 million net cash provided in the first six months of 2013. In the first six months of 2014 cash was used for repaying a short-term credit line of approximately $0.6 million, offset by proceeds from options and warrants of approximately $0.2 million, while the cash provided in the first six months of 2013 was mainly due to proceeds from the issuance of ordinary shares as part of the 2013 PIPE, offset by a short-term loan received from a major shareholder.

The Company believes that its existing capital resources and expected cash flows from operations will be adequate to satisfy its expected liquidity requirements at least for the next 12 months.

CERTAIN CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the United States requires us to make judgments, assumptions and estimates that affect the amounts reported in the Consolidated Financial Statements and accompanying notes. Note 2 to the Consolidated Financial Statements in our Annual Report on Form 20-F for the fiscal year ended December 31, 2013 filed with the SEC on March 26, 2014 describes the significant accounting policies and methods used in the preparation of the Consolidated Financial Statements.

RISK FACTORS

Except as detailed below, there are no material changes to the risk factors previously disclosed in our Annual Report on Form 20-F for the year ended December 31, 2013 filed with the SEC on March 26, 2014.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Reference is made to “Quantitative and Qualitative Disclosures About Market Risk” (Item 11) in our Annual Report on Form 20-F for the year ended December 31, 2013 filed with the SEC on March 26, 2014.

Not applicable.

Exhibit 99.2

RADCOM LTD. AND ITS SUBSIDIARIES

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2014

UNAUDITED

INDEX

| |

Page

|

| |

|

|

|

F-2 - F-3

|

| |

|

|

|

F - 4

|

| |

|

|

|

F - 5

|

| |

|

|

|

F-6 - F-7

|

| |

|

|

|

F-8 - F-14

|

RADCOM LTD. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

June 30,

|

|

|

December 31, |

|

| |

|

2014

|

|

|

2013

|

|

|

|

|

Unaudited

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

3,853 |

|

|

$ |

1,185 |

|

|

Restricted bank deposits

|

|

|

- |

|

|

|

1,505 |

|

|

Trade receivables (net of allowances for doubtful accounts of $ 20 as

of June 30, 2014 and December 31, 2013)

|

|

|

4,397 |

|

|

|

5,723 |

|

|

Inventories

|

|

|

4,217 |

|

|

|

4,352 |

|

|

Other account receivables and prepaid expenses

|

|

|

3,199 |

|

|

|

3,092 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

15,666 |

|

|

|

15,857 |

|

| |

|

|

|

|

|

|

|

|

|

SEVERENCE PAY FUND

|

|

|

3,469 |

|

|

|

3,535 |

|

| |

|

|

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, NET

|

|

|

234 |

|

|

|

253 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

19,369 |

|

|

$ |

19,645 |

|

The accompanying notes are an integral part of the consolidated financial statements.

RADCOM LTD. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands, except share and share data

| |

|

June 30,

|

|

|

December 31

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

Short-term bank credit

|

|

$ |

- |

|

|

$ |

629 |

|

|

Trade payables

|

|

|

1,162 |

|

|

|

2,257 |

|

|

Employees and payroll accruals

|

|

|

2,113 |

|

|

|

2,109 |

|

|

Deferred revenues and advances from customers

|

|

|

1,405 |

|

|

|

1,305 |

|

|

Other account payables and accrued expenses

|

|

|

1,681 |

|

|

|

1,795 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

6,361 |

|

|

|

8,095 |

|

| |

|

|

|

|

|

|

|

|

|

NON- CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Deferred revenue

|

|

|

508 |

|

|

|

107 |

|

|

Accrued severance pay

|

|

|

3,925 |

|

|

|

3,944 |

|

| |

|

|

|

|

|

|

|

|

|

Total long-term liabilities

|

|

|

4,433 |

|

|

|

4,051 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

10,794 |

|

|

|

12,146 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Share capital:

Ordinary shares of NIS 0.20 par value: 9,997,670 and 9,997,670

shares authorized at June 30, 2014 and December 31, 2013;

8,000,125 and 7,978,183 shares issued at June 30, 2014 and

December 31, 2013, respectively; 8,030,968 and 7,947,340 shares

outstanding at June 30, 2014 and December 31, 2013, respectively

|

|

|

339 |

|

|

|

335 |

|

|

Additional paid-in capital

|

|

|

66,299 |

|

|

|

65,791 |

|

|

Accumulated other comprehensive loss

|

|

|

(558 |

) |

|

|

(805 |

) |

|

Accumulated deficit

|

|

|

(57,505 |

) |

|

|

(57,822 |

) |

| |

|

|

|

|

|

|

|

|

|

Total shareholders' equity

|

|

|

8,575 |

|

|

|

7,499 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

$ |

19,369 |

|

|

$ |

19,645 |

|

The accompanying notes are an integral part of the consolidated financial statements.

RADCOM LTD. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

U.S. dollars in thousands, except share and share data

| |

|

Six months ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

|

Revenues:

|

|

|

|

|

|

|

|

Products

|

|

$ |

9,002 |

|

|

$ |

8,733 |

|

|

Services

|

|

|

1,439 |

|

|

|

1,283 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

10,441 |

|

|

|

10,016 |

|

| |

|

|

|

|

|

|

|

|

|

Cost of revenues:

|

|

|

|

|

|

|

|

|

|

Products

|

|

|

2,844 |

|

|

|

3,173 |

|

|

Services

|

|

|

181 |

|

|

|

143 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

3,025 |

|

|

|

3,316 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

7,416 |

|

|

|

6,700 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

3,086 |

|

|

|

2,871 |

|

|

Less - royalty-bearing participation

|

|

|

587 |

|

|

|

669 |

|

| |

|

|

|

|

|

|

|

|

|

Research and development, net

|

|

|

2,499 |

|

|

|

2,202 |

|

| |

|

|

|

|

|

|

|

|

|

Selling and marketing, net

|

|

|

3,721 |

|

|

|

3,790 |

|

|

General and administrative

|

|

|

1,136 |

|

|

|

978 |

|

| |

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

7,356 |

|

|

|

6,970 |

|

| |

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

60 |

|

|

|

(270 |

) |

| |

|

|

|

|

|

|

|

|

|

Financial income (expenses), net

|

|

|

257 |

|

|

|

(120 |

) |

| |

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

317 |

|

|

$ |

(390 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic and diluted net income (loss) per Ordinary Share

|

|

$ |

0.04 |

|

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares used in computing

basic net income (loss) per ordinary share

|

|

|

7,995,073 |

|

|

|

6,795,807 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares used in computing

diluted net income (loss) per ordinary share

|

|

|

8,482,199 |

|

|

|

6,795,807 |

|

The accompanying notes are an integral part of the consolidated financial statements.

RADCOM LTD. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

U.S. dollars in thousands, except share and share data

| |

|

Six months ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

317 |

|

|

$ |

(390 |

) |

| |

|

|

|

|

|

|

|

|

|

Other comprehensive loss:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

(247 |

) |

|

|

(240 |

) |

| |

|

|

|

|

|

|

|

|

|

Other comprehensive loss

|

|

|

(247 |

) |

|

|

(240 |

) |

| |

|

|

|

|

|

|

|

|

|

Comprehensive income (loss)

|

|

$ |

70 |

|

|

$ |

(630 |

) |

The accompanying notes are an integral part of the consolidated financial statements.

