Northfield Bancorp, Inc., the holding company for Northfield Bank,

reported net income of $482,000 for the three months ended December

31, 2007, compared to $3.1 million for the three months ended

December 31, 2006. The Company also reported net income of $10.5

million for the year ended December 31, 2007, compared to $10.8

million for the year ended December 31, 2006. Operating results for

the three months and year ended December 31, 2007, included a

charge of $12.0 million ($7.8 million, net of tax) due to the

Company�s contribution to the Northfield Bank Foundation, partially

offset by net interest income of approximately $1.1 million

($625,000, net of tax) for the three months ended December 31, 2007

and $1.4 million ($795,000, net of tax) for the year ended December

31, 2007, related to short-term investment returns earned on

subscription proceeds (net of interest paid during the stock

offering), and the reversal of state and local tax liabilities of

approximately $4.5 million, net of federal taxes. The Company

concluded an audit by the State of New York with respect to the

Company�s combined state tax returns for years 2000 through 2006.

Net income for the year ended December 31, 2007, also includes a

pre-tax gain of $4.3 million ($2.4 million, net of tax) as a result

of the sale of two branch locations, and associated deposit

relationships, during the first quarter of 2007. Net income for the

year ended December 31, 2006, reflects a pre-tax charge of $1.6

million ($860,000, net of tax) related to a supplemental retirement

agreement entered into by the Company with its former president.

The Company completed its previously announced minority stock

offering on November 7, 2007. Loss per share for the period from

November 8, 2007 to December 31, 2007 was $0.03. Commenting on the

quarter and year-end results, John W. Alexander, the Company�s

Chairman, President, and Chief Executive Officer said, �We are

pleased with our financial performance in a very challenging

business environment and we remain focused on the communities and

the markets we serve, prudently working to increase our loans and

deposits, maintaining operating expense efficiencies, and

evaluating profitable alternatives for the investment of our

capital.� Results of Operations Net interest income for the three

months ended December 31, 2007, increased to $11.2 million, from

$8.6 million for the three months ended December 31, 2006, and

increased to $36.9 million for the year ended December 31, 2007,

from $36.5 million for the prior year. Net interest income

increased approximately $1.1 million and $1.4 million for the three

months and year ended December 31, 2007, respectively, as a result

of the earnings on cash proceeds received from stock subscriptions.

The net interest margin increased to 3.17% for the three months

ended December 31, 2007, from 2.69% for the same prior-year period.

The net interest margin increased to 2.87% for the year ended

December 31, 2007 from 2.81% for the prior year. The margin for the

three months and year ended December 31, 2007, included net

interest income earned on stock subscription proceeds held in

escrow at the Bank until the stock offering was completed. Average

interest-earning assets increased by $138.4 million for the three

months ended December 31, 2007, as compared to the same prior-year

period, due primarily to $124.9 million in average subscription

proceeds received, partially offset by the sale of two branch

locations and related deposit liabilities of $26.6 million in the

first quarter of 2007. Average interest-earning assets decreased by

$12.2 million for the year ended December 31, 2007, as compared to

the prior year due primarily to the sale of two branch locations

and related deposit liabilities in the first quarter of 2007, and

pay downs of mortgage-backed securities, partially offset by

subscription proceeds received. The yield on interest-earning

assets decreased to 5.07% for the three months ended December 31,

2007, compared to 5.08% for the same prior year period. The

decrease in the yield earned on interest-earning assets was

primarily attributable to a decrease in rates earned on loans

indexed to the Prime Rate, due to the decreases in this index

during the fourth quarter of 2007. The decrease in yield also was

caused by lower yields earned on deposits in other financial

institutions, where a majority of the stock subscription proceeds

was invested pending the completion of the offering. The yield on

interest-earning assets increased to 5.11%, for the year ended

December 31, 2007, as compared to 5.00%, for the prior year. The

yield on interest-earning assets increased primarily due to the

change in the mix of average earning assets. Average balances of

loans as a percent of average interest-earning assets increased to

33.0% for the year ended December 31, 2007, from 31.4% for the

prior year. The cost of interest-bearing liabilities decreased to

2.52% for the three months ended December 31, 2007, as compared to

2.89%, for the same prior-year period. This decrease was primarily

attributable to the subscription proceeds having a cost of 0.60%.

