Northfield Bancorp, Inc., the holding company for Northfield Bank,

reported net income of $5.6 million for the quarter ended March 31,

2008, compared to $4.7 million for the quarter ended March 31,

2007. Operating results for the current quarter included a $2.5

million, nontaxable, death benefit realized on bank owned life

insurance. For the quarter ended March 31, 2007, operating results

included a pre-tax gain of $4.3 million ($2.4 million, net of tax)

related to the sale of two branch locations and associated deposit

relationships. Earnings per share for the quarter ended March 31,

2008 was $0.13. Excluding the realized gain on the death benefit

from bank owned life insurance of $0.06 per share, earnings per

share for the quarter ended March 31, 2008 was $0.07 per share.

Commenting on the current quarter�s results, John W. Alexander, the

Company�s Chairman, President, and Chief Executive Officer said,

�We remain focused on deploying capital into high quality

commercial real estate, construction, and multifamily loans. We

believe that continuing to offer competitive loan products, coupled

with prompt credit decisions, will lead to profitable longer-term

relationships.� Mr. Alexander also said, �The Company has also

implemented, and net interest income has benefited from, securities

leveraging strategies with acceptable levels of interest rate and

credit risk.� Mr. Alexander continued, �Sadly, we recently lost a

valued and long time member of the Northfield family. This person

was dedicated to and exemplified Northfield�s commitment to

supporting the community, and will be missed by all.� Results of

Operations Net income for the first quarter of 2008 as compared to

the first quarter of 2007 was positively affected by an increase in

net interest income of $2.3 million, or 28.3%, and a decrease in

income tax expense of $900,000 due to lower taxable income

resulting in part from the realization of the nontaxable death

benefit. Total non-interest expense declined slightly over the

comparable prior year quarter. These items were partially offset by

an increase in the provision for loan losses of $158,000 and a

decrease in non-interest income of $2.2 million. The increase in

the provision for loan losses was due primarily to loan growth, and

deterioration in one impaired loan with a total outstanding

principal balance of approximately $3.4 million at March 31, 2008.

The decrease in non-interest income was due primarily to a gain of

$4.3 million on the sale of deposits in two underperforming

branches in March 2007. We had no similar transaction in 2008. The

reduction in non-interest income was partially offset by the

realized nontaxable death benefit of approximately $2.5 million in

the quarter ended March 31, 2008. The increase in net interest

income was primarily the result of an increase in average

interest-earning assets of $146.4 million, or 11.9%, coupled with

an increase in the net interest margin of 38 basis points, or

14.0%, from 2.72% to 3.10%. Average interest-earning assets

increased in the first quarter of 2008 as compared to the first

quarter of 2007, as average loans held-for-investment, net

increased $16.3 million, or 3.9%. Average interest earning assets

was also positively affected by an increase of $124.1 million, or

16.5%, in mortgage-backed securities and deposits in other

financial institutions from leveraging strategies executed in the

later part of 2007 and the first quarter of 2008. The decline in

market interest rates resulted in the yield on our average

interest-earning assets decreasing five basis points to 5.06% for

the quarter ended March 31, 2008, as compared to 5.11% for the same

prior year quarter. The cost of interest-bearing liabilities also

decreased by 13 basis points to 2.77% for the quarter ended March

31, 2008 as compared to 2.90% for the same prior year quarter.

Average interest-bearing deposits decreased by $121.3 million in

the first quarter of 2008 as compared to the prior year quarter

primarily as a result of the sale of $26.6 million of deposits in

two branches at the end of the first quarter of 2007, and customers

using $82.4 million in deposits to purchase common stock in the

Company�s initial public offering. The cost of interest-bearing

deposits decreased in the first quarter of 2008 to 2.51% from 2.77%

in the first quarter of 2007, as higher yielding certificates of

deposits matured and were replaced by lower cost borrowings.

Financial Condition Total assets increased to $1.5 billion at March

31, 2008, from $1.4 billion at December 31, 2007. The increase was

reflective of increases in securities available-for-sale of $33.2

million, cash and due from banks of $75.6 million, and loans

held-for-investment, net of $22.1 million. Total liabilities

increased to $1.1 billion at March 31, 2008, from $1.0 billion at

December 31, 2007. The increase was primarily attributable to an

increase in securities sold under agreements to repurchase of

$126.0 million and an increase in other borrowings of $11.2 million

partially offset by a decrease in deposits of $4.4 million.

