NASDAQ Announces End-of-Month Open Short Interest Positions in NASDAQ Stocks as of Settlement Date October 31, 2011

November 09 2011 - 4:05PM

At the end of the settlement date of October 31, 2011, short

interest in 2,277 NASDAQ Global MarketSM securities totaled

6,718,917,154 shares compared with 7,157,409,848 shares in 2,288

Global Market issues reported for the prior settlement date of

October 14, 2011. The end-of-October short interest represents 3.66

days average daily NASDAQ Global Market share volume for the

reporting period, compared with 3.15 days for the prior reporting

period.

Short interest in 496 securities on The NASDAQ Capital MarketSM

totaled 352,392,555 shares at the end of the settlement date of

October 31, 2011 compared with 355,968,209 shares in 495 securities

for the previous reporting period. This represents 7.48 days

average daily volume, compared with the previous reporting period's

figure of 7.46.

In summary, short interest in all 2,773 NASDAQ® securities

totaled 7,071,309,709 shares at the October 31, 2011 settlement

date, compared with 2,783 issues and 7,513,378,057 shares at the

end of the previous reporting period. This is 3.75 days average

daily volume, compared with an average of 3.24 days for the

previous reporting period.

The open short interest positions reported for each NASDAQ

security reflect the total number of shares sold short by all

broker/dealers regardless of their exchange affiliations. A

short sale is generally understood to mean the sale of a security

that the seller does not own or any sale that is consummated by the

delivery of a security borrowed by or for the account of the

seller.

For more information on NASDAQ Short interest positions,

including publication dates, visit

http://quotes.nasdaq.com/asp/MasterDataEntry.asp?page=ShortInterest

or http://www.nasdaqtrader.com/asp/short_interest.asp.

About NASDAQ OMX

The NASDAQ OMX Group, Inc. (Nasdaq:NDAQ) is the world's largest

exchange company. It delivers trading, exchange technology and

public company services across six continents, with approximately

3,500 listed companies. NASDAQ OMX offers multiple capital raising

solutions to companies around the globe, including its U.S.

listings market, NASDAQ OMX Nordic, NASDAQ OMX Baltic, NASDAQ OMX

First North, and the U.S. 144A sector. The company offers trading

across multiple asset classes including equities, derivatives,

debt, commodities, structured products and exchange-traded funds.

NASDAQ OMX technology supports the operations of over 70 exchanges,

clearing organizations and central securities depositories in more

than 50 countries. NASDAQ OMX Nordic and NASDAQ OMX Baltic

are not legal entities but describe the common offering from NASDAQ

OMX exchanges in Helsinki, Copenhagen, Stockholm, Iceland, Tallinn,

Riga, and Vilnius. For more information about NASDAQ OMX, visit

http://www.nasdaqomx.com. Please follow NASDAQ OMX on Facebook

(http://www.facebook.com/nasdaqomx) and Twitter

(http://www.twitter.com/nasdaqomx).

NDAQO

CONTACT: Media Contact:

Wayne Lee

+1.301.978.4875

Wayne.D.Lee@NASDAQOMX.Com

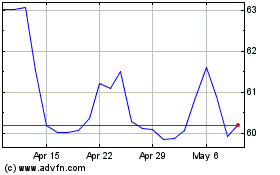

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Aug 2024 to Sep 2024

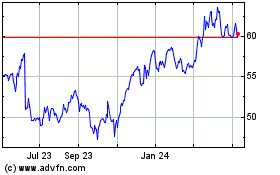

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Sep 2023 to Sep 2024