Profitability Swings From $5.4 Million Net Loss in 2008 to $2.6

Million Net Income in 2009; Company Expects Significant Increase in

Revenues and Profitability in 2010 REHOVOT, Israel, February 17,

2010 /PRNewswire-FirstCall/ -- Nova Measuring Instruments Ltd.

(NASDAQ:NVMI), provider of leading edge stand alone metrology and

the market leader of integrated metrology solutions to the

semiconductor process control market, today reported its 2009

fourth quarter and full year financial results. Highlights for the

Fourth Quarter of 2009 - Revenues of $15.2 million, up 34%

sequentially and 145% from the fourth quarter of 2008 - Gross

margin of 49%, up from 48% in the third quarter of 2009 and 22% in

the fourth quarter of 2008 - Record quarterly GAAP net income of

$2.7 million or $0.13 per diluted share - $2.1 million positive

operating cash flow - Record quarterly bookings Highlights for full

year 2009 results - Revenues of $39.3 million - Gross margin of

45%, up from 33% in 2008 - Reduced operating expenses by 24% versus

2008 - GAAP net income of $2.6 million, or $0.13 per diluted share

- Significantly increased market share in all served markets 2009

Fourth Quarter Results Total revenues for the fourth quarter of

2009 were $15.2 million, an increase of 145% relative to the fourth

quarter of 2008, and an increase of 34% relative to the third

quarter of 2009. Gross margin for the fourth quarter of 2009 was

49%, compared with 22% in the fourth quarter of 2008 and 48% in the

third quarter of 2009. Operating expenses in the fourth quarter of

2009 were $4.7 million, compared with $4.4 million in the fourth

quarter of 2008 and $4.0 million in the third quarter of 2009. On a

GAAP basis, the Company reported quarterly net income of $2.7

million in the fourth quarter of 2009, or $0.13 per diluted share.

This compares to a GAAP net loss of $1.6 million, or $0.08 per

share, for the fourth quarter of 2008, and a net income of $1.7

million, or $0.08 per diluted share, for the third quarter of 2009.

On a non-GAAP basis, which excludes stock-based compensation and

other charges, the Company reported quarterly net income of $2.8

million in the fourth quarter of 2009, or $0.13 per diluted share.

This compares with a non-GAAP net loss of $2.3 million, or $0.12

per share, in the fourth quarter of 2008, and non-GAAP net income

of $1.8 million, or $0.09 per diluted share, in the third quarter

of 2009. The company generated $2.1 million in cash from operating

activities during the fourth quarter of 2009. 2009 Full Year

Results Total revenues for 2009 were $39.3 million, as compared

with total revenues of $39.0 million for 2008. Gross margin in 2009

was 45%, as compared to 33% in 2008. Operating expenses in 2009

were $15.1 million, as compared with $20.0 million in 2008. On a

GAAP basis, the Company reported $2.6 million net income in 2009,

or $0.13 per diluted share, as compared to a net loss of $5.4

million, or $0.28 per share, in 2008. On a non-GAAP basis, which

excludes stock-based compensation and other charges, the company

reported net income of $3.1 million, or $0.15 per diluted share,

for 2009. This compares with a non-GAAP net loss of $4.2 million,

or $0.22 per share, in 2008. During 2009, the company used $1.8

million in cash flow for operating activities, as compared to $3.3

million cash flow used for operating activities in 2008. Total cash

reserves at the end of 2009 were $19.0 million, a decrease of $0.9

million compared to the end of 2008. On February 9, 2010, the

company completed a follow-on offering of approximately 4.4 million

shares. Including approximately $17 million net proceeds from the

offering, the Company's cash reserves increased to about $36

million. Management Comments "Fourth quarter results showed a

significant sequential improvement and a very strong finish for the

year as a whole," commented Gabi Seligsohn, President and CEO of

Nova. "As a result of our market share gains and improved business

model, we were able to increase our annual revenues while the

overall industry shrank by approximately 50% year over year. In

parallel, we improved our products gross margins while reducing our

operating expenses by 24% versus 2008, achieving a 7% net profit

margin for the year." "Looking forward, we expect further growth to

be driven by the improving industry fundamentals as well as the

disruptive nature of our technology which is expanding our fab

footprint and displacing traditional metrology techniques. While

the pace of growth will require some increase in operating expenses

in 2010, we expect to be able to grow profits faster than revenues,

leading to an expansion of our net profit margin compared to 2009."

