Trofile(TM) Assay Ready for Commercial Introduction after FDA

Approval of Pfizer's Maraviroc; SOUTH SAN FRANCISCO, Calif., July

26 /PRNewswire-FirstCall/ -- Monogram Biosciences, Inc.

(NASDAQ:MGRM) today reported financial results for the quarter

ended June 30, 2007. Second Quarter Results The Company had revenue

of $9.7 million for the second quarter of 2007. Monogram's

Trofile(TM) Assay, which has been used for patient selection in the

phase III trial of Pfizer's CCR5 antagonist, maraviroc, is ready

for commercial introduction and is expected to contribute to

revenue growth for Monogram after maraviroc is approved by the FDA.

Total revenue in the second quarter of 2006, when Pfizer's phase

III trial for maraviroc was still in process, was $13.4 million.

The net loss was $3.9 million, or $0.03 per common share, in the

second quarter of 2007, compared to a net loss of $21.8 million, or

$0.17 per common share, for the same period in 2006. Included in

these results were substantial non-cash items which are described

below under "Non-GAAP Proforma Results." On a non-GAAP proforma

basis, adjusted for these non-cash items, the net loss was $8.3

million, or $0.06 per share, in the second quarter of 2007 compared

to a net loss of $5.3 million, or $0.04 per share, in the same

period of 2006. Six Month Results The Company had revenue of $19.1

million for the first six months of 2007, compared to revenue of

$26.6 million for the first six months of 2006. The net loss was

$15.4 million, or $0.12 per common share, in the first six months

of 2007, compared to a net loss of $25.1 million, or $0.19 per

common share, for the same period in 2006. Included in these

results were substantial non-cash items which are described below

under "Non-GAAP Proforma Results." On a non-GAAP proforma basis,

adjusted for these non-cash items, the net loss was $18.1 million,

or $0.14 per share, in the first six months of 2007 compared to a

net loss of $8.7 million, or $0.07 per share, in the same period of

2006. The Company had $36.6 million in cash resources (comprised of

cash, cash equivalents and short-term investments) at June 30,

2007. Monogram's Trofile Assay and Pfizer's maraviroc "We are

encouraged by the outlook for maraviroc and our Trofile Assay,"

said William Young, Monogram chief executive officer. "Pfizer

reported in June that it received an approvable letter for

maraviroc from the FDA and is continuing to discuss labeling

issues. We look forward to Pfizer resolving these issues so that we

can commercialize Trofile in concert with Pfizer's launch of

maraviroc." Earlier this week, Pfizer reported positive clinical

results from a separate phase III trial of maraviroc in

treatment-naive patients. These latest data follow the positive

safety and efficacy data presented by Pfizer in February 2007 at

the Conference on Retroviral and Opportunistic Infections (CROI)

and the unanimous recommendation in April by an FDA advisory panel

that maraviroc be approved for use in treatment-experienced

patients with CCR5- tropic HIV-1. The data presented by Pfizer at

CROI was based on 24 week follow up in the phase III trials of

maraviroc, and Pfizer has now reported that these results have been

confirmed by the 48 week follow up data. "Our Trofile Assay is

primed and ready for commercialization in the U.S. as soon as

Pfizer's maraviroc receives FDA approval. Our national commercial

organization of over 50 people, including a 33 person national

field force, has been trained and is ready to communicate the value

of Trofile," continued Young. "For many years, we have served the

HIV physician and patient communities by providing resistance tests

that have become an integral part of managing HIV therapy. We now

look forward to providing the only assay that has been clinically

demonstrated to identify a patient's tropism and thereby guide

decisions about the use of Pfizer's maraviroc as a relevant

addition to the patient's therapy." Monogram believes that tens of

thousands of patients each year in the U.S. potentially could be

candidates for new classes of HIV drugs such as maraviroc. Outside

of the U.S., Pfizer reported last week that the Committee for

Medicinal Products for Human Use (CHMP) of the European Medicines

Agency (EMEA) has issued a positive opinion recommending marketing

authorization for maraviroc. A final decision from the European

Commission, which has the authority to approve medications for the

European Union, is expected within months. VeraTag(TM) Assays for

Oncology "In June, at ASCO, we presented the first clinical data

generated by our novel assays in oncology," added Young. "As we

move into a new phase of the evolution of this technology we have

adopted the brandname VeraTag, for our proprietary platform

formerly known as eTag. Monogram made three presentations at the

American Society of Clinical Oncology (ASCO) in June. Two

presentations involved VeraTag testing in two separate clinical

cohorts of Herceptin-treated patients with metastatic breast

cancer. These presentations demonstrated the ability of the VeraTag

assay to identify different sub-populations of patients with

different clinical outcomes on Herceptin, whether they were

selected by IHC or FISH. The third presentation demonstrated the

ability of the VeraTag assay to identify elevated heterodimer

levels that correlated with Herceptin resistance in cell lines. "We

believe that these studies suggest the power of our VeraTag

technology to significantly improve the information available to

physicians in making treatment decisions and also provide direction

for our first VeraTag product opportunities," added Young. "We

expect that our first VeraTag products will be directed at

predicting response in metastatic breast cancer patients to

targeted drugs such as Herceptin(R). Less than 50% of patients

selected for treatment with Herceptin by currently available tests

(IHC and/or FISH) actually respond. In addition, based on data

presented at ASCO by other investigators, there is growing concern

that currently available tests may miss some patients who can

benefit from Herceptin. Tests that can more accurately identify

which patients are likely to benefit from Herceptin are needed. The

data we presented at ASCO suggest that the VeraTag assay can help

solve this problem, and we are hard at work generating more data to

confirm these observations. We have now reported two cohorts, with

a total of almost 150 patient samples, in which we have identified

consistent relationships between VeraTag measurements and clinical

outcomes. A third cohort has been analyzed and showed similar

results. Building on these three clinical cohorts involving a total

of nearly 250 patients, we are obtaining additional samples for the

purpose of validating clinical cutoffs that can be used to improve

patient selection for Herceptin and enhance the management of HER2

positive breast cancer." "Our specific goals now are to publish

these initial studies and to test the predictive ability of the

VeraTag assay in additional cohorts of metastatic breast cancer as

we move toward commercialization," continued Young. The assays on

which the recent presentations at ASCO were based are undergoing

technical validation in the Company's CLIA-certified clinical

laboratory and CLIA validation is expected to be completed during

the third quarter of 2007. Capital Structure At June 30, 2007, a

total of 132.2 million shares of common stock were outstanding.