RADCOM LTD. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| |

|

Six months ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

317 |

|

|

$ |

(390 |

) |

|

Adjustments to reconcile net profit (loss) to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

46 |

|

|

|

55 |

|

|

Share-based compensation

|

|

|

291 |

|

|

|

297 |

|

|

Increase (decrease) in severance pay, net

|

|

|

47 |

|

|

|

(23 |

) |

|

Decrease (increase) in trade receivables

|

|

|

1,451 |

|

|

|

(2,213 |

) |

|

Decrease (increase) in other account receivables and prepaid expenses

|

|

|

(47 |

) |

|

|

67 |

|

|

Decreases in inventories

|

|

|

311 |

|

|

|

1,036 |

|

|

Decrease in trade payables

|

|

|

(1,068 |

) |

|

|

(693 |

) |

|

Decrease in employees and payroll accrual

|

|

|

(2 |

) |

|

|

(44 |

) |

|

Decrease in other account payables and accrued expenses

|

|

|

(321 |

) |

|

|

(108 |

) |

|

Change in restricted bank deposit

|

|

|

28 |

|

|

|

(8 |

) |

|

Increase (decrease) in deferred revenue and advances from customers

|

|

|

480 |

|

|

|

537 |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

1,533 |

|

|

|

(1,487 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows used in investing activities:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Investment in restricted bank deposits

|

|

|

- |

|

|

|

(297 |

) |

|

Maturity of restricted bank deposits

|

|

|

1,477 |

|

|

|

- |

|

|

Purchase of property and equipment

|

|

|

(52 |

) |

|

|

(41 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

1,425 |

|

|

|

(338 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Payment of short-term bank credit

|

|

|

(629 |

) |

|

|

(1,058 |

) |

|

Payment of short-term loan

|

|

|

- |

|

|

|

(777 |

) |

|

Proceeds from issuance of ordinary shares and warrants, net of issuance expenses

|

|

|

- |

|

|

|

3,428 |

|

|

Proceeds from exercise of warrants

|

|

|

20 |

|

|

|

- |

|

|

Proceeds from exercise of options

|

|

|

201 |

|

|

|

43 |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

|

(408 |

) |

|

|

1,636 |

|

| |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments on cash and cash equivalents

|

|

|

118 |

|

|

|

(7 |

) |

| |

|

|

|

|

|

|

|

|

|

Increase (Decrease) in cash and cash equivalents

|

|

|

2,668 |

|

|

|

(196 |

) |

|

Cash and cash equivalents at beginning of the period

|

|

|

1,185 |

|

|

|

1,474 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of the period

|

|

$ |

3,853 |

|

|

$ |

1,278 |

|

The accompanying notes are an integral part of the consolidated financial statements.

RADCOM LTD. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

| |

|

|

Six months ended

June 30,

|

|

| |

|

|

2014

|

|

|

2013

|

|

| |

|

|

Unaudited

|

|

|

(a)

|

Non-cash investing activities:

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Purchase of property and equipment

|

|

$ |

3 |

|

|

$ |

54 |

|

| |

|

|

|

|

|

|

|

|

|

|

(b)

|

Cash paid for interest

|

|

$ |

8 |

|

|

$ |

8 |

|

The accompanying notes are an integral part of the consolidated financial statements.

RADCOM LTD. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share and share data

|

|

a.

|

RADCOM Ltd (the "Company") is an Israeli corporation which provides innovative service assurance and customer experience management solutions for leading telecom operators and communications service providers. The Company specializes in solutions for next-generation mobile and fixed networks, including LTE, VoLTE, IMS, VoIP, UMTS/GSM and mobile broadband. RADCOM's comprehensive, carrier-grade solutions are designed for big data analytics on terabit networks, and are used to prevent service provider revenue leakage and to enhance customer care management. The Company's products interact with policy management to provide self-optimizing network solutions. RADCOM's shares are listed on the NASDAQ Capital Market under the symbol RDCM.

