UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of September 2014 (Report No. 1)

Commission File Number: 0-29452

RADCOM LTD.

(Translation of registrant’s name into English)

24 Raoul Wallenberg Street, Tel Aviv 69719, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form:40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): N/A

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): N/A

THIS FORM 6-K IS HEREBY INCORPORATED BY REFERENCE INTO RADCOM LTD.’S REGISTRATION STATEMENTS ON FORM S-8 (REGISTRATION STATEMENT NOS. 333-13250, 333-111931, 333-123981, 333-190207 AND 333-195465) AND FORM F-3 (REGISTRATION STATEMENT NOS. 333-170512 AND 333-189111), AND SHALL BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FILED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

CONTENTS

This report on Form 6-K of the registrant consists of the following document, which is attached hereto and incorporated by reference herein:

Exhibit 99.1 Notice of 2014 Annual General Meeting of Shareholders and Proxy Statement, dated September 1, 2014.

Exhibit 99.2 Proxy Card for 2014 Annual General Meeting of Shareholders.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

RADCOM LTD.

|

|

| |

|

|

|

|

Date: September 2, 2014

|

By:

|

/s/ Uri Birenberg

|

|

| |

Name:

|

Uri Birenberg

|

|

| |

Title:

|

CFO

|

|

EXHIBIT INDEX

|

Exhibit

Number

|

Description of Exhibit |

| |

|

|

99.1

|

Notice of 2014 Annual General Meeting of Shareholders and Proxy Statement, dated September 1, 2014.

|

| |

|

|

99.2

|

Proxy Card for 2014 for Annual General Meeting of Shareholders.

|

Exhibit 99.1

RADCOM LTD.

___________________________

NOTICE OF 2014 ANNUAL GENERAL MEETING OF SHAREHOLDERS

___________________________

Notice is hereby given that the 2014 Annual General Meeting of Shareholders (the "Meeting") of Radcom Ltd. will be held on Tuesday, September 30, 2014 at 3:00 p.m. (Israel time), at our offices located at 24 Raoul Wallenberg Street, Tel Aviv, Israel.

Throughout this Notice of Annual General Meeting of Shareholders and the enclosed Proxy Statement, we use terms such as "Radcom", "we", "us", "our" and "our company" to refer to Radcom Ltd. and terms such as "you" and "your" to refer to our shareholders.

The agenda of the Meeting will be as follows:

|

|

(1)

|

To re-elect the following members of our Board of Directors: Zohar Zisapel, Matty Karp and Ms. Heli Bennun;

|

|

|

(2)

|

To approve a grant of options to Mr. David Ripstein, our President and Chief Executive Officer;

|

|

|

(3)

|

To re-appoint Kost Forer Gabbay & Kasierer, a Member of Ernst and Young Global, as our independent auditors until the next annual general meeting of shareholders, and to authorize the Audit Committee of our Board of Directors, to fix their remuneration;

|

|

|

(4)

|

To discuss the auditors’ report and our consolidated financial statements for the year ended December 31, 2013; and

|

|

|

(5)

|

To transact such other business as may properly come before the Meeting or any adjournment thereof.

|

These proposals are described in detail in the enclosed proxy statement, which we urge you to read in its entirety. As more fully described in the proxy statement, shareholders may present proposals for consideration at the Meeting by submitting their proposals to the Company no later than September 2, 2014. If we determine that a shareholder proposal has been duly and timely received and is appropriate, we will publish a revised agenda in the manner set forth in the proxy statement.

The Board of Directors recommends a vote FOR approval of all matters to be voted upon at the Meeting.

Shareholders of record at the close of business on September 2, 2014 are entitled to notice of, and to vote at, the Meeting and any adjournment or postponement thereof. You are cordially invited to attend the Meeting in person.

Whether or not you plan to attend the Meeting, you are urged to promptly complete, date and sign the enclosed proxy and to mail it in the enclosed envelope, which requires no postage if mailed in the United States. Return of your proxy does not deprive you of your right to attend the Meeting, to revoke the proxy or to vote your shares in person.

Joint holders of shares should take note that, pursuant to Article 32(d) of our Articles of Association, the vote of the senior holder of the joint shares who tenders a vote, in person or by proxy, will be accepted to the exclusion of the vote(s) of the other joint holder(s). For this purpose seniority will be determined by the order in which the names stand in our Register of Members.

