Office Depot, Inc. (NYSE: ODP), a leading global provider of

office supplies and services, today announced results for the

fiscal quarter ended September 28, 2013.

THIRD QUARTER RESULTS1

Total Company sales for the third quarter of 2013 were $2.6

billion, down 3% compared to the third quarter of 2012 in both U.S.

dollars and in constant currency.

The Company reported net income, after preferred stock

dividends, of $133 million or $0.41 per diluted share in the third

quarter of 2013, compared to a net loss, after preferred stock

dividends, of $70 million or $0.25 per share in the third quarter

of 2012.

- Third quarter 2013 results included a

$381 million pre-tax gain on the sale of our investment in the

Mexican joint venture (JV), as well as $138 million in income tax

expense driven largely by the JV sale. The quarter also included a

$22 million preferred stock redemption dividend, and approximately

$93 million of pre-tax charges. The charges were comprised

primarily of $44 million in goodwill impairment triggered by the JV

sale, $40 million in merger and certain shareholder-related

expenses, $4 million in restructuring activities, and $5 million in

non-cash store impairment charges in the North American Retail

Division. Excluding the items above, adjusted net income for the

third quarter of 2013, after preferred stock dividends, was $5

million or $0.02 per share.

- The prior year third quarter results

included approximately $96 million of pre-tax charges, consisting

of $88 million in asset impairment charges and $8 million in

restructuring and other charges. Excluding these items, third

quarter 2012 net income, after preferred stock dividends, was $18

million or $0.06 per share.

“Although we experienced some weakness in July, we had a

relatively strong back-to-school season this year as evidenced by

sales increases in our school supplies categories and K-12

education customers,” said Neil Austrian, Chairman and Chief

Executive Officer of Office Depot. “I’m pleased that we were able

to deliver these results while continuing to make progress with the

integration planning for the pending merger with OfficeMax.”

Total Company gross profit margin decreased 45 basis points in

the third quarter of 2013 compared to the prior year period, with

decreases in the North American Retail and International Divisions

partially offset by an increase in the North American Business

Solutions Division.

Total Company operating expenses decreased by $33 million in the

third quarter of 2013 compared to the prior year period. When

adjusted for merger and certain shareholder-related expenses and

impairment and restructuring charges, total Company operating

expenses decreased by $30 million versus the prior year period.

Third quarter 2013 adjusted earnings before interest and taxes

(EBIT), which excludes the gain on sale of our Mexican JV, charges

related to goodwill impairment, merger and certain

shareholder-related expenses, restructuring activities, and store

asset impairment charges, was $42 million, compared to adjusted

EBIT of $54 million last year in the same quarter. The third

quarter 2012 results included $11 million of miscellaneous income

generated by the Mexican JV.

Income tax expense of $155 million in the third quarter of 2013

includes $146 million of income tax expense resulting from the gain

on the sale of the Mexican JV, as well as the continuing impact of

valuation allowances and the timing of earnings within various tax

jurisdictions.

The Company ended the third quarter of 2013 with a use of free

cash flow of $58 million, compared to positive free cash flow of

$190 million in the prior year period. The use of cash in the third

quarter of 2013 includes the income taxes noted above from the

Mexican JV sale as well as $9 million in payments of merger and

certain shareholder-related expenses.

1 Includes non-GAAP information. Additional information is

provided in our Form 10-Q for the fiscal quarter ended September

28, 2013. Reconciliations from GAAP to non-GAAP financial measures

can be found in this release, as well as on our Investor Relations

website at http://investor.officedepot.com.

THIRD QUARTER DIVISION RESULTS

North American Retail Division

The North American Retail Division reported third quarter 2013

sales of $1.1 billion, a decrease of 4% compared to the prior year

period.

Comparable store sales in the 1,063 stores that have been open

for more than one year decreased 2% for the third quarter of 2013.

Ink and toner sales were down in the quarter, partially impacted by

higher sales from certain vendor promotions in the prior year.

Certain technology and related category sales were lower in the

third quarter, but sales of tablets and mobility products

increased. Compared to the prior year period, paper and printer

sales were down and were impacted by lower average selling prices,

Copy and Print Depot and school supplies increased, and furniture

sales were down. Average order value was down approximately 1% in

the quarter and customer transaction counts declined about 2%

compared to the same period last year.

