false

0001001385

0001001385

2024-03-04

2024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2024

NORTHWEST PIPE COMPANY

(Exact name of registrant as specified in its charter)

|

Oregon

|

0-27140

|

93-0557988

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

201 NE Park Plaza Drive, Suite 100

Vancouver, WA 98684

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code: 360-397-6250

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.01 per share

|

|

NWPX

|

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

|

| |

|

|

| |

|

On March 4, 2024, Northwest Pipe Company (the “Company”) issued a press release announcing its financial results for the quarter and year ended December 31, 2023 and its current outlook. The press release contains forward-looking statements regarding the Company, and includes cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated. The press release issued March 4, 2024 is furnished herewith as Exhibit No. 99.1 to this Report, and shall not be deemed filed for purposes of Section 18 of the Exchange Act.

|

| |

|

|

|

Item 9.01.

|

|

FINANCIAL STATEMENTS AND EXHIBITS

|

| |

|

|

|

(d)

|

|

Exhibits

|

| |

|

|

| |

|

|

| |

|

|

| |

|

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on March 4, 2024.

| |

NORTHWEST PIPE COMPANY

|

| |

(Registrant)

|

| |

|

|

| |

By

|

/s/ Aaron Wilkins

|

| |

|

Aaron Wilkins,

|

| |

|

Senior Vice President, Chief Financial Officer, and Corporate Secretary

|

Exhibit 99.1

Northwest Pipe Company Announces Fourth Quarter and Full Year 2023 Financial Results

| |

• |

Fourth quarter 2023 net sales of $110.2 million increased 3.1% year-over-year |

| |

• |

Annual net sales of $444.4 million decreased 2.9% year-over-year |

| |

•

|

Annual gross profit of $77.6 million decreased 9.6% year-over-year from 2022 record |

| |

•

|

Annual net income of $2.09 per diluted share |

| |

• |

Strong annual cash generation with net cash provided by operating activities of $53.5 million |

| |

•

|

Backlog1 of $273 million; backlog including confirmed orders2 of $319 million for the Engineered Steel Pressure Pipe segment (“SPP”)

|

| |

•

|

Order book3 of $46 million for the Precast Infrastructure and Engineered Systems segment (“Precast”)

|

| |

• |

Repurchased $4.4 million of common stock through February 29, 2024 |

| |

• |

Record safety performance; annual total recordable incident rate of 1.51 |

VANCOUVER, Washington—March 4, 2024—Northwest Pipe Company (NASDAQ: NWPX) (the “Company”), a leading manufacturer of water-related infrastructure products, today announced its financial results for the fourth quarter and full year ended December 31, 2023. The Company will broadcast its fourth quarter and full year 2023 earnings conference call on Tuesday, March 5, 2024 at 7:00 a.m. PT.

Management Commentary

“Despite the challenging circumstances of 2023, we generated annual net sales of $444.4 million, down only moderately from 2022, demonstrating what we believe is a new level of through cycle resilience created by the growth strategy deployed over the last several years. In 2023 we faced significant challenges in both our Steel Pressure Pipe and Precast businesses. The SPP business had one of the smallest bidding volume periods we have seen in many years and the Precast business continued to be suppressed by the interest rate environment throughout 2023,” said Scott Montross, President and Chief Executive Officer of Northwest Pipe Company. “In addition, we achieved record safety performance in 2023 and collectively our facilities are well below the national average for total recordable incident rate.”

Mr. Montross continued, “Our SPP revenue of $296.4 million was strong and our backlog including confirmed orders remained elevated at $319 million despite significantly reduced bidding activity and steel price volatility throughout 2023. While we anticipate a significantly stronger bidding year in 2024, due to typical seasonality and severe weather conditions that have led to unscheduled downtime time at several facilities, first quarter SPP net sales are expected to decline compared to the fourth quarter of 2023, but expected to remain well above first quarter 2023 levels. We also expect year-over-year SPP margins in the first quarter to improve moderately compared to 2023. Precast net sales declined slightly by 1.4% year-over-year to $148.0 million in 2023 as higher interest rates continued to impact demand for both the residential and commercial construction markets. Precast margins were compressed due to reduced overhead absorption on lower demand. Further, the aforementioned early 2024 weather events have also caused unscheduled downtime in our Precast facilities, further suppressing the already seasonally slow first quarter. We expect Precast net sales in the first quarter to be similar to the same quarter last year with near-term margins remaining compressed.”

