Photronics Misses on Q2 Earnings, Beats Revs - Analyst Blog

May 20 2014 - 9:00AM

Zacks

Photronics Inc.

(PLAB) reported weaker year-over-year results for the second

quarter of fiscal 2014 (ended May 4, 2014). Adjusted earnings came

in at 2 cents per share, down roughly 75.0% from 8 cents per share

in the year-ago quarter. The decline was due to reduced revenues

and margins. Moreover, earnings missed the Zacks Consensus Estimate

of 4 cents per share by 50.0%.

On a GAAP-basis, Photronics

recorded earnings of 22 cents per share, up 175.0% from the

year-ago quarter. The growth in earnings was due to the inclusion

of acquisition gains along with transaction expenses associated

with the joint venture, PDMC in Taiwan.

Revenues: Revenues

fell 1.7% year over year to $104.9 million, slightly ahead of the

Zacks Consensus Estimate of $104.0 million. Revenues from the

semiconductor photomasks were $76.6 million, representing 73% of

total revenues, while revenues from flat panel display (FPD)

photomasks came in at $28.3 million, accounting for 27% of total

revenue.

Costs/Margins:

Photronics’ cost of sales increased marginally year over year to

$82.7 million, representing 78.8% of total revenue.

Selling, general and administrative

expenses, as a percentage of revenues, increased 140 basis points

(bps) year over year to 12.8%, while research and development

expenses rose 139 bps to 5.7% of total revenue. Operating profit

dropped 65.0% year over year to $2.8 million, against $8.1 million

recorded in the prior-year quarter.

Balance Sheet:

Photronics had cash and cash equivalents balance of approximately

$191.8 million at the end of fiscal second-quarter 2014 versus

$189.2 million in the preceding quarter. Long-term borrowings were

$158.7 million compared with $161.1 million at the end of fiscal

first-quarter 2014.

Outlook: The

company is optimistic about recording higher revenues in the coming

quarters on the back of the recently formed joint venture PDMC in

Taiwan. With this, Photronics is hopeful of promoting an efficient

photomask delivery in the region.

Other Stocks to

Consider

Photronics currently carries a

Zacks Rank #3 (Hold). Some better-ranked stocks worth considering

in the industry include Kulicke and Soffa Industries,

Inc. (KLIC), Cohu, Inc. (COHU) and

Ultratech, Inc. (UTEK). While Kulicke and Soffa

Industries sports a Zacks Rank #1 (Strong Buy), Cohu and Ultratech

have a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

COHU INC (COHU): Get Free Report

KULICKE & SOFFA (KLIC): Free Stock Analysis Report

PHOTRONICS INC (PLAB): Free Stock Analysis Report

ULTRATECH STEP (UTEK): Free Stock Analysis Report

To read this article on Zacks.com click here.

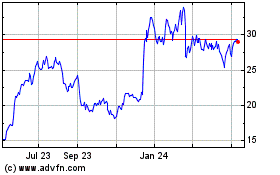

Photronics (NASDAQ:PLAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

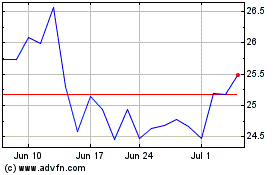

Photronics (NASDAQ:PLAB)

Historical Stock Chart

From Jul 2023 to Jul 2024