Otonomo Technologies Ltd. Announces Extension of Exchange Offer and Consent Solicitation Relating to Warrants

August 21 2023 - 5:04PM

Otonomo Technologies Ltd. (Nasdaq: OTMO) (“Otonomo” or the

“Company”), the platform powering the mobility economy, today

announced that it has extended the expiration date of its

previously announced exchange offer (the “Offer”) and consent

solicitation (the “Consent Solicitation”) relating to its

outstanding (i) public warrants to purchase the Company’s ordinary

shares, no par value per share (the “Ordinary Shares”), which

warrants trade on The Nasdaq Stock Market LLC under the symbol

“OTMOW” (the “public warrants”), and (ii) private placement

warrants to purchase Ordinary Shares (together with the public

warrants, the “warrants”). As a result of the extension, the Offer

is now scheduled to expire at 11:59 P.M., Eastern Time, on August

22, 2023.

The Offer and Consent Solicitation was previously scheduled to

expire at 11:59 P.M., Eastern Time, on August 21, 2023. The other

terms of the Offer and Consent Solicitation are as set forth in the

Prospectus/Offer to Exchange dated July 24, 2023 and as amended on

August 21, 2023, and a Schedule TO dated July 24, 2023 and as

amended on August 21, 2023, each of which are filed with the U.S.

Securities and Exchange Commission (“SEC”).

The Company is offering to all holders of its outstanding

warrants the opportunity to receive 0.0167 Ordinary Shares (the

equivalent of 0.25 Ordinary Shares after giving effect to the

Company’s recently completed 1:15 reverse share split) in exchange

for each outstanding warrant tendered by the holder and exchanged

pursuant to the Offer. Pursuant to the Offer, the Company is

offering up to an aggregate of 230,877 Ordinary Shares in exchange

for the warrants.

The sole Dealer Manager for the Offer and Consent Solicitation

is Piper Sandler & Co. D.F. King & Co., Inc. is serving as

the Information Agent for the Offer and Consent Solicitation and

Equiniti Trust Company, LLC is serving as the Exchange Agent.

For all questions relating to the Offer and Consent

Solicitation, please contact the Information Agent, D.F. King &

Co., Inc. at OTMO@dfking.com or

call (212) 269-5500 (for banks and brokers) or (877) 783-5524 (for

all others), or call the Dealer Manager, Piper Sandler & Co. at

(800) 754-1172.

Additional Information

Copies of the Schedule TO and Prospectus/Offer to Exchange will

be available free of charge at the website of the SEC at

www.sec.gov. Requests for documents may also be directed to D.F.

King & Co., Inc. at (212) 269-5500 (for banks and brokers) or

(877) 783-5524 (for all others) or via the following email address:

OTMO@dfking.com. A registration statement on Form F-4 relating to

the Ordinary Shares to be issued in the Offer has been filed with

the SEC but has not yet become effective. Such Ordinary Shares may

not be sold nor may offers to buy be accepted prior to the time the

registration statement becomes effective.

This announcement is for informational purposes only and shall

not constitute an offer to purchase or a solicitation of an offer

to sell the warrants or an offer to sell or a solicitation of an

offer to buy any Ordinary Shares in any state in which such offer,

solicitation or sale would be unlawful before registration or

qualification under the laws of any such state. The Offer and

Consent Solicitation are being made only through the Schedule TO

and Prospectus/Offer to Exchange, and the complete terms and

conditions of the Offer and Consent Solicitation are set forth in

the Schedule TO and Prospectus/Offer to Exchange.

Holders of the warrants are urged to read the Schedule TO and

Prospectus/Offer to Exchange carefully before making any decision

with respect to the Offer and Consent Solicitation because they

contain important information, including the various terms of, and

conditions to, the Offer and Consent Solicitation.

None of the Company, any of its management or its board of

directors, or the Information Agent, the Exchange Agent or the

Dealer Manager makes any recommendation as to whether or not

holders of warrants should tender warrants for exchange in the

Offer or consent to the Warrant Amendment (as defined in the

Prospectus/Offer to Exchange) in the Consent Solicitation.

About Otonomo

Otonomo (NASDAQ: OTMO), the platform powering the mobility

economy, is igniting a new generation of mobility experiences and

services and is making mobility more accessible, equitable,

sustainable and safe. Our partners gain access to the broadest,

most diverse, range of data from connected vehicles with just one

contract and one API. Architected with privacy and security by

design, our platform is GDPR, CCPA, and other privacy regulation

compliant, ensuring all parties are protected and companies remain

privacy compliant across geographies worldwide. Otonomo has R&D

centers in Israel and the UK, with a presence in the United States

and Europe. For more information, visit www.otonomo.io.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the federal securities laws. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including, but

not limited to, the ability to implement business plans, forecasts,

and other expectations, the ability to identify and realize

additional opportunities and potential changes and developments in

the highly competitive data marketplace. The foregoing list of

factors is not exhaustive. You should carefully consider the

foregoing factors and the other risks and uncertainties described

in Otonomo’s annual report on Form 20-F filed with the SEC on March

31, 2023 and other documents filed by Otonomo from time to time

with the SEC. These filings identify and address other important

risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and Otonomo assumes no obligation and

does not intend to update or revise these forward-looking

statements, whether as a result of new information, future events,

or otherwise. Otonomo gives no assurance that it will achieve its

expectations.

For media and investment inquiries, please

contact:

Otonomopress@otonomo.io

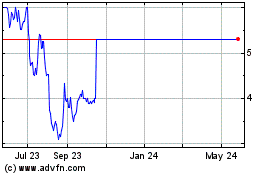

Otonomo Technologies (NASDAQ:OTMO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Otonomo Technologies (NASDAQ:OTMO)

Historical Stock Chart

From Nov 2023 to Nov 2024