Stock options and warrants are outstanding on 21.8 million shares

and 0.7 million shares of common stock, respectively. The principal

amount of Pfizer's $25 million convertible note, issued in May

2006, is convertible into approximately 9.2 million shares of

common stock. The $30 million principal amount of our 0%

Convertible Senior Unsecured Notes, issued in January 2007, is

convertible into approximately 11.9 million shares of common stock.

Non-GAAP Proforma Results The Company is reporting non-GAAP

proforma results which exclude certain items to provide a clearer

view of ongoing expenses without the impact of non- cash valuation

adjustments related to our convertible debt in 2007 and to our CVRs

in 2006. A reconciliation of these non-GAAP proforma results to

GAAP results is included with the Statement of Operations data

attached to this release. In prior years, we have reported non-GAAP

proforma information that excludes the effect of stock

compensation, since there was a lack of comparability in the

information reported in our statement of operations for stock

compensation under different accounting rules in 2005 and 2006.

However, since for 2007, the statement of operations for the

current year and the immediately preceding year are both presented

on the same basis in accordance with SFAS123( R ) we are no longer

excluding these non- cash items from proforma net loss. Stock-based

compensation in accordance with SFAS123( R ) was $1.1 million in

the second quarter of 2007, compared to $1.5 million in the prior

year's second quarter. The following non-cash items that were

reflected in non-operating income and expense for the periods ended

June 30, 2007 and 2006 are excluded from proforma net loss: --

"Mark-to-market" adjustments to the 3% Senior Secured Convertible

Note and the 0% Convertible Senior Unsecured Debt. Favorable

adjustments of $4.5 million and $0.4 million were recorded in the

three and six months ending June 30, 2007, respectively. There were

no such adjustments in the prior year, although a favorable

adjustment of $2.2 million was recorded in the first quarter of

2007 for the cumulative effect of the change in accounting

principle at January 1, 2007. Such adjustments could be significant

and unpredictable in future quarters depending on several factors,

including the level of the Company's common stock price. --

"Mark-to-market" adjustments in 2006 to the liability established

for the payment on the CVRs issued as part of the merger

consideration for ACLARA. As the outstanding CVR's were settled in

the second quarter of 2006, adjustments are not relevant for third

and fourth quarters of 2006 or for 2007. An unfavorable adjustment

of $16.5 million was recorded in the three and six months ended

June 30, 2006. Conference Call Details Monogram will host a

conference call today at 4:30 p.m. Eastern Time. To participate in

the live teleconference please call (800) 817 2743 or (913) 981

4915 for international callers, fifteen minutes before the

conference begins. Live audio of the call will be simultaneously

broadcast over the Internet and will be available to members of the

news media, investors and the general public. Access to live and

archived audio of the conference call will be available by

following the appropriate links at http://www.monogrambio.com/ and

clicking on the Investor Relations link. Following the live

broadcast, a replay of the call will also be available at (888)

203-1112, or (719) 457-0820 for international callers. The replay

passcode is 3750409. The information provided on the teleconference

is only accurate at the time of the conference call, and Monogram

assumes no obligation to provide updated information except as

required by law. About Monogram Monogram is advancing

individualized medicine by discovering, developing and marketing

innovative products to guide and improve treatment of serious

infectious diseases and cancer. The Company's products are designed

to help doctors optimize treatment regimens for their patients that

lead to better outcomes and reduced costs. The Company's technology

is also being used by numerous biopharmaceutical companies to

develop new and improved anti-viral therapeutics and vaccines as

well as targeted cancer therapeutics. More information about the

Company and its technology can be found on its web site at

http://www.monogrambio.com/. Forward Looking Statements Certain

statements in this press release and attached supplemental

information are forward-looking. These forward-looking statements

include references to the availability of our Trofile Assay for

commercial introduction, the potential need for our Trofile Assay

for patient selection for maraviroc, potential FDA and European

Commission approval and labeling provisions for maraviroc, the

outlook for maraviroc and our Trofile Assay, the number of patients

each year in the U.S. who potentially could be candidates for new

classes of HIV drugs such as maraviroc, the ability of VeraTag

technology to significantly improve the information available to

physicians, plans for further development of the VeraTag technology

and products and anticipated clinical and laboratory validation of

VeraTag in a CLIA setting, expected protection provided by patents,

possible regulation of Trofile and our other products by the FDA,

and activities expected to occur in connection with the Pfizer

collaboration. These forward-looking statements are subject to

risks and uncertainties and other factors, which may cause actual

results to differ materially from the anticipated results or other

expectations expressed in such forward-looking statements. These

risks and uncertainties include, but are not limited to: the risk

that maraviroc will not be approved by the FDA; the risk that

regulatory authorities may not require or recommend a molecular

diagnostic for patient selection for maraviroc or other HIV drugs;