Guidance for year 2010 The company's guidance for 2010 is revenues

of $58-$63 million and net profitability of 10%-14%. The Company

will host a conference call today, February 17, 2010, at 10:00am

ET. To participate, please dial in the US: 1-800-994-4498; or

internationally: +972-3-918-0650. A recording of the call will be

available on Nova's website, within 24 hours following the end of

the call. In addition, the conference call will also be webcast

live from a link on Nova's website at http://www.nova.co.il/. This

press release provides financial measures that exclude non-cash

charges for stock-based compensation, inventory write-off and

impairment charges and are therefore not calculated in accordance

with generally accepted accounting principles (GAAP). Management

believes that these non-GAAP financial measures provide meaningful

supplemental information regarding Nova's performance because they

reflect our operational results and enhances management's and

investors' ability to evaluate Nova's performance before charges

considered by management to be outside Nova's ongoing operating

results. The presentation of this non-GAAP financial information is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

GAAP. Management believes that it is in the best interest of its

investors to provide financial information that will facilitate

comparison of both historical and future results and allows greater

transparency to supplemental information used by management in its

financial and operational decision making. A reconciliation of each

GAAP to non-GAAP financial measure discussed in this press release

is contained in the accompanying financial tables. About Nova Nova

Measuring Instruments Ltd. develops, produces and markets advanced

integrated and stand alone metrology solutions for the

semiconductor manufacturing industry. Nova is traded on the NASDAQ

& TASE under the symbol NVMI. The Company's website is

http://www.nova.co.il/. This press release contains forward-looking

statements within the meaning of safe harbor provisions of the

Private Securities Litigation Reform Act of 1995 relating to future

events or our future performance, such as statements regarding

trends, demand for our products, expected deliveries, transaction,

expected revenues, operating results, earnings and profitability.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied in those forward looking

statements. These risks and other factors include but are not

limited to: unanticipated consequences of the global economic

crisis, our dependency on a single integrated process control

product line; the highly cyclical nature of the markets we target;

our inability to reduce spending during a slowdown in the

semiconductor industry; our ability to respond effectively on a

timely basis to rapid technological changes; risks associated with

our dependence on a single manufacturing facility; our ability to

expand our manufacturing capacity or marketing efforts to support

our future growth; our dependency on a small number of large

customers and small number of suppliers; risks related to our

intellectual property; changes in customer demands for our

products; new product offerings from our competitors; changes in or

an inability to execute our business strategy; unanticipated

manufacturing or supply problems; changes in tax requirements;

changes in customer demand for our products; risks related to

currency fluctuations; and risks related to our operations in

Israel. We cannot guarantee future results, levels of activity,

performance or achievements. The matters discussed in this press

release also involve risks and uncertainties summarized under the

heading "Risk Factors" in Nova's Annual Report on Form 20-F for the

year ended December 31,2008 filed with the Securities and Exchange

Commission on March 30, 2009. These factors are updated from time

to time through the filing of reports and registration statements

with the Securities and Exchange Commission. Nova Measuring

Instruments Ltd. does not assume any obligation to update the

forward-looking information contained in this press release. NOVA

MEASURING INSTRUMENTS LTD. CONSOLIDATED BALANCE SHEET (U.S. dollars

in thousands) As of December 31, 2009 2008 CURRENT ASSETS Cash and

cash equivalents 9,861 19,325 Short-term interest-bearing bank

deposits 8,607 97 Trade accounts receivable 11,545 2,783

Inventories 3,949 6,862 Other current assets 1,728 1,086 35,690

30,153 LONG-TERM ASSETS Long-term interest-bearing bank deposits

561 544 Other Long-term assets 142 157 Severance pay funds 2,368

2,141 3,071 2,842 FIXED ASSETS, NET 2,163 2,796 Total assets 40,924

35,791 CURRENT LIABILITIES Trade accounts payable 3,715 3,480

Deferred income 1,671 2,385 Other current liabilities 5,237 4,042

10,623 9,907 LONG-TERM LIABILITIES Liability for employee severance

pay 3,168 3,152 Deferred income 183 351 Other long-term liability

35 40 3,386 3,543 SHAREHOLDERS' EQUITY 26,915 22,341 Total

liabilities and shareholders' equity 40,924 35,791 NOVA MEASURING

INSTRUMENTS LTD. QUARTERLY CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except per share data) Three months