The cost of interest-bearing liabilities increased to 2.77% for the

year ended December 31, 2007, as compared to 2.60%, for the same

prior year period due primarily to pricing competition on time

deposits throughout 2007. Total non-interest income of $1.2 million

remained substantially unchanged for the three months ended

December 31, 2007, as compared to the same prior year period and

increased to $9.5 million for the year ended December 31, 2007, as

compared to $4.6 million for the prior year. The increase for the

year ended December 31, 2007, was primarily attributable to the

sale of two branch locations and deposit relationships in the first

quarter of 2007, which resulted in a pre-tax gain of $4.3 million.

Total non-interest expense amounted to $18.6 million and $36.0

million for the three months and year ended December 31, 2007,

respectively, as compared to $5.3 million and $23.8 million,

respectively, for the corresponding prior periods. This increase

was primarily attributable to the recognition of a charge for the

contribution of Company common stock and cash with a value of $12.0

million to the Northfield Bank Foundation, partially offset by a

$1.6 million charge related to a supplemental retirement agreement

entered into by the Company with its former president, during the

third quarter of 2006. The provision (credit) for loan losses was

$705,000 and $1.4 million, respectively, for the three months and

year ended December 31, 2007, as compared to $(318,000) and

$235,000, respectively, for the corresponding prior year periods.

The increase in the provision for loan losses was primarily

attributable to increases in loss reserves on impaired loans

related to declines in estimated fair values of real estate

securing these loans, as well as an increase in loan loss factors

utilized in the calculation of loan loss reserves for commercial

real estate, land, and construction loans. In evaluating loan loss

factors utilized in the calculation of the allowance for loan

losses, management evaluated relevant environmental factors present

in its marketplace and loan portfolio. Significant factors

considered included the current deterioration in economic and

business conditions, as well as in commercial and construction real

estate collateral values. The Company recorded a (benefit)

provision for income taxes of $(7.4) million and $(1.6) million for

the three months and the year ended December 31, 2007,

respectively, as compared to provisions of $1.8 million and $6.2

million, respectively, in the corresponding prior year periods. The

decline in income tax expense related to a decrease in pre-tax

income, as well as the Company reversing $4.5 million in state and

local income tax liabilities, net of federal taxes. The Company

concluded an audit by the State of New York with respect to the

Company�s combined state tax returns for years 2000 through 2006.

