66% Revenue Growth; HERmark Breast Cancer Assay launched

commercially SOUTH SAN FRANCISCO, Calif., July 29

/PRNewswire-FirstCall/ -- Monogram Biosciences, Inc. (NASDAQ:MGRM)

today reported financial results for the quarter ended June 30,

2008. The Company had revenues of $16.1 million for the second

quarter of 2008, 66% higher than $9.7 million in the second quarter

of 2007. This growth was driven by revenue from Trofile(TM) for

selecting HIV patients to be treated with Selzentry(TM), Pfizer's

CCR5 antagonist, and by revenue from use of Monogram's PhenoSense

HIV(TM) resistance test and Trofile in a phase III trial by a

pharmaceutical company customer. Revenue for the six months ended

June 30, 2008 was $31.0 million, an increase of 62% over $19.1

million in the first six months of 2007. In addition to the

reported revenue for the quarter, Monogram recorded as deferred

revenue, the sale of Trofile assays to Pfizer for patient testing

outside of the U.S. and for use in clinical trials. These deferred

revenues were $1.2 million and $2.0 million for the three and six

months ended June 30, 2008, respectively. This revenue was recorded

as deferred revenue due to the accounting for the Company's

collaboration with Pfizer. Had these sales not been accounted for

as deferred revenue, total revenue on a Non-GAAP basis, for the

three and six months ended June 30, 2008 would have been $17.3

million and $33.0 million, respectively. Monogram has performed

over 8,000 Trofile tests to date for U.S. patients and revenue from

Trofile in the quarter ended June 30, 2008 was $3.7 million.

"Revenues were again at a record level in the second quarter," said

Alfred Merriweather, Monogram's Chief Financial Officer. "Gross

margin on product revenues for the second quarter was 54%." The

Company had approximately $26.9 million in cash, cash equivalents

and short-term investments at June 30, 2008. Cash used in

operations for the first six months of 2008 was $8.4 million. HIV

Tropism and Resistance Testing Recent significant developments in

Monogram's HIV business include: -- Introduction in June of

sensitivity enhancements to Trofile enabling the identification of

X4 virus present at a level as low as 0.3% of the total viral

population, a thirty-fold increase in sensitivity. -- Presentation

in June, at the Drug Resistance Workshop in Sitges, Spain, of data

providing clinical validation of optimized patient selection with

the enhanced assay format. -- Establishment of coverage for Trofile

by New York and California state Medicaid programs. -- Announcement

of the availability August 4 of the PhenoSense Integrase assay for

assessing resistance to the integrase class of HIV drugs. --

Extension of Trofile's availability outside of the U.S. to thirteen

European countries, Canada, Brazil and Argentina. "Selecting the

right treatment regimens for HIV patients is critical, not only to

assure that each individual drug is appropriate for the individual

patient but also to make sure that the entire regimen is as robust

as possible to protect the other drugs in the patient's regimen

from unnecessary exposure to the development of resistance," said

William Young, Monogram Chief Executive Officer. "The

implementation of enhanced sensitivity in Trofile and the

introduction of our resistance test for the integrase class of HIV

drugs further extend Monogram's industry-leading portfolio of

assays for guiding HIV therapy decisions." HERmark(TM) Breast

Cancer Assay Recent significant developments for Monogram's HERmark

Breast Cancer Assay include: -- Presentation by collaborators at

ASCO in June of a study demonstrating the superiority of HERmark

over FISH as a predictor of trastuzumab response ("Total HER2 and

HER2 Homodimer Levels Predict Response to trastuzumab"). --

Commercial introduction in July of HERmark for assessment of HER2

status in patients with breast cancer -- providing a precise and

quantitative measurement of HER2 total protein and HER2 homodimer

levels by a CLIA-validated assay through Monogram's CAP-certified

clinical laboratory. -- Establishment of initial sales organization

to introduce HERmark to the oncology community. -- Introduction at

ASCO of a Collaborative Biomarker Study, designed to (i) compare

conventional IHC and FISH methods of HER2 testing with the

quantitative measurements of HER2 total protein and HER2 homodimers

provided by HERmark, and (ii) to describe the

expression/co-expression profiles identified by Monogram's HER1 and

HER3 Total Protein Assays along with HER2 total protein and

homodimer levels identified by HERmark to facilitate analyses of

how such measurements may correlate with certain laboratory and

clinical parameters, including disease progression. "Current

technologies -- IHC, FISH and CISH -- are well recognized by breast

cancer researchers and oncologists as being inadequate for the

accurate assessment of HER2 status," continued Young. "This is the

important clinical need that HERmark addresses by providing

accurate and quantitative measurements of the drug target."