Mr. Montross concluded, “We were pleased to have improved our liquidity position in the fourth quarter by continuing to pay down debt and generating strong cash flow from operations given our effective management of working capital despite reduced levels of profitability. Our growth strategy remains focused on growing our Precast business to reduce the cyclicality of our SPP operations and improving our overall margins and cash flow generation.”

Fourth Quarter 2023 Financial Results

Consolidated

Engineered Steel Pressure Pipe Segment (SPP)

| |

•

|

SPP net sales increased 4.1% to $75.1 million from $72.1 million in the fourth quarter of 2022 driven by a 2% increase in tons produced resulting primarily from changes in project timing and a 2% increase in selling price per ton primarily due to product mix.

|

| |

•

|

SPP gross profit decreased 6.8% to $11.2 million, or 14.9% of SPP net sales, from $12.0 million, or 16.6% of SPP net sales, in the fourth quarter of 2022 primarily due to changes in product mix.

|

| |

•

|

SPP backlog was $273 million as of December 31, 2023 compared to $253 million as of September 30, 2023 and $274 million as of December 31, 2022. Backlog including confirmed orders was $319 million as of December 31, 2023 compared to $335 million as of September 30, 2023 and $372 million as of December 31, 2022.

|

Precast Infrastructure and Engineered Systems Segment (Precast)

| |

•

|

Precast net sales increased 1.1% to $35.1 million from $34.7 million in the fourth quarter of 2022 driven by a 25% increase in volume shipped due to product mix, partially offset by a 19% decrease in selling prices due to both product mix and decreased demand.

|

| |

•

|

Precast gross profit decreased 17.8% to $8.1 million, or 23.2% of Precast net sales, from $9.9 million, or 28.5% of Precast net sales, in the fourth quarter of 2022 primarily due to decreased demand and related decreased cost absorption.

|

| |

•

|

Precast order book was $46 million as of December 31, 2023 compared to $52 million as of September 30, 2023 and $64 million as of December 31, 2022.

|

Full Year 2023 Financial Results

Consolidated

Engineered Steel Pressure Pipe Segment (SPP)

Precast Infrastructure and Engineered Systems Segment (Precast)

Balance Sheet and Cash Flow Details

| |

•

|

As of December 31, 2023, the Company had $54.5 million of outstanding revolving loan borrowings and additional borrowing capacity of approximately $69 million under the revolving credit facility. |

| |

•

|

Net cash provided by (used in) operating activities was $9.0 million in the fourth quarter of 2023 compared to ($8.0) million in the fourth quarter of 2022 primarily due to a $21.7 million increase in cash provided by changes in working capital partially offset by a $4.7 million decrease in cash provided by net income adjusted for non-cash items. Net cash provided by operating activities was $53.5 million in 2023 compared to $17.5 million in 2022 primarily due to a $46.6 million increase in cash provided by changes in working capital partially offset by a $10.7 million decrease in cash provided by net income adjusted for non-cash items. |

| |

•

|

Capital expenditures were $5.0 million in the fourth quarter of 2023 compared to $11.0 million in the fourth quarter of 2022, which included a $6.9 million investment in the fourth quarter of 2022 for the reinforced concrete pipe mill. Capital expenditures were $18.3 million in 2023 compared to $22.8 million in 2022. |

| |

• |

The Company repurchased approximately 29,000 shares of its common stock at an average price of $29.20, for a total of $0.8 million during the fourth quarter of 2023. Since the authorization of the share repurchase program in November 2023, the Company repurchased approximately 149,000 shares of its common stock at an average price of $29.32, for a total of $4.4 million as of February 29, 2024.

|

1 Northwest Pipe Company defines “backlog” as the balance of remaining performance obligations under signed contracts for Engineered Steel Pressure Pipe products for which revenue is recognized over time.

2 Northwest Pipe Company defines “confirmed orders” as Engineered Steel Pressure Pipe projects for which the Company has been notified that it is the successful bidder, but a binding agreement has not been executed.

3 Northwest Pipe Company defines “order book” as unfulfilled orders outstanding at the measurement date for its Precast Infrastructure and Engineered Systems segment.

