Marin Software Incorporated (NASDAQ: MRIN) (“Marin”, "Marin

Software" or the “Company”), a leading provider of digital

marketing software for performance-driven advertisers and agencies,

today announced financial results for the fourth quarter and full

year ended December 31, 2023.

“Companies that are not leveraging AI to plan and manage their

performance media are falling behind,” said Chris Lien, Marin

Software’s CEO. “We’ve published our amazing results with Alumni

Ventures and an agency partner showing how our optimization engine

continues to help agencies and brands accelerate sales, stay on

budget, and get ahead of their competition.”

Fourth Quarter 2023 Product

Highlights:

- Increased our coverage of the Chinese search market by adding

support for Qihoo Search 360, to now provide coverage for more than

90% of searches conducted in this important market.

- Launched our Google Sheets plugin, enabling Marin users to link

Google Sheets to their Marin instance to leverage it as a data

source and destination.

- Released an automated anomaly detector to notify users of any

abnormal campaign performance.

- Enhanced our Forecasting to include a visualization of Return

on Ad Spend vs. Revenue, helping advertisers determine the right

targets by showing how changing their ROAS will affect their

volumes.

- Added “Review and Send” for budget recommendations to provide

enhanced transparency and control over campaign optimization

actions.

- Saved time and increased revenue for an agency customer by 20%

with intelligent budget pacing with Dynamic Allocation.

- Doubled lead volume for Alumni Ventures and reduced CPL by 33%

with Marin budgeting optimization.

- Expanded Performance Max campaign functionality by enabling

Marin users to create and edit for Listing Groups at scale.

- Enhanced in-app e-commerce data to include Amazon Shopping

Product-level Cost and Revenue across both paid and organic sales

for greater transparency and more comprehensive revenue

reporting.

- Enabled support for Amazon Store Spotlight and Sponsored Brand

Video, critical ad types to drive brand awareness, to deliver more

comprehensive campaign management of campaigns on the increasingly

important e-commerce platform.

- Integrated BigQuery data into Marin’s ecosystem to expand

coverage of business insights platforms.

- Simplified deployment of custom scripts with real-time feedback

to accelerate the development of bespoke automation by less

technical users.

- Updated and streamlined UI to provide a more intuitive, modern

user experience.

- Increased revenue for Yotel by 323% using Marin’s Google to

Microsoft Sync.

- Increased Internet Brands’ revenue 30% by uniting customer

lifecycle data with Marin’s Revenue Hub.

Fourth Quarter 2023 Financial

Updates:

- Net revenues totaled $4.4 million, a year-over-year decrease of

16% when compared to $5.2 million in the fourth quarter of

2022.

- GAAP loss from operations was ($5.7) million, resulting in a

GAAP operating margin of (132%), as compared to a GAAP loss from

operations of ($5.2) million and a GAAP operating margin of (102%)

for the fourth quarter of 2022.

- Non-GAAP loss from operations was ($1.9) million, resulting in

a non-GAAP operating margin of (43%), as compared to a non-GAAP

loss from operations of ($4.2) million and a non-GAAP operating

margin of (82%) for the fourth quarter of 2022.

Full Year 2023 Financial

Updates:

- Net revenues totaled $17.7 million, a year-over-year decrease

of 11% when compared to $20.0 million for 2022.

- GAAP loss from operations was ($22.8) million, resulting in a

GAAP operating margin of (129%), as compared to a GAAP loss from

operations of ($22.0) million and a GAAP operating margin of (110%)

for 2022.

- Non-GAAP loss from operations was ($14.6) million, resulting in

a non-GAAP operating margin of (82%), as compared to a non-GAAP

loss from operations of ($17.7) million and a non-GAAP operating

margin of (88%) for 2022.

- Cash and cash equivalents were $11.4 million as of December 31,

2023.

Reconciliations of GAAP to non-GAAP financial measures have been

provided in the financial statement tables included in this press

release. An explanation of these measures is also included below,

under the heading “Non-GAAP Financial Measures.”