Physicians currently use these semi-quantitative technologies to

determine HER2 status and decide whether or not to prescribe

Herceptin(R). Inaccurate measurements of HER2 may lead to

inappropriate therapy selection. Guidance recently issued jointly

by ASCO and CAP (the College of American Pathologists) indicated

that approximately 20% of HER2 determinations conducted in local

laboratories by current testing technologies may be inaccurate. "We

have correlated the HERmark assay with IHC, FISH and CISH results

obtained in central laboratories in more than one thousand

patients, and we see a high degree of concordance between the best

central laboratory tests and HERmark," said Michael Bates, M.D.,

Vice President of Clinical Research at Monogram. "However, even

when compared to the best central laboratory measurements, HERmark

identifies patients with high HER2 levels but who are HER2-negative

by other assays, as well as some patients with low HER2 levels but

who are judged positive by conventional assays. Comparisons with

local laboratory IHC or FISH results suggest significantly larger

numbers of discordant results. We believe the HERmark Assay

measures HER2 total protein and homodimer levels very accurately

and will help physicians to make treatment decisions with high

confidence." Monogram expects that as many as 15-20% of patients

determined by conventional technologies to be HER2-negative would

be reclassified by HERmark. VeraTag(TM) Oncology Platform Recent

significant developments for the VeraTag technology platform

include: -- Introduction to biopharmaceutical companies of the HER1

and HER3 Total Protein Assays for research use. -- Issuance of

three U.S. patents and one European patent covering the detection

and profiling with VeraTag technology of protein complexes,

including homodimers and heterodimers. While the HERmark Breast

Cancer Assay, which measures the expression of the HER2 protein and

the HER2:HER2 homodimer, is the first product to be developed based

on Monogram's proprietary VeraTag technology, Monogram has a

growing portfolio of VeraTag assays that measure proteins, protein

complexes and post-translational modifications such as

phosphorylation, in FFPE tumor samples. In addition to the HER1,

HER2 and HER3 total protein assays and the HER2:HER2 homodimer

assay, Monogram has assays in advanced development for the

measurement of: -- heterodimers of HER1 and HER2 (HER1:HER2) --

heterodimers of HER2 and HER3 (HER2:HER3) -- the HER3:PI3K complex,

which is related to the Akt signaling pathway for tumor cell

survival -- the truncated form of HER2, known as p95. These

activated protein complexes are believed to mediate resistance to

Herceptin(R) in patients with breast cancer and are targets of

other cancer drugs in development. "As we extend the range of

assays beyond HER2, we will be able to address not only resistance

pathways to Herceptin in breast cancer but also provide assays that

may be informative in lung, colorectal and other cancers," added

Young. "With a broad range of assays, our VeraTag platform is

intended to inform the rational design of combination therapies,

such as those for patients with resistance to Herceptin." GAAP and

Non-GAAP Proforma Results Net Loss and Net Loss Per Share is shown

below in accordance with GAAP and also on a Non-GAAP Proforma

Basis. The Company is reporting Non-GAAP Proforma results which

exclude certain items to provide a clearer view of ongoing results

without the impact of non-cash valuation adjustments related to our

convertible debt. A reconciliation of these Non-GAAP Proforma

results to GAAP results is included with the Statement of

Operations data attached to this release. Three Months Ended Six

Months Ended June 30, June 30, 2008 2007 2008 2007 Net Loss ($

Millions) GAAP Net Loss $(5.5) $(3.9) $(7.2) $(15.4) Non-GAAP

Proforma Net Loss $(5.7) (8.3) $(12.1) (18.1) Net Loss Per Share

($) GAAP Net Loss Per Share $(0.04) $(0.03) $(0.05) $(0.12)

