- Quarterly sales of $124.9 million; at

high-end of guidance of $120 - $125 million

- GAAP and non-GAAP diluted EPS of $0.07;

at high-end of guidance of $0.02 - $0.07

- High end IC sales of $36.6 million, a

new quarterly high

- Gross margin increases 170 bps

sequentially

- Operating margin improves sequentially

to 8.9%

- EBITDA of $34 million, up $9 million

sequentially

Photronics, Inc. (NASDAQ:PLAB), a worldwide leader in supplying

innovative imaging technology solutions for the global electronics

industry, today reported financial results for the fiscal 2014

third quarter ended August 3, 2014.

Constantine ("Deno") Macricostas, Photronics' chairman and chief

executive officer, commented: "This quarter represents the first

full quarter including our PDMC joint venture and the results

reflect the strength in that business. In addition, during the

quarter we completed our 14nm qualification with a key foundry

customer in Asia and are now benefitting from high-end business

ramps across our leading edge customer base. High-end semiconductor

revenues of $36.6 million set a new record for the company and we

expect continued growth as our customers begin to ramp new designs.

Higher sales volumes led to solid bottom line returns with

operating margin improving to 8.9% and non-GAAP earnings per share

of $0.07 at the high end of our guidance. Overall, our business is

strong and we are optimistic about the balance of the fiscal year

as our investments in high-end capability are being utilized more

robustly by our customers.”

Sales for the third quarter of fiscal 2014 were $124.9 million,

an increase of 13.9% compared with $109.7 million for the third

quarter of fiscal 2013. Sales of semiconductor photomasks were

$100.6 million, or 81% of revenues, during the third quarter of

fiscal 2014, and sales of flat panel display photomasks were $24.3

million, or 19% of revenues. GAAP net income attributable to

Photronics, Inc. shareholders for the third quarter of fiscal 2014

was $4.2 million, or $0.07 per diluted share, compared with $5.9

million, or $0.10 per diluted share in the third quarter of fiscal

2013.

Sales for the first nine months of fiscal 2014 increased 4.8% to

$331.3 million, compared with $316.2 million for the first nine

months of fiscal 2013. For the first nine months of fiscal 2014,

sales of semiconductor photomasks were $253.4 million, or 76% of

revenues, and sales of FPD photomasks were $77.9 million, or 24% of

revenues. GAAP net income attributable to Photronics, Inc.

shareholders for the first nine months of fiscal 2014 was $21.7

million, or $0.34 per diluted share, and non-GAAP net income

attributable to Photronics, Inc. shareholders for the first nine

months of fiscal 2014 was $7.8 million, or $0.13 per diluted share,

compared with the first nine months of fiscal 2013 GAAP and

non-GAAP net income attributable to Photronics, Inc. shareholders

of $13.1 million, or $0.21 per diluted share. Non-GAAP net income

attributable to Photronics, Inc. shareholders for the first nine

months of fiscal 2014 excludes the acquisition gain and expenses

related to the joint venture.

The section below entitled "Non-GAAP Financial Measures"

provides a definition and information about the use of non-GAAP

financial measures in this press release, and the attached

financial supplement reconciles non-GAAP financial information with

Photronics, Inc.'s financial results under GAAP.

Non-GAAP Financial Measures

Non-GAAP net income attributable to Photronics, Inc.

shareholders and non-GAAP earnings per share are "non-GAAP

financial measures," as such term is defined by the Securities and

Exchange Commission, and may differ from non-GAAP financial

measures used by other companies. Photronics, Inc. believes that

non-GAAP net income attributable to Photronics, Inc. shareholders

and non-GAAP earnings per share that exclude certain non-cash or

non-recurring income or expense items are useful for analysts and

investors to evaluate Photronics, Inc.'s future on-going

performance because they enable a more meaningful comparison of

Photronics, Inc.'s projected earnings and performance with its

historical results of prior periods. These non-GAAP metrics, in

particular non-GAAP net income attributable to Photronics, Inc.

shareholders and non-GAAP earnings per share are not intended to

represent funds available for Photronics, Inc.'s discretionary use

and are not intended to represent, or be used as a substitute for,

operating income, net income or cash flows from operations data as

measured under GAAP. The items excluded from these non-GAAP

metrics, but included in the calculation of their closest GAAP

equivalent, are significant components of the consolidated

statements of operations and must be considered in performing a

comprehensive assessment of overall financial performance. Non-GAAP

financial information is adjusted for the following items:

- Non-cash acquisition gain and

transaction expenses related to the joint venture, PDMC, in Taiwan

are excluded because they are not part of ongoing operations.

