The apartment sector, one of the best-performing of the

commercial real-estate market in recent years, is starting to lose

some appeal for investors.

Last year, residential rental properties were one of the most

sought-after property types, with sales totaling $54 billion by one

measure, up more than 50% from the prior year, according to Real

Capital Analytics. The average apartment price per unit, about

$102,000 nationally, is near peak levels.

But this year, the excitement is fading. Investors are pushing

back on property prices, rent growth is slowing and yields are

flattening in some markets.

While few investors believe apartment buildings will be a bad

investment, the best rent hikes of this cycle are likely "in the

rear-view mirror," said Andrew McCulloch, an analyst with REIT

research firm Green Street Advisors.

Such concern is weighing on the stocks of real-estate investment

trusts that own and develop apartment buildings. Shares of Colonial

Properties Trust Inc. (CLP) have gained less than 1% this year,

while sector giant Equity Residential (EQR) is up less than 3%. In

comparison, stock prices of industrial real-estate giant Prologis

Inc. (PLD) are up about 20% year-to-date while Brookfield Office

Properties Inc. (BPO) has gained 11%. Zelman & Associates, a

real-estate research firm, expects net operating income growth to

slow over the next year at the 10 apartment REITs it covers.

Investors and developers are changing course in response.

"Eighteen months to two years ago, you really could have owned

apartments in any major U.S. city and made very attractive

returns," said Jay Leupp, a portfolio manager at Lazard Asset

Management. Now "we are being more cautious of the apartment

investments that we make" and diversifying.

With the Lazard U.S. Realty Equity Open fund, for example, the

firm has in the last six months reduced its holdings in apartment

operators Equity Residential and Apartment Investment &

Management Co. (AIV) and beefed up shares in hotel operator

Marriott International Inc. (MAR) and First Industrial Realty Trust

Inc. (FR), which specializes in industrial space.

Other investors are also changing tack.

"It's a lot harder for people to buy and make money, as opposed

to building and making money," said Gary Kauffman, managing

director and head of U.S. transactions at Parsippany, N.J.-based

Prudential Real Estate Investors. Prudential will still look to buy

properties, he said, but is moving more toward constructing new

buildings.

There is some worry that a bubble could be forming, fed by

low-cost financing and aggressive cash-flow growth assumptions.

Research by economist Sam Chandan of New York-based Chandan

Economics, shows that multifamily buyers in competitive large

metropolitan areas last year were often too optimistic about their

future cash-flow growth. This could spell trouble if the owners

don't meet these targets and then must refinance at higher

rates.

But the overall argument for apartments, as Chandan and others

say, remains sound. People need to live somewhere, and apartments

have won out as the home-ownership rate has dropped. Over the past

five years, renter households have increased by more than 4

million, or 12%, according to Green Street, helping explain why the

sector was so healthy despite the ailing economy. And while job

growth has been weak overall, the upticks have been weighted toward

those more likely to rent.

As a result, vacancy rates have dropped to levels not seen in

years, allowing landlords to raise monthly rents. In the fourth

quarter, the vacancy rate fell to 5.2% from 6.6% a year earlier,

according to Reis Inc. Nationwide, landlords raised asking rents an

average of 0.4% in the fourth quarter, to $1,064 a month.

Yet some believe those rent hikes can't continue, especially as

the supply of new rental properties grows. Nearly 180,000 units

were started in 2011 and some 225,000 starts are expected this year

with an additional 280,000 starts in 2013, according to Zelman.

One market in particular that investors are watching is

metropolitan Washington, D.C., which is bracing for an onslaught of

new apartments even as the area's main employer, the federal

government, slows down hiring. AvalonBay Communities Inc. (AVB), a

large apartment owner, is tracking 8,600 new apartment units to

open this year and another 15,000 units in 2013.

"In specific markets, with D.C. really being the poster child,

we are worried about supply," said Zelman analyst Dave Bragg.

There is also concern about Seattle, which saw eight quarters of

vacancy-rate declines end in the fourth quarter, partially because

more than 1,800 apartment units were built last year, according to

Apartment Insights Washington LLC. More than 6,000 additional units

are expected.

-By Dawn Wotapka, Dow Jones Newswires; 212-416-2193;

dawn.wotapka@dowjones.com

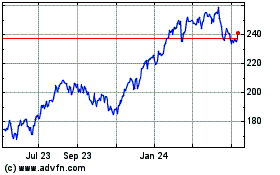

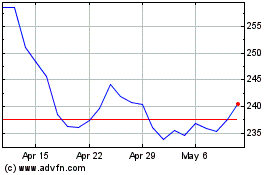

Marriott (NASDAQ:MAR)

Historical Stock Chart

From May 2024 to Jun 2024

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Jun 2023 to Jun 2024