Financial Outlook:

Marin is providing guidance for its first quarter of 2024 as

follows:

Forward-Looking

Guidance

In millions

Range of Estimate

From

To

Three Months Ending March 31,

2024

Revenues, net

$

4.0

$

4.3

Non-GAAP loss from operations

(2.2

)

(1.9

)

Non-GAAP loss from operations excludes the effects of

stock-based compensation expense, amortization of internally

developed software, impairment of long-lived assets, capitalization

of internally developed software, non-recurring costs associated

with restructurings, and certain professional fees that the Company

has incurred in responding to third-party subpoenas that the

Company has received related to governmental investigations of

Google and Facebook.

Additionally, the Company does not reconcile its forward-looking

non-GAAP loss from operations, due to variability between revenues

and non-cash items such as stock-based compensation. The GAAP loss

from operations includes stock-based compensation expense, which is

affected by hiring and retention needs, as well as the future price

of Marin’s stock. As a result, a reconciliation of the

forward-looking non-GAAP financial measures to the corresponding

GAAP measures cannot be made without unreasonable effort.

Quarterly Results Conference

Call

Marin Software will host a conference call today at 2:00 PM

Pacific Time (5:00 PM Eastern Time) to review the Company’s

financial results for the quarter and full year ended December 31,

2023, and its outlook for the future. To access the call, please

dial (877) 704-4453 in the United States or (201) 389-0920

internationally with reference to conference ID 13742151. A live

webcast of the conference call will be accessible at

https://viavid.webcasts.com/starthere.jsp?ei=1639585&tp_key=860ce9f72e.

Following the completion of the call through 11:59 p.m. Eastern

Time on February 29, 2024, a recorded replay will be available on

the Company’s website at http://investor.marinsoftware.com/ and a

telephone replay will be available by dialing (844) 512-2921 in the

United States or (412) 317-6671 internationally with the recording

access code 13742151.

About Marin Software

Marin Software Incorporated’s (NASDAQ: MRIN) mission is to give

advertisers the power to drive higher efficiency and transparency

in their paid marketing programs that run on the world’s largest

publishers. Marin Software provides enterprise marketing software

for advertisers and agencies to integrate, align, and amplify their

digital advertising spend across the web and mobile devices. Marin

Software offers a unified SaaS advertising management platform for

search, social, and eCommerce advertising. The Company helps

digital marketers convert precise audiences, improve financial

performance, and make better decisions. Headquartered in San

Francisco with offices worldwide, Marin Software’s technology

powers marketing campaigns around the globe. For more information

about Marin Software, please visit www.marinsoftware.com.

Non-GAAP Financial

Measures

Marin uses certain non-GAAP financial measures in this release.

Marin uses these non-GAAP financial measures internally in

analyzing its financial results and believes they are useful to

investors, as a supplement to GAAP measures, in evaluating its

ongoing operational performance. Marin believes that the use of

these non-GAAP financial measures provides an additional tool for

investors to use in evaluating ongoing operating results and trends

and in comparing our financial results with other companies in our

industry, many of which present similar non-GAAP financial measures

to investors. Non-GAAP financial measures that Marin uses may

differ from measures that other companies may use.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. A reconciliation of the non-GAAP

financial measures to their most directly comparable GAAP measures

has been provided in the financial statement tables included below

in this press release. Investors are encouraged to review the

reconciliation of these non-GAAP financial measures to their most

directly comparable GAAP financial measures.

Non-GAAP expenses, measures and net loss per share. Marin

defines non-GAAP sales and marketing, non-GAAP research and

development, non-GAAP general and administrative, non-GAAP gross

profit, non-GAAP operating loss and non-GAAP net loss as the

respective GAAP balances, adjusted for stock-based compensation

expense, amortization of internally developed software and

intangible assets, impairment of long-lived assets, non-cash

expenses related to debt agreements, capitalization of internally

developed software, CARES Act employee retention credit,

non-recurring costs associated with restructurings, and certain

professional fees that the Company has incurred in responding to

third-party subpoenas that the Company has received related to

governmental investigations of Google and Facebook. Non-GAAP net

loss per share is calculated as non-GAAP net loss divided by the

weighted average shares outstanding.