The presentation of this financial information should not be

considered in isolation or as a substitute for the financial

information prepared and presented in accordance with accounting

principles generally accepted in the United States. The attached

financial supplement reconciles non-GAAP financial information with

Photronics, Inc.'s financial results under GAAP.

A conference call with investors and the media to discuss these

results is scheduled for 8:30 a.m. Eastern time on Wednesday,

August 20, 2014. The live dial-in number is (408) 774-4601. The

call can also be accessed by logging onto Photronics' web site at

www.photronics.com. The call will be archived for instant replay

access until the Company reports its fiscal 2014 fourth quarter

results.

About Photronics

Photronics is a leading worldwide manufacturer of photomasks.

Photomasks are high precision quartz plates that contain

microscopic images of electronic circuits. A key element in the

manufacture of semiconductors and flat panel displays, photomasks

are used to transfer circuit patterns onto semiconductor wafers and

flat panel substrates during the fabrication of integrated

circuits, a variety of flat panel displays and, to a lesser extent,

other types of electrical and optical components. They are produced

in accordance with product designs provided by customers at

strategically located manufacturing facilities in Asia, Europe, and

North America. Additional information on the Company can be

accessed at www.photronics.com

The Private Securities Litigation Reform Act of 1995 provides a

“safe harbor” for forward-looking statements made by or on behalf

of Photronics, Inc. and its subsidiaries (the Company). The

forward-looking statements contained in this press release and

other parts of Photronics’ web site involve risks and uncertainties

that may affect the Company’s operations, markets, products,

services, prices, and other factors. These risks and uncertainties

include, but are not limited to, economic, competitive, legal,

governmental, and technological factors as well as decisions we may

make in the future regarding our business, capital structure and

other matters. These forward-looking statements generally can be

identified by phrases such as “believes”, “expects”, “anticipates”,

“plans”, “projects”, “could”, “estimate”, “intend”, “may”, “will”

and similar expressions. Accordingly, there is no assurance that

the Company’s expectations will be realized. For a fuller

discussion of the factors that may affect the Company's operations,

see "Forward Looking Statements" in the Company's Quarterly and

Annual Reports to the Securities and Exchange Commission on Forms

10-Q and 10-K. The Company assumes no obligation to provide

revisions to any forward-looking statements.

09-2014

PLAB – E

PHOTRONICS, INC.

AND SUBSIDIARIES

Condensed

Consolidated Statements of Income

(in thousands, except per share amounts) (Unaudited)

Three Months Ended Nine Months Ended August 3,

July 28, August 3, July 28, 2014

2013 2014

2013 Net sales $ 124,852 $ 109,652 $ 331,276 $

316,171 Costs and expenses: Cost of sales (96,202 )

(82,574 ) (257,554 ) (243,206 ) Selling, general and

administrative (12,394 ) (12,068 ) (38,092 ) (35,286 )

Research and development (5,199 ) (4,985 )

(16,111 ) (14,380 ) Operating income 11,057 10,025

19,519 23,299 Gain on acquisition - - 16,372 - Other

expense, net (1,168 ) (972 ) (3,264 )

(2,479 ) Income before income taxes 9,889 9,053 32,627

20,820 Income tax provision (2,545 ) (2,689 )

(7,291 ) (6,155 ) Net income 7,344 6,364

25,336 14,665 Net income attributable to noncontrolling

interests (3,158 ) (424 ) (3,617 )

(1,539 ) Net income attributable to Photronics, Inc.

shareholders $ 4,186 $ 5,940 $ 21,719 $ 13,126

Earnings per share: Basic

$

0.07 $ 0.10

$ 0.35 $

0.22 Diluted

$

0.07 $ 0.10

$ 0.34 $

0.21 Weighted-average number of common

shares outstanding: Basic

61,436 60,746

61,336 60,505 Diluted

62,432 66,177 77,706

61,478

PHOTRONICS, INC.

