Starwood W Hotel Steps in France - Analyst Blog

March 01 2012 - 7:30AM

Zacks

W, one of the high-end brands of

Starwood Hotels & Resorts Worldwide Inc. (HOT)

finally stepped into France. Located in the heart of Paris, W Paris

– Opéra features 91 stylish guest rooms including 20 suites and two

presidential suites along with many other amenities. Owned by

Barcelona-based Meridia Capital, the hotel is set inside a historic

heritage building near Opéra Garnier.

Starwood set a new trend in hotel

designs with its W brand and remains on the track to spread its

operations globally through its 50 hotels since its launch in 1998

in New York. The brand, generally aimed at a younger crowd, started

to ride on a high growth trajectory and has already left its mark

in every region including North America, Europe, Latin America,

Asia Pacific as well as Middle East and Africa.

However, Singapore, Bangkok and

some places in China are awaiting brand’s debut later this year.

The brand will also step into India in 2015 with the opening of the

W Mumbai and the W Retreat & Spa Goa, followed by the W Noida,

Delhi NCR in 2016. In the fourth quarter of 2011, RevPAR growth in

W was a solid 7.8% or 8.2% in constant dollars.

W opened its first hotel in Europe

in Istanbul in May of 2008, followed by The W Barcelona hotel in

October 2009. With the recent launch in Paris, Stawood operates

five W hotels in Europe. The other four hotels are in Russia,

Spain, Turkey and United Kingdom. Greece, Italy and Switzerland

will see their share of W property in 2013.

It is quite evident that Paris is a

strategic fit for new hotels, as it is an important tourist

destination. The hotelier is all set to beef up its portfolio in

that market, as Paris attracts tourists from all over the world.

Apart from W, Starwood’s other brands, such as Le Meridien,

Sheraton and Westin are also operating in Paris.

However, the market is not free

from competition. Several major hoteliers like

InterContinental Hotels Group (IHG), Hyatt

Hotels Corporation (H) and Marriott International

Inc. (MAR) also have considerable presence in Paris.

Additionally, there are some near-term macro-economic

challenges in Europe owing to the debt crisis. European revenue per

available room rate was flat in the fourth quarter of 2011 and

management expects the softness to likely loom in the near

term.

Starwood currently retains a Zacks

#2 Rank, which translates into a short-term 'Buy' rating.

HYATT HOTELS CP (H): Free Stock Analysis Report

STARWOOD HOTELS (HOT): Free Stock Analysis Report

MARRIOTT INTL-A (MAR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

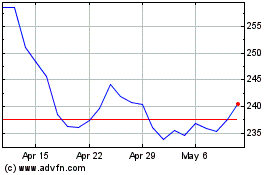

Marriott (NASDAQ:MAR)

Historical Stock Chart

From May 2024 to Jun 2024

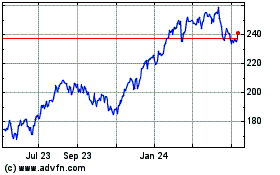

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Jun 2023 to Jun 2024