risks related to the implementation of the collaboration with

Pfizer; risks related to our ability to recognize revenue from

activities under the collaboration with Pfizer; risks and

uncertainties relating to the performance of our products; the

growth in revenues; the size, timing and success or failure of any

clinical trials for CCR5 inhibitors, entry inhibitors or integrase

inhibitors; the risk that our Trofile Assay may not be utilized for

patient use in the event of approval of any CCR5 inhibitors; the

risk that our VeraTag assays may not predict response to particular

therapeutic agents; the risk that we may not be able to obtain

additional cohorts of patient samples for additional VeraTag

studies, our ability to successfully conduct clinical studies and

the results obtained from those studies; whether larger

confirmatory clinical studies will confirm the results of initial

studies; our ability to establish reliable, high-volume operations

at commercially reasonable costs; expected reliance on a few

customers for the majority of our revenues; the annual renewal of

certain customer agreements; actual market acceptance of our

products and adoption of our technological approach and products by

pharmaceutical and biotechnology companies; our estimate of the

size of our markets; our estimates of the levels of demand for our

products; the impact of competition; the timing and ultimate size

of pharmaceutical company clinical trials; whether payers will

authorize reimbursement for our products and services; whether the

FDA or any other agency will decide to further regulate our

products or services, including Trofile; whether the draft guidance

on Multivariate Index Assays issued by FDA will be subsequently

determined to apply to our current or planned products; whether we

will encounter problems or delays in automating our processes; the

ultimate validity and enforceability of our patent applications and

patents; the possible infringement of the intellectual property of

others; whether licenses to third party technology will be

available; whether we are able to build brand loyalty and expand

revenues; restrictions on the conduct of our business imposed by

the Pfizer, Merrill Lynch and other debt agreements; the impact of

additional dilution if our convertible debt is converted to equity;

and whether we will be able to raise sufficient capital in the

future, if required. For a discussion of other factors that may

cause actual events to differ from those projected, please refer to

our most recent annual report on Form 10-K and quarterly reports on

Form 10-Q, as well as other subsequent filings with the Securities

and Exchange Commission. We do not undertake, and specifically

disclaim any obligation, to revise any forward-looking statements

to reflect the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements. PhenoSense,

PhenoSenseGT, Trofile, VeraTag and eTag are trademarks of Monogram

Biosciences, Inc. Herceptin is a registered trademark of Genentech,

Inc. MONOGRAM BIOSCIENCES, INC. SELECTED STATEMENT OF OPERATIONS

DATA (In thousands, except per share amounts) (Unaudited) Three

Months Ended Six Months Ended June 30, June 30, 2007 2006 2007 2006

Revenue: Product revenue $8,907 $12,757 $18,006 $25,003 Contract

revenue 485 620 803 1,623 License revenue 300 - 300 - Total revenue

9,692 13,377 19,109 26,626 Operating costs and expenses: Cost of

product revenue 5,327 5,664 11,032 11,345 Research and development

5,176 5,208 10,507 9,783 Sales and marketing 4,159 4,067 8,102

7,445 General and administrative 3,629 4,282 7,857 7,863 Total

operating costs and expenses 18,291 19,221 37,498 36,436 Operating

loss (8,599) (5,844) (18,389) (9,810) Convertible debt valuation

adjustment and interest income/ (expense), net 4,727 544 717 1,143

CVR valuation adjustment - (16,464) - (16,450) Net loss before

cumulative effect of change in accounting principle (3,872)

(21,764) (17,672) (25,117) Cumulative effect of change in

accounting principle - - 2,242 - Net loss after cumulative effect

of change in accounting principle $(3,872) $(21,764) $(15,430)

$(25,117) Basic and diluted net loss per common share before

cumulative effect of change in accounting principle $(0.03) $(0.17)

$(0.13) $(0.19) Cumulative effect per share of change in accounting

principle $- $- $0.01 $- Basic and diluted net loss per common

share after cumulative effect of change in accounting principle

$(0.03) $(0.17) $(0.12) $(0.19) Weighted-average shares used in

computing basic net loss per common share 132,026 130,348 131,805

129,983 Reconciliation of Non-GAAP Proforma Results to GAAP Net

loss after cumulative effect of change in accounting principle

$(3,872) $(21,764) $(15,430) $(25,117) Adjustments for certain

non-cash items: Cumulative effect of change in accounting principle

- - (2,242) - CVR valuation adjustment - 16,464 - 16,450

Convertible debt valuation adjustment (4,463) - (408) - Non-GAAP

Proforma net loss (8,335) (5,300) (18,080) (8,667) Non-GAAP

Proforma net loss per common share, basic $(0.06) $(0.04) $(0.14)

$(0.07) Management believes that this non-GAAP proforma financial

data supplements the Company's GAAP financial statements by

providing investors with additional information which allows them

to have a clearer picture of the Company's operations, financial

performance and the comparability of the Company's operating

results from period to period as they exclude the effects in 2007

of revaluation of the Company's convertible debt and the effects in

2006 of revaluation of the contingent value rights issued in

connection with the Company's merger with ACLARA that management

believes are not indicative of the Company's ongoing operations.

The presentation of this additional information is not meant to be

considered in isolation or as a substitute for results prepared in

accordance with GAAP. Above, management has provided a

reconciliation of the non-GAAP proforma financial information with

the comparable financial information reported in accordance with

GAAP. MONOGRAM BIOSCIENCES, INC. SELECTED BALANCE SHEET DATA (In

thousands) (Unaudited) June 30, December 31, 2007 2006 ASSETS (Note

1) Current assets: Cash and cash equivalents $14,712 $8,263

Short-term investments 21,853 22,867 Accounts receivable, net 7,991

6,849 Prepaid expenses 1,080 1,234 Inventory 1,073 961 Other

current assets 634 378 Total current assets 47,343 40,552 Property

and equipment, net 7,661 7,463 Goodwill 9,927 9,927 Deferred costs

3,687 1,783 Other assets 876 1,120 Total assets $69,494 $60,845

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts

payable $1,849 $1,271 Accrued compensation 3,420 2,258 Accrued

liabilities 3,994 4,720 Current portion of restructuring costs 637

1,128 Deferred revenue, current portion 689 404 Current portion of

loans payable and capital lease obligations 5,607 6,355 Contingent

value rights 2,828 2,813 Total current liabilities 19,024 18,949

Long-term 3% convertible promissory note 21,959 25,000 Long-term 0%

convertible promissory note 21,136 - Long-term portion of

restructuring costs 579 868 Long-term deferred revenue 4,106 1,783

Other long-term liabilities 375 337 Total liabilities 67,179 46,937

Stockholders' equity: Common stock 132 131 Additional paid-in

capital 281,620 277,892 Accumulated other comprehensive loss (16)