AND SUBSIDIARIES

Condensed

Consolidated Balance Sheets

(in thousands) (Unaudited)

August 3,

November 3, 2014 2013

Assets

Current assets: Cash and cash equivalents $ 196,338 $

215,615 Accounts receivable 102,899 73,357 Inventories 23,661

18,849 Other current assets 30,939 10,645

Total current assets 353,837 318,466 Property, plant and

equipment, net 547,377 422,740 Investment in joint venture 93,141

93,124 Intangible assets, net 31,277 34,080 Other assets

19,794 17,519 $ 1,045,426 $ 885,929

Liabilities and

Equity

Current liabilities: Current portion of long-term borrowings

$ 10,306 $ 11,818 Accounts payable and accrued liabilities

138,695 92,769 Total current liabilities 149,001

104,587 Long-term borrowings 156,283 182,203 Other

liabilities 19,881 11,308 Photronics, Inc. shareholders'

equity 609,938 585,314 Noncontrolling interests 110,323

2,517 Total equity 720,261 587,831 $

1,045,426 $ 885,929

PHOTRONICS, INC.

AND SUBSIDIARIES

Condensed

Consolidated Statements of Cash Flows

(in thousands) (Unaudited)

Nine Months Ended August 3, July 28,

2014 2013 Cash flows from operating

activities: Net income $ 25,336 $ 14,665 Adjustments to reconcile

net income to net cash provided by operating activities: Gain on

acquisition (16,372 ) - Depreciation and amortization 58,412 55,081

Changes in assets and liabilities and other (5,538 )

(2,192 ) Net cash provided by operating activities

61,838 67,554 Cash flows from investing

activities: Purchases of property, plant and equipment (58,278 )

(47,281 ) Cash from acquisition 4,508 - Other (759 )

(2,630 ) Net cash used in investing activities

(54,529 ) (49,911 ) Cash flows from financing

activities: Repayments of long-term borrowings (27,432 ) (4,990 )

Payment of deferred financing fees (336 ) (40 ) Purchase of common

stock of subsidiary - (31,627 ) Proceeds from share-based

arrangements 1,043 715 Other (597 ) -

Net cash used in financing activities (27,322 )

(35,942 ) Effect of exchange rate changes on cash 736

(2,473 ) Net decrease in cash and cash

equivalents (19,277 ) (20,772 ) Cash and cash equivalents,

beginning of period 215,615 218,043

Cash and cash equivalents, end of period $ 196,338 $

197,271 Noncash net assets from acquisition $

110,211 $ -

PHOTRONICS, INC.

AND SUBSIDIARIES

Reconciliation of

GAAP to Non-GAAP Financial Information

(in thousands, except per share data) (Unaudited)

Three Months Ended

Nine Months Ended August 3, July 28, August

3, July 28, 2014 2013 2014

2013

Reconciliation of

GAAP to Non-GAAP Net Income

Attributable to

Photronics, Inc. Shareholders

GAAP net income attributable to Photronics, Inc.

shareholders $ 4,186 $ 5,940 $ 21,719 $ 13,126

(a)

Gain on acquisition, net of tax - - (16,372 ) -

(b)

Acquisition transaction expenses, net of tax - - 2,455 -

Non-GAAP net income attributable to

Photronics, Inc. shareholders $ 4,186 $ 5,940 $ 7,802 $

13,126

Reconciliation of

GAAP to Non-GAAP Net Income

Applicable to

Common Shareholders

Weighted average number of diluted shares outstanding

GAAP 62,432 66,177 77,706 61,478

Non-GAAP 62,432 66,177 62,283

61,478 Net income per diluted share GAAP $

0.07 $ 0.10 $ 0.34 $ 0.21 Non-GAAP $ 0.07 $ 0.10 $

0.13 $ 0.21

(a) Represents gain on acquisition of DNP

Photomask Technology Taiwan Co., Ltd (DPTT), a wholly-owned

subsidiary of Dai Nippon Printing Co., Ltd.

(b)

Represents transaction expenses in connection with the acquisition

of DPTT

Photronics, Inc.Pete Broadbent, 203-775-9000Vice President,

Investor Relations & Marketingpbroadbent@photronics.com

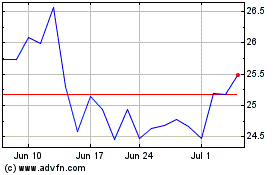

Photronics (NASDAQ:PLAB)

Historical Stock Chart

From May 2024 to Jun 2024

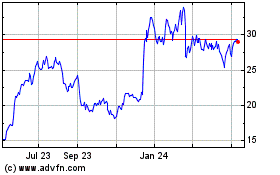

Photronics (NASDAQ:PLAB)

Historical Stock Chart

From Jun 2023 to Jun 2024