The North American Retail Division reported operating income of

$10 million in the third quarter of 2013, compared to an operating

loss of $52 million in the prior year period. The Division

operating income/loss included charges of $5 million and $74

million in the third quarter of 2013 and 2012, respectively, which

were driven by non-cash store asset impairments and restructuring

activities. Excluding the charges, third quarter 2013 adjusted

operating income was $15 million, compared to $22 million in third

quarter 2012. The $7 million year-over-year decrease resulted

primarily from the negative flow-through impact of lower sales and

a 58 basis point gross margin decrease, partially offset by

initiative-driven expense reductions including payroll,

professional fees, advertising, and general & administrative

expenses.

At the end of the third quarter of 2013, Office Depot operated

1,104 stores in the U.S. and Puerto Rico. The North American Retail

Division opened two new stores and closed seven during the third

quarter of 2013.

North American Business Solutions Division

The North American Business Solutions Division reported third

quarter 2013 sales of $811 million, a 2% decrease compared to the

prior year period.

Contract channel sales in the third quarter of 2013 were down

low-single digits versus the prior year period. The decline was

driven primarily by the restructuring and relocation of the

technology sales organization and sales to federal customers, who

continue to experience significant budgetary constraints. The

private sector experienced sales softness, particularly within

large and enterprise accounts. Sales improved year over year in the

public sector, driven by education, state, and local accounts. In

the Direct channel, third quarter 2013 sales were flat compared to

the prior year quarter. Online sales increased in the quarter and

sales through our catalog and call center operations continued to

decline.

The North American Business Solutions Division reported third

quarter 2013 operating income of $39 million, compared to $30

million in the same period last year. The Division operating income

included restructuring charges of $2 million in the third quarter

of 2012. Excluding the charges, the $6 million year-over-year

improvement in operating income reflects a 13 basis point gross

margin increase which was driven by margin initiatives, as well as

lower advertising, payroll, and general & administrative

expenses.

International Division

The International Division reported third quarter 2013 sales of

$681 million, a decrease of 2% in U.S. dollars and 4% in constant

currency compared to the third quarter of 2012.

European Contract sales decreased mid-single digits in third

quarter 2013 compared to the prior year period. Strategic decisions

to exit certain unprofitable customers partially contributed to the

sales declines. In the Direct channel, the rate of year-over-year

sales decline continued to improve sequentially in third quarter

2013. The Division continued to take pricing actions on ink and

toner in several markets. Retail sales in the quarter were down

largely as a result of store closures in Sweden, partially offset

by increased sales in France.

The International Division reported operating income of $3

million in the third quarter of 2013, compared to an operating loss

of $15 million in the same period last year. The Division operating

income in the quarter included $3 million in restructuring charges,

compared to an operating loss in the third quarter of 2012 that

included $19 million of charges related to asset impairments and

restructuring activities. Excluding the charges, third quarter 2013

adjusted operating income was $6 million, compared to adjusted

operating income of $4 million in third quarter 2012. The $2

million year-over-year improvement resulted primarily from

operating expense reductions including advertising, payroll and

general & administrative expenses, offset by sales declines and

an 81 basis point gross margin decrease largely driven by the ink

and toner pricing actions.

The movement in exchange rates had a minimal impact on

International Division operating income in the third quarter of

2013 compared to the same period in 2012.

Other Matters

On July 9, 2013, the Company completed the sale of its

investment in the Mexican JV to Grupo Gigante for the Mexican Peso

amount of 8,777 million in cash, or approximately $680 million. In

the third quarter the Company recognized a $381 million pre-tax

gain on the sale as well as a $44 million goodwill impairment

related to the transaction.

At the end of the third quarter of 2013, the Company had $725

million in cash and cash equivalents on hand and $728 million

available under the Amended and Restated Credit Agreement, for a

total of approximately $1.5 billion in available liquidity.

Additional information on the Company’s third quarter results

can be found in our Form 10-Q filed with the SEC on November 5,

2013, as well as in the Investor Relations section of our corporate

website, www.officedepot.com, under the category Financial

Information.

Non-GAAP Reconciliations

Reconciliations of GAAP results to non-GAAP results are

presented in this release and also may be found on our Investor

Relations website at http://investor.officedepot.com.

About Office Depot

Office Depot provides office supplies and services through more

than 1,300 worldwide retail stores, a field sales force, top-rated

catalogs and e-commerce operations, all delivered through a global

network of wholly owned operations, licensees, franchisees and

alliance partners. Office Depot has annual sales of approximately

$10.7 billion, employs about 38,000 associates and serves customers

in 59 countries around the world.