(124) Accumulated deficit (279,421) (263,991) Total stockholders'

equity 2,315 13,908 Total liabilities and stockholders' equity

$69,494 $60,845 (1) The balance sheet data at December 31, 2006 is

derived from audited financial statements included in the Company's

Annual Report on Form 10-K for the year ended December 31, 2006

filed with the Securities and Exchange Commission. MONOGRAM

BIOSCIENCES, INC. SUPPLEMENTAL INFORMATION To provide additional

insights to investors, the following information is provided in a

question and answer format. HIV 1. What is the status of the

opportunity in the U.S. for Monogram's Trofile Assay with Pfizer's

maraviroc? Pfizer received an approvable letter from the U.S. Food

and Drug Administration (FDA) for maraviroc on June 20. This

followed a unanimous recommendation, from the FDA Antiviral Drugs

Advisory Committee that maraviroc be approved for use along with

other antiretroviral agents for treatment-experienced adult

patients infected with CCR5-tropic HIV-1. Pfizer indicated that it

was in continuing discussions with FDA regarding open questions and

labeling, and that no additional clinical data was being requested

by FDA. If approved, maraviroc would be the first member of a new

class of oral HIV medicines in more than a decade. Monogram's

Trofile(TM) Assay has been used to select patients for the clinical

trials of maraviroc. The CCR5 class of drug blocks the use by HIV

of the patient's CCR5 co- receptor, if this co-receptor is being

used for entry by HIV into cells. In later stage patients, the CCR5

co-receptor is in use only in approximately half of patients.

Accordingly, knowing whether the CCR5 co-receptor is being used by

HIV in a particular patient is critical for drug efficacy, and

potentially for drug safety. Information provided by Pfizer to the

advisory panel indicates that "the results in treatment-experienced

patients with CCR5-tropic versus non CCR5-tropic HIV-1 provide

clinical data validating Monogram's Trofile Assay as an effective

and appropriate means to identify patients with CCR5-tropic HIV-1

and who are therefore likely to respond to maraviroc." Pfizer's

submission to the FDA was based on the clinical results from two

phase III trials, for which 24 week follow up results were reported

in February, 2007. Pfizer has reported in July, 2007 that 48 week

follow up data has confirmed the previously reported results. We,

and Pfizer, await FDA action on maraviroc. We anticipate that

maraviroc may be approved by the FDA soon, although this is not

assured. While the ultimate drug labeling will not be known till

maraviroc is approved, there was extensive discussion in the FDA

panel meeting regarding the Trofile Assay and we believe there may

be a role for our test in clinical use of maraviroc after approval.

We have begun working with public and private payers to achieve

coverage and reimbursement by these payers. Operationally, our

clinical lab is prepared for the potential commercial introduction

of Trofile. Over 23,000 Trofile Assays have been performed since

2004 in Monogram's CLIA certified laboratory. After approval, all

Trofile Assays will be run in this same clinical laboratory.

Currently our turnaround time in performing the Trofile Assay, like

our phenotypic resistance tests, is approximately two weeks.

Trofile is the only diagnostic demonstrated in clinical studies to

identify whether patients are CCR5-tropic and has been used in all

clinical trials of CCR5 antagonists to date. In addition, Monogram

performs tens of thousands of phenotypic and genotypic resistance

tests annually, including the PhenoSenseGT(TM) assay that was used

to optimize background therapy in the clinical trials of maraviroc.

We are ready to make our Trofile Assay available commercially as

soon as maraviroc is approved. We intend to bring Trofile to the

HIV physician community through our direct sales and marketing

channels throughout the U.S. These channels have been used

successfully for our phenotypic and genotypic resistance tests and

we believe that this existing sales and marketing organization,

comprising over 50 sales, marketing and support personnel, is well

placed to communicate the value of Trofile to physicians. While the

pending FDA submission for maraviroc relates to its use in

treatment-experienced patients, an additional phase III study (the

MERIT study) has been conducted by Pfizer in treatment-naive

patients and in July 2007, Pfizer reported the results of this

study in Sydney at the International AIDS Society Meeting. Pfizer

reported favorable safety and efficacy data in the MERIT trial. The

primary analyses of the 48 week data indicate that treatment na�ve

subjects treated with a maraviroc-containing regimen as a first

course of therapy responded well, as measured by suppression of HIV

replication and gains in CD4+ T-cell counts. The results of the

MERIT study also reinforce the favorable safety profile of

maraviroc that was previously demonstrated in the treatment

experienced population. 2. What about the CCR5 class as a whole?

Other CCR5 antagonists are in development. The most advanced of

these is Schering Plough's vicriviroc, which is in ongoing clinical

development. In July 2007 at the International Aids Society meeting

in Sydney, Schering reported that that results from a Phase II

clinical trial showed that vicriviroc, demonstrated potent and

sustained viral suppression through 48 weeks of therapy in

treatment-experienced HIV patients. Schering also stated that based

on results from its Phase II clinical trials, they will select a

dose of vicriviroc to move forward into Phase III clinical

development in treatment-experienced patients. As with Pfizer's

studies of maraviroc, Schering used our Trofile Assay to select

patients and our phenotypic tests to optimize background therapy

for their studies of vicriviroc. Our testing services have been

used in all clinical programs of CCR5 antagonists conducted to

date, for patient selection and monitoring utilizing our Trofile

Assay, and for optimization of patients' background treatment

regimens utilizing our PhenoSenseGT test. 3. What is the nature of

the collaboration agreement with Pfizer? The collaboration

agreement announced in May 2006 provides a framework in which

Pfizer and Monogram are collaborating to make our Trofile Assay

available globally. This collaboration puts in place arrangements

that are designed to make sure that the test can be available in

countries outside of the U.S. where Pfizer, after regulatory

approval, wishes to commercialize maraviroc. The agreement covers

commercialization of Trofile outside the U.S., where Pfizer will

take the lead in commercializing the assay. In the U.S., Monogram

will be responsible for all aspects of commercializing Trofile. 4.