In accordance with the Israeli Companies Law, 5759-1999 and regulations promulgated thereunder, any shareholder of the Company may submit to the Company a position statement on its behalf, expressing its position on an agenda item for the Meeting, to our General Counsel at the following address: Radcom Ltd., 22 Raoul Wallenberg Street, Tel Aviv 69710, Israel, Attention: General Counsel, or by facsimile to +9723-6474681 no later than September 12th, 2014. Any position statement received will be furnished with the SEC on Form 6-K, which will be available to the public on the SEC’s website at http://www.sec.gov.

| |

By Order of the Board of Directors,

Chairman of the Board of Directors

|

Dated: September 1, 2014

Our audited financial statements for the fiscal year ended December 31, 2013, are not a part of the proxy solicitation material, but were filed together with our Annual Report on Form 20-F, which was filed on March 26, 2014 with the Securities and Exchange Commission and is available at their website, www.sec.gov, and at our website, www.radcom.com.

RADCOM LTD.

24 RAOUL WALLENBERG STREET

TEL AVIV 69719, ISRAEL

___________________________

PROXY STATEMENT

___________________________

2014 ANNUAL GENERAL MEETING OF SHAREHOLDERS

This Proxy Statement is furnished to the holders of our ordinary shares, NIS 0.20 nominal value ("Ordinary Shares"), in connection with the solicitation by our Board of Directors ("Board of Directors") of proxies for use at the 2014 Annual General Meeting of Shareholders (the "Meeting"), or at any adjournment thereof, pursuant to the accompanying Notice of 2014 Annual General Meeting of Shareholders. The Meeting will be held on Tuesday, September 30, 2014 at 3:00 p.m. (Israel time), at our offices located at 24 Raoul Wallenberg Street, Tel Aviv, Israel.

Throughout this Proxy Statement, we use terms such as "Radcom", "we", "us", "our" and "our company" to refer to Radcom Ltd. and terms such as "you" and "your" to refer to our shareholders.

It is proposed that at the Meeting, resolutions be adopted as follows:

| |

(1)

|

To re-elect the following members of our Board of Directors: Zohar Zisapel, Matty Karp and Ms. Heli Bennun;

|

| |

(2)

|

To approve a grant of options to Mr. David Ripstein, our President and Chief Executive Officer;

|

| |

(3)

|

To re-appoint Kost Forer Gabbay & Kasierer, a Member of Ernst and Young Global, as our independent auditors until the next annual general meeting of shareholders, and to authorize the Audit Committee of our Board of Directors to fix their remuneration;

|

| |

(4)

|

To discuss the auditors’ report and our consolidated financial statements for the year ended December 31, 2013; and

|

| |

(5)

|

To transact such other business as may properly come before the Meeting or any adjournment

|

These proposals are described in detail in this proxy statement, which we urge you to read in its entirety. As more fully described in this proxy statement, shareholders may present proposals for consideration at the Meeting by submitting their proposals to the Company no later than September 2, 2014. We are currently not aware of any other matters that will come before the Meeting. If any other matters properly come before the Meeting or any adjournment thereof, the persons designated as proxies intend to vote in accordance with their judgment on such matters.

You may elect to vote your Ordinary Shares once, either by attending the Meeting in person or by a duly executed proxy as detailed below.

A form of proxy for use at the Meeting and a return envelope for the proxy are enclosed. You may revoke the authority granted by your execution of proxies at any time before the exercise thereof by filing with us a written notice of revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. Unless otherwise indicated on the form of proxy, Ordinary Shares represented by any proxy in the enclosed form, if the proxy is properly executed and received by us not less than 48 hours prior to the time fixed for the Meeting, will be voted in favor of all the matters to be presented at the Meeting, as described above. On all matters considered at the Meeting, abstentions and broker non-votes will be treated as neither a vote "for" nor "against" the matter, although they will be counted in determining whether a quorum is present.

Proxies for use at the Meeting are being solicited by our Board of Directors. Only shareholders of record at the close of business on September 2 2014 will be entitled to vote at the Meeting and any adjournments or postponements thereof. Proxies will be mailed to shareholders on or about September 5, 2014 and will be solicited chiefly by mail. However, certain of our officers, directors, employees and agents, none of whom will receive additional compensation in connection therewith, may solicit proxies by telephone, telegram or other personal contact. We will bear the cost for the solicitation of the proxies, including postage, printing and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of Ordinary Shares.

