O'Reilly Tops EPS, Misses Sales - Analyst Blog

February 09 2012 - 9:15AM

Zacks

O’Reilly Automotive

Inc. (ORLY) reported a 35% jump in adjusted profit to 93

cents per share in the fourth quarter of 2011 from 69 cents per

share in the prior-year quarter, surpassing the Zacks Consensus

Estimate by 7 cents per share. Adjusted net profit was $121 million

compared with $98 million in the fourth quarter of 2010.

Including special items, net income

and earnings per share in the quarter stood at $123 million and 94

cents, respectively. This compared favorably with net income of

$105.8 million and earnings per share of 74 cents in the prior-year

quarter.

Sales in the quarter grew 6% to

$1.39 billion from $1.31 billion in the comparable quarter of 2010

but fell short of the Zacks Consensus Estimate of $1.41 billion.

Comparable store sales (sales for stores open for at least one

year) rose 3.3% for the quarter versus 9.2% in the same quarter a

year ago.

Gross profit increased 9% to $695

million from $636 million for the fourth quarter of 2010.

Consequently, gross margin expanded 130 basis points to 49.9% from

the year-ago quarter. Selling, general and administrative expenses

went up 4% to $491 million from $472 million in the prior-year

quarter. Adjusted operating income rose 24% to $204 million from

$164 million in the fourth quarter of 2010. Adjusted operating

margin was 14.7%, a 214 basis point expansion from the year-ago

quarter.

Fiscal 2011

Performance

O’Reilly’s adjusted earnings per

share in fiscal 2011 were $3.81, a 25% increase from $3.05 earned

in the prior year, outperforming the Zacks Consensus Estimate of

$3.74. Adjusted net income was $522 million versus $433 million in

fiscal 2010. Including special items, net income and earnings per

share were a respective $507.7 million and $3.71 compared with $419

million and $2.95 in fiscal 2010.

Revenues upped 7% to reach $5.79

billion but missed the Zacks Consensus Estimate of $6.23 billion.

Comparable store sales for the year increased 4.6% compared with

8.8% in fiscal 2010.

Store Update

During the quarter, O’Reilly opened

34 new stores bringing total store openings to 183 for fiscal 2011.

With 13 stores closed during the year, the company has met its goal

of 170 (net) store openings in 2011.

Share

Repurchase

During the quarter under study, the

company has repurchased 1.8 million shares of its common stock at

an average price of $75.60, for a total investment of $136 million.

During fiscal 2011, O’Reilly repurchased 15.9 million shares of its

common stock at an average price per share of $61.49, for a total

investment of $976 million.

Following the end of the fourth

quarter and till the date of this release, the company has

repurchased an additional 0.1 million shares of its common stock at

an average price per share of $79.45, for a total investment of $10

million. The company has approximately $514 million remaining

under its share repurchase program.

Financial

Position

O’Reilly had cash and cash

equivalents of $361 million as of December 31, 2011, a significant

increase from $29.7 million as of December 31, 2010. Long-term debt

was $796 million at year end, up from $357 million as of December

31, 2010. This translated into a long-term debt-to-capitalization

ratio of 21.9%, significantly up from 10.1% at the end of fiscal

2010.

In fiscal 2011, cash flow from

operations improved substantially to $1.12 billion from $704

million in the previous year. Free cash flow increased a whopping

134% to $791 million due to working capital improvement and reduced

level of capital expenditures.

Guidance

O’Reilly has projected earnings per

share in the range of 99 cents–$1.03 and consolidated comparable

store sales to increase in a band of 4% to 6% for the first quarter

of 2012.

For full year 2012, the company

anticipates adjusted earnings per share in the range of $4.27 to

$4.37 and consolidated comparable store sales to increase by 3% to

6%. The company also provided revenue guidance of $6.15 billion to

$6.25 billion, gross margin in the vicinity of 48.9% to 49.3%, and

operating margin to range from 15% to 15.5%.

The company plans to open 180 new

stores along with the relocation or renovation of nearly 50

existing stores in fiscal 2012. The company expects capital

expenditures in the range of $315 million to $345 million and to

earn free cash flow between $600 million and $650 million.

Our Take

O’Reilly is continuously benefiting

from its dual market strategy and a strong distribution network.

The CSK acquisition is expected to boost the company’s earnings and

savings, and will help it to outgrow its competitors. These along

with improved results have led the company to retain a Zacks #2

Rank on its stock, which translates into a short-term (1 to 3

months) rating of Buy.

O'Reilly is the third largest

specialty retailer of automotive aftermarket parts, tools,

supplies, equipment, and accessories in the U.S., selling products

to both Do-it-Yourself (DIY) customers (53% of sales) and

Do-it-for-Me (DIFM) or professional installers (47%).

O REILLY AUTO (ORLY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

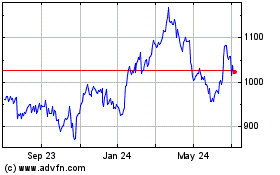

O Reilly Automotive (NASDAQ:ORLY)

Historical Stock Chart

From May 2024 to Jun 2024

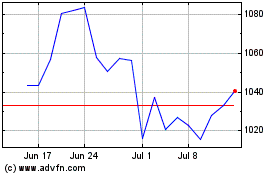

O Reilly Automotive (NASDAQ:ORLY)

Historical Stock Chart

From Jun 2023 to Jun 2024