What are the economic aspects of the agreements with Pfizer? There

are two separate aspects to the arrangements with Pfizer. The first

was a $25 million financing that is described in the Financial

section of this Q&A. The second is a collaboration that is

designed to make Trofile available globally. Outside of the U.S.

Pfizer will lead the commercial effort and so will be responsible

for, and incur the costs of marketing, sales, reimbursement and

regulatory matters. We will be responsible for logistics and

medical education in those countries where Pfizer elects to market

maraviroc. However, Pfizer will reimburse us for all of our costs

incurred in these activities. These costs are potentially

substantial, but, due to Pfizer's funding obligation, is not

expected to place a burden on our cash flows. Through the second

quarter of 2007, such costs amounted to $3.7m. Pfizer will also buy

tests from Monogram. For details of how revenue and expenses will

be recognized for this collaboration, refer to the Financial

section of this Q&A. 5. How does the collaboration with Pfizer

affect the U.S. market? While we are working collaboratively with

Pfizer's commercial organization, we have full control over our

U.S. marketing activities. We will independently set our commercial

price for the Trofile Assay and obtain reimbursement for the assay.

We have already had initial discussions with some of the larger

public and private payers to introduce Trofile and its potential

value in clinical use of CCR5 antagonists. Our goal is to achieve

appropriate coverage and reimbursement as soon as possible after

drug approval. Refer also to question 1 above. 6. What is the

status of the opportunity internationally for Monogram's Trofile

Assay with Pfizer's maraviroc? In the European Union, Pfizer made a

submission to the E.U. authorities for regulatory approval

simultaneously with the FDA submission. Pfizer announced in July

2007 that the Committee for Medicinal Products for Human Use (CHMP)

of the European Medicines Agency (EMEA) issued a positive opinion

recommending marketing authorization for maraviroc for use in

combination with other antiretroviral agents for treatment-

experienced patients infected with CCR5-tropic HIV-1. The CHMP's

positive opinion will be reviewed by the European Commission, which

has authority to approve medicines for the European Union. Pfizer

anticipates a final decision from the Commission in the coming

months. In our collaboration with Pfizer described above, we have

been engaged in planning for commercial availability of Trofile in

those countries identified by Pfizer for commercial launch. Our

responsibility is to implement the logistical arrangements for

blood samples to be delivered from local markets to our lab in

South San Francisco for processing. Pfizer is responsible for

reimbursing us for all of our costs incurred in establishing and

operating the logistics infrastructure. We are well advanced in the

initial countries identified by Pfizer and expect to be ready to

make Trofile available in as many as eight countries outside the

U.S. by the end of this year, should regulatory approval be

obtained. Planning is under way in 40 additional countries. 7. What

is the significance of the integrase class of HIV drugs to

Monogram's business? Our tests have been used in the clinical

development programs of the new integrase drugs for optimization of

background therapy, prior to addition of the new investigational

drug. We also have an assay available for research use in assessing

resistance to integrase inhibitors. This assay will be available as

a CLIA approved test when clinically relevant after the potential

approval of the drugs. Monogram's current resistance tests assess

resistance of patients' virus to the existing classes of drugs,

including the one currently marketed entry inhibitor, Fuzeon(R)

from Roche. The advent of CCR5 antagonists and integrase inhibitors

add both to the richness of potential treatment options for

patients and also to the potential testing opportunity for

Monogram. For us, this means opportunity not only for our current

genotypic and phenotypic tests but also for our new class-specific

resistance tests for these classes. As the range of therapeutic

options becomes more varied and complex, we believe that the need

for sophisticated testing will increase. 8. What is the proprietary

nature of your tests for tropism and HIV entry? Our tropism and

entry tests are covered by our fundamental patents for phenotypic

analysis. In addition, in May 2006 we received four notices of

allowance from the U.S. Patent Office related to the use of

Monogram's PhenoSense(TM) technology for assessing the likely

efficacy of entry inhibitors, a new class of drug that prevents HIV

from entering cells. All four of these patents have subsequently

issued. Monogram's tests measure co-receptor tropism and the

susceptibility or resistance of HIV to entry inhibitors, critical

elements in the development and use of these new drugs. The

phenotypic approach covered by these allowed patents is able to

directly and accurately assess the susceptibility or resistance of

a patient's HIV to entry inhibitors, and to determine to what

extent a patient's virus is able to gain entry into cells via one

or other, or a mixture, of the two major co-receptors, CCR5 or

CXCR4, that are used in conjunction with the virus' primary

receptor, CD4. The allowed patents cover an approach that is able

to directly assess resistance to entry inhibitors, the

identification of co-receptor usage, screening for new entry

inhibitor compounds and an antibody response capable of blocking

infection. Monogram's assays utilizing these methods include the

PhenoSense Entry Assay that assesses resistance of HIV to all

classes of entry inhibitor drugs and the Trofile Assay that

identifies the ability of a patient's HIV to enter cells using

specific co-receptors such as CCR5. We believe these patents are

important because the envelope region of the virus (the area

involved in cell entry) has a particularly heterogeneous genetic

sequence. This renders genotypic methods significantly less

effective for measuring co-receptor tropism and resistance to

specific viral entry inhibitors, giving Monogram's phenotypic

methods significant advantages. 9. Is there published data

available related to your Trofile Assay? In February 2007, Pfizer

reported the results of its phase III studies of maraviroc in

treatment-experienced patients at the 14th Conference on

Retroviruses and Opportunistic Infections (CROI). A 24 week

analysis showed that approximately twice as many patients receiving

maraviroc with an optimized background regimen achieved

undetectable virus in the blood than if an optimized regimen was

given alone. In addition, patients receiving maraviroc and an

optimized regimen saw an increase in CD4 cells nearly twice that

seen in those receiving optimized regimen alone. Adverse events in

the group receiving maraviroc plus an optimized regimen were

similar to those receiving an optimized regimen alone when adjusted

for duration of exposure. Pfizer reported that the data from the

two identical studies are remarkably consistent and demonstrate

significant decreases in viral load and increases in CD4 cells when

maraviroc is added to the standard optimized treatment regimen.

