ICE's Sprecher: Global Exchange Deals Can Still Be Done

February 10 2012 - 12:22PM

Dow Jones News

The top executive of IntercontinentalExchange Inc. (ICE) said

that it was still possible for exchange companies to do major

cross-border mergers, though satisfying a myriad of constituencies

in the process has proven extremely tricky.

"It could be done at all points in my career in this industry

and it can still be done," said Jeff Sprecher, ICE chief executive

and co-founder, speaking at an investor event Friday. "But none of

it is easy."

A clutch of large-scale exchange merger proposals -- including

an attempted takeover of NYSE Euronext (NYX) backed by Sprecher

himself -- fell apart over the last year due to pushback from

regulators and nationalistic sentiment.

Last week the highest-profile deal of them all, NYSE Euronext's

agreed combination with Deutsche Boerse AG (DB1.XE, DBOEF), was

abandoned after the European Union determined the tie-up would

amount to a monopoly over regional derivatives trading.

Sprecher said that success of such deals depended on satisfying

the desires of shareholders, exchange customers, employees,

regulators and politicians, many of whom have divergent

interests.

"If you're a management team that can thread that needle and

still create value for your shareholders, then it can happen,"

Sprecher said.

-By Jacob Bunge, Dow Jones Newswires; 312-750-4117;

jacob.bunge@dowjones.com

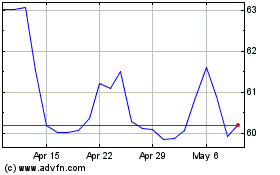

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Apr 2024 to May 2024

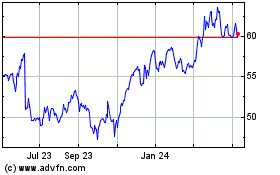

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From May 2023 to May 2024