Adjusted EBITDA. Marin defines Adjusted EBITDA as net loss,

adjusted for stock-based compensation expense, depreciation,

amortization of internally developed software and intangible

assets, capitalization of internally developed software, impairment

of long-lived assets, benefit from or provision for income taxes,

CARES Act employee retention credit, other income, net,

non-recurring costs associated with restructurings, and certain

professional fees that the Company has incurred in responding to

third-party subpoenas that the Company has received related to

governmental investigations of Google and Facebook. These amounts

are often excluded by other companies to help investors understand

the operational performance of their business. The Company uses

Adjusted EBITDA as a measurement of its operating performance

because it assists in comparing the operating performance on a

consistent basis by removing the impact of certain non-cash and

non-operating items. Adjusted EBITDA reflects an additional way of

viewing aspects of the operations that Marin believes, when viewed

with the GAAP results and the accompanying reconciliations to

corresponding GAAP financial measures, provide a more complete

understanding of factors and trends affecting its business.

Forward-Looking

Statements

This press release contains forward-looking statements

including, among other things, statements regarding Marin’s

business, impact of investments in product and technology on future

operating results, the increasing complexity in marketing, progress

on product development efforts, product capabilities, advertiser

and customer behavior, and future financial results, including its

outlook for the first quarter of 2024. These forward-looking

statements are subject to the safe harbor provisions created by the

Private Securities Litigation Reform Act of 1995. Actual results

could differ materially from those projected in the forward-looking

statements as a result of certain risk factors, including but not

limited to, our ability to reduce our expenses or raise additional

capital to meet our obligations as a going concern; our ability to

successfully implement a restructuring plan that we commenced in

July 2023 and the expected costs and savings from the restructuring

plan; the amount of digital advertising spend managed by our

customers using our products; the extent of customer acceptance,

adoption and usage of our MarinOne platform; the productivity of

our personnel and other aspects of our business; our ability to

maintain or grow sales to new and existing customers; any adverse

changes in our relationships with and access to publishers and

advertising agencies and strategic business partners, including any

adverse changes in our revenue sharing agreement with Google; our

ability to manage expenses; our ability to retain and attract

qualified management, technical and sales and marketing personnel;

any delays in the release of updates to our product platform or new

features or delays in customer deployment of any such updates or

features; competitive factors, including but not limited to pricing

pressures, entry of new competitors and new applications; quarterly

fluctuations in our operating results due to a number of factors;

inability to adequately forecast our future revenues, expenses,

Adjusted EBITDA, cash flows or other financial metrics; delays,

reductions or slower growth in the amount spent on online and

mobile advertising and the development of the market for

cloud-based software; progress in our efforts to update our

software platform; our ability to maintain or expand sales of our

solutions in channels other than search advertising; any slow-down

in the search advertising market generally; any shift in customer

digital advertising budgets from search to segments in which we are

not as deeply penetrated; the development of the market for digital

advertising; our ability to provide high-quality technical support

to our customers; material defects in our platform including those

resulting from any updates we introduce to our platform, service

interruptions at our single third-party data center or breaches in

our security measures; our ability to develop enhancements to our

platform; our ability to protect our intellectual property; our

ability to manage risks associated with international operations;