Non-GAAP Proforma Net Loss Per Share $(0.04) $(0.06) $(0.09)

$(0.14) Non-cash "mark-to-market" adjustments to the 3% Senior

Secured Convertible Note and the 0% Convertible Senior Unsecured

Debt that were reflected in non-operating income and expense for

the periods ended June 30, 2008 and 2007 are excluded from proforma

net loss. Favorable adjustments of $0.1 million and $4.5 million

were recorded in the three months ending June 30, 2008 and 2007,

respectively. Favorable adjustments of $4.8 million and $0.4

million were recorded in the six months ending June 30, 2008 and

2007, respectively. In addition, a favorable adjustment of $2.2

million was recorded at January 1, 2007 for the cumulative effect

of the change in accounting principle at that date. Such

adjustments could be significant and unpredictable in future

quarters depending on several factors, including the level of the

Company's common stock price. Stock-based compensation in

accordance with SFAS123(R) is recorded as expense for purposes of

both GAAP and our Non-GAAP Proforma results. Such costs were $1.2

million in the second quarter of 2008, compared to $1.1 million in

the prior year's second quarter. We believe that the foregoing

presentation of these Non-GAAP financial measures will enable

investors, analysts and readers of our financial statements to

compare Non-GAAP measures with relevant GAAP measures in all

periods presented. Any Non-GAAP financial measure used by us should

not be considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. Capital Structure At

June 30, 2008, a total of 134.9 million shares of common stock were

outstanding and stock options were outstanding on 24.2 million

shares of common stock. The principal amount of Pfizer's $25

million convertible note, issued in May 2006, is convertible into

approximately 9.2 million shares of common stock. The $30 million

principal amount of our 0% Convertible Senior Unsecured Notes,

issued in January 2007, is convertible into approximately 11.9

million shares of common stock. Conference Call Details Monogram

will host a conference call today at 4:30 p.m. Eastern Time. To

participate in the live teleconference please call (877) 675-4748,

or (719) 325-4848 for international callers, fifteen minutes before

the conference begins. Live audio of the call will be

simultaneously broadcast over the Internet and will be available to

members of the news media, investors and the general public. Access

to live and archived audio of the conference call will be available

by following the appropriate links at http://www.monogrambio.com/

and clicking on the Investor Relations link. Following the live

broadcast, a replay of the call will also be available at (888)