If your Ordinary Shares are held in “street name,” meaning you are a beneficial owner with your shares held through a bank, brokerage firm or other nominee, you will receive instructions from your bank, brokerage firm or nominee, who is the holder of record of your shares. You must follow the instructions of the holder of record in order for your shares to be voted.

Position Statements

In accordance with the Israeli Companies Law, 5759-1999 (the "Companies Law") and regulations promulgated thereunder, any shareholder of the Company may submit to the Company a position statement on its behalf, expressing its position on an agenda item for the Meeting, to our General Counsel at the following address: Radcom Ltd., 22 Raoul Wallenberg Street, Tel Aviv 69710, Israel, Attention: General Counsel, or by facsimile to +972-3-6474681 no later than September 12th, 2014 Any position statement received will be furnished with the SEC on Form 6-K, which will be available to the public on the SEC’s website at http://www.sec.gov.

OUTSTANDING VOTING SECURITIES AND VOTING RIGHTS

We had outstanding on September 2, 2014, 8,110,418 Ordinary Shares, each of which is entitled to one vote upon each of the matters to be presented at the Meeting. Two or more shareholders holding Ordinary Shares conferring in the aggregate at least one-third (1/3) of our voting power, present in person or by proxy and entitled to vote, will constitute a quorum at the Meeting.

BENEFICIAL OWNERSHIP OF SECURITIES BY CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our Ordinary Shares as of September 2, 2014 by (i) each person or entity known to beneficially own more than five percent (5%) of our Ordinary Shares based on information provided to us by the holders or disclosed in public filings with the Securities and Exchange Commission (the "SEC"), and (ii) all directors and executive officers as indicated below, based on information provided to us by the holders or disclosed in public filings with the SEC. The percentage of outstanding Ordinary Shares is based on 8,110,418 Ordinary Shares outstanding as of September 2, 2014.

|

|

|

Number of Ordinary

Shares Beneficially Owned (1)

|

|

|

Percentage of

Outstanding Ordinary

Shares (2)

|

|

|

Zohar Zisapel (3)

|

|

|

2,807,843 |

|

|

|

33.50 |

% |

|

Yehuda Zisapel (4)

|

|

|

506,790 |

|

|

|

6.25 |

% |

|

David Ripstein (5)

|

|

|

243,939 |

|

|

|

2.92 |

% |

|

All directors and executive officers as a group,

except Zohar Zisapel and David Ripstein, (8

persons) (6)

|

|

|

233,520 |

|

|

|

2.80 |

% |

|

(1)

|

Except as otherwise noted and subject to applicable community property laws, each person named in the table has sole voting and investment power with respect to all Ordinary Shares listed as owned by such person. Ordinary Shares beneficially owned include Ordinary Shares that may be acquired pursuant to options to purchase Ordinary Shares that are exercisable within 60 days of September 2,2014.

|

|

(2)

|

For determining the percentage owned by each person or group, Ordinary Shares for each person or group includes Ordinary Shares that may be acquired by such person or group pursuant to options to purchase Ordinary Shares that are exercisable within 60 days of September 2, 2014. The number of outstanding Ordinary Shares does not include 5,189 Ordinary Shares held by RADCOM Equipment, Inc., our wholly owned subsidiary and 30,843 Ordinary Shares that were repurchased by us.

|

|

(3)

|

Includes (i) 2,016,472 ordinary shares held of record by Mr. Zohar Zisapel, (ii) 44,460 ordinary shares held by RAD Data Communications Ltd. ("RDC"), an Israeli company, (iii) 13,625 ordinary shares held by Klil & Michael Ltd., an Israeli company wholly owned by Mr. Zohar Zisapel,(iv) 224,562 Ordinary Shares held of record by Michael & Klil Holdings (93) Ltd ("Klil"), an Israeli company, wholly owned by Mr. Zohar Zisapel (v) 238,187 ordinary shares held of record by Lomsha Ltd. ("Lomsha"), an Israeli company wholly owned by Mr. Zohar Zisapel, (vi) 135,000 ordinary shares issuable upon exercise of options, with an average exercise price per share of $5.65, expiring between the years 2015 and 2019, and (vii) 74,854 ordinary shares issuable upon exercise of warrants held by Klil and 60,683 ordinary shares issuable upon exercise of warrants held by Lomsha, all of which have an exercise price per share of $3.49, and expire in June 2016. The options and warrants listed above are exercisable currently or within 60 days of September 2, 2014. Mr. Zohar Zisapel is a principal shareholder and Chairman of the Board of Directors of RDC. Mr. Zohar Zisapel and his brother, Mr. Yehuda Zisapel, have shared voting and dispositive power with respect to the shares held by RDC. This information is based on information provided by Mr. Zohar Zisapel.

