CME Takes Up More Service Initiatives - Analyst Blog

October 11 2011 - 7:21AM

Zacks

Yesterday, CME Group Inc. (CME) announced its

plan of launching CME Co-Location Services in the US on January 29,

2012, in an attempt to enhance the efficiency of its Globex

platform.

Accordingly, CME Co-Location Services will operate from the

company’s data center located in the suburbs of Chicago. This

service is expected to help in well-organized trading for its

buyers and sellers athwart on the Globex platform

Besides, the new co-location services are aimed at offering

hosting, connectivity and support services that will

comprehensively substantially minimize the latency connectivity for

all the trading products that are being traded on CME Group’s

Globex platform.

Therefore, the new the co-location service will not only boost

the operational efficiency with lowest latency factor but will also

offer fair access as it initiates equal pricing to all customers.

This enhanced efficiency, fair pricing and similar terms across its

customer base are likely expected to further increase the demand

for CME Group’s co-location services.

Besides, CME Group also expects to launch the clearing of

over-the-counter (OTC) metal products in UK through CME Clearing

Europe by the end of this year. The company had previously

intimidated about the plan in June this year.

The clearing of metals have been developing at a rapid pace

recently, primarily since the London Stock Exchange (LSE) announced

its plans to build its own clearing house in May of this year.

Moreover, the new regulatory reforms are also aiming at increasing

competition among exchanges, which further allows for the launch of

new post-trading clearing initiatives and hence, offer an open

business model for markets.

Overall, we believe that co-location and OTC clearing of metals

are likely to trigger growth opportunities for CME Group in the

long run. These efforts are also crucial for the company given the

demanding regulations and intense competitiveness in these areas

from other exchanges, such as NYSE Euronext Inc.

(NYX), NASDAQ OMX Group Inc. (NDAQ) and LSE,

across the US and Europe.

On Monday, the shares of CME Group closed at $266.06, up 4.8%,

on the NASDAQ Stock Exchange.

CME GROUP INC (CME): Free Stock Analysis Report

NASDAQ OMX GRP (NDAQ): Free Stock Analysis Report

NYSE EURONEXT (NYX): Free Stock Analysis Report

Zacks Investment Research

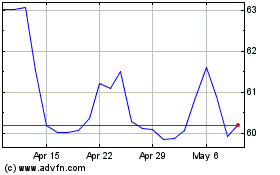

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From May 2024 to Jun 2024

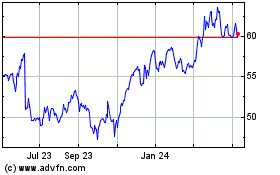

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Jun 2023 to Jun 2024