Office Depot’s common stock is listed on the New York Stock

Exchange under the symbol ODP. Additional press information can be

found at: http://news.officedepot.com.

OFFICE DEPOT SAFE HARBOR

STATEMENT

This communication may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements or disclosures may discuss goals, intentions

and expectations as to future trends, plans, events, results of

operations or financial condition, or state other information

relating to, among other things, the Company, the merger and other

transactions contemplated by the merger agreement, based on current

beliefs and assumptions made by, and information currently

available to, management. Forward-looking statements generally will

be accompanied by words such as “anticipate,” “believe,” “plan,”

“could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,”

“may,” “possible,” “potential,” “predict,” “project,” “propose” or

other similar words, phrases or expressions, or other variations of

such words. These forward-looking statements are subject to various

risks and uncertainties, many of which are outside of the Company’s

control. There can be no assurances that the Company will realize

these expectations or that these beliefs will prove correct, and

therefore investors and shareholders should not place undue

reliance on such statements.

Factors that could cause actual results to differ materially

from those in the forward-looking statements include adverse

regulatory decisions; the risks that the combined company will not

realize the estimated accretive effects of the merger or the

estimated cost savings and synergies; the businesses of Office

Depot and OfficeMax may not be integrated successfully or such

integration may take longer, be more difficult, time-consuming or

costly to accomplish than expected; the business disruption

following the merger, including adverse effects on employee

retention; the combined company’s ability to maintain its long-term

credit rating; unanticipated changes in the markets for the

combined company’s business segments; unanticipated downturns in

business relationships with customers; competitive pressures on the

combined company’s sales and pricing; increases in the cost of

material, energy and other production costs, or unexpected costs

that cannot be recouped in product pricing; the introduction of

competing technologies; unexpected technical or marketing

difficulties; unexpected claims, charges, litigation or dispute

resolutions; new laws and governmental regulations. The foregoing

list of factors is not exhaustive. Investors and shareholders

should carefully consider the foregoing factors and the other risks

and uncertainties described in Office Depot’s and OfficeMax’s

Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q

filed with the Securities and Exchange Commission. The combined

company does not assume any obligation to update or revise any

forward-looking statements.

OFFICE DEPOT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands,

except share and per share amounts) (Unaudited)

September 28, December 29, September

29, 2013 2012 2012 Assets Current

assets: Cash and cash equivalents $ 724,741 $ 670,811 $ 619,532

Receivables, net 798,147 803,944 833,895 Inventories 1,034,313

1,050,625 1,004,925 Prepaid expenses and other current assets

136,578 170,810 141,146 Total current

assets 2,693,779 2,696,190 2,599,498 Property and equipment, net

796,058 856,341 871,153 Goodwill 19,431 64,312 63,983 Other

intangible assets, net 15,010 16,789 17,272 Deferred income taxes

28,582 33,421 39,923 Other assets 98,912 343,726

358,021 Total assets $ 3,651,772 $ 4,010,779

$ 3,949,850

Liabilities and stockholders’

equity Current liabilities: Trade accounts payable $ 841,293 $

934,892 $ 867,249 Accrued expenses and other current liabilities

944,137 931,618 960,113 Income taxes payable 10,600 5,310 7,088

Short-term borrowings and current maturities of long-term debt

23,916 174,148 185,075 Total current

liabilities 1,819,946 2,045,968 2,019,525 Deferred income taxes and

other long-term liabilities 390,133 431,531 380,852 Long-term debt,

net of current maturities 471,259 485,331

486,039 Total liabilities 2,681,338 2,962,830

2,886,416 Commitments and contingencies

Redeemable preferred stock, net (liquidation preference – $203,386

in September 2013, $406,773 in December 2012 and September 2012)

193,201 386,401 386,401 Stockholders'

equity: Office Depot, Inc. stockholders’ equity: Common stock -

authorized 800,000,000 shares

of $.01 par value; issued shares –

294,991,583 in September 2013, 291,734,027 in December 2012 and

291,146,086 in September 2012 2,950 2,917 2,911 Additional paid-in

capital 1,088,595 1,119,775 1,126,787 Accumulated other

comprehensive income 259,617 212,717 213,892 Accumulated deficit

(516,196 ) (616,235 ) (608,919 ) Treasury stock, at cost –

5,915,268 shares in 2013 and 2012 (57,733 ) (57,733 )