203-1112, or (719) 457-0820 for international callers. The replay

passcode is 3249168. The information provided on the teleconference

is only accurate at the time of the conference call, and Monogram

assumes no obligation to provide updated information except as

required by law. About Monogram Monogram is advancing

individualized medicine by discovering, developing and marketing

innovative products to guide and improve treatment of serious

infectious diseases and cancer. The Company's products are designed

to help doctors optimize treatment regimens for their patients that

lead to better outcomes and reduced costs. The Company's technology

is also being used by numerous biopharmaceutical companies to

develop new and improved anti-viral therapeutics and vaccines as

well as targeted cancer therapeutics. More information about the

Company and its technology can be found on its web site at

http://www.monogrambio.com/. Forward Looking Statements Certain

statements in this press release are forward-looking. These

forward-looking statements include references to the demand and

outlook for our products, including our Trofile and HERmark assays,

the outlook for Selzentry, Pfizer's CCR5 antagonist HIV drug,

reimbursement for Trofile and HERmark, the ability of VeraTag

technology, including HERmark, to significantly improve the

information available to physicians, results of studies intended to

demonstrate clinical utility of our VeraTag technology and HERmark

products and activities related to the Pfizer collaboration. These

forward-looking statements are subject to risks and uncertainties

and other factors, which may cause actual results to differ

materially from the anticipated results or other expectations

expressed in such forward-looking statements. These risks and

uncertainties include, but are not limited to: the risk that

physicians may not use a molecular diagnostic for patient selection

for Selzentry or other HIV drugs; risks related to the

implementation of the collaboration with Pfizer; risks related to

our ability to recognize revenue from activities under the

collaboration with Pfizer; risks and uncertainties relating to the

performance of our products; the growth in revenues; the size,

timing and success or failure of any clinical trials for CCR5

inhibitors, entry inhibitors or integrase inhibitors; the risk that

our Trofile Assay may not be utilized for patient use with

Selzentry and other CCR5 inhibitors; the risk that our VeraTag

assays, including HERmark, may not predict response to particular

therapeutic agents; the risk that we may not be able to obtain

additional cohorts of patient samples for additional VeraTag

studies, our ability to successfully conduct clinical studies and

the results obtained from those studies; whether larger

confirmatory clinical studies will confirm the results of initial

studies; our ability to establish reliable, high-volume operations

at commercially reasonable costs; expected reliance on a few

customers for the majority of our revenues; the annual renewal of

certain customer agreements; actual market acceptance of our

products and adoption of our technological approach and products by

pharmaceutical and biotechnology companies; our estimate of the

size of our markets; our estimates of the levels of demand for our

products; the impact of competition; the timing and ultimate size

of pharmaceutical company clinical trials; whether payers will

authorize reimbursement for our products and services and the

amount of such reimbursement that may be allowed; whether the FDA

or any other agency will decide to further regulate our products or

services, including Trofile; whether existing levels of

reimbursement will be reviewed and reduced by third party payers,

including Medicare; whether the draft guidance on Multivariate

Index Assays issued by FDA will be subsequently determined to apply

to our current or planned products; whether we will encounter

problems or delays in automating our processes; the ultimate

validity and enforceability of our patent applications and patents;

the possible infringement of the intellectual property of others;

whether licenses to third party technology will be available;

whether we are able to build brand loyalty and expand revenues;

restrictions on the conduct of our business imposed by the Pfizer,

G.E. and other debt agreements; the impact of additional dilution

if our convertible debt is converted to equity; and whether we will

be able to raise sufficient capital in the future, if required. For

a discussion of other factors that may cause actual events to

differ from those projected, please refer to our most recent annual

report on Form 10-K and quarterly reports on Form 10-Q, as well as

other subsequent filings with the Securities and Exchange

Commission. We do not undertake, and specifically disclaim any

obligation, to revise any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements. PhenoSense, PhenoSenseGT,

Trofile, HERmark and VeraTag are trademarks of Monogram

Biosciences, Inc. Herceptin is a registered trademark of Genentech,

Inc. Selzentry is a trademark of Pfizer Inc. MONOGRAM BIOSCIENCES,

INC. SELECTED STATEMENT OF OPERATIONS DATA (In thousands, except

per share amounts) (Unaudited) Three Months Ended Six Months Ended

June 30, June 30, 2008 2007 2008 2007 Revenue: Product revenue

$15,440 $8,907 $29,447 $18,006 Contract revenue 687 485 1,506 803

License revenue 5 300 15 300 Total revenue 16,132 9,692 30,968

19,109 Operating costs and expenses: Cost of product revenue 7,124

5,327 13,488 11,032 Research and development 6,244 5,176 12,268

10,507 Sales and marketing 4,133 4,159 8,485 8,102 General and

administrative 4,163 3,629 8,729 7,857 Total operating costs and

expenses 21,664 18,291 42,970 37,498 Operating loss (5,532) (8,599)

(12,002) (18,389) Convertible debt valuation adjustment and

interest income/(expense), net (58) 4,727 4,684 717 Contingent

Value Rights valuation adjustment 72 - 72 - Net loss before

cumulative effect of change in accounting principle (5,518) (3,872)

(7,246) (17,672) Cumulative effect of change in accounting

principle - - - 2,242 Net loss after cumulative effect of change in

accounting principle $(5,518) $(3,872) $(7,246) $(15,430) Basic and

diluted net loss per common share before cumulative effect of

change in accounting principle $(0.04) $(0.03) $(0.05) $(0.13)

Cumulative effect per share of change in accounting principle $- $-

$- $0.01 Basic and diluted net loss per common share after

cumulative effect of change in accounting principle $(0.04) $(0.03)

$(0.05) $(0.12) Weighted-average shares used in computing basic net

loss per common share 134,553 132,026 134,372 131,805

Reconciliation of Non-GAAP Proforma Results to GAAP Net loss after

cumulative effect of change in accounting principle $(5,518)

