Weekly Bond Issuance Nears Record, Coke Selling Subordinated-Libor Notes

March 09 2012 - 1:38PM

Dow Jones News

The weekly record for high-grade corporate bond issuance is

within reach but unlikely to be broken just yet, while Coca-Cola

Co. (KO) is on track to price part of a three-part deal below the

three-month London interbank offered rate, or Libor.

A little more than $4.8 billion would have to be sold Friday to

break the $42.9 billion record set in March 2009, according to data

provider Dealogic. The weekly tally as of Thursday was $38.1

billion, the fifth-largest in records going back to 1995.

Coke is the only benchmark-size offering in the U.S. credit

markets. It jumped into the market to repay commercial paper just

after the monthly U.S. employment report beat consensus

expectations, spurring a rally. Markit's CDX North America

Investment-Grade Index, a measure of the health for the market,

improved 1% following the report.

As companies race to the markets to take advantage of record-low

financing costs, estimates for monthly issuance are as high as $100

billion for this month. In February, the market absorbed $99

billion, breaking a record for that month, according to

Dealogic.

Coke's three-part bond issue features two-year floating-rate

notes, and three- and six-year fixed-rate notes. A size hasn't been

determined but the deal has received more than $4 billion of

orders, according to a person familiar with the matter.

Early pricing guidance suggests the FRNs have so much demand

they might be sold at 0.02 to 0.05 percentage points below the

three-month London interbank offered rate, or Libor, which is

currently 0.474%.

"It's obviously not common" for a deal to price below Libor,

said an underwriter working on the deal, "but Coke is seen as an

ultra-quality credit."

Procter & Gamble issued $1 billion of FRNs last month for

0.08 points below Libor.

Pricing guidance on Coke's three- and six-year notes is 0.35

points and around 0.82 points above Treasurys, according to a

person familiar with the matter.

The fixed-notes are seeing "large interest" comparable to the

PepsiCo Inc. (PEP) and TransCanada Corp. (TRP, TRP.T) deals sold in

recent weeks, said portfolio manager Jesse Fogarty at Cutwater

Asset Management.

"Investors continually are searching for yield in the front-end

to supplement the miniscule Treasury yields," he said. "We are

buying the three-year fixed deal for some of our high quality

accounts where we can pick up some additional yield while not

taking on much credit risk."

The Coke notes are expected to be rated Aa3 by Moody's Investors

Service and A-plus by Standard & Poor's and Fitch Ratings.

Also in the high-grade market, Marriott International Inc. (MAR)

is adding $200 million to an outstanding issue of 3% coupon bonds

due 2019. Pricing guidance is 1.72 percentage points over

Treasurys.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

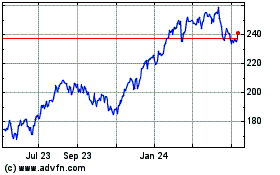

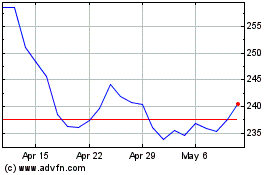

Marriott (NASDAQ:MAR)

Historical Stock Chart

From May 2024 to Jun 2024

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Jun 2023 to Jun 2024