The Company has wholly-owned subsidiaries in the United States, Brazil and India that are primarily engaged in the sales, marketing and customer support of the Company's products in North America, Brazil and India, respectively.

|

|

|

b.

|

The Company has an accumulated deficit of $57,505 as of December 31, 2013. The Company has managed its liquidity needs through a series of cost reduction initiatives, including reduction in workforce and private placement transactions. The Company believes that its existing capital resources and expected cash flows from operations will be adequate to satisfy its expected liquidity requirements at least for the next 12 months. The Company’s foregoing estimate is based, among others, on its current backlog and pipeline.

|

|

NOTE 2:-

|

UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

The accompanying unaudited interim financial statements have been prepared in accordance with U.S. generally accepted accounting principles and standards of the Public Company Accounting Oversight Board for interim financial information. Accordingly, they do not include all the information and footnotes required by generally accepted accounting principles in the United States for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the Company's consolidated financial position as of June 30, 2014, consolidated results of operations and consolidated cash flows for the six months ended June 30, 2014 and 2013, have been included. The Results for the six months ended June 30, 2014, are not necessarily indicative of the results that may be expected for the year to end on December 31, 2014.

|

NOTE 3:-

|

SIGNIFICANT ACCOUNTING POLICIES

|

The significant accounting policies applied in the annual consolidated financial statements of the Company as disclosed in the Company's Annual Report on Form 20-F for the period ended December 31, 2013 filed with the Securities and Exchange Commission ("SEC") on March 26, 2014, are applied consistently in these interim condensed consolidated financial statements.

RADCOM LTD. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share and share data

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

|

|

|

| |

|

|

|

|

|

|

|

Raw materials

|

|

$ |

548 |

|

|

$ |

884 |

|

|

Work in process

|

|

|

329 |

|

|

|

420 |

|

|

Finished products (*)

|

|

|

3,340 |

|

|

|

3,048 |

|

| |

|

|

|

|

|

|

|

|

| |

|

$ |

4,217 |

|

|

$ |

4,352 |

|

|

|

(*)

|

Includes amounts of $ 2,305 and $ 2,109 at June 30, 2014 and December 31, 2013, respectively, with respect to inventory delivered to customers but for which revenue recognition criteria have not been met.

|

|

NOTE 5:-

|

RELATED PARTY BALANCES AND TRANSACTIONS

|

|

|

a.

|

The Company carries out transactions with related parties as detailed below. Certain principal shareholders of the Company are also principal shareholders of affiliates known as the RAD-BYNET Group. The Company's transactions with related parties are carried out on an arm's-length basis.

|

|

|

1.

|

The Company was a party to a distribution agreement with Bynet Electronics Ltd. ("BYNET"), a related party, giving BYNET the exclusive right to distribute the Company's products in Israel.

Revenues related to this distribution agreement are included in Note 5d below as "revenues". The remainder of the amount of "revenues" included in Note 5d below is comprised of sales of the Company's products to entities within RAD-BYNET Group. These revenues are aggregated for total amount of $ 12 and $ 20 for the six months ended June 30, 2014 and 2013, respectively.

|

|

|

2.

|

Certain premises occupied by the Company and the US subsidiary are rented from related parties. The US subsidiary also sub-leases certain premises to a related party. The aggregate net amounts for lease payments for the six months ended June 30, 2014 and 2013 were $ 222 and $ 184 respectively.

|

|

|

b.

|

In December 2012, the Company entered into a consulting agreement with a related party. The expenses incurred for the six months ended June 30, 2014 and 2013 were $ 31 and $ 35, respectively.

|

RADCOM LTD. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share and share data

|

NOTE 5:-

|

RELATED PARTY BALANCES AND TRANSACTIONS (Cont.)

|

|

|

c.

|

Balances with related parties:

|

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Trade

|

|

$ |

- |

|

|

$ |

11 |

|

|

Other account receivables

|

|

$ |

128 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Trade

|

|

$ |

134 |

|

|

$ |

159 |

|

|

Other account payables and accrued expenses

|

|

$ |

20 |

|

|

$ |

46 |

|

|

|

d.