the impact of fluctuations in currency exchange rates, particularly

an increase in the value of the dollar; near term changes in sales

of our software services or spend under management may not be

immediately reflected in our results due to our subscription

business model; our ability to maintain the listing of our common

stock on the Nasdaq; and adverse changes in general economic or

market conditions. These forward-looking statements are based on

current expectations and are subject to uncertainties and changes

in condition, significance, value and effect as well as other risks

detailed in documents filed with the Securities and Exchange

Commission, including our most recent report on Form 10-K, recent

reports on Form 10-Q and current reports on Form 8-K, which we may

file from time to time, and all of which are available free of

charge at the SEC’s website at www.sec.gov. Any of these risks

could cause actual results to differ materially from expectations

set forth in the forward-looking statements. All forward-looking

statements in this press release reflect Marin’s expectations as of

February 22, 2024. Marin assumes no obligation to, and expressly

disclaims any obligation to update any such forward-looking

statements after the date of this release.

Marin Software Incorporated

Condensed Consolidated Balance

Sheets

(On a GAAP basis)

December 31,

December 31,

(Unaudited; in thousands, except par

value)

2023

2022

Assets:

Current assets:

Cash and cash equivalents

$

11,363

$

27,957

Accounts receivable, net

3,864

4,521

Prepaid expenses and other current

assets

1,548

2,016

Total current assets

16,775

34,494

Property and equipment, net

120

3,213

Right-of-use assets, operating leases

1,912

3,844

Other non-current assets

508

533

Total assets

$

19,315

$

42,084

Liabilities and Stockholders'

Equity:

Current liabilities:

Accounts payable

$

664

$

1,011

Accrued expenses and other current

liabilities

2,099

3,513

Operating lease liabilities

1,518

1,645

Total current liabilities

4,281

6,169

Operating lease liabilities,

non-current

394

2,199

Other long-term liabilities

1,001

1,002

Total liabilities

5,676

9,370

Stockholders’ equity:

Convertible preferred stock, $0.001 par

value

—

—

Common stock, $0.001 par value

18

17

Additional paid-in capital

358,869

355,996

Accumulated deficit

(344,251

)

(322,334

)

Accumulated other comprehensive loss

(997

)

(965

)

Total stockholders’ equity

13,639

32,714

Total liabilities and stockholders’

equity

$

19,315

$

42,084

Marin Software Incorporated

Condensed Consolidated Statements of

Operations

(On a GAAP basis)

Three Months Ended December

31,

Year Ended December

31,

(Unaudited; in thousands, except per

share data)

2023

2022

2023

2022

Revenues, net

$

4,350

$

5,161

$

17,731

$

20,019

Cost of revenues

2,134

3,083

11,635

12,795

Gross profit

2,216

2,078

6,096

7,224

Operating expenses:

Sales and marketing

1,078

1,962

6,520

6,997

Research and development

1,636

2,901

10,235

11,832

General and administrative

1,974

2,459

8,871

10,396

Impairment loss on long-lived assets

3,276

—

3,276

—

Total operating expenses

7,964

7,322

28,902

29,225

Loss from operations

(5,748

)

(5,244

)

(22,806

)

(22,001

)

Other income, net

141

190

739

4,079

Loss before income taxes

(5,607

)

(5,054

)

(22,067

)

(17,922

)

Provision for income taxes

(344

)

64

(150

)

305

Net loss

$

(5,263

)

$

(5,118

)

$

(21,917

)

$

(18,227

)

Net loss per common share, basic and

diluted

$

(0.29

)

$

(0.31

)

$

(1.24

)

$

(1.15

)

Weighted-average shares outstanding, basic

and diluted

18,053

16,337

17,656

15,891

Marin Software Incorporated

Condensed Consolidated Statements of

Cash Flows

(On a GAAP basis)

Year Ended December

31,

(Unaudited; in thousands)

2023

2022

Operating activities:

Net loss

$

(21,917

)

$

(18,227

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation

19

447

Amortization of internally developed

software

1,701

1,810

Amortization of right-of-use assets

1,528

2,832

Amortization of deferred costs to obtain

and fulfill contracts

366

352

Forgiveness of Paycheck Protection Program

loan

—

(3,117

)

