Palomar Holdings, Inc. Announces Proposed Public Offering of Common Stock

August 08 2024 - 4:05PM

Palomar Holdings, Inc. (NASDAQ:PLMR) (“Palomar” or “Company”),

today announced the underwritten public offering of 1,200,000

shares of the Company’s common stock, par value $0.0001 per share

(the “Common Stock”), subject to market and other conditions. All

of the shares in the offering are to be sold by Palomar. Palomar

intends to grant the underwriters a 30-day option to purchase up to

180,000 additional shares of common stock at the public

offering price, less the underwriting discounts and commissions.

The Company intends to use the net proceeds that

it will receive from the offering for general corporate purposes,

including using approximately $25.0 million to finance the

contemplated acquisition of First Indemnity of America Insurance

Company, a New Jersey domiciled insurance carrier specializing in

surety bonds for small to medium sized contractors primarily in the

Northeast United States, and to fund future growth.

J.P. Morgan, Evercore ISI, and Keefe, Bruyette

& Woods, Inc., A Stifel Company, will act as joint lead

book-running managers for the offering.

The shares of common stock described above are

being offered by Palomar pursuant to its shelf registration

statement on Form S-3 that became automatically effective upon

filing with the Securities and Exchange

Commission (the “SEC”) on August 8, 2024. The offering

may be made only by means of a prospectus supplement and

accompanying prospectus, copies of which may be obtained by

contacting J.P. Morgan Securities LLC, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, New York

11717, by email at prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com; Evercore Group L.L.C.,

Attention: Equity Capital Markets, 55 East 52nd Street, 35th Floor,

New York, NY 10055, by telephone at 1-888-474-0200, or by email at

ecm.prospectus@evercore.com; or Keefe, Bruyette & Woods, Inc.,

787 Seventh Ave., 4th Floor, New York, NY, 10019, Attention: Equity

Capital Markets, or by calling 800-966-1559, or by emailing

kbwsyndicatedesk@kbw.com.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Palomar Holdings, Inc.

Palomar Holdings, Inc. is the holding company of

subsidiaries Palomar Specialty Insurance Company (“PSIC”), Palomar

Specialty Reinsurance Company Bermuda Ltd., Palomar Insurance

Agency, Inc., Palomar Excess and Surplus Insurance Company

(“PESIC”), and Palomar Underwriters Exchange Organization, Inc.

Palomar's consolidated results also include Laulima Reciprocal

Exchange, a variable interest entity for which the Company is the

primary beneficiary. Palomar is an innovative specialty insurer

serving residential and commercial clients in five product

categories: Earthquake, Inland Marine and Other Property, Casualty,

Fronting, and Crop. Palomar’s insurance subsidiaries, Palomar

Specialty Insurance Company, Palomar Specialty Reinsurance Company

Bermuda Ltd., and Palomar Excess and Surplus Insurance Company,

have a financial strength rating of “A” (Excellent) from A.M.

Best.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995. These

statements are subject to risks and uncertainties. All statements

other than statements of historical fact or relating to present

facts or current conditions included in this press release are

forward-looking statements, including statements regarding the

offering. Forward-looking statements give our current expectations

and projections relating to our financial condition, results of

operations, plans, objectives, future performance and business. You

can identify forward-looking statements by the fact that they do

not relate strictly to historical or current facts. These

statements may include words such as “anticipate,” “estimate,”

“expect,” “project,” “seek,” “plan,” “intend,” “believe,” “will,”

“may,” “could,” “continue,” “likely,” “should,” and other

words.

The forward-looking statements contained in this

press release are based on our current expectations and assumptions

regarding our business, the economy, and other future conditions.

Because forward-looking statements relate to the future, by their

nature, they are subject to inherent uncertainties, risks, and

changes in circumstances that are difficult to predict. Our actual

results may differ materially from those contemplated by the

forward-looking statements as a result of several factors including

market risks and uncertainties and the satisfaction of customary

closing conditions for an offering of securities, and other factors

discussed in greater detail in the Company's filings with the SEC.

Any forward-looking statement made by us in this press release

speaks only as of the date on which we make it. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible for us to predict all of them. We

undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by law.

Comparisons of results for current and any prior periods are not

intended to express any future trends or indications of future

performance, unless specifically expressed as such, and should be

viewed as historical data.

Investor Relations

Jamie Lillis1-203-428-3223investors@plmr.com

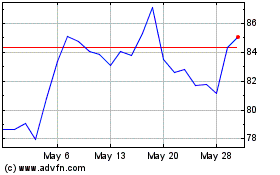

Palomar (NASDAQ:PLMR)

Historical Stock Chart

From Oct 2024 to Nov 2024

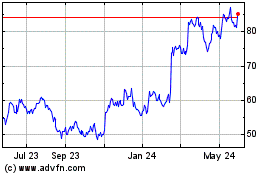

Palomar (NASDAQ:PLMR)

Historical Stock Chart

From Nov 2023 to Nov 2024