|

Transactions with related parties:

|

| |

|

Six months ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

Revenues

|

|

$ |

12 |

|

|

$ |

20 |

|

| |

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

$ |

28 |

|

|

$ |

27 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Research and development, net

|

|

$ |

105 |

|

|

$ |

103 |

|

|

Sales and marketing, net

|

|

$ |

85 |

|

|

$ |

64 |

|

|

General and administrative

|

|

$ |

35 |

|

|

$ |

25 |

|

RADCOM LTD. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share and share data

|

NOTE 6:-

|

COMMITMENTS AND CONTINGENCIES

|

The Company receives research and development grants from the Office of the Chief Scientist ("OCS"). In consideration for the research and development grants received from the OCS, the Company has undertaken to pay royalties as a percentage of revenues from products developed from research and development projects financed. If the Company will not generate sales of products developed with funds provided by the OCS, the Company is not obligated to pay royalties or repay the grants.

Royalties are payable at the rate of 3.5% from the time of commencement of sales of all of these products until the cumulative amount of the royalties paid equals 100% of the dollar-linked amounts of the grants received, the maximum to be repaid is 100% plus interest at LIBOR.

The total research and development grants that the Company has received from the OCS as of June 30, 2014 were $ 36,685 which excluding accumulated interest of $ 12,010. As of June 30, 2014, the accumulated royalties paid to the OCS were $ 10,569. Accordingly, the Company's total commitment with respect to royalty-bearing participation received or accrued, net of royalties paid or accrued, amounted to $ 38,126 as of June 30, 2014.

|

NOTE 7:-

|

SHAREHOLDERS' EQUITY

|

|

|

a.

|

On April 24, 2013, the Company entered into a private placement transaction (the "2013 PIPE"). Under the PIPE investment, the Company issued 1,239,639 Ordinary Shares to investors (investors in the 2013 PIPE included certain existing shareholders) at an aggregate purchase price of $ 3,459 or $ 2.79 per Ordinary Share. The Company also issued to the investors warrants to purchase one Ordinary Share for every three Ordinary Shares purchased by each investor (up to 413,213 shares) for an exercise price of $ 3.49 per Ordinary Share. Such warrants have standard anti-dilution protection provisions and therefore were classified as part of the Company's equity. The warrants are exercisable for three years from the closing of the 2013 PIPE. As of June 30, 2014, 79,307 warrants were exercised for total amount of $ 277.

|

|

|

b.

|

On April 3, 2013, the Company approved a new Share Option Plan (the "2013 Share Option Plan"). The 2013 Share Option Plan grants options to purchase Ordinary Shares. These options are granted pursuant to the 2013 Share Option Plan for the purpose of providing incentives to employees, directors, consultants and contractors of the Company.

|

|

|

c.

|

During the six months periods ended June 30, 2014, the Company's Board of Directors approved the grant of 160,000 to certain employees at an exercise price ranged among $5.25 to $6.99 per share. Such options have vesting schedule of one year since the grant date.

|

RADCOM LTD. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share and share data

|

NOTE 7:-

|

SHAREHOLDERS' EQUITY (Cont.)

|

|

|

d.

|

The following is a summary of the Company's stock options activity for the six months ended June 30, 2014:

|

| |

|

Number of options(in thousands)

|

|

|

Weighted-average exercise price

|

|

|

Weighted- average remaining contractual term

(in years)

|

|

|

Aggregate intrinsic value

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding at December 31, 2013

|

|

|

1,013,492 |

|

|

|

4.34 |

|

|

|

3.64 |

|

|

$ |

1,813 |

|

|

Granted

|

|

|

160,000 |

|

|

|

5.41 |

|

|

|

|

|

|

|

|

|

|

Exercised

|

|

|

(77,654 |

) |

|

|

2.60 |

|

|

|

|

|

|

|

|

|

|

Expired & Forfeited

|

|

|

(24,874 |

) |

|

|

5.91 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding at June 30, 2014

|

|

|

1,070,964 |

|

|

|

4.59 |

|

|

|

3.37 |

|

|

$ |

1,562 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercisable at June 30, 2014

|

|

|

884,864 |

|

|

|

4.56 |

|

|

|

3.06 |

|

|

$ |

1,433 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vested and expected to vest at June 30, 3014

|

|

|

1,070,964 |

|

|

|

4.59 |

|

|

|

3.37 |

|

|

$ |

1,562 |

|

The weighted average fair value of options granted during the six months ended June 30, 2014 was $ 2.5.