Although total deposits decreased during the first quarter of 2008

as compared to year-end 2007, the decrease related primarily to

higher cost certificates of deposit, which decreased $19.8 million

in the first quarter of 2008. This decrease was partially offset by

an increase in lower cost core deposits, primarily money market and

savings accounts which increased $21.0 million in the first quarter

of 2008. The Company experienced a decrease in checking accounts of

approximately $5.6 million in the first quarter of 2008. Total

stockholders� equity increased to $378.0 million at March 31, 2008,

from $367.3 million at December 31, 2007. The increase was

primarily attributable to net income of $5.6 million for the

quarter ended March 31, 2008, and an increase in other

comprehensive income of $4.9 million, related primarily to

unrealized gains on securities available for sale, net of tax.

Asset Quality The Company's non-performing loans totaled $11.3

million at March 31, 2008, an increase from $9.8 million at

December 31, 2007. The increase in non-performing loans from

December 31, 2007, was primarily attributable to an increase in

non-performing one- to four-family residential mortgage loans of

$595,000, an increase of $213,000 in non-performing construction

loans, and an increase of $896,000 in non-performing commercial

real estate loans. These increases were partially offset by a

decrease in non-performing commercial and industrial loans of

$248,000. The Company does not have any lending programs commonly

referred to as sub-prime lending. Sub-prime lending generally

targets borrowers with weakened credit histories typically

characterized by payment delinquencies, previous charge-offs,

judgments, bankruptcies, or borrowers with questionable repayment

capacity as evidenced by low credit scores or high debt burden

ratios. At March 31, 2008, approximately $87,000 of our

mortgage-backed securities portfolio (not guaranteed by Fannie Mae

or Freddie Mac) was secured by sub-prime loans. The securities were

rated AAA at March 31, 2008. Forward-Looking Statements: This

release may contain certain "forward looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995,

and may be identified by the use of such words as "may," "believe,"

"expect," "anticipate," "should," "plan," "estimate," "predict,"

"continue," and "potential" or the negative of these terms or other

comparable terminology. Examples of forward-looking statements

include, but are not limited to, estimates with respect to the

financial condition, results of operations and business of

Northfield Bancorp, Inc. Any or all of the forward-looking

statements in this release and in any other public statements made

by Northfield Bancorp, Inc. may turn out to be wrong. They can be

affected by inaccurate assumptions Northfield Bancorp, Inc. might

make or by known or unknown risks and uncertainties. Consequently,

no forward-looking statement can be guaranteed. Northfield Bancorp,

Inc. does not intend to update any of the forward-looking

statements after the date of this release or to conform these

statements to actual events. NORTHFIELD BANCORP, INC. SELECTED

CONSOLIDATED FINANCIAL AND OTHER DATA (Dollars in thousands, except

per share amounts) (unaudited) � � At Selected Financial Condition

Data: � March 31, 2008 � December 31, 2007 � � Total assets $

1,522,249 $ 1,386,918 Cash and due from banks 125,145 49,588

Securities available-for-sale, at estimated fair value 836,061

802,817 Securities held-to-maturity 18,347 19,686 Trading

securities 3,576 3,605 Loans held for sale 120 270 Loans

held-for-investment, net 446,407 424,329 Allowance for loan losses

(6,234) (5,636) Net loans held-for-investment 440,173 418,693 Bank

owned life insurance 44,493 41,560 Non-performing loans(1) 11,313

9,834 Federal Home Loan Bank of New York stock, at cost 12,881

6,702 � Securities sold under agreements to repurchase 228,000

102,000 Other borrowings 33,668 22,420 Deposits 872,800 877,225

Total liabilities 1,144,293 1,019,578 Total stockholders� equity

377,956 367,340 � � � � For the Three Months Ended Selected

Operating Data: � March 31, 2008 � March 31, 2007 � Interest income

$ 17,315 $ 15,502 Interest expense 6,724 7,244 Net interest income

before provision for loan losses 10,591 8,258 Provision for loan

losses 598 440 Net interest income after provision for loan losses

9,993 7,818 Non-interest income 3,399 5,602 Non-interest expense

5,986 6,026 Income before income tax expense 7,406 7,394 Income tax

expense 1,801 2,701 Net income 5,605 4,693 � Net income per common

share(2) $ 0.13 $ n/a � � � At or For the Three Months Ended

Selected Financial Ratios: � March 31, 2008 � March 31, 2007

Performance Ratios: Return on assets (ratio of net income to

average total assets) (3) 1.54 % � 1.48 % Return on equity (ratio

of net income to average equity) (3) 6.03 11.53 Interest rate

spread (3) 2.29 2.21 Net interest margin (3) � 3.10 2.72 Efficiency

ratio (4) 42.79 43.48 Non-interest expense to average total assets

1.65 1.90 Average interest-earning assets to average

interest-bearing liabilities 141.09 121.46 Average equity to

average total assets 25.60 12.84 Asset Quality Ratios:

Non-performing loans to total assets 0.74 0.69 Non-performing loans

to total loans 2.53 2.07 Allowance for loan losses to

non-performing loans 55.10 61.57 Allowance for loan losses to total

loans 1.40 1.28 (1) � Non-performing loans consist of non-accruing

loans and loans 90 or more past due and still accruing, and are

included in loans held-for-investment, net. (2) Net income per

common share (calculated based on 43,111,876 shares outstanding for

the quarter ended March 31, 2008) is not applicable prior to the

Company's completion of its stock offering on November 7, 2007. (3)

Annualized. (4) The efficiency ratio represents non-interest

expense divided by the sum of net interest income and non-interest

income. NORTHFIELD BANCORP, INC. ANALYSIS OF NET INTEREST INCOME

(Dollars in thousands) � � � � � � � For the Three Months Ended

March 31, 2008 2007 � � � Average Outstanding Balance � � Interest

� Average Yield/ Rate (1) � � Average Outstanding Balance � �

Interest � Average Yield/ Rate (1) � � � Interest-earning assets:

Loans $ 433,166 $ 6,989 6.49 % $ 416,871 $ 6,913 6.73 %

Mortgage-backed securities 760,018 8,425 4.46 700,608 7,199 4.17

Other securities 58,042 710 4.92 55,600 675 4.92 Federal Home Loan

Bank of New York stock 10,524 131 5.01 � 6,922 140 8.20

Interest-earning deposits in financial institutions 114,137 1,060

3.74 49,445 575 4.72 Total interest-earning assets 1,375,887 17,315

5.06 1,229,446 15,502 5.11 Non-interest-earning assets 83,968

56,031 Total assets $ 1,459,855 $ 1,285,477 � Interest-bearing

liabilities: Savings, NOW, and money market accounts $ 373,569 904

0.97 $ 391,041 746 0.77 Certificates of deposit 392,260 3,881 3.98

496,123 5,319 4.35 Total interest-bearing deposits 765,829 4,785

2.51 887,164 6,065 2.77 Repurchase agreements 178,923 1,650 3.71

102,577 968 3.83 Other borrowings 30,399 289 3.82 22,496 211 3.80

Total interest-bearing liabilities 975,151 6,724 2.77 1,012,237

7,244 2.90 Non-interest bearing deposit accounts 94,364 97,246

Accrued expenses and other liabilities 16,563 10,928 Total

liabilities 1,086,078 1,120,411 Stockholders' equity 373,777

165,066 Total liabilities and stockholders' equity $ 1,459,855 $

1,285,477 � � Net interest income � $ 10,591 $ 8,258 Net interest

rate spread (2) 2.29 % 2.21 % Net interest-earning assets (3) $

400,736 $ 217,209 Net interest margin (4) 3.10 % 2.72 % Average

interest-earning assets to interest- bearing liabilities 141.09 %

121.46 % (1) � Average yields and rates for the three months ended

March 31, 2008 and 2007 are annualized. (2) Net interest rate

spread represents the difference between the weighted average yield

on interest-earning assets and the weighted average cost of

interest-bearing liabilities. (3) Net interest-earning assets

represent total interest-earning assets less total interest-bearing

liabilities. (4) Net interest margin represents net interest income

divided by average total interest-earning assets.

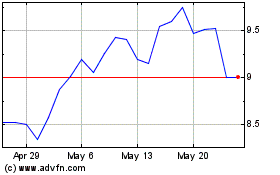

Northfield Bancorp (NASDAQ:NFBK)

Historical Stock Chart

From May 2024 to Jun 2024

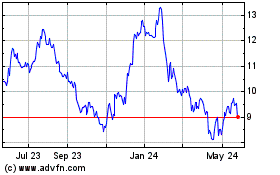

Northfield Bancorp (NASDAQ:NFBK)

Historical Stock Chart

From Jun 2023 to Jun 2024