|

|

(4)

|

Includes (i) 234,740 ordinary shares held of record by Mr. Yehuda Zisapel, (ii) 44,460 ordinary shares held of record by RDC, an Israeli company, and (iii) 227,590 ordinary shares held of record by Retem Local Networks Ltd., an Israeli company. Mr. Yehuda Zisapel and his brother, Mr. Zohar Zisapel, have shared voting and dispositive power with respect to the shares held by RDC. Mr. Yehuda Zisapel is a principal shareholder and director of each of RDC and Retem Local Networks Ltd. and, as such, Mr. Yehuda Zisapel may be deemed to have voting and dispositive power over the ordinary shares held by such companies. Mr. Yehuda Zisapel disclaims beneficial ownership of these ordinary shares except to the extent of his pecuniary interest therein. This information is based on information provided by Mr. Yehuda Zisapel.

|

|

(5)

|

Includes 243,939 Ordinary Shares issuable upon exercise of options, which expire between the years 2014 and 2019.

|

|

(6)

|

Each of the directors and executive officers not separately identified in the above table beneficially owns less than 1% of our outstanding Ordinary Shares (including options or warrants held by each such party, which are vested or shall become vested within 60 days of September 2, 2014) and have, therefore, not been separately disclosed. The amount of Ordinary Shares is comprised of 233,520 Ordinary Shares issuable upon exercise of options and warrants exercisable within 60 days of September 2, 2014.

|

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Summary Compensation Table

The table and summary below outline the compensation granted to our five most highly compensated office holders during or with respect to the year ended December 31, 2013. We refer to the five individuals for whom disclosure is provided herein as our "Covered Executives."

For purposes of the table and the summary below, “compensation” includes base salary, discretionary and non-equity incentive bonuses, equity-based compensation, retirement or termination payments, benefits and perquisites such as car, phone and social benefits and any undertaking to provide such compensation. All amounts reported in the table represent incremental cost to our company, as recognized in our financial statements for the year ended December 31, 2013.

|

Name and Principal Position (1)

|

Year

|

Salary ($)

|

Bonus ($) (2)

|

Equity-Based

Compensation

($) (3)

|

All Other

Compensation

($) (4)

|

Total ($)

|

|

David Ripstein

CEO

|

2013

|

224,680

|

40,179

|

153,279

|

73,215

|

491,354

|

|

Ronen Hovav

VP Americas

|

2013

|

240,000

|

232,000

|

3,704

|

-

|

475,704

|

|

Yoram Sherman

VP Sales

|

2013

|

154,556

|

38,043

|

137

|

57,850

|

250,586

|

|

Gilad Yehudai

CFO

(5)

|

2013

|

146,194

|

-

|

28,199

|

55,546

|

229,939

|

|

Yuval Porat

VP R&D

|

2013

|

147,957

|

-

|

10,312

|

55,564

|

213,833

|

|

(1)

|

Unless otherwise indicated herein, all Covered Executives are employed on a full-time (100%) basis.

|

|

(2)

|

Amounts reported in this column represent annual bonuses granted to the Covered Executives based on performance based formulas, as more fully described below.

|

|

(3)

|

Amounts reported in this column represent the grant date fair value in accordance with accounting guidance for stock-based compensation. For a discussion of the assumptions used in reaching this valuation, see Note 2k to our consolidated financial statements included in our annual report on Form 20-F for the year ended December 31, 2013.

|

|

(4)

|

Amounts reported in this column include benefits and perquisites, including those mandated by applicable law. Such benefits and perquisites may include, to the extent applicable to the respective Covered Executive, payments, contributions and/or allocations for savings funds (e.g., Managers Life Insurance Policy), education funds (referred to in Hebrew as “keren hishtalmut”), pension, severance, vacation, car or car allowance, medical insurances and benefits, risk insurance (e.g., life insurance or work disability insurance), telephone expense reimbursement, convalescence or recreation pay, relocation reimbursement, payments for social security and other benefits and perquisites consistent with the Company’s guidelines.

|

|

(5)

|

Mr. Gilad Yehudai, who acted as our former CFO for the past 3 years, ended his employment with Radcom on April 30, 2014, and was replaced by Mr. Uri Birenberg, who joined us as our new CFO, on May 18, 2014.

|

ITEM 1 – RE-ELECTION OF NON-EXTERNAL DIRECTORS

At the Meeting, you will be asked to re-elect three non-external directors, Mr. Zohar Zisapel, Mr. Matty Karp and Ms. Heli Bennun, to serve as members of our Board of Directors. The nominees, if re-elected, together with our external directors who were re-elected by our shareholders on June 30, 2013 for a third three-year term as required under Israeli law, will constitute our entire Board of Directors. If elected, the nominees will continue to be entitled to receive the compensation we pay to our directors as approved by our shareholders at our 2013 Annual General Meeting of Shareholders.