As of June 30, 2014, the total amount of unrecognized stock-based compensation expenses was approximately $ 170 which will be recognized over a weighted average period of 0.65 years.

The following table shows the total stock-based compensation expense included in the interim condensed consolidated statements of operations:

| |

|

Six months ended

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

Cost of revenue

|

|

$ |

8 |

|

|

$ |

5 |

|

|

Research and development, net

|

|

|

102 |

|

|

|

86 |

|

|

Selling and marketing, net

|

|

|

104 |

|

|

|

61 |

|

|

General and administrative

|

|

|

77 |

|

|

|

145 |

|

| |

|

|

|

|

|

|

|

|

| |

|

$ |

291 |

|

|

$ |

297 |

|

RADCOM LTD. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share and share data

|

NOTE 8:-

|

SELECTED STATEMENTS OF OPERATIONS DATA

|

|

|

a.

|

Financial expenses (income), net:

|

| |

|

Six months ended

June 30

|

|

| |

|

2014

|

|

2013

|

|

| |

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

Financial income:

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

$ |

181 |

|

|

$ |

- |

|

|

Interest from banks

|

|

$ |

101 |

|

|

$ |

9 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

282 |

|

|

|

9 |

|

| |

|

|

|

|

|

|

|

|

|

Financial expenses:

|

|

|

|

|

|

|

|

|

|

Interest and bank charges

|

|

|

(25 |

) |

|

|

(59 |

) |

|

Foreign currency translation adjustments

|

|

|

- |

|

|

|

(70 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

|

(25 |

) |

|

|

(129 |

) |

| |

|

|

|

|

|

|

|

|

|

Financial income (expenses), net

|

|

$ |

257 |

|

|

$ |

(120 |

) |

RADCOM LTD. AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share and share data

|

NOTE 8:-

|

SELECTED STATEMENTS OF OPERATIONS DATA (Cont.)

|

|

|

b.

|

Net income (loss) per share:

The following table sets forth the computation of basic and diluted net income (loss) per share:

|

| |

|

Six months ended

June 30

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

Unaudited

|

|

|

Numerator:

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Numerator for basic net income (loss) per share

|

|

$ |

317 |

|

|

$ |

(390 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of dilutive securities:

|

|

|

|

|

|

|

|

|

|

Option and warrants issued to grantees and

investors, respectively

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Numerator for dilutive net income (loss) per share

|

|

$ |

317 |

|

|

$ |

(390 |

) |

| |

|

|

|

|

|

|

|

|

|

Denominator:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Denominator for dilutive net income (loss) per

share - weighted average number of ordinary share

|

|

|

7,995,073 |

|

|

|

6,795,807 |

|

| |

|

|

|

|

|

|

|

|

|

Effect of dilutive securities:

|

|

|

|

|

|

|

|

|

|

Option and warrants issued to grantees and

investors, respectively

|

|

|

487,126 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Denominator for diluted net income (loss) per

share - adjusted weighted average number of

ordinary share

|

|

|

8,482,199 |

|

|

|

6,795,807 |

|

F - 14

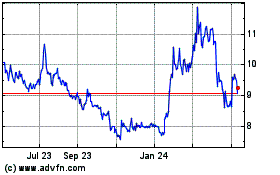

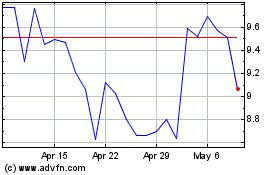

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From May 2024 to Jun 2024

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Jun 2023 to Jun 2024