Financial Condition Total assets increased to $1.4 billion at

December 31, 2007, from $1.3 billion at December 31, 2006. The

increase was primarily attributable to an increase in securities

available for sale of $89.3 million funded, in part, by proceeds

received in the Company�s initial public offering. The Company

raised $192.7 million and utilized proceeds of approximately $3.0

million for direct offering expenses, $17.6 million for a loan to

the employee stock ownership plan, and $3.0 million in cash for a

contribution to the Northfield Bank Foundation. Of the $192.7

million raised in the stock offering, $82.4 million was funded with

customer deposits held at Northfield Bank. The increase in total

assets was also attributable to an increase in bank owned life

insurance of $8.7 million, and an increase in net loans held for

investment of $15.1 million. These increases were partially offset

by decreases in securities held to maturity, Federal Home Loan Bank

of New York stock, premises and equipment, and other assets. Total

liabilities decreased to $1.0 billion at December 31, 2007, from

$1.1 billion at December 31, 2006. The decrease was primarily

attributable to a decrease in deposits of $112.6 million, a

decrease in securities sold under agreements to repurchase of $4.0

million, and a decrease in accrued expenses of $5.0 million. The

decrease in deposits was attributable primarily to the transfer of

$82.4 million in deposits to stockholders� equity as part of the

stock offering closing on November 7, 2007 and the sale of two

branch locations and related deposit relationships of $26.6 million

during the first quarter of 2007. Total stockholders� equity

increased to $367.4 million at December 31, 2007, from $164.0

million at December 31, 2006. The increase was primarily

attributable to stock offering capital of $192.7 million, net

income of $10.5 million for the year ended December 31, 2007, a

$500,000 capital contribution from Northfield Bancorp, MHC, $8.9

million of Company stock issued to the Northfield Bank Foundation,

and a decrease of $10.7 million in accumulated other comprehensive

loss, primarily due to a decrease in unrealized losses on

securities available for sale. These increases were partially

offset by $3.0 million in direct IPO expenses and $17.6 million for

a loan to the employee stock ownership plan. Asset Quality The

Company's non-performing loans totaled $9.8 million at December 31,

2007, an increase from $7.1 million at December 31, 2006, and a

decrease from $10.4 million at September 30, 2007. For the year

ended December 31, 2007, the Company recognized net loan

charge-offs of $836,000, which were primarily related to one loan

whose remaining outstanding loan balance was fully charged-off. The

increase in non-performing loans from December 31, 2006, was

primarily attributable to one loan that was placed on non-accrual

status as of June 30, 2007, in the amount of $3.4 million, which

management believes to be adequately collateralized by a first

mortgage on commercial real estate. The Company does not have any

lending programs commonly referred to as sub-prime lending.

Sub-prime lending generally targets borrowers with weakened credit

histories typically characterized by payment delinquencies,

previous charge-offs, judgments, bankruptcies, or borrowers with

questionable repayment capacity as evidence by low credit scores or

high debt burden ratios. At December 31, 2007, approximately

$87,000 of our mortgage-backed securities portfolio (not guaranteed

by the Fannie Mae or Freddie Mac) was secured by sub-prime loans.

The securities were rated AAA at December 31, 2007. Annual Meeting

of Stockholders The 2008 Annual Meeting of Stockholders of

Northfield Bancorp, Inc. has been set for 10:00 a.m., local time,

on May 28, 2008. The 2008 Annual Meeting of Stockholders will be

held at the Hilton Garden Inn, located at 1100 South Avenue, Staten

Island, New York 10314. The voting record date will be April 8,

2008. Forward-Looking Statements This release may contain certain

"forward looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995, and may be identified by

the use of such words as "may," "believe," "expect," "anticipate,"

"should," "plan," "estimate," "predict," "continue," and

"potential" or the negative of these terms or other comparable

terminology. Examples of forward-looking statements include, but

are not limited to, estimates with respect to the financial

condition, results of operations and business of Northfield

Bancorp, Inc. Any or all of the forward-looking statements in this

release and in any other public statements made by Northfield

Bancorp, Inc. may turn out to be wrong. They can be affected by

inaccurate assumptions Northfield Bancorp, Inc. might make or by

known or unknown risks and uncertainties. Consequently, no

forward-looking statement can be guaranteed. Northfield Bancorp,

Inc. does not intend to update any of the forward-looking

statements after the date of this release or to conform these

statements to actual events. NORTHFIELD BANCORP, INC. SELECTED

CONSOLIDATED FINANCIAL AND OTHER DATA (Dollars in thousands, except

per share amounts) (unaudited) � � At December 31, 2007 � At

December 31, 2006 Selected Financial Condition Data: Total assets $

1,386,918 $ 1,294,747 Cash and due from banks 49,588 65,824

Securities available for sale, at estimated fair value 802,817

713,498 Securities held to maturity 19,686 26,169 Trading

securities 3,605 2,667 Loans held for sale 270 125 Loans held for

investment, net 424,329 409,189 Allowance for loan losses (5,636 )