(57,733 ) Total Office Depot, Inc. stockholders’ equity 777,233

661,441 676,938 Noncontrolling interests - 107

95 Total equity 777,233 661,548 677,033

Total liabilities and equity $ 3,651,772 $ 4,010,779

$ 3,949,850

OFFICE DEPOT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share

amounts)

(Unaudited)

13 Weeks Ended 39 Weeks Ended September

28, September 29, September 28,

September 29, 2013 2012 2013

2012 Sales $ 2,619,448 $ 2,692,933 $ 7,756,327 $

8,072,892 Cost of goods sold and occupancy costs 1,986,705

2,030,261 5,917,618

6,143,621 Gross profit 632,743 662,672 1,838,709 1,929,271

Operating and selling expenses 451,760 464,709 1,341,504

1,393,617 Recovery of purchase price ― ― ― (68,314 ) Asset

impairments 48,719 87,998 58,381 129,753 General and administrative

expenses 144,847 165,065 455,070 510,272 Merger and certain

shareholder-related expenses 39,740 ―

71,564 ― Operating loss (52,323 ) (55,100 ) (87,810 )

(36,057 ) Other income (expense): Interest income 1,012 482

1,422 1,804 Interest expense (15,359 ) (16,947 ) (48,471 ) (49,128

) Loss on extinguishment of debt ― ― ― (12,110 ) Gain on

disposition of joint venture 380,813 ― 381,541 ― Miscellaneous

income, net 1,318 13,073 14,192

26,019 Earnings (loss) before income

taxes 315,461 (58,492 ) 260,874 (69,472 ) Income tax expense

154,561 3,433 160,823

341 Net earnings (loss) 160,900 (61,925 )

100,051 (69,813 )

Less: Net earnings (loss) attributable to

the noncontrolling interests

―

(9

)

12

(18

)

Net earnings (loss) attributable to Office Depot, Inc.

160,900 (61,916 ) 100,039

(69,795 ) Preferred stock dividends 28,039

7,650 48,378 22,765

Net earnings (loss) available to common stockholders $

132,861 $ (69,566 ) $ 51,661 $ (92,560 ) Net

earnings (loss) per share: Basic $ 0.42 $ (0.25 ) $ 0.18 $ (0.33 )

Diluted $ 0.41 $ (0.25 ) $ 0.18 $ (0.33 ) Weighted average

number of common shares outstanding Basic 283,631 280,238

281,906

279,438 Diluted 334,243 280,238

281,906

279,438

OFFICE DEPOT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

39 Weeks Ended September 28,

September 29, 2013 2012 Cash flows

from operating activities: Net earnings (loss) $ 100,051 $

(69,813 ) Adjustments to reconcile net earnings (loss) to net cash

provided by (used in) operating activities: Depreciation and

amortization 144,520 151,074 Charges for losses on inventories and

receivables 41,964 48,814 Loss on extinguishment of debt ― 13,377

Recovery of purchase price ― (58,049 ) Pension plan funding ―

(58,030 ) Asset impairments 58,381 129,753 Gain on disposition of

joint venture (381,541 ) ― Changes in working capital and other

(83,172 ) (73,033 ) Net cash provided by (used in)

operating activities (119,797 ) 84,093

Cash flows from investing activities: Capital expenditures

(94,315 ) (88,716 ) Recovery of purchase price ― 49,841 Restricted

cash (789 ) ― Release of restricted cash ― 8,570 Proceeds from the

sale of joint venture 674,826 ― Proceeds from assets sold and other

1,721 31,373 Net cash provided by

investing activities 581,443 1,068

Cash flows from financing activities: Proceeds from

exercise of stock options 1,079 1,379 Tax benefit from employee

share-based exercises 6,420 ― Share transactions under employee

related plans (2,810 ) (218 ) Redemption of redeemable preferred

stock (203,386 ) ― Preferred stock dividends (43,277 ) ― Payment

for noncontrolling interests (597 ) (551 ) Loss on extinguishment

of debt __ (13,377 ) Debt related fees __ (8,012 ) Debt retirement

(150,000 ) (250,000 ) Debt issuance __ 250,000 Net payments on

other long- and short-term borrowings (17,261 )

(17,881 ) Net cash used in financing activities (409,832 )

(38,660 )

Effect of exchange rate changes on cash

and cash equivalents 2,116 2,350

Net increase in cash and cash equivalents 53,930 48,851 Cash

and cash equivalents at beginning of period 670,811

570,681 Cash and cash equivalents at end of period $

724,741 $ 619,532

OFFICE DEPOT, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited)

We report our results in accordance with

accounting principles generally accepted in the United States

(“GAAP”). We also review certain financial measures excluding

impacts of transactions that are beyond our core operations

(“non-GAAP”). A reconciliation of GAAP financial measures to

non-GAAP financial measures and the limitations on their use may be

accessed in the “Investor Relations” section of our corporate

website, www.officedepot.com. Certain portions of

those reconciliations are provided in the following tables.