Conference Call Details

A conference call and simultaneous webcast to discuss the Company’s fourth quarter and full year 2023 financial results will be held on Tuesday, March 5, 2024, at 7:00 a.m. Pacific Time. The call will be broadcast live on the Investor Relations section of the Company’s website at investor.nwpipe.com and will be archived online upon completion of the conference call. For those unable to listen to the live call, a replay will be available approximately three hours after the event and will remain available until Tuesday, March 19, 2024, by dialing 1-844-512-2921 in the U.S. or 1-412-317-6671 internationally and entering the replay access code: 13743773.

About Northwest Pipe Company

Founded in 1966, Northwest Pipe Company is a leading manufacturer of water-related infrastructure products. In addition to being the largest manufacturer of engineered steel water pipeline systems in North America, the Company manufactures stormwater and wastewater technology products; high-quality precast and reinforced concrete products; pump lift stations; steel casing pipe, bar-wrapped concrete cylinder pipe, and one of the largest offerings of pipeline system joints, fittings, and specialized components. Strategically positioned to meet growing water and wastewater infrastructure needs, Northwest Pipe Company provides solution-based products for a wide range of markets under the ParkUSA, Geneva Pipe and Precast, Permalok®, and Northwest Pipe Company lines. The Company’s diverse team is committed to quality and innovation while demonstrating the Company’s core values of accountability, commitment, and teamwork. The Company is headquartered in Vancouver, Washington, and has 13 manufacturing facilities across North America. Please visit www.nwpipe.com for more information.

Forward-Looking Statements

Statements in this press release by Scott Montross contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on current expectations, estimates, and projections about the Company’s business, management’s beliefs, and assumptions made by management. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements as a result of a variety of important factors. While it is impossible to identify all such factors, those that could cause actual results to differ materially from those estimated by the Company include changes in demand and market prices for its products, product mix, bidding activity and order modifications or cancelations, timing of customer orders and deliveries, production schedules, price and availability of raw materials, excess or shortage of production capacity, international trade policy and regulations, changes in tariffs and duties imposed on imports and exports and related impacts on the Company, economic uncertainty and associated trends in macroeconomic conditions, including potential recession, inflation, and the state of the housing market, interest rate risk and changes in market interest rates, including the impact on the Company’s customers and related demand for its products, the Company’s ability to identify and complete internal initiatives and/or acquisitions in order to grow its business, the Company’s ability to effectively integrate Park Environmental Equipment, LLC and other acquisitions into its business and operations and achieve significant administrative and operational cost synergies and accretion to financial results, effects of security breaches, computer viruses, and cybersecurity incidents, timing and amount of share repurchases, impacts of U.S. tax reform legislation on the Company’s results of operations, adequacy of the Company’s insurance coverage, supply chain challenges, labor shortages, ongoing military conflicts in areas such as Ukraine and Israel, and related consequences, operating problems at the Company’s manufacturing operations including fires, explosions, inclement weather, and floods and other natural disasters, material weaknesses in the Company’s internal control over financial reporting and its ability to remediate such weaknesses, impacts of pandemics, epidemics, or other public health emergencies, and other risks discussed in the Company’s Annual Report on Form 10‑K for the year ended December 31, 2022 and from time to time in its other Securities and Exchange Commission filings and reports. Such forward-looking statements speak only as of the date on which they are made, and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this release. If the Company does update or correct one or more forward-looking statements, investors and others should not conclude that it will make additional updates or corrections with respect thereto or with respect to other forward-looking statements.

Non-GAAP Financial Measures

The Company is presenting backlog including confirmed orders. This non-GAAP financial measure is provided to better enable investors and others to assess the Company’s ongoing operating results and compare them with its competitors. This should be considered a supplement to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP.

For more information, visit www.nwpipe.com.

Contact:

Aaron Wilkins

Chief Financial Officer

Northwest Pipe Company

investors@nwpipe.com

Or

Addo Investor Relations

nwpx@addo.com

###

|

NORTHWEST PIPE COMPANY AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(Unaudited)

|

|

(In thousands, except per share amounts)

|

| |

|

Three Months Ended December 31,

|

|

|

Year Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineered Steel Pressure Pipe

|

|

$ |

75,087 |

|

|

$ |

72,126 |

|

|

$ |

296,381 |

|

|

$ |

307,572 |

|

|

Precast Infrastructure and Engineered Systems

|

|

|

35,077 |

|

|

|

34,702 |

|

|

|

147,974 |

|

|

|

150,093 |

|

|

Total net sales

|

|

|

110,164 |

|

|

|

106,828 |

|

|

|

444,355 |

|

|

|

457,665 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineered Steel Pressure Pipe