These results were obtained by utilizing Monogram's Trofile test to

confirm in advance whether a patient is infected with CCR5-tropic

HIV. Pfizer has reported in July 2007 that the 48 week follow up

data has confirmed the previously reported 24 week results. In July

2007, Pfizer reported the results of its phase III trial (the MERIT

trial) in treatment-na�ve patients in Sydney at the International

AIDS Society Meeting. Pfizer reported favorable safety and efficacy

data in the MERIT trial. The primary analyses of the 48 week data

indicate that treatment na�ve subjects treated with a maraviroc-

containing regimen as a first course of therapy responded well, as

measured by suppression of HIV replication and gains in CD4+ T-cell

counts. The results of the MERIT study also reinforce the favorable

safety profile of maraviroc that was previously demonstrated in the

treatment experienced population. Previously, four studies

demonstrating the utility and clinical significance of our Trofile

Assay were presented in August 2006 at the XVI International AIDS

Conference in Toronto. The first study, presented by Monogram

scientists, confirmed that the Trofile Assay can accurately

characterize the tropism of a panel of diverse HIV strains. Our

scientists used the assay to evaluate the co- receptor tropism of a

panel of 46 well-characterized strains of HIV-1 that included

multiple subtypes (CCR5, CXCR4, or dual/mixed tropism (DM)). The

assay accurately measured the tropism of all 46 strains. The assay

also was accurate when tested against three clonal viruses (CCR5,

CXCR4 and DM). When CCR5 and CXCR4 clones were mixed together, the

assay was able to detect minor variants down to 10 percent in all

samples tested, and to 5 percent in 83 percent of samples tested.

The data show that Monogram's Trofile Assay is an accurate,

precise, sensitive, reproducible and robust assay for the

measurement of tropism and support its use as the standard assay

for patient screening and monitoring in the development of

co-receptor antagonists. The second study, also presented by

Monogram scientists, compared the abilities of V3 sequencing and

Monogram's Trofile Assay to accurately characterize tropism. V3

sequencing examines the genetic sequence of only the V3 region of

the envelope gene of HIV taken from a patient and uses algorithms

to predict co-receptor tropism. The Trofile Assay uses the entire

envelope gene taken from the patient's virus to measure viral

tropism directly. The study used patient-derived virus sequences

representing multiple subtypes of HIV-1, and found that sensitivity

for detection of viruses using the CXCR4 co-receptor varied widely

depending on viral sub-type and on the interpretation system used.