(In millions, except per share

amounts)

Q3

2013

GAAP

% ofSales

Charges/Credits

Non-GAAP

% ofSales

Gross profit $ 632.7 24.2 % $ - $ 632.7 24.2 % Operating expenses $

685.0 26.2 % $ 92.6 $ 592.4 22.6 % Operating income (loss) $ (52.3

) (2.0 )% $ (92.6 ) $ 40.3 1.5 % Net earnings (loss) attributable

to common

stockholders

$ 132.9 5.1 % $ 128.2

$ 4.7 0.2 % Diluted earnings (loss) per share $ 0.41

$ 0.39 $ 0.02

Q3

2012

GAAP

% ofSales

Charges/Credits

Non-GAAP

% ofSales

Gross profit * $ 662.7 24.6 % $ - $ 662.7 24.6 % Operating expenses

* $ 717.8 26.7 % $ 95.6 $ 622.2 23.1 % Operating income (loss) $

(55.1 ) (2.0 )% $ (95.6 ) $ 40.5 1.5 % Net earnings (loss)

attributable to common

stockholders

$ (69.6 ) (2.6 )% $ (87.6 ) $

18.0 0.7 % Diluted earnings (loss) per share $ (0.25 ) $

(0.31 ) $ 0.06

YTD

2013

GAAP

% ofSales

Charges/Credits

Non-GAAP

% ofSales

Gross profit $ 1,838.7 23.7 % $ - $ 1,838.7 23.7 % Operating

expenses $ 1,926.5 24.8 % $ 148.0 $ 1,778.5 22.9 % Operating income

(loss) $ (87.8 ) (1.1 )% $ (148.0 ) $ 60.2 0.8 % Net earnings

(loss) attributable to common

stockholders

$ 51.7 0.7 % $ 73.5

$ (21.9 ) (0.3 )% Diluted earnings (loss) per share $ 0.18

$ 0.26 $ (0.08 )

YTD

2012

GAAP

% ofSales

Charges/Credits

Non-GAAP

% ofSales

Gross profit * $ 1,929.3 23.9 % $ - $ 1,929.3 23.9 % Operating

expenses * $ 1,965.4 24.3 % $ 106.6 $ 1,858.8 23.0 % Operating

income (loss) $ (36.1 ) (0.4 )% $ (106.6 ) $ 70.5 0.9 % Net

earnings (loss) attributable to common

stockholders

$ (92.6 ) (1.1 )% $ (100.3 ) $

7.7 0.1 % Diluted earnings (loss) per share $ (0.33 ) $

(0.36 ) $ 0.03

* Gross profit and Operating expenses for Q3 2012 and YTD 2012

have been adjusted by $172.0 million and $534.7 million,

respectively, related to the impact of the change in accounting

principle of presenting shipping and handling expenses in Operating

expenses to presenting such expenses in Costs of goods sold and

occupancy costs.

OFFICE DEPOT, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited) (Continued)

Q3 2013 Q3 2012 Cash Flow Summary Net

cash provided by (used in) operating activities $ (25.6 ) $ 215.9

Net cash provided by (used in) investing activities 648.1 (15.5 )

Net cash provided by (used in) financing activities (376.1 ) (6.5 )

Effect of exchange rate changes on cash and cash equivalents

6.4 3.0 Net increase (decrease) in cash and

cash equivalents $ 252.8 $ 196.9

Free Cash

Flow Net cash provided by (used in) operating activities $

(25.6 ) $ 215.9 Less: Capital expenditures 32.0

26.2 Free Cash Flow $ (57.6 ) $ 189.7

Cash Flow Before Financing Activities Net increases

(decrease) in cash and cash equivalents $ 252.8 196.9 Less: Net

cash provided by (used in) financing activities (376.1 )