|

|

|

63,924 |

|

|

|

60,143 |

|

|

|

253,954 |

|

|

|

263,099 |

|

|

Precast Infrastructure and Engineered Systems

|

|

|

26,950 |

|

|

|

24,814 |

|

|

|

112,759 |

|

|

|

108,711 |

|

|

Total cost of sales

|

|

|

90,874 |

|

|

|

84,957 |

|

|

|

366,713 |

|

|

|

371,810 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineered Steel Pressure Pipe

|

|

|

11,163 |

|

|

|

11,983 |

|

|

|

42,427 |

|

|

|

44,473 |

|

|

Precast Infrastructure and Engineered Systems

|

|

|

8,127 |

|

|

|

9,888 |

|

|

|

35,215 |

|

|

|

41,382 |

|

|

Total gross profit

|

|

|

19,290 |

|

|

|

21,871 |

|

|

|

77,642 |

|

|

|

85,855 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expense

|

|

|

10,665 |

|

|

|

10,885 |

|

|

|

43,784 |

|

|

|

41,034 |

|

|

Operating income

|

|

|

8,625 |

|

|

|

10,986 |

|

|

|

33,858 |

|

|

|

44,821 |

|

|

Other income

|

|

|

500 |

|

|

|

41 |

|

|

|

276 |

|

|

|

97 |

|

|

Interest expense

|

|

|

(1,133 |

) |

|

|

(1,175 |

) |

|

|

(4,855 |

) |

|

|

(3,568 |

) |

|

Income before income taxes

|

|

|

7,992 |

|

|

|

9,852 |

|

|

|

29,279 |

|

|

|

41,350 |

|

|

Income tax expense

|

|

|

2,548 |

|

|

|

1,891 |

|

|

|

8,207 |

|

|

|

10,201 |

|

|

Net income

|

|

$ |

5,444 |

|

|

$ |

7,961 |

|

|

$ |

21,072 |

|

|

$ |

31,149 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.54 |

|

|

$ |

0.80 |

|

|

$ |

2.11 |

|

|

$ |

3.14 |

|

|

Diluted

|

|

$ |

0.54 |

|

|

$ |

0.79 |

|

|

$ |

2.09 |

|

|

$ |

3.11 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in per share calculations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

10,010 |

|

|

|

9,927 |

|

|

|

9,991 |

|

|

|

9,914 |

|

|

Diluted

|

|

|

10,105 |

|

|

|

10,061 |

|

|

|

10,081 |

|

|

|

10,012 |

|

|

NORTHWEST PIPE COMPANY AND SUBSIDIARIES

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

(Unaudited)

|

|

|

(In thousands)