Proxies may not be voted for a greater number of persons than the number of nominees named. Under our Articles of Association, our Board of Directors will be entitled to fill, until the next election of directors, any vacancies existing on our Board of Directors following the annual general meeting at its sole discretion.

It is intended that proxies (other than those directing the proxy holders to vote against the listed nominees or for certain of them or to abstain) will be voted for the election of the three nominees named below as our directors, each to hold office until the next annual general meeting and until his successor shall have duly taken office, unless his office is vacated earlier under any relevant provision of our Articles of Association.

In the event any one or more of the below nominees should be unable to serve, the proxies will be voted for the election of such other person or persons as shall be determined by the persons named in the proxy in accordance with their best judgment. We are not aware of any reason why any of the nominees, if elected, should be unable to serve as a director. We do not have any understanding or agreement with respect to the future election of any nominees named herein.

Set forth below is a brief biography of each of the nominees for director, based upon our

records and information furnished to us by each of them.

Mr. Zohar Zisapel, (65) a co-founder of our Company, has served as our Chairman of the Board since our inception in 1985. Mr. Zisapel is also the Chairman of Ceragon Networks Ltd. (NASDAQ: CRNT), and a director of two other public companies, Amdocs Ltd. (NYSE: DOX) and Silicom Ltd. (NASDAQ and TASE: SILC), as well as a director or Chairman of several private companies. Mr. Zisapel has a B.Sc. degree and an M.Sc. degree in electrical engineering from the Technion - Israel Institute of Technology and an M.B.A. degree from Tel-Aviv University.

Mr. Matty Karp (65), has served as a director since December 2009. He is the managing partner of Concord Ventures, an Israeli venture capital fund focused on Israeli early stage technology companies, which he co-founded in 1997. From 2007 to 2008 he served as the Chairman of Israel Growth Partners Acquisition Corp. From 1994 to 1999, he served as the Chief Executive Officer of Kardan Technologies, a technology investment company, and continued to serve as a director until October 2001. From 1994 to 1997, he served as the President of Nitzanim Venture Fund, an Israeli venture capital fund focused on early-stage high technology companies. From 1987 to 1994, he served in numerous positions at Elbit Systems Ltd. (NASDAQ and TASE: ESLT). Mr. Karp has served as a director of a number of companies, including: Galileo Technology, which was acquired by Marvell Technology Group (NASDAQ: MRVL); Accord Networks which was acquired by Polycom (NASDAQ: PLCM); Saifun Semiconductors, which merged with Spansion and El Al Israel Airlines (TASE: ELAL). Mr. Karp received a B.S., cum laude, in Electrical Engineering from the Technion - Israel Institute of Technology and is a graduate of the Harvard Business School Advanced Management Program.

Ms. Heli Bennun (60) has served as a director since December 2012. Ms. Bennun has over 25 years of professional experience in hi-tech companies. In 1988, Ms. Bennun co-founded Arel Communications & Software Ltd. (formerly NASDAQ:ARLC) ("Arel"), a company focused on offering integrated video, audio and data-enabled conferencing solutions, including real time Interactive Distance Learning. Ms. Bennun served as Arel’s CEO and CFO from 1988 until 1998, during which time Arel went public on the NASDAQ (1994). In addition, Ms. Bennun served as a director of Arel from 1988 until 1998 and as the vice-chairman of Arel's board of directors from 1998 until 2001. In 1996, Ms. Bennun co-founded ArelNet Ltd. (formerly TASE: ARNT) ("ArelNet"), a pioneer in the field of Voice over IP. Ms. Bennun served as ArelNet’s CEO from 1998 until 2001, during which time ArelNet went public on the TASE. In 2004, Ms. Bennun resumed her position as ArelNet's CEO and a director, until ArelNet was acquired by Airspan Network Inc. in 2005. From 2006 until 2009, Ms. Bennun served as the CEO and director of OrganiTech USA, Inc. (PINK:ORGT), a pioneer in the Cleantech industry. Ms. Bennun holds an M.Sc and B.Sc. degree in industrial and management engineering from Ben-Gurion University. Ms. Bennun is the domestic partner of Mr. Zohar Zisapel, our Chairman of the Board and largest shareholder, who may be deemed a “controlling shareholder” of Radcom, as such term is defined in the Companies Law.