(5,030 ) Net loans held for investment 418,693 404,159 Bank owned

life insurance 41,560 32,866 Non-performing loans(4) 9,834 7,115

Federal Home Loan Bank of New York stock, at cost 6,702 7,186 �

Securities sold under agreements to repurchase 102,000 106,000

Other borrowings 22,420 22,534 Deposits 877,225 989,789 Total

liabilities 1,019,532 1,130,753 Total stockholders� equity 367,386

163,994 � Three Months Ended December 31, � Year Ended December 31,

2007 � 2006 2007 � 2006 Selected Operating Data: Interest income $

17,919 $ 16,191 $ 65,702 $ 64,867 Interest expense � 6,717 � �

7,629 � � 28,836 � � 28,406 Net interest income before provision

for loan losses 11,202 8,562 36,866 36,461 Provision (credit) for

loan losses 705 � � (318 ) � 1,442 � � 235 Net interest income

after provision for loan losses 10,497 8,880 35,424 36,226

Non-interest income 1,218 1,226 9,478 4,600 Non-interest expense �

18,600 � � 5,292 � � 35,950 � � 23,818 (Loss) income before income

tax (benefit) expense (6,885 ) 4,814 8,952 17,008 Income tax

(benefit) expense � (7,367 ) � 1,754 � � (1,555 ) � 6,166 Net

income $ 482 � $ 3,060 � $ 10,507 � $ 10,842 � Net loss per share

(3) $ (0.03 ) $ N/A � $ (0.03 ) $ N/A � At or For the Three Months

Ended December 31, (annualized) � At or For the Year Ended December

31, 2007 � 2006 2007 � 2006 Selected Financial Ratios: Performance

Ratios(1): Return on assets (ratio of net income to average total

assets) 0.13% 0.92% 0.78% 0.80% Return on equity (ratio of net

income to average equity) 0.66% 7.45% 5.27% 7.01% Interest rate

spread 2.55% 2.19% 2.34% 2.40% Net interest margin 3.17% 2.69%

2.87% 2.81% Efficiency ratio(2) 149.27% 54.07% 77.57% 58.01%

Non-interest expense to average total assets 5.05% 1.59% 2.66%

1.77% Average interest-earning assets to average interest-bearing

liabilities 132.82% 120.65% 123.33% 118.89% Average equity to

average total assets 19.70% 12.37% 14.73% 11.47% Asset Quality

Ratios: Non-performing loans to total assets 0.71% 0.55% 0.71%

0.55% Non-performing loans to total loans 2.32% 1.74% 2.32% 1.74%

Allowance for loan losses to non-performing loans 57.31% 70.70%

57.31% 70.70% Allowance for loan losses to total loans 1.33% 1.23%

1.33% 1.23% (1) 2007 performance ratios include the after-tax

effect of: a charge of $7.8 million due to the Company�s

contribution to the Northfield Bank Foundation; a gain of $2.4

million as a result of the sale of two branch locations, and

associated deposit relationships; net interest income of

approximately $0.6 million for the three months ended December 31,

2007, and $0.8 million, for the year ended December 31, 2007, as it

relates to short-term investment returns earned on subscription

proceeds (net of interest paid during the stock offering); and the

reversal of state and local tax liabilities of approximately $4.5

million, net of federal taxes. 2006 performance ratios include the

after tax effect of a $0.9 million charge related to a supplemental

retirement agreement entered into by the Company with its former

president. (2) The efficiency ratio represents non-interest expense

divided by the sum of net interest income and non-interest income.

(3) Net loss per share is calculated for the period that the

Company�s shares of common stock were outstanding (November 8, 2007

through December 31, 2007). The net loss for this period was

$1,501,000 and the weighted average common shares outstanding were

43,076,586. (4) Non-performing loans are included in loans held for

investment, net. Non-performing loans amounted to $9.8 million,

$10.4 million, $11.7 million, $8.9 million, and $7.1 million, at

December 31, 2007, September 30, 2007, June 30, 2007, March 31,

2007, and December 31, 2006, respectively. NORTHFIELD BANCORP, INC.