|

|

| |

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

4,068 |

|

|

$ |

3,681 |

|

|

Trade and other receivables, net

|

|

|

47,645 |

|

|

|

71,563 |

|

|

Contract assets

|

|

|

120,516 |

|

|

|

121,778 |

|

|

Inventories

|

|

|

91,229 |

|

|

|

71,029 |

|

|

Prepaid expenses and other

|

|

|

9,026 |

|

|

|

10,689 |

|

|

Total current assets

|

|

|

272,484 |

|

|

|

278,740 |

|

|

Property and equipment, net

|

|

|

143,955 |

|

|

|

133,166 |

|

|

Operating lease right-of-use assets

|

|

|

88,155 |

|

|

|

93,124 |

|

|

Goodwill

|

|

|

55,504 |

|

|

|

55,504 |

|

|

Intangible assets, net

|

|

|

31,074 |

|

|

|

35,264 |

|

|

Other assets

|

|

|

6,709 |

|

|

|

5,542 |

|

|

Total assets

|

|

$ |

597,881 |

|

|

$ |

601,340 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Current debt

|

|

$ |

10,756 |

|

|

$ |

10,756 |

|

|

Accounts payable

|

|

|

31,142 |

|

|

|

26,968 |

|

|

Accrued liabilities

|

|

|

27,913 |

|

|

|

30,957 |

|

|

Contract liabilities

|

|

|

21,450 |

|

|

|

17,456 |

|

|

Current portion of operating lease liabilities

|

|

|

4,933 |

|

|

|

4,702 |

|

|

Total current liabilities

|

|

|

96,194 |

|

|

|

90,839 |

|

|

Borrowings on line of credit

|

|

|

54,485 |

|

|

|

83,696 |

|

|

Operating lease liabilities

|

|

|

85,283 |

|

|

|

89,472 |

|

|

Deferred income taxes

|

|

|

10,942 |

|

|

|

11,402 |

|

|

Other long-term liabilities

|

|

|

10,617 |

|

|

|

7,657 |

|

|

Total liabilities

|

|

|

257,521 |

|

|

|

283,066 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

340,360 |

|

|

|

318,274 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

597,881 |

|

|

$ |

601,340 |

|

NORTHWEST PIPE COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| |

|

For the Year Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

21,072 |

|

|

$ |

31,149 |

|

|

Depreciation and finance lease amortization

|

|

|

11,616 |

|

|

|

12,664 |

|

|

Amortization of intangible assets

|

|

|

4,190 |

|

|

|

4,439 |

|

|

Deferred income taxes

|

|

|

(172 |

) |

|

|

514 |

|

|

Gain on insurance proceeds

|

|

|

(466 |

) |

|

|

- |

|

|

Share-based compensation expense

|

|

|

3,672 |

|

|

|

3,702 |

|

|

Other, net

|

|

|

1,547 |

|

|

|

(286 |

) |

|

Changes in working capital

|

|

|

11,996 |

|

|

|

(34,642 |

) |

|

Net cash provided by operating activities

|

|

|

53,455 |

|

|

|

17,540 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(18,291 |

) |

|

|

(22,829 |

) |

|

Purchases of intangible assets

|

|

|

- |

|

|

|

(327 |

) |

|

Payment of working capital adjustment in acquisition of business

|

|

|

(2,731 |

) |

|

|

- |

|

|

Proceeds from insurance

|

|

|

431 |

|

|

|

- |

|

|

Other investing activities

|

|

|

219 |

|

|

|

106 |

|

|

Net cash used in investing activities

|

|

|

(20,372 |

) |

|

|

(23,050 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Borrowings on line of credit

|

|

|

155,398 |

|

|

|

177,634 |

|

|

Repayments on line of credit

|

|

|

(184,609 |

) |

|

|

(180,699 |

) |

|

Borrowings on other debt

|

|

|

- |

|

|

|

10,756 |

|

|

Payments on finance lease obligations

|

|

|

(826 |

) |

|

|

(597 |

) |

|

Tax withholdings related to net share settlements of equity awards

|

|

|

(1,652 |

) |

|

|

(853 |

) |

|

Repurchase of common stock

|

|

|

(707 |

) |

|

|

- |

|

|

Other financing activities

|

|

|

(300 |

) |

|

|

(47 |

) |

|

Net cash provided by (used in) financing activities

|

|

|

(32,696 |

) |

|

|

6,194 |

|

| |

|

|

|

|

|

|

|

|

|

Change in cash and cash equivalents

|

|

|

387 |

|

|

|

684 |

|

|

Cash and cash equivalents, beginning of period

|

|

|

3,681 |

|

|

|

2,997 |

|

|

Cash and cash equivalents, end of period

|

|

$ |

4,068 |

|

|

$ |

3,681 |

|

v3.24.0.1

Document And Entity Information

|

Mar. 04, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NORTHWEST PIPE COMPANY

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 04, 2024

|

| Entity, Incorporation, State or Country Code |

OR

|

| Entity, File Number |

0-27140

|

| Entity, Tax Identification Number |

93-0557988

|

| Entity, Address, Address Line One |

201 NE Park Plaza Drive, Suite 100

|

| Entity, Address, City or Town |

Vancouver

|

| Entity, Address, State or Province |

WA

|

| Entity, Address, Postal Zip Code |

98684

|

| City Area Code |

360

|

| Local Phone Number |

397-6250

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NWPX

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001001385

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

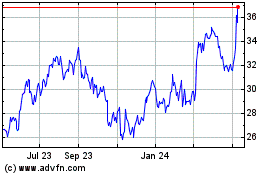

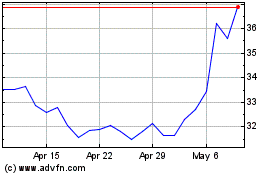

Northwest Pipe (NASDAQ:NWPX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Northwest Pipe (NASDAQ:NWPX)

Historical Stock Chart

From Jul 2023 to Jul 2024