Required Approval

The affirmative vote of a majority of the Ordinary Shares present, in person or by proxy, and voting on the matter is required for the approval of the re-election of the directors set forth above.

Proposed Resolutions

It is proposed that the following resolutions be adopted at the Meeting:

"RESOLVED, that Mr. Zohar Zisapel be and hereby is re-elected to serve as a member of our Board of Directors, effective immediately."

"RESOLVED, that Mr. Matty Karp be and hereby is re-elected to serve as a member of our Board of Directors, effective immediately."

"RESOLVED, that Ms. Heli Bennun be and hereby is re-elected to serve as a member of our Board of Directors, effective immediately.”

The Board of Directors recommends a vote FOR approval of the proposed resolutions.

ITEM 2 – APPROVAL OF EQUITY BASED COMPENSATION TO OUR CHIEF EXECUTIVE

OFFICER, MR. DAVID RIPSTEIN

Under the Companies Law, any public Israeli company that seeks to approve new compensation terms of its chief executive officer is required to obtain the approval of its compensation committee, board of directors and shareholders, in that order. In addition, under the Companies Law, when approving such compensation, the compensation committee and board of directors have to review, discuss and confirm that the compensation is in accordance with the company's compensation policy. At the Meeting, you will be asked to approve the equity based compensation for Mr. David Ripstein, our President and Chief Executive Officer. Our Compensation Committee and Board of Directors have already approved such compensation and have also determined that such compensation terms are in accordance with our Compensation Policy for Executive Officers and Directors, which was approved by our shareholders at our extraordinary general meeting of shareholders, held on January 8, 2014 (the "Compensation Policy").

In addition to the proposed equity based compensation of Mr. Ripstein as described below, which is subject to shareholder approval, Mr. Ripstein also receives certain additional compensation and benefits as more fully described under "Compensation of Executive Officers and Directors" above.

Proposed Equity Based Compensation

An annual grant of options under our 2013 Share Option Plan (the “2013 Plan”), to purchase 15,000 Ordinary Shares. The options will be fully vested in one year over four (4) equal quarterly installments commencing as of March 25, 2014, the date our Board of directors approved the equity based compensation terms. The options will expire on the earlier of five years or 180 days from the date of termination without cause or resignation from office. The exercise price per share of the options will be equal to the closing price per share of our Ordinary Shares on the NASDAQ Capital Market on the applicable date of grant, which will be the date of the Meeting. For more information regarding options issued under the 2013 Plan, see Item No. 6B of our Annual Report on Form 20-F for the year ended December 31, 2013, which was filed with the SEC on March 26, 2014.

Reasons for the Proposal

Mr. Ripstein has served as our President and Chief Executive Officer since April 2007. The Compensation Committee and Board of Directors noted in their approval of the proposed equity based compensation that the proposed compensation is intended to compensate Mr. Ripstein for his services and his contributions to our development, and is in accordance with our Compensation Policy.

Required Approval

The approval of the equity-based compensation of Mr. Ripstein requires the affirmative vote of a majority of the Ordinary Shares present, in person or by proxy, and voting on such matter. In addition, this matter will be approved only if either (i) at least a majority of the Ordinary Shares voted on the matter by shareholders who are not controlling shareholders or who do not have a personal interest in the matter are voted in favor or (ii) the total number of Ordinary Shares voted against such matter by shareholders who do not have a personal interest in the matter or who are not controlling shareholders, does not exceed two percent of our outstanding Ordinary Shares.

According to the Companies Law, even if the shareholders do not approve the proposed terms of the compensation of Mr. Ripstein, our Compensation Committee and Board of Directors may thereafter approve the proposal, provided that they have approved it, based on detailed reasoning, following a re-evaluation of the proposed compensation and taking into account the opposition of the shareholders, among other things, all in accordance with the requirements set forth in the Companies Law.

