Raises Annual Guidance to $114

Million

PCTEL, Inc. (NASDAQ:PCTI), a leader in simplifying wireless and

site solutions for private and public networks, announced its 2014

first quarter results.

First Quarter Highlights

- $23.7 million in revenue for the

quarter, a decrease of six percent from the same period last

year.

- Gross profit margin of 41 percent in

the quarter, compared to 38 percent in the same period last

year.

- GAAP operating margin from

continuing operations of negative two (2) percent for the

quarter, compared to operating margin of negative five (5)

percent for the same period last year.

- GAAP net loss from continuing

operations of $(146,000) for the quarter, or $(0.01) per diluted

share, compared to net income of $2.0 million from continuing

operations, or $0.11 per diluted share for the same period last

year. Net income for the first quarter last year included a

one-time gain from a legal settlement net of expenses of $0.11 per

diluted share.

- Non-GAAP operating profit and net

income are measures the company uses to reflect the results of its

core earnings. The Company’s reporting of Non-GAAP net income

excludes expenses for restructuring, gain or loss on sale of

assets, stock based compensation, amortization and impairment of

intangible assets and goodwill related to the Company’s

acquisitions, and non-cash related income tax expense.

- Non-GAAP operating margin from

continuing operations of five percent in the quarter, compared

to six percent in the same period last year.

- Non-GAAP net income from continuing

operations of $914,000 or $0.05 per diluted share in the

quarter, as compared to $1.2 million or $0.06 per diluted share

in the same period last year.

- $56.2 million of cash, short-term

investments at March 31, 2014, a decrease of approximately

$(1.7) million from the preceding quarter. During the quarter the

company used cash to pay $2.4 million in annual accrued expenses

from 2013 and $739,000 in dividends.

"Our in-building engineering services and scanning receiver

revenue continue to grow as does our Site Solutions product sales,”

said Marty Singer, PCTEL’s Chairman and CEO. “Core antenna sales

were soft for seasonal reasons but we expect a strong rebound this

quarter in that product area. That coupled with new business makes

us comfortable with the high end of our previous revenue guidance

of $112 - $114 million for our full year 2014. Finally, we had an

extremely active quarter with respect to new product releases that

will benefit the company this year,” added Singer.

CONFERENCE CALL / WEBCAST

PCTEL’s management team will discuss the Company’s results today

at 5:15 PM ET. The call can be accessed by dialing (877) 734-5369

(U.S. / Canada) or (706) 679-6397 (International), conference ID:

28238948. The call will also be webcast at

http://investor.pctel.com/events.cfm.

REPLAY: A replay will be available for two weeks after the call

on either the website listed above or by calling (855) 859-2056

(U.S./Canada), or International (404) 537-3406, conference ID:

28238948.

About PCTEL

PCTEL, Inc. (NASDAQ: PCTI), develops antenna, scanning receiver,

and engineered site solutions and services for public and private

networks. PCTEL RF Solutions enables superior utilization of

wireless spectrum for cellular and WiFi networks. The RF Solutions

services team specializes in the design, testing, and optimization

of in-building, small cell, and traditional wireless networks.

PCTEL RF Solutions develops and supports specialized network test

equipment for LTE FDD, TD-LTE, WCDMA, GSM, CDMA, EV-DO, TD-SCDMA,

and WiFi networks. The company's SeeGull® scanning receivers and

SeeHawk® visualization tool measure and analyze wireless signals

for efficient cellular network planning, deployment, and

optimization. Its IBflex™ simplifies in-building wireless network

testing and SeeWave™ identifies and locates interference sources

that impair network throughput.

PCTEL Connected Solutions™ simplifies network and site

deployment for wireless data and communications applications for

private and public networks, public safety, and government

customers. PCTEL Connected Solutions develops and delivers

high-value YAGI, Land Mobile Radio, WiFi, GPS, Subway, and

broadband antennas (parabolic and flat panel) through its MAXRAD®,

Bluewave™, and Wi-Sys™ product lines. PCTEL also sells specialized

towers, enclosures, and cable assemblies for custom engineered site

solutions. PCTEL delivers site solutions composed of PCTEL and

third party sourced material to allow customers to cost effectively

deploy and upgrade networks. The company's vertical markets include

SCADA, Health Care, Smart Grid, Positive Train Control, Precision

Agriculture, Indoor Wireless, Telemetry, Off-loading, and Wireless

Backhaul. PCTEL's products are sold worldwide through direct and

indirect channels. For more information, please visit the company's

web sites www.pctel.com, www.antenna.com, or

www.rfsolutions.pctel.com.

