Illinois Legislative Leaders Agree On CME, Sears Tax Deal

December 08 2011 - 5:18PM

Dow Jones News

Illinois legislative leaders agreed Thursday to change their

tactics to win passage of a tax-relief plan aimed at keeping

Chicago's largest derivatives exchanges and a major retailer in

Illinois.

Democrats and Republicans in the Illinois House said they will

split in two a proposal to reduce the tax load on CME Group Inc.

(CME), CBOE Holdings Inc. (CBOE), and Sears Holdings Corp. (SHLD).

Lawmakers will vote separately on a series of tax breaks for

Illinois workers, according to information supplied by the office

of Republican House Minority Leader Tom Cross.

The larger package was approved by the Illinois Senate, but

garnered only eight 'yes' votes a few hours later in the House.

Lawmakers generally agreed on aiding CME, CBOE and Sears, and

ease the tax burden for smaller businesses. However, they were

divided on providing earned income tax credits for low- and

middle-income workers.

Democrats, particularly Governor Pat Quinn, argued that cash in

the hands of workers stimulates consumer demand. Republicans

complained that such assistance does not create or retain jobs.

The deal provides "some relief to a broad base of businesses in

our state," Cross said in a prepared statement.

"It will also less the tax burden on our family farmers and

small businesses," Cross also said.

Tax relief for CME and options exchange CBOE remained generally

intact compared with previous versions. They would be taxed on

27.54% of all electronic trades, which account for the vast

majority of the business performed at the exchanges. Currently, the

exchanges pay taxes on 100% of their electronic transactions, even

though the bulk of the trades are done outside of Illinois.

Tax breaks won't kick in for CME and CBOE until the start of the

next fiscal year, which begins July 1 of next year.

Cost to the already cash-strapped state government would be $43

million in the first year and $85 million in the second year should

the bill become law.

A special taxing district would be renewed for Sears, which has

its headquarters in the Chicago suburbs of Hoffman Estates. The

retailer employs 6,100 people there, a Sears spokesman said.

Attempts to break the legislative bottleneck has taken on

increased urgency in recent days. Last Friday, CME executives

hosted Indianapolis Mayor Greg Ballard, who said his city has made

a "very competitive offer" to land CME headquarters.

CME has run its exchange from Chicago for 163 years. It employs

approximately 2,000 employees in Illinois.

CME Chairman Terry Duffy told a state House committee last month

that it might relocate its electronic trading operations and

clearinghouse. Only the trading floors at CME-owned Chicago Board

of Trade would remain. Open-outcry pits represent less than 5% of

CME's business, said Duffy.

CME and CBOE protested loudly the legislature's passage in

January of an increase in the corporate tax rate to 7%, from 4.8%.

The tax increase costs CME an extra $50 million a year, Duffy

said.

-By Howard Packowitz, Dow Jones Newswires; 312-750-4132;

howard.packowitz@dowjones.com

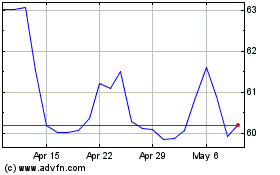

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From May 2024 to Jun 2024

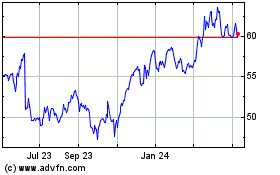

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Jun 2023 to Jun 2024