The Companies Law requires that each shareholder voting on the matter indicate whether or not the shareholder has a personal interest in the matter. If a shareholder who has a personal interest does not indicate this interest, the shareholder is not eligible to vote on this matter and the shareholder’s votes will be disregarded. Under the Companies Law, a "personal interest" of a shareholder (i) includes a personal interest of any member of the shareholder’s family (or spouse thereof) or a personal interest of a company with respect to which the shareholder (or such family member) serves as a director or chief executive officer, owns at least 5% of our shares or has the right to appoint a director or chief executive officer, and (ii) excludes an interest arising solely from the ownership of our shares. Under the Companies Law, in the case of a person voting by proxy for another person, "personal interest" includes a personal interest of either the proxy holder or the shareholder granting the proxy, whether or not the proxy holder has discretion how to vote. If you do not have a personal interest in this matter, you may assume that using the form of proxy enclosed herewith will not create a personal interest.

Since it is highly unlikely that any of our public shareholders has a personal interest on this matter and to avoid confusion in the voting and tabulation processes, the enclosed form of proxy includes a certification that you do not have a personal interest in this matter. If you have a personal interest, please contact Mr. Uri Birenberg, our Chief Financial Officer for guidance at +972-77-774-5060 for instructions on how to vote your shares and indicate that you have a personal interest or, if you hold your shares in "street name", you may also contact the representative managing your account, who could then contact us on your behalf.

Proposed Resolution

It is proposed that the following resolution be adopted at the Meeting:

"RESOLVED, that the equity based compensation terms of Mr. Ripstein as described in the Proxy Statement, be, and the same hereby is, approved."

The Board of Directors recommends a vote FOR approval of the proposed resolution.

ITEM 3 – RE-APPOINTMENT OF OUR INDEPENDENT AUDITORS

At the Meeting, you will be asked to approve the re-appointment of Kost Forer Gabbay & Kasierer, a Member of Ernst and Young Global, as our independent registered public accounting firm until the end of next year’s annual general meeting of shareholders, as well as to approve the authorization of our Audit Committee to fix their remuneration. The re-appointment has been recommended by our Audit Committee. Such auditors have served as our auditors since the 2009 annual general meeting of shareholders, and have no relationship with us or with any of our affiliates, except as auditors.

Required Approval

The affirmative vote of a majority of the Ordinary Shares present, in person or by proxy, and voting on the matter is required for the approval of the re-appointment of our independent auditors.

Proposed Resolution

It is proposed that the following resolution be adopted at the Meeting:

"RESOLVED, that Kost Forer Gabbay & Kasierer, a Member firm of Ernst and Young Global, be, and hereby are, re-appointed as our independent registered public accounting firm until the end of the 2015 annual general meeting of shareholders and that the Audit Committee, by the authority duly delegated by the Board of Directors, be, and it hereby is, authorized to fix the compensation of the independent auditors in accordance with the amount and nature of their services."

The Board of Directors recommends a vote FOR approval of the proposed resolution.

ITEM 4 – REVIEW OF THE AUDITORS’ REPORT AND THE CONSOLIDATED FINANCIAL STATEMENTS

Our audited financial statements for the fiscal year ended December 31, 2013 were filed together with our Annual Report on Form 20-F, which was filed on March 26, 2014 with the SEC and is available at their website, www.sec.gov, and at our website, www.radcom.com. We will hold a discussion with respect to the financial statements at the Meeting. This Item will not involve a vote by the shareholders.

ITEM 5 OTHER BUSINESS

Management knows of no other business to be transacted at the Meeting, other than as set forth in the Notice of Annual General Meeting. However, if any other matters are properly presented to the Meeting, the persons named in the enclosed form of proxy will vote upon such matters in accordance with their best judgment.

PROPOSALS OF SHAREHOLDERS

Shareholder Proposals for the Meeting

Any shareholder of the Company who intends to present a proposal at the Meeting must satisfy the requirements of the Companies Law. Under the Companies Law, only shareholders who hold at least 1% of the Company’s outstanding voting rights are entitled to request that the Board of Directors include a proposal in a future shareholders meeting, provided that such proposal is appropriate for consideration by shareholders at such meeting. Such shareholders may present proposals for consideration at the Meeting by submitting their proposals in writing to our General Counsel at the following address: Radcom Ltd., 22 Raoul Wallenberg Street, Tel Aviv 69710, Israel, Attention: General Counsel. For a shareholder proposal to be considered for inclusion in the Meeting, our General Counsel must receive the written proposal no later than September 2, 2014. If our Board of Directors determines that a shareholder proposal is duly and timely received and is appropriate for inclusion in the agenda of the Meeting, we will publish a revised agenda for the Meeting no later than September 2, 2014, by way of issuing a press release or submitting a Current Report on Form 6-K to the SEC.