PCTEL Safe Harbor Statement

This press release contains “forward-looking statements” as

defined in the Private Securities Litigation Reform Act of 1995.

Specifically, the statements regarding the growth of PCTEL’s

in-building engineering services and scanning receiver sales, the

performance of the Connected Solutions business and the anticipated

success of our new antenna and scanning receiver products, are

forward-looking statements within the meaning of the safe harbor.

These statements are based on management’s current expectations and

actual results may differ materially from those projected as a

result of certain risks and uncertainties, including the ability to

successfully grow the wireless products business and the ability to

implement new technologies and obtain protection for the related

intellectual property. These and other risks and uncertainties are

detailed in PCTEL's Securities and Exchange Commission filings.

These forward-looking statements are made only as of the date

hereof, and PCTEL disclaims any obligation to update or revise the

information contained in any forward-looking statement, whether as

a result of new information, future events or otherwise.

PCTEL, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands, except share data)

(unaudited) March 31, December

31, 2014 2013 ASSETS Cash and cash

equivalents $16,475 $21,790 Short-term investment securities 39,694

36,105 Accounts receivable, net of allowance for doubtful accounts

of $120 and $130 at March 31, 2014 and December 31, 2013,

respectively 17,541 18,603 Inventories, net 15,961 14,535 Deferred

tax assets, net 1,629 1,629 Prepaid expenses and other assets 1,664

3,166 Total current assets 92,964 95,828 Property and

equipment, net 14,892 14,971 Goodwill 161 161 Intangible assets,

net 4,031 4,604 Deferred tax assets, net 11,915 11,827 Other

noncurrent assets 39 41

TOTAL ASSETS $124,002

$127,432 LIABILITIES AND STOCKHOLDERS’ EQUITY

Accounts payable $4,244 $4,440 Accrued liabilities 7,248

7,803 Total current liabilities 11,492 12,243 Other

long-term liabilities 1,226 3,137 Total liabilities

12,718 15,380 Stockholders’ equity: Common stock, $0.001 par

value, 100,000,000 shares authorized, 18,620,085 and 18,566,119

shares issued and outstanding at March 31, 2014 and December 31,

2013, respectively 19 19 Additional paid-in capital 143,742 143,572

Accumulated deficit (32,635) (31,748) Accumulated other

comprehensive income 158 209 Total stockholders’ equity of PCTEL,

Inc. 111,284 112,052

TOTAL LIABILITIES AND EQUITY

$124,002 $127,432

PCTEL, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data)

(unaudited) Three Months Ended March 31,

2014 2013 REVENUES $23,656 $25,073

COST OF REVENUES 14,074 15,475

GROSS PROFIT 9,582

9,598

OPERATING EXPENSES: Research and development 3,242

2,550 Sales and marketing 2,956 3,020 General and administrative

3,232 4,632 Amortization of intangible assets 574 604 Restructuring

charges 0 101 Total operating expenses 10,004 10,907

OPERATING

LOSS (422) (1,309) Other income, net 197 4,332

INCOME (LOSS)

BEFORE INCOME TAXES (225) 3,023 Expense (benefit) for income

taxes (79) 1,070

NET INCOME (LOSS) FROM CONTINUING

OPERATIONS (146) 1,953

LOSS FROM DISCONTINUED OPERATIONS,

NET OF TAX BENEFIT 0 (88)

NET INCOME (LOSS) ($146)

$1,865

Earnings (Loss) per Share from Continuing

Operations: Basic ($0.01) $0.11 Diluted ($0.01) $0.11

Earnings (Loss) per Share from Discontinued Operations:

Basic $0.00 ($0.00) Diluted $0.00 ($0.01)

Earnings (Loss)

per Share: Basic ($0.01) $0.11 Diluted ($0.01) $0.10

Weighed Average Shares: Basic 18,176 17,684 Diluted 18,176

17,911 Cash dividend per share $0.040 $0.035

PCTEL, INC. P&L INFORMATION BY SEGMENT - Continuing

Operations (in thousands)

Three Months Ended March

31, 2014 Connected Solutions RF Solutions Consolidating Total

REVENUES $15,997 $7,722 ($63) $23,656

GROSS PROFIT 5,116 4,459 7 9,582

OPERATING INCOME (LOSS) $1,170 $1,014 ($2,606)

($422) Three Months Ended March 31, 2013 Connected

Solutions RF Solutions Consolidating Total

REVENUES

$19,356 $5,772 ($55) $25,073

GROSS

PROFIT 6,011 3,581 6 9,598

OPERATING INCOME (LOSS) $1,687 $1,042 ($4,038) ($1,309)

Reconciliation

GAAP To non-GAAP Results Of Continuing Operations

(unaudited)