Impairment loss on long-lived assets

3,276

—

Loss on disposals of property and

equipment and right-of-use assets

3

28

Unrealized foreign currency losses

46

80

Stock-based compensation related to equity

awards

3,006

3,555

Provision for bad debts

(414

)

16

Deferred income tax benefits

(70

)

48

Changes in operating assets and

liabilities

Accounts receivable

1,037

73

Prepaid expenses and other assets

183

(102

)

Accounts payable

(353

)

31

Accrued expenses and other liabilities

(1,466

)

(2,786

)

Operating lease liabilities

(1,528

)

(3,177

)

Net cash used in operating activities

(14,583

)

(18,137

)

Investing activities:

Purchases of property and equipment

—

(24

)

Capitalization of internally developed

software

(1,807

)

(1,740

)

Net cash used in investing activities

(1,807

)

(1,764

)

Financing activities:

Proceeds from issuance of common shares

through at-the-market offering, net of offering costs

—

1,333

Repayment of Paycheck Protection Program

loan

—

(203

)

Employee taxes paid for withheld shares

upon equity award settlement

(206

)

(424

)

Proceeds from employee stock purchase

plan, net

(3

)

34

Net cash provided by (used in) financing

activities

(209

)

740

Effect of foreign exchange rate changes on

cash and cash equivalents and restricted cash

5

61

Net decrease in cash and cash equivalents

and restricted cash

(16,594

)

(19,100

)

Cash and cash equivalents and

restricted cash:

Beginning of period

27,957

47,057

End of the period

$

11,363

$

27,957

Marin Software Incorporated

Reconciliation of GAAP to Non-GAAP

Expenses

Three Months Ended

Year Ended

Three Months Ended

Year Ended

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

Mar 31,

Jun 30,

Sep 30

Dec 31,

Dec 31,

(Unaudited; in thousands)

2022

2022

2022

2022

2022

2023

2023

2023

2023

2023

Sales and Marketing (GAAP)

$

1,787

$

1,588

$

1,660

$

1,962

$

6,997

$

2,025

$

1,935

$

1,482

$

1,078

$

6,520

Less Stock-based compensation

(175

)

(157

)

(99

)

(165

)

(596

)

(165

)

(184

)

(88

)

(65

)

(502

)

Less Restructuring related expenses

—

—

—

—

—

—

—

(122

)

—

(122

)

Sales and Marketing (Non-GAAP)

$

1,612

$

1,431

$

1,561

$

1,797

$

6,401

$

1,860

$

1,751

$

1,272

$

1,013

$

5,896

Research and Development (GAAP)

$

2,917

$

2,980

$

3,034

$

2,901

$

11,832

$

2,942

$

2,797

$

2,860

$

1,636

$

10,235

Less Stock-based compensation

(224

)

(213

)

(303

)

(256

)

(996

)

(270

)

(305

)

(131

)

(119

)

(825

)

Less Restructuring related expenses

(36

)

(59

)

(76

)

—

(171

)

—

—

(815

)

(22

)

(837

)

Plus Capitalization of internally

developed software

512

408

449

397

1,766

579

578

354

296

1,807

Research and Development (Non-GAAP)

$

3,169

$

3,116

$

3,104

$

3,042

$

12,431

$

3,251

$

3,070

$

2,268

$

1,791

$

10,380

General and Administrative (GAAP)

$

2,469

$

2,545

$

2,923

$

2,459

$

10,396

$

2,336

$

2,442

$

2,119

$

1,974

$

8,871

Less Stock-based compensation

(334

)

(340

)

(405

)

(403

)

(1,482

)

(473

)

(627

)

(85

)

(187

)

(1,372

)

Less Restructuring related expenses

—

—

(78

)

—

(78

)

—

—

(189

)

—

(189

)

Less Third-party subpoena-related

expenses

(72

)

(99

)

(198

)

(72

)

(441

)

(84

)

(45

)

(36

)

(30

)