Shareholder Proposals for Annual General Meeting in 2015

To be considered for inclusion in our proxy statement for our 2015 annual general meeting of shareholders pursuant to the Companies Law, shareholder proposals must be in writing and must be properly submitted to our General Counsel at the following address: Radcom Ltd., 22 Raoul Wallenberg Street, Tel Aviv 69710, Israel, Attention: General Counsel, no later than March 31, 2015, and must otherwise comply with the requirements of the Companies Law.

| |

By Order of the Board of Directors,

Chairman of the Board of Directors

|

Dated: September 1, 2014

10

Exhibit 99.2

RADCOM LTD.

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints David Ripstein, President and Chief Executive Officer and Uri Birenberg, Chief Financial Officer, and each of them, attorneys, agents and proxies of the undersigned, with full power of substitution to each of them, to represent and to vote on behalf of the undersigned all the Ordinary Shares of Radcom Ltd. (the “Company”), which the undersigned is entitled to vote at the 2014 Annual General Meeting of Shareholders of the Company (the “Annual Meeting”), to be held at the offices of the Company, 24 Raoul Wallenberg Street, Tel Aviv, Israel on Tuesday, September 30, 2014 at 3:00 p.m. (Israel time), and at any adjournments or postponements thereof, upon the following matters, which are more fully described in the Notice of 2014 Annual General Meeting of Shareholders and Proxy Statement, dated September 1, 2014.

This Proxy, when properly executed, will be voted in the manner directed herein by the undersigned. If no direction is made with respect to any matter, this Proxy will be voted FOR such matter. Any and all proxies heretofore given by the undersigned are hereby revoked.

(Continued and to be signed on the reverse side)

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" ITEMS 1, 2 and 3. PLEASE

SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK

YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x.

|

1.

|

Re-election of directors.

|

| |

1.1

|

Zohar Zisapel

|

o FOR

|

o AGAINST

|

o ABSTAIN

|

| |

1.2

|

Matty Karp

|

|

|

|

| |

1.3

|

Heli Bennun

|

|

|

|

|

2.

|

Approval of the grant of options to the President and CEO of the Company.

|

o FOR o AGAINST o ABSTAIN

|

3.

|

Re-appointment of Kost Forer Gabbay & Kasierer as independent auditors and authorizing the Audit Committee to fix their remuneration.

|

o FOR o AGAINST o ABSTAIN

In their discretion, the proxies are authorized to vote upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The undersigned acknowledges receipt of the Notice of the 2014 Annual General Meeting of Shareholders and Proxy Statement, dated September 1, 2014. By signing this Proxy, the undersigned hereby certifies that the undersigned has no "personal interest" under the Israeli Companies Law in Item 2 (See Item No. 2 of the Proxy Statement for more information and for instructions on how to vote if you do have a "personal interest"). If you have a personal interest, please contact Mr. Uri Birenberg, the Company's Chief Financial Officer for guidance at +972-77-7745060 for instructions on how to vote your shares and indicate that you have a personal interest or, if you hold your shares in "street name", you may also contact the representative managing your account, who could then contact the Company on your behalf.

Signature: ____________________ ___________________________ Date: _____________, 2014

title (if applicable)

Signature if held jointly: __________________ _____________________ Date: ____________, 2014

title (if applicable)

Please date, sign exactly as your name appears on this proxy and promptly return in the enclosed envelope. In the case of joint ownership, each owner should sign. Otherwise, the signature of the senior owner who votes shall be accepted to the exclusion of the vote(s) of the other joint owner(s); for this purpose, seniority shall be determined by the order in which the names appear in the shareholders register. When signing as attorney, executor, administrator, trustee or guardian, or in any other similar capacity, please give full title. If a corporation, sign in full corporate name by president or other authorized officer, giving title, and affix corporate seal. If a partnership, sign in the partnership’s name by an authorized person.

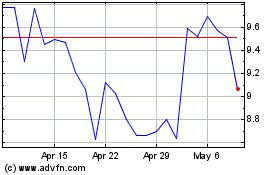

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Jun 2024 to Jul 2024

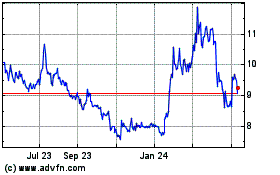

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Jul 2023 to Jul 2024