ended December 31, September 30, December 31, 2009 2009 2008

REVENUES Product sales 12,646 8,717 3,028 Services 2,594 2,677

3,200 15,240 11,394 6,228 COST OF REVENUES Product sales 5,399

3,699 1,643 Inventory write-off and inventory purchase commitments

losses -- -- 550 Services 2,445 2,191 2,696 7,844 5,890 4,889 GROSS

PROFIT 7,396 5,504 1,339 OPERATING EXPENSES Research &

Development expenses, net 2,049 1,850 2,223 Sales & Marketing

expenses 2,025 1,523 1,390 General & Administration expenses

659 594 738 4,733 3,967 4,351 OPERATING PROFIT (LOSS) 2,663 1,537

(3,012) Interest income, net 31 153 75 Gain on short-term

investments -- -- 1,366 NET INCOME (LOSS) FOR THE PERIOD 2,694

1,690 (1,571) Net income (loss) per share: Basic 0.14 0.09 (0.08)

Diluted 0.13 0.08 (0.08) Shares used for calculation of net income

(loss) per share: Basic 19,717 19,417 19,378 Diluted 21,173 19,942

19,378 NOVA MEASURING INSTRUMENTS LTD. YEAR TO DATE CONSOLIDATED

STATEMENTS OF OPERATIONS (U.S. dollars in thousands, except per

share data) Year ended December 31, 2009 2008 REVENUES Product

sales 29,639 25,673 Services 9,679 13,296 39,318 38,969 COST OF

REVENUES Product sales 12,732 12,527 Inventory write-off and

inventory purchase commitments losses -- 1,400 Services 8,999

12,059 21,731 25,986 GROSS PROFIT 17,587 12,983 OPERATING EXPENSES

Research & Development expenses, net 6,865 8,606 Sales &

Marketing expenses 6,014 7,503 General & Administration

expenses 2,240 3,199 Impairment loss on equipment related to

Hypernex assets and liabilities acquisition -- 633 15,119 19,941

OPERATING PROFIT (LOSS) 2,468 (6,958) Interest income, net 163 171

Gain on short-term investments -- 1,366 NET INCOME (LOSS) FOR THE

YEAR 2,631 (5,421) Net income (loss) per share: Basic 0.14 (0.28)

Diluted 0.13 (0.28) Shares used for calculation of net income

(loss) per share: Basic 19,473 19,369 Diluted 20,089 19,369 NOVA

MEASURING INSTRUMENTS LTD. QUARTERLY CONSOLIDATED STATEMENTS OF

CASH FLOWS (U.S. dollars in thousands) Three months ended December

31, September 30, December 31, 2009 2009 2008 CASH FLOW - OPERATING

ACTIVITIES Net income (loss) for the period 2,694 1,690 (1,571)

Adjustments to reconcile net loss to net cash used in operating

activities: Depreciation and amortization 347 311 315 Impairment

loss on equipment -- -- 10 Amortization of deferred stock-based

compensation 118 130 114 Decrease in liability for employee

termination benefits, net (187) (2) (61) Gain on short-term

investments -- -- (1,366) Net recognized losses on investments -- 4

49 Decrease (increase) in trade accounts receivables (5,943) (622)

2,465 Decrease in inventories 749 790 759 Decrease (increase) in

other current and long term assets (555) 45 40 Increase (decrease)

in trade accounts payables and other long-term liabilities 2,198

(662) (452) Increase (decrease) in other current liabilities 1,769

1,039 (253) Increase (decrease) in short and long term deferred

income 913 (857) (740) Net cash from (used in) operating activities

2,103 1,866 (691) CASH FLOW - INVESTMENT ACTIVITIES Decrease

(increase) in short-term interest-bearing bank deposits (8,560) --

21 Decrease in short-term investments -- 4,595 8,586 Proceeds

(investments) in long-term interest-bearing bank deposits (36) (2)

2,928 Additions to fixed assets (303) (72) (40) Net cash from (used

in) investment activities (8,899) 4,521 11,495 CASH FLOW -

FINANCING ACTIVITIES Shares issued under employee share-based plans

1,111 142 -- Net cash from investment activities 1,111 142 --

Increase (decrease) in cash and cash equivalents (5,685) 6,529

10,804 Cash and cash equivalents - beginning of period 15,546 9,017

8,521 Cash and cash equivalents - end of period 9,861 15,546 19,325

NOVA MEASURING INSTRUMENTS LTD. YEAR TO DATE CONSOLIDATED

STATEMENTS OF CASH FLOWS (U.S. dollars in thousands) Year ended

December 31, 2009 2008 CASH FLOW - OPERATING ACTIVITIES Net income

(loss) for the year 2,631 (5,421) Adjustments to reconcile net

income (loss) to net cash used in operating activities:

Depreciation and amortization 1,254 1,320 Impairment loss on

equipment -- 643 Amortization of deferred stock-based compensation

454 556 Increase (decrease) in liability for employee termination

benefits, net (159) 33 Gain on short-term investments -- (1,366)

Net recognized losses on investments -- 66 Decrease (increase) in

trade accounts receivables (8,762) 6,363 Decrease in inventories

2,695 1,330 Decrease (increase) in other current and long term

assets (421) 247 Decrease (increase) in trade accounts payables and

other long term liabilities 234 (4,013) Increase (decrease) in

other current liabilities 1,169 (3,371) Increase (decrease) in

short and long term deferred income (882) 339 Net cash used in

operating activities (1,787) (3,274) CASH FLOW - INVESTMENT

ACTIVITIES Increase in short-term interest-bearing bank (8,510)

(97) deposits Increase in short-term and long-term investments --

32 Proceeds from held to maturity securities -- 3,701 Proceeds from

(investments in) long-term interest-bearing bank deposits and

long-term investments (17) 4,571 Additions to fixed assets (403)

(944) Net cash from (used in) investment activities (8,930) 7,263

CASH FLOW - FINANCING ACTIVITIES Shares issued under employee

share-based plans 1,253 12 Net cash from financing activities 1,253

12 Increase (decrease) in cash and cash equivalents (9,464) 4,001

Cash and cash equivalents - beginning of year 19,325 15,324 Cash

and cash equivalents - end of year 9,861 19,325 NOVA MEASURING

INSTRUMENTS LTD. DISCLOSURE OF NON-GAAP NET INCOME (LOSS) (U.S.

dollars in thousands, except per share data) Three months ended

December 31, September 30, December 31, 2009 2009 2008 GAAP Net

income (loss) for the period 2,694 1,690 (1,571) Non-GAAP

Adjustments: Stock based compensation expenses 118 130 114

Inventory write-off and inventory purchase commitments losses -- --

550 Gain on short term investments -- -- (1,366) Non-GAAP Net

income (loss) for the period 2,812 1,820 (2,273) Non-GAAP net

income (loss) per share: Basic 0.14 0.09 (0.12) Diluted 0.13 0.09

(0.12) Shares used for calculation of non-GAAP net income (loss)

per share: Basic 19,717 19,417 19,378 Diluted 21,173 19,942 19,378

Year ended December 31, 2009 2008 GAAP Net (income) loss for the

year 2,631 (5,421) Non-GAAP Adjustments: Stock based compensation

expenses 454 556 Inventory write-off and inventory purchase

commitments losses -- 1,400 Impairment loss on equipment related to

Hypernex assets and liabilities acquisition -- 633 Gain on short

term investments -- (1,366) Non-GAAP Net income (loss) for the year

3,085 (4,198) Non-GAAP net income (loss) per share: Basic 0.16

(0.22) Diluted 0.15 (0.22) Shares used for calculation of non-GAAP

net income (loss) per share Basic 19,473 19,369 Diluted 20,089

19,369 Company Contact: Investor relations Contacts: Dror David,

Chief Financial Officer Ehud Helft / Kenny Green Nova Measuring

Instruments Ltd. CCG Investor Relations Tel: +972-8-938-7505 Tel:

+1-646-201-9246 E-mail: E-mail: http://www.nova.co.il/ DATASOURCE:

Nova Measuring Instruments Ltd CONTACT: Company Contact: Dror

David, Chief Financial Officer, Nova Measuring Instruments Ltd.,

Tel: +972-8-938-7505, E-mail: ; Investor relations Contacts: Ehud

Helft / Kenny Green, CCG Investor Relations, Tel: +1-646-201-9246,

E-mail:

Copyright

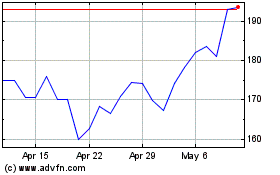

Nova (NASDAQ:NVMI)

Historical Stock Chart

From May 2024 to Jun 2024

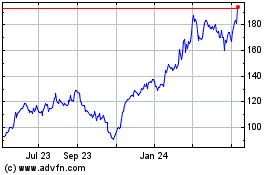

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jun 2023 to Jun 2024