- Post-Effective Amendment to Registration Statement (POS AM)

February 23 2011 - 6:14AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on February 23, 2011

Registration No. 333-125060

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

OCCAM

NETWORKS, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

3576

|

|

77-0442752

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

6868 Cortona Drive

Santa Barbara, CA 93117

(805) 692-2900

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

Robert L.

Howard-Anderson

President and Chief Executive Officer

Occam Networks, Inc.

6868 Cortona Drive

Santa Barbara, CA 93117

(805) 692-2900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert F. Kornegay, Esq.

Wilson Sonsini Goodrich & Rosati

Professional Corporation

650 Page Mill Road

Palo Alto, CA 94304

Telephone: (650) 493-9300

Telecopy: (650) 493-6811

Approximate

date of commencement of proposed sale to the public:

Not applicable.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

¨

|

|

Accelerated filer

|

|

x

|

|

|

|

|

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

¨

|

DEREGISTRATION OF SECURITIES

Occam Networks, Inc. (“the Company”) filed with the Securities and Exchange Commission a Registration Statement

on Form S-1, as amended (File No. 333-125060), which registered 447,405,026 shares of the Company’s common stock, par value $0.001 per share (the “Registration Statement”). The Registration Statement was declared effective

by the Securities and Exchange Commission on January 31, 2006.

On February 22, 2011, at a special meeting of

stockholders, the stockholders of the Company adopted that certain Agreement and Plan of Merger and Reorganization, dated as of September 16, 2010, by and among Calix, Inc. (“Calix”), Ocean Sub I, Inc., a direct, wholly owned

subsidiary of Calix (“Merger Sub One”), Ocean Sub II, LLC, a second direct, wholly owned subsidiary of Calix (“Merger Sub Two”) and the Company (the “Merger Agreement”), after which Calix completed its acquisition of

the Company. Pursuant to the terms of the Merger Agreement, Merger Sub One merged with the Company in accordance with the General Corporation Law of the State of Delaware (the “DGCL”), with the Company continuing as the surviving entity as

a wholly owned subsidiary of Calix (such merger referred to herein as the “First-Step Merger,” and the effective time of the First-Step Merger referred to herein as the “Effective Time”). Thereafter, in accordance with the Merger

Agreement, the Company will merge with Merger Sub Two in accordance with the DGCL, with Merger Sub Two continuing as the surviving company (the “Second-Step Merger” and together with the First-Step Merger, the “Merger”) under the

name Occam Networks, LLC as a direct, wholly owned subsidiary of Calix upon completion of the Second-Step Merger. As a result of the Merger, the Company has terminated any offering of the Company’s securities pursuant to the Registration

Statement.

The Company hereby removes and withdraws from registration all securities registered pursuant to this Registration

Statement which remain unissued.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this Post-Effective Amendment No. 1 to the Registration Statement to be signed on its behalf by the

undersigned, thereunto duly authorized, in the City of Santa Barbara, State of California, on this 22 day of February, 2011.

|

|

|

|

|

OCCAM NETWORKS, INC.

|

|

|

|

|

By:

|

|

/

S

/ Jeanne Seeley

|

|

|

|

Jeanne Seeley

Senior Vice

President and Chief Financial Officer

|

Pursuant to the requirements of the Securities Act of 1933, this

Registration Statement has been signed below by the following persons in the capacities and on the dates indicated:

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/

S

/ Robert L. Howard-Anderson

Robert L. Howard-Anderson

|

|

Chief Executive Officer and Director (Principal Executive Officer)

|

|

February 22, 2011

|

|

|

|

|

|

/

S

/ Jeanne Seeley

Jeanne Seeley

|

|

Senior Vice President and Chief Financial

Officer (Principal Financial and Accounting Officer)

|

|

February 22, 2011

|

|

|

|

|

|

/

S

/ Carl Russo

Carl Russo

|

|

Director

|

|

February 22, 2011

|

Occam Networks (MM) (NASDAQ:OCNW)

Historical Stock Chart

From Oct 2024 to Nov 2024

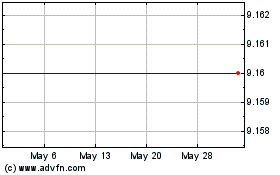

Occam Networks (MM) (NASDAQ:OCNW)

Historical Stock Chart

From Nov 2023 to Nov 2024