For Immediate Release

Chicago, IL – March 7, 2012 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Express

Scripts ( ESRX),

Walgreen ( WAG), Starwood Hotels

& Resorts Worldwide Inc. ( HOT), Marriott

International Inc. ( MAR) and

Wyndham Worldwide Corporation ( WYN).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Tuesday’s Analyst

Blog:

ESRX Hurts Walgreens Comps

The termination of the Express

Scripts ( ESRX) contract continues to

affect Walgreen ( WAG) sales.

Comparing the first 28 days in February 2012 with February 2011,

the company recorded a modest 1.5% year-over-year growth in sales

to $5.86 billion for the month of February 2012. Total front-end

sales increased 6.9% with a 2.0% rise in comparable store front-end

sales.

Prescriptions filled at comparable stores decreased 9.5% in

February this year. Lower incidence of flu (down by 1.2 percentage

points) and the negative impact of the contract termination with

Express Scripts (10.7 percentage points) were primarily responsible

for the lower prescriptions filled in comparable stores. In

February 2011, prescriptions processed by Express Scripts comprised

12.6% of Walgreen prescriptions.

Pharmacy sales, accounting for 61.6% of total sales, in

February, decreased 1.4% with an 8.6% decline in comparable

pharmacy sales. Comparable pharmacy sales witnessed a negative

impact owing to the introduction of generics in the last 12 months

(2.2), lower incidence of cough, cold and flu (2.4) and the

Express Scripts contract loss (10.6 percentage points). The lower

incidence of cough, cold and flu led to a decline in the number of

flu shots administered to 5.5 million for the season-till-date

compared to 6.3 million in the previous year. Sales in comparable

stores decreased by 4.6%.

In February, Walgreen opened 10 stores including 1 relocation,

and 1 acquired.

As per this preliminary announcement, Walgreen’s total sales for

the second quarter of fiscal 2012 were $18.63 billion, up 0.7% year

over year. Fiscal 2012 year-to-date sales for the first six months

were $36.79 billion, up 2.6% from the comparable period last year.

Calendar year-to-date sales were $11.64 billion, down 0.6% from

$11.71 billion in 2011.

At February 29, Walgreens operated 8,290 locations in all 50

states, the District of Columbia, Puerto Rico and Guam. With the

intention of retaining some of Express Scripts’ clients, Walgreen

recently came up with its comprehensive Patient Transition Plan,

which will enable the smooth transition of existing members of the

Express Scripts pharmacy network to another community pharmacy.

Under this plan, Walgreen is providing several discounts to the

members of Walgreen Prescriptions Savings Club, which facilitates

savings on over 8,000 brand names and all generic drugs.

Meanwhile, Walgreen is expanding its business with other payers

and customers and implementing cost-control initiatives. The

company is reassured by the fact that more than 100 of Express

Scripts clients, encompassing health plans and employers, would

continue with Walgreen pharmacies in 2012. The company aims to

retain 10 million prescriptions annually and maintain 97-99% of the

2011 prescription volumes at fiscal 2012 end.

Our Take

Despite its best efforts to counter the loss of the Express

Scripts contract, which accounted for 7.3% of total sales in fiscal

2011, Walgreen’s financials will, nevertheless, be affected by the

loss of the contract. Although the company is expecting to retain

75% of its business, we await further clarity regarding this.

On a long-term horizon, we are nonetheless optimistic about

Walgreen. The introduction of new generics should help improve the

company’s gross margins in the second half of fiscal 2012.

Moreover, a strong cash balance enables the company to reward its

shareholders. During the last reported quarter, the company

enhanced shareholders’ value through dividend payments and share

repurchases amounting to $803 million ($601 million in share

repurchases and $202 million in dividends). In the last eight

years, the company’s dividend has grown at a compound annual growth

rate (“CAGR”) of nearly 22%.

Currently, Walgreen retains a Zacks #4 Rank (short-term Sell

rating). However we have ‘Neutral’ recommendation on the stock over

the long term.

Starwood Downgraded to Neutral

We have recently downgraded our rating on the shares

of Starwood Hotels & Resorts Worldwide

Inc. ( HOT) to Neutral from Outperform due to a

slowdown in 2012 RevPAR growth target in North America, weak EBITDA

projection as well as weakness in certain international

markets.

We were impressed with Starwood’s outperformance in the recently

concluded fourth quarter of 2011. The strength of the namesake

brand allows the company to charge a premium for its hotel rooms.

Moreover, the company is in a steady expansion mode. Starwood

has over half of its hotel properties outside the U.S., an

international exposure that not many of its peers can boast of.

Starwood will open 80 new hotels in 2012, with 75% of them being

outside North America, primarily in the faster growing Asia

(60.0%). The company’s balance sheet also remains in good

shape.

However, although we believe that Starwood is well positioned

for the long term, we expect the operating environment to weaken in

the near term before improving. In the developed markets,

unemployment remains extremely high and the pressure of public and

private debt is mounting, leading to a slower pace of recovery.

Management expects lodging recovery in North America to be slower

in 2012 than 2011.

Exchange rate shifts will negatively impact Starwood’s hotel

business in 2012. EBITDA will be hurt by approximately $7 million

net of benefits from Euro hedge. Additionally, there are several

Starwood properties awaiting renovations in 2012. Hence, 2012

renovations and the hotels sold in 2011 will adversely impact the

company’s total owned EBITDA by $10 million.

To add to the worry, there is the Eurozone debt crisis. RevPAR

was flat in Europe in the fourth quarter of 2011 due to the

austerity measures and fragile economic conditions in Europe.

Management commented that softness in demand will likely loom in

future, despite the adoption of crucial measures in resolving the

crisis. Deceleration in European RevPAR is a cause of concern given

Starwood’s considerable exposure to that region.

The other geographies are also not in a very good shape. Unrest

in Middle East and Africa as well as the Korean Peninsula remains

another area of apprehension. In Japan, although occupancies

recovered well from early 2011, revival of average daily rate was

still down compared to the pre-earthquake level. In fact, China,

Starwood’s one of the strongest hubs, targets economic growth of

7.5% in 2012. It is the slowest rate since 2004.

Moreover, we believe all the positive attributes in the stock

are reflected at the current level. Hence, in light of the current

state of industry fundamentals, we recommend investors to remain on

the sidelines.

Starwood, which competes with the likes of Marriott

International Inc. (

MAR) and Wyndham Worldwide

Corporation ( WYN), currently retains the Zacks #3

Rank that translates into a short-term Hold rating.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

EXPRESS SCRIPTS (ESRX): Free Stock Analysis Report

STARWOOD HOTELS (HOT): Free Stock Analysis Report

MARRIOTT INTL-A (MAR): Free Stock Analysis Report

WALGREEN CO (WAG): Free Stock Analysis Report

WYNDHAM WORLDWD (WYN): Free Stock Analysis Report

To read this article on Zacks.com click here.

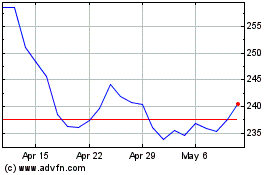

Marriott (NASDAQ:MAR)

Historical Stock Chart

From May 2024 to Jun 2024

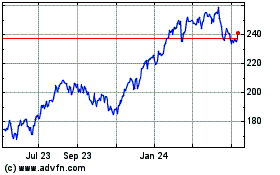

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Jun 2023 to Jun 2024