In comparison to phenotypic analysis with Trofile, which accurately

and directly measures co-receptor usage, genotypic measures, on

average, were only approximately 65% accurate, and in many cases

were even less accurate. These results demonstrate that genotypic

approaches are inferior for assessing tropism when compared with

Trofile. This is because the region of the virus involved in

cellular entry has a particularly heterogeneous genetic sequence,

which renders genotypic methods significantly less effective. In a

study presented by scientists from Pfizer, Inc., the negative

predictive value of Monogram's Trofile Assay was assessed in an

ongoing Phase III trial of Pfizer's investigational CCR5

antagonist, maraviroc (Study 1029). Results showed that patients

identified by the assay as having virus using BOTH the CXCR4 and

CCR5 receptors (dual/mixed tropic) did not respond to the

investigational (CCR5) therapy. These data suggest that screening

patients with the Trofile Assay will allow physicians to avoid

treating patients with expensive drug therapy who are unlikely to

respond to that therapy. A study presented by investigators from

the AIDS Clinical Trial Group 5211 study team and Schering Plough

demonstrated the positive predictive value of the assay in patients

participating in a Phase IIb trial of Schering-Plough's

investigational CCR5 antagonist vicriviroc. In this study, patients

identified by the assay as having virus utilizing only the CCR5

co-receptor demonstrated clinical responses to the investigational

therapy. These two studies involving Pfizer's maraviroc and

Schering Plough's vicriviroc, suggest that the Trofile Assay is an

effective method of identifying appropriate patients for treatment

with CCR5 antagonists. By virtue of its high positive and negative

predictive values, the Trofile Assay is highly capable of ensuring

that individuals receive treatments that are most likely to provide

them with clinical benefit. 10. What will be the impact of possible

FDA regulation? In September 2006, the FDA issued draft guidance

related to the regulation of certain kinds of test provided through

CLIA labs. This draft guidance was subject to public comment and a

revised draft was issued in July 2007. This is also subject to

public comment and may be revised before being finalized. We do not

believe that the guidance is intended to regulate all CLIA-based

lab tests. Rather it appears to be focused on a subset of tests

referred to as IVD Multivariate Index Assays where multiple

variables are combined using an interpretation function to yield a

single patient-specific result whose derivation is non-transparent

to end-users. With regard to our HIV business, we do not currently

believe that our products will be affected by this draft guidance

for the following reasons: * First, our phenotypic resistance tests

and our co-receptor tropism test are all direct biological

measurements and are not the kind of "black box" algorithms on

which the draft guidance appears to be focused * Second, genotypic

HIV tests are explicitly mentioned as not being covered by the

draft guidance * Third, with respect to our Trofile Assay, because

of the role of our Trofile Assay in the phase II and phase III

clinical evaluation of CCR5 antagonists, we have had direct

interactions with the FDA and in 2004 filed a Master File on our

Trofile Assay with the FDA which provided the agency substantial

performance characteristics and validation data on the Trofile

Assay. FDA has verbally concurred with our assessment that Trofile

does not fall within the draft guidance. However, because of the

significance of Trofile to use of maraviroc, the FDA, during the

advisory panel meeting, expressed an interest in the regulatory

status of the assay and it is not clear what regulatory approach

the FDA may take. The FDA has, however, indicated that it does not

intend to take precipitous regulatory action that would delay the

availability of maraviroc to patients. It remains unclear what

action the FDA may take in this regard. With regard to our

potential VeraTag products for oncology, we will continue to

monitor the evolution of the regulatory situation and will be

actively engaged in the process both through direct interaction

with the FDA and through trade groups. Our VeraTag assays are

currently designed to make direct biological measurements of

proteins and protein dimers and facilitate predictions based on a

clear biological rationale. As such, they may be viewed as

different from the "black box" algorithm based tests that the draft

guidance is intended to reach, though at this time we cannot make

this determination. However, in the evolving area of molecular

diagnostics, it is not clear when or what delineations will be made

in determining applicability of the draft guidance once finalized

and we are currently unable to predict the applicability of such

final guidelines or whether any additional regulations will be

proposed which might impact our current or future products.

Oncology 11. What is VeraTag technology? How will VeraTag assays be

used? Our VeraTag assays enable detailed analysis of activated

protein drug targets and signaling pathways in cancer cells,

including FFPE samples, which is the standard format in most

pathology labs. The unique capability of eTag assays is the ability

to directly measure, quantitatively and precisely, activated

pathway status by measuring protein complexes, not just indirect

measures such as gene mutations and gene expression levels. The

assays are designed to provide information on a drug's mechanism of

action, selectivity and potency in a biological setting in

pre-clinical research, and enable enrichment or selection of

clinical trial populations later in a drug's development. In

addition, we believe these assays may ultimately be used to help

physicians better determine whether certain therapies are more

appropriate for individual cancer patients, and whether to combine

therapies with different mechanisms or properties for such

patients. 12. What is the status of your clinical studies for the

VeraTag EGFR/HER test panel? In June 2007, we presented the first

clinical data generated by our novel VeraTag assays in oncology at

the American Society of Clinical Oncology (ASCO). Two presentations

involved VeraTag testing in two separate clinical cohorts, for a

total of almost 150 Herceptin- treated patients with metastatic

breast cancer. These presentations demonstrated the ability of the

VeraTag assay to identify different sub-populations of patients

with different clinical outcomes on Herceptin, whether they were

selected by IHC or FISH. A third presentation demonstrated the

ability of the VeraTag assay to identify elevated heterodimer

levels that correlated with Herceptin resistance in cell lines. We

believe that these studies suggest the power of our VeraTag

technology. Our goals now are to publish these initial studies and

to conduct and publish analyses of additional metastatic patient

cohorts. One of the planned additional cohorts, involving almost

100 metastatic breast cancer patients, has already been tested and

the results are consistent with prior observations. These three

cohorts, totaling almost 250 patients, suggest that VeraTag Assays

can significantly improve the information available to physicians

in managing patient therapies in metastatic breast cancer.

Additional samples are targeted to confirm these observations. 13.

What is the CLIA status of your VeraTag assays? The assays on which

the recent presentations at ASCO were based are undergoing

technical validation in the Company's CLIA certified clinical

laboratory and CLIA validation is expected to be completed during

the third quarter of 2007. 14. What will your first commercial

oncology product be? We expect that our first products will be

directed at predicting response in metatstatic breast cancer

patients to targeted drugs such as Herceptin(R). Less than 50% of

patients selected for treatment with Herceptin by currently

available tests (IHC and/or FISH) respond. In addition, there is

growing concern that poor implementation coupled with the

insensitive nature of these currently available tests leads to some

patients being incorrectly identified as HER2 negative and being

denied Herceptin, when in fact they may be appropriate candidates

for the drug. We believe there is an important clinical need for

enhanced information such as that demonstrated in our presentations

at ASCO. We intend that our portfolio of assays for the EGFR/Her

pathway will ultimately include assays that measure the levels of

individual receptor monomers (HER1, HER2 and HER3); receptor

homo-dimers (HER1:HER1, and HER2:HER2); and hetero-dimers

(HER1:HER2, HER2:HER3), and assays for various modified forms of

these receptors, (e.g. p95/HER2). In time, we plan to have a broad

portfolio of assays that provide comprehensive information for

drugs targeting individual protein components of the EGFR/HER

pathway so that physicians will be able to detect resistance early

and make better choices for their patients. These choices may

involve not only decisions about individual drugs, but also about

combinations of drugs. Our initial focus has been breast cancer

where Herceptin has been marketed for several years, Tykerb has

recently been approved, and other drugs are in development. In

breast cancer, there may be two opportunities based on evolving

treatment settings for Herceptin. One is the opportunity for a

better test to support the design of treatment regimens, for

advanced disease, that contain Herceptin, chemotherapy and

potentially other agents. A second and potentially larger

opportunity may be for an improved test (in relation to existing

FISH and IHC tests) to support the design of treatment regimens in

patients with early stage disease, again looking at likely efficacy

of targeted agents like Herceptin and chemotherapeutics. 15. What

happened to "eTag"? We view the presentation of our first clinical

data at ASCO in June 2007 as a very important event in the

evolution of the technology, and as we move into a new phase of the

evolution of this technology we felt it appropriate to evaluate the

appropriate brand for our proprietary platform. The brandname we

selected is VeraTag. Financial 16. What has been your use of cash?