(6.5 ) Cash Flow Before Financing Activities $ 628.9

$ 203.4

YTD 2013 YTD 2012 Cash Flow

Summary Net cash provided by (used in) operating activities $

(119.8 ) $ 84.1 Net cash provided by (used in) investing activities

581.4 1.1 Net cash provided by (used in) financing activities

(409.8 ) (38.7 ) Effect of exchange rate changes on cash and cash

equivalents 2.1 2.4 Net increase

(decrease) in cash and cash equivalents $ 53.9 $ 48.9

Free Cash Flow Net cash provided by (used in)

operating activities $ (119.8 ) $ 84.1 Less: Capital expenditures

94.3 88.7 Free Cash Flow $ (214.1 ) $

(4.6 )

Cash Flow Before Financing Activities Net

increases (decrease) in cash and cash equivalents $ 53.9 $ 48.9

Less: Net cash provided by (used in) financing activities

(409.8 ) (38.7 ) Cash Flow Before Financing Activities $

463.7 $ 87.6

Free cash flow is calculated as net cash provided by (used in)

operating activities less capital expenditures.

Cash flow before financing activities is calculated as the net

increase (decrease) in cash and cash equivalents less net cash

provided by (used in) financing activities.

OFFICE DEPOT, INC.

DIVISION INFORMATION

(Unaudited)

North American

Retail Division

Third Quarter Year to Date

(Dollars in

millions)

2013 2012

2013 2012

Sales $ 1,127.8 $ 1,173.7 $ 3,211.1 $ 3,387.1 % change (4)%

(5)% (5)% (7)% Division operating income (loss)* $ 10.2 $

(52.0 ) $ (2.7 ) $ (84.4 ) % of sales 0.9% (4.4)% (0.1)% (2.5)%

North American

Business Solutions Division

Third Quarter Year to Date

(Dollars in

millions)

2013 2012 2013 2012 Sales $

811.2 $ 827.4 $ 2,407.8 $ 2,451.5 % change (2)% 1% (2)% 1%

Division operating income (loss)* $ 38.8 $ 30.4 $ 94.9 $ 72.0 % of

sales 4.8% 3.7% 3.9% 2.9%

International

Division

Third Quarter Year to Date

(Dollars in

millions)

2013 2012 2013 2012 Sales $

680.5 $ 691.9 $ 2,137.4 $ 2,234.3 % change (2)% (12)% (4)% (9)% %

change in constant currency (4)% (4)% (6)% (3)% Division

operating income (loss)* $ 2.6 $ (14.6 ) $ (3.8 ) $ (25.8 ) % of

sales 0.4% (2.1)% (0.2)% (1.2)%

* Divisions operating income (loss) for Q3 2012 and YTD

2012 have been updated to conform to the Company’s measure of

business segment adopted in Q1 2013. This change in Division

operating income (loss) had no impact on Consolidated operating

income (loss). For reconciliation of Division operating income

(loss) reported above to amounts reported prior to Q1 2013, refer

to Earnings Release filed with the United States Securities and

Exchange Commission on April 30, 2013 and available in the investor

relations section of our web site at www.officedepot.com/.

OFFICE DEPOT, INC.

SELECTED FINANCIAL AND OPERATING

DATA

(Unaudited)

Selected Operating Highlights 13 Weeks Ended

39 Weeks Ended

September 28,2013

September 29,2012

September 28,2013

September 29,2012

Store Statistics United States: Store count: Stores opened 2

1 5 2 Stores closed 7 4 13 19 Stores relocated 4 5 9 13 Total U.S.

stores 1,104 1,114 1,104 1,114 North American Retail

Division square footage: 25,001,724 25,909,234 Average square

footage per NAR store 22,646 23,258 International Division

company-owned: Store count: Stores opened - 1 1 4 Stores closed 2 1

3 1 Total International Division company-owned stores 121 134 121

134

Office Depot, Inc.Richard Leland, 561-438-3796Investor

Relationsrichard.leland@officedepot.comorBrian Levine,

561-438-2895Public Relationsbrian.levine@officedepot.com

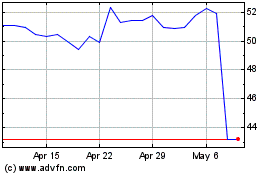

ODP (NASDAQ:ODP)

Historical Stock Chart

From Jun 2024 to Jul 2024

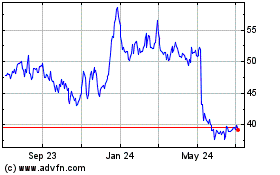

ODP (NASDAQ:ODP)

Historical Stock Chart

From Jul 2023 to Jul 2024