ANALYSIS OF NET INTEREST INCOME � � For the Three Months Ended

December 31, 2007 � 2006 Average Outstanding Balance � Interest �

Average Yield/ Rate(1) Average Outstanding Balance � Interest �

Average Yield/ Rate(1) (Dollars in thousands) � Interest-earning

assets: Loans $ 427,042 $ 7,069 6.57 % $ 409,866 $ 7,048 6.82 %

Mortgage-backed securities 744,918 8,228 4.38 734,645 7,534 4.07

Other securities 57,775 648 4.45 61,049 791 5.14 Federal Home Loan

Bank of New York stock 6,166 132 8.49 7,934 138 6.90

Interest-earning deposits in financial institutions � 167,279 �

1,842 4.37 � 51,311 � 680 5.26 Total interest-earning assets

1,403,180 17,919 5.07 1,264,805 16,191 5.08 Non-interest-earning

assets � 57,781 � 53,119 Total assets $ 1,460,961 $ 1,317,924 �

Interest-bearing liabilities: NOW accounts $ 53,981 350 2.57 $

37,235 136 1.45 Savings accounts 334,618 550 0.65 366,650 650 0.70

Subscription proceeds 124,973 189 0.60 - - - Certificates of

deposit � 430,352 � 4,494 4.14 � 499,321 � 5,489 4.36 Total

interest-bearing deposits 943,924 5,583 2.35 903,206 6,275 2.76

Repurchase agreements 88,266 909 4.09 122,630 1,138 3.68 Other

borrowings � 24,239 � 225 3.68 � 22,528 � 216 3.80 Total

interest-bearing liabilities 1,056,429 6,717 2.52 1,048,364 7,629

2.89 Non-interest bearing deposit accounts 102,834 94,565 Accrued

expenses and other liabilities � 13,872 � 11,945 Total liabilities

1,173,135 1,154,874 Stockholders� equity � 287,826 � 163,050 Total

liabilities and stockholders� equity $ 1,460,961 $ 1,317,924 � Net

interest income $ 11,202 $ 8,562 Net interest rate spread (2) 2.55

% 2.19 % Net interest-earning assets (3) $ 346,751 $ 216,441 Net

interest margin (4) 3.17 % 2.69 % Average interest-earning assets

to interest-bearing liabilities 132.82 % 120.65 % (1) Average

yields and rates for the three months ended December 31, 2007, and

2006 are annualized. (2) Net interest rate spread represents the

difference between the weighted average yield on interest-earning

assets and the weighted average cost of interest-bearing

liabilities. (3) Net interest-earning assets represent total

interest-earning assets less total interest-bearing liabilities.

(4) Net interest margin represents net interest income divided by

average total interest-earning assets. NORTHFIELD BANCORP, INC.

ANALYSIS OF NET INTEREST INCOME � � For the Year Ended December 31,

2007 � 2006 Average Outstanding Balance � Interest � Average Yield/

Rate Average Outstanding Balance � Interest � Average Yield/ Rate

(Dollars in thousands) � Interest-earning assets: Loans $ 423,947 $

28,398 6.70 % $ 407,068 $ 27,522 6.76 % Mortgage-backed securities

718,279 30,576 4.26 799,244 32,764 4.10 Other securities 45,077

2,100 4.66 51,883 2,397 4.62 Federal Home Loan Bank of New York

stock 6,486 519 8.00 9,582 592 6.18 Interest-earning deposits in

financial institutions � 92,202 � 4,109 4.46 � 30,435 � 1,592 5.23

Total interest-earning assets 1,285,991 65,702 5.11 1,298,212

64,867 5.00 Non-interest-earning assets � 66,614 � 49,564 Total

assets $ 1,352,605 $ 1,347,776 � Interest-bearing liabilities: NOW

accounts $ 49,209 951 1.93 $ 37,454 349 0.93 Savings accounts

351,503 2,303 0.66 398,852 2,788 0.70 Subscription proceeds 49,500

297 0.60 - - - Certificates of deposit � 464,552 � 20,212 4.35 �

474,313 � 18,797 3.96 Total interest-bearing deposits 914,764

23,763 2.60 910,619 21,934 2.41 Repurchase agreements 104,927 4,202

4.00 154,855 5,501 3.55 Other borrowings � 22,999 � 871 3.79 �

26,441 � 971 3.67 Total interest-bearing liabilities 1,042,690

28,836 2.77 1,091,915 28,406 2.60 Non-interest bearing deposit

accounts 96,796 89,989 Accrued expenses and other liabilities �

13,905 � 11,261 Total liabilities 1,153,391 1,193,165 Stockholders�

equity � 199,214 � 154,611 Total liabilities and stockholders�

equity $ 1,352,605 $ 1,347,776 � Net interest income $ 36,866 $

36,461 Net interest rate spread (1) 2.34 % 2.40 % Net

interest-earning assets (2) $ 243,301 $ 206,297 Net interest margin

(3) 2.87 % 2.81 % Average interest-earning assets to

interest-bearing liabilities 123.33 % 118.89 % (1) Net interest

rate spread represents the difference between the weighted average

yield on interest-earning assets and the weighted average cost of

interest-bearing liabilities. (2) Net interest-earning assets

represent total interest-earning assets less total interest-bearing

liabilities. (3) Net interest margin represents net interest income

divided by average total interest-earning assets.

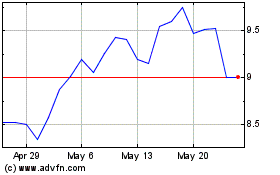

Northfield Bancorp (NASDAQ:NFBK)

Historical Stock Chart

From May 2024 to Jun 2024

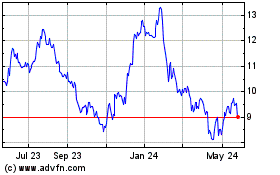

Northfield Bancorp (NASDAQ:NFBK)

Historical Stock Chart

From Jun 2023 to Jun 2024