The following table summarizes elements of cash flow in 2006 and

the first half of 2007. 2006 2007 $ millions Q1 Q2 Q3 Q4 Q1 Q2 Cash

provided by (used in) operations (1) $0.3 $0.2 $(4.6) $(5.9) $(7.4)

$(6.7) Cash used in CVR settlement - (57.1) - - - - Cash provided

by (used in) investing activities (2) (0.6) (0.8) - (0.2) (0.3)

(1.0) Cash provided by financing activities 2.7 25.4 5.6 1.0 18.9

2.0 $2.4 $(32.3) $1.0 $(5.1) $11.2 $(5.7) (1) Cash used in

operations in 2006 excludes the payment on the CVR liability. (2)

Cash used in investing activities excludes purchase and

maturities/sales of investments. 17. What is your current cash

position? At June 30, 2007 we had cash resources (comprising cash,

cash equivalents, short-term investments) of approximately $36.6

million. 18. What are the details of the two convertible notes on

your balance sheet? Pfizer financing 0% Convertible Senior (May

2006) Unsecured Debt (January 2007) Amount $25m $22.5 m ($30m face

value) Due date May 2010 December 2011 Interest 3%, payable in cash

Zero coupon or common stock Conversion price per share $2.7048

$2.52 "Autoconversion" $4.06 for 20 out of $3.15 for 20 out of

feature if common 30 consecutive 30 consecutive stock trades at

trading days trading days specified level Security HIV assets None

Greater details on these debt arrangements can be found in the

notes to our financial statements in our Form 10K filing with the

SEC. 19. How will revenue and expenses be recognized in relation to

your collaboration with Pfizer? The collaboration involves a number

of elements, including supply of the Trofile Assay in additional

clinical studies (including Pfizer's announced expanded access

program for maraviroc) supply of the Trofile Assay for clinical use

outside of the U.S., reimbursement of costs for the establishment

and operation of supply infrastructure outside of the U.S. and

potential assistance to Pfizer in the establishment and operation

of a second facility for processing of tropism assays. Under

applicable accounting rules, each of these deliverables has to be

separately analyzed to establish an appropriate fair value. Absence

of an established fair value for any undelivered elements requires

a deferral of all other revenue in the arrangements. The

application of these accounting rules requires us to defer all the

revenue until the expiry or termination of the contract, or earlier

completion of the deliverable, due to the absence of an established

fair value for the potential assistance to Pfizer in the

establishment and operation of a second facility for processing of

tropism assays. Costs associated with deferred revenues to date

have also been deferred. The deferrals are included in the balance

sheet as long term deferred revenue of $4.1 million and deferred

costs of $3.7 million. Additional details will be included in our

SEC filings on Form 10Q and 10K. 20. What are the details of the

Line of Credit with Merrill Lynch? In September 2006, we entered

into a Credit and Security Agreement with Merrill Lynch Capital, a

division of Merrill Lynch Business Financial Services Inc. This

revolving credit line provides the Company with a $10 million line

of credit, with borrowings limited by the amount of eligible

accounts receivable, currently approximately $5.4 million. The line

is secured by our accounts receivable, inventory and intellectual

property related to our oncology testing business and is subject to

certain covenants related to the conduct of our business. The

Agreement expires in March 2010. As of June 30, 2007, approximately

$5.4 million was outstanding under the revolving credit line. 21.

What are the trends in your net losses? Our net loss includes

adjustments to fair value for (i) in 2007, our convertible debt,

and (ii) in 2006, the CVR liability for quarters prior to the June

2006 CVR maturity date. The effects of these items have caused and

may cause significant fluctuations from quarter to quarter in net

loss. The table below shows the net loss both in accordance with

GAAP and on a non-GAAP proforma basis, adjusted for these non-cash

items. The convertible debt is stated at fair value as a result of

a requirement to bifurcate, and value, certain derivatives that are

embedded within the convertible debt, such as the option on the

part of the holder to convert the debt to equity. This arises

because of certain provisions of the two convertible debt

securities. Several assumptions will affect future valuations, with

the principle one being the price of our common stock. In the event

that our stock price increases, the future adjustments to fair

value of the convertible debt could be significant and unfavorable.

$ millions 2006 2007 Q1 Q2 Q3 Q4 Q1 Q2 GAAP Net Income (Loss)

$(3.3) $(21.8) $(6.6) $(7.0) $(11.6) $(3.9) Contingent Valuation

Rights Adjustment Included in Non-operating Income/Expense (1) -

16.5 - - - - Cumulative effect of change in accounting principle -

- - - (2.2) - Convertible Debt Valuation Adjustment (2) - - - - 4.1

(4.4) Non-GAAP Proforma Net Loss $(3.3) $(5.3) $(6.6) $(7.0) $(9.7)

$(8.3) (1) Reflects the adjustments to fair value in respect of

CVRs outstanding and in respect of CVRs associated with vested

ACLARA options as of the closing of the merger with ACLARA on

December 10, 2004. (2) Reflects the adjustments to fair value in

respect of the 3% Senior Secured Convertible Debt and the 0%

Convertible Senior Unsecured Debt. contacts: Alfred G. Merriweather

Chief Financial Officer Tel: 650 624 4576 Jeremiah Hall Feinstein

Kean Healthcare Tel: 415 677 2700 DATASOURCE: Monogram Biosciences,

Inc. CONTACT: Alfred G. Merriweather, Chief Financial Officer of

Monogram Biosciences, Inc., +1-650-624-4576, ; Jeremiah Hall of

Feinstein Kean Healthcare, +1-415-677-2700, , for Monogram

Biosciences, Inc.

Copyright

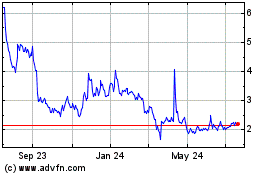

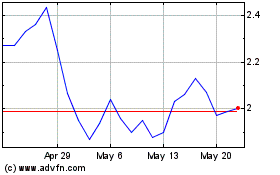

Monogram Technologies (NASDAQ:MGRM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Monogram Technologies (NASDAQ:MGRM)

Historical Stock Chart

From Jul 2023 to Jul 2024