$(3,872) $(7,246) $(15,430) Adjustments for certain non-cash items:

Cumulative effect of change in accounting principle - - - (2,242)

Contingent Value Rights valuation adjustment (72) - (72) -

Convertible debt valuation adjustment (66) (4,463) (4,802) (408)

Non-GAAP Proforma net loss (5,656) (8,335) (12,120) (18,080)

Non-GAAP Proforma net loss per common share, basic $(0.04) $(0.06)

$(0.09) $(0.14) Management believes that this Non-GAAP proforma

financial data supplements the Company's GAAP financial statements

by providing investors with additional information which allows

them to have a clearer picture of the Company's operations,

financial performance and the comparability of the Company's

operating results from period to period as they exclude the effects

of revaluation of the Company's convertible debt that management

believes are not indicative of the Company's ongoing operations.

The presentation of this additional information is not meant to be

considered in isolation or as a substitute for results prepared in

accordance with GAAP. Above, management has provided a

reconciliation of the Non-GAAP proforma financial information with

the comparable financial information reported in accordance with

GAAP. MONOGRAM BIOSCIENCES, INC. SELECTED BALANCE SHEET DATA (In

thousands) (Unaudited) June 30, December 31, 2008 2007(1) ASSETS

Current assets: Cash and cash equivalents $21,943 $18,762

Short-term investments 4,984 11,828 Accounts receivable, net 13,731

9,100 Prepaid expenses 1,164 1,279 Inventory 1,761 1,250 Other

current assets 1,249 917 Total current assets 44,832 43,136

Property and equipment, net 7,913 7,665 Goodwill 9,927 9,927

Deferred costs 12,675 8,043 Other assets 94 540 Total assets

$75,441 $69,311 LIABILITIES AND STOCKHOLDERS' DEFICIT Current

liabilities: Accounts payable $1,765 $2,116 Accrued compensation

5,402 3,324 Accrued liabilities 4,708 3,818 Current portion of

restructuring costs 610 610 Deferred revenue, current portion 727

605 Current portion of loans payable and capital lease obligations

10,175 4,469 Contingent value rights 2,060 2,119 Total current

liabilities 25,447 17,061 Long-term 3% convertible promissory note

19,678 20,786 Long-term 0% convertible promissory note 14,817

18,511 Long-term portion of restructuring costs - 289 Long-term

deferred revenue 20,248 13,622 Other long-term liabilities 661 282

Total liabilities 80,851 70,551 Stockholders' deficit: Common stock

135 134 Additional paid-in capital 289,243 286,196 Accumulated

other comprehensive loss (3) (31) Accumulated deficit (294,785)

(287,539) Total stockholders' deficit (5,410) (1,240) Total

liabilities and stockholders' deficit $75,441 $69,311 (1) The

balance sheet data at December 31, 2007 is derived from audited

financial statements included in the Company's Annual Report on

Form 10-K for the year ended December 31, 2007 filed with the

Securities and Exchange Commission. contacts: Alfred G.

Merriweather Jeremiah Hall Chief Financial Officer Feinstein Kean

Healthcare Tel: 650 624 4576 Tel: 415 677 2700 amerriweather@

jeremiah.hall@ monogrambio.com fkhealth.com DATASOURCE: Monogram

Biosciences, Inc. CONTACT: Alfred G. Merriweather, Chief Financial

Officer of Monogram Biosciences, Inc., +1-650-624-4576, , or

Jeremiah Hall of Feinstein Kean Healthcare, +1-415-677-2700, , for

Monogram Biosciences, Inc. Web site: http://www.monogrambio.com/

Copyright

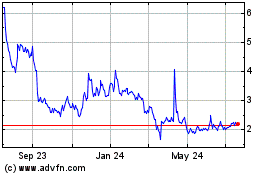

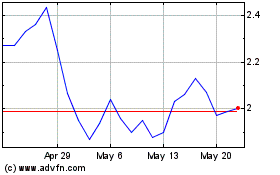

Monogram Technologies (NASDAQ:MGRM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Monogram Technologies (NASDAQ:MGRM)

Historical Stock Chart

From Jul 2023 to Jul 2024