(in thousands except per share information)

Reconciliation of

GAAP operating income to non-GAAP operating income (a) from

Continuing Operations

Three Months Ended March 31,

2014

2013

Operating Loss ($422) ($1,309) (a) Add: Amortization

of intangible assets 574 604 TelWorx restructuring: -Restructuring

charges 0 101 TelWorx investigation: -General & Administrative

235 1,391 Stock Compensation: -Cost of Goods Sold 86 85

-Engineering 173 145 -Sales & Marketing 147 106 -General &

Administrative 345 286 1,560 2,718 Non-GAAP Operating

Income $1,138 $1,409 % of revenue 4.8% 5.6%

Reconciliation of

GAAP net income to non-GAAP net income (b) from Continuing

Operations

Three Months Ended March 31,

2014

2013

Net Income (Loss) from Continuing Operations ($146) $1,953

Adjustments: (a) Non-GAAP adjustment to operating income

1,560 2,718 Other income related to the TelWorx settlement and

TelWorx SEC investigation (220) (4,330) (b) Income Taxes (280) 816

1,060 (796) Non-GAAP Net Income from Continuing

Operations $914 $1,157

Non-GAAP Earning per Share:

Basic $0.05 $0.07 Diluted $0.05 $0.06

Weighed Average

Shares: Basic 18,176 17,684 Diluted 18,379 17,911

This schedule reconciles the Company's

GAAP operating income and GAAP net income to its non-GAAP operating

income and non-GAAP net income. The Company believes that

presentation of this schedule provides meaningful supplemental

information to both management and investors that is indicative of

the Company's core operating results and facilitates comparison of

operating results across reporting periods. The Company uses these

non-GAAP measures when evaluating its financial results as well as

for internal planning and forecasting purposes. These non-GAAP

measures should not be viewed as a substitute for the Company's

GAAP results.

(a) These adjustments reflect stock based

compensation expense, amortization of intangible assets,

restructuring charges, and general and administrative expenses

associated with the TelWorx investigation.

(b) These adjustments include the items

described in footnote (a) as well as other income for the TelWorx

legal settlement and insurance claims related to the TelWorx

investigation, and non-cash income tax expense.

Reconciliation

GAAP To non-GAAP SEGMENT INFORMATION (unaudited) (a) - Continuing

Operations

(in thousands except per share information)

Three

Months Ended March 31, 2014 Connected Solutions RF Solutions

Consolidating Total

Operating Income (Loss)

$1,170 $1,014 ($2,606) ($422) Add: Amortization of

intangible assets 370 204 0 574 TelWorx investigation: -General

& Administrative 0 0 235 235 Stock Compensation: -Cost of Goods

Sold 45 40 0 85 -Engineering 80 93 0 173 -Sales & Marketing 128

19 0 147 -General & Administrative 87 30 229 346 710 386 464

1,560

Non-GAAP Operating Income

(Loss) $1,880 $1,400 ($2,142) $1,138 Three Months

Ended March 31, 2013 Connected Solutions RF Solutions Consolidating

Total

Operating Income (Loss) $1,687 $1,042

($4,038) ($1,309) Add: Amortization of intangible assets 394

210 0 604 Restructuring charges 101 0 0 101 TelWorx investigation:

-General & Administrative 0 0 1,391 1,391 Stock Compensation:

-Cost of Goods Sold 27 58 0 85 -Engineering 55 90 0 145 -Sales

& Marketing 78 28 0 106 -General & Administrative 66 15 205

286 721 401 1,596 2,718

Non-GAAP

Operating Income (Loss) $2,408 $1,443 ($2,442) $1,409

This schedule reconciles the Company's

GAAP operating income by segment to its non-GAAP operating income

and non-GAAP net income. The Company believes that presentation of

this schedule provides meaningful supplemental information to both

management and investors that is indicative of the Company's core

operating results and facilitates comparison of operating results

across reporting periods. The Company uses these non-GAAP measures

when evaluating its financial results as well as for internal

planning and forecasting purposes. These non-GAAP measures should

not be viewed as a substitute for the Company's GAAP results.

(a) These adjustments reflect stock based

compensation expense, amortization of intangible assets,

restructuring charges, and general and administrative expenses

associated with the TelWorx investigation.

PCTEL, Inc.John SchoenCFO(630) 372-6800orJack SellerPublic

Relations(630) 372-6800Jack.seller@pctel.com

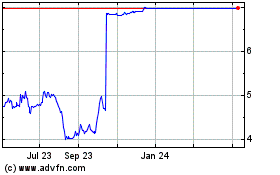

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Jan 2025 to Feb 2025

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Feb 2024 to Feb 2025