(195

)

General and Administrative (Non-GAAP)

$

2,063

$

2,106

$

2,242

$

1,984

$

8,395

$

1,779

$

1,770

$

1,809

$

1,757

$

7,115

Marin Software Incorporated

Reconciliation of GAAP to Non-GAAP

Measures

Three Months Ended

Year Ended

Three Months Ended

Year Ended

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

(Unaudited; in thousands)

2022

2022

2022

2022

2022

2023

2023

2023

2023

2023

Gross Profit (GAAP)

$

1,833

$

1,517

$

1,796

$

2,078

$

7,224

$

1,343

$

1,186

$

1,351

$

2,216

$

6,096

Plus Stock-based compensation

124

90

148

119

481

124

137

5

41

307

Plus Amortization of internally developed

software

542

431

419

418

1,810

419

426

433

423

1,701

Plus Restructuring related expenses

17

—

—

—

17

—

—

671

2

673

Gross Profit (Non-GAAP)

$

2,516

$

2,038

$

2,363

$

2,615

$

9,532

$

1,886

$

1,749

$

2,460

$

2,682

$

8,777

Operating Loss (GAAP)

$

(5,340

)

$

(5,596

)

$

(5,821

)

$

(5,244

)

$

(22,001

)

$

(5,960

)

$

(5,988

)

$

(5,110

)

$

(5,748

)

$

(22,806

)

Plus Stock-based compensation

857

800

955

943

3,555

1,032

1,253

309

412

3,006

Plus Amortization of internally developed

software

542

431

419

418

1,810

419

426

433

423

1,701

Plus Restructuring related expenses

53

59

154

—

266

—

—

1,797

24

1,821

Less Capitalization of internally

developed software

(512

)

(408

)

(449

)

(397

)

(1,766

)

(579

)

(578

)

(354

)

(296

)

(1,807

)

Plus Third-party subpoena-related

expenses

72

99

198

72

441

84

45

36

30

195

Plus Impairment loss on long-lived

assets

—

—

—

—

—

—

—

—

3,276

3,276

Operating Loss (Non-GAAP)

$

(4,328

)

$

(4,615

)

$

(4,544

)

$

(4,208

)

$

(17,695

)

$

(5,004

)

$

(4,842

)

$

(2,889

)

$

(1,879

)

$

(14,614

)

Net Loss (GAAP)

$

(1,999

)

$

(5,374

)

$

(5,736

)

$

(5,118

)

$

(18,227

)

$

(5,783

)

$

(5,917

)

$

(4,954

)

$

(5,263

)

$

(21,917

)

Plus Stock-based compensation

857

800

955

943

3,555

1,032

1,253

309

412

3,006

Plus Amortization of internally developed

software

542

431

419

418

1,810

419

426

433

423

1,701

Plus Restructuring related expenses

53

59

154

—

266

—

—

1,797

24

1,821

Less Capitalization of internally

developed software

(512

)

(408

)

(449

)

(397

)

(1,766

)

(579

)

(578

)

(354

)

(296

)

(1,807

)

Plus Third-party subpoena-related

expenses

72

99

198

72

441

84

45

36

30

195

Plus Impairment loss on long-lived

assets

—

—

—

—

—

—

—

—

3,276

3,276

Less Forgiveness and repayment of Paycheck

Protection Program loan

(3,320

)

—

—

—

(3,320

)

—

—

—

—

—

Net Loss (Non-GAAP)

$

(4,307

)

$

(4,393

)

$

(4,459

)

$

(4,082

)

$

(17,241

)

$

(4,827

)

$

(4,771

)

$

(2,733

)

$

(1,394

)

$

(13,725

)

Marin Software Incorporated

Calculation of Non-GAAP Earnings Per

Share

Three Months Ended

Year Ended

Three Months Ended

Year Ended

(Unaudited; in thousands, except per

share data)

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

2022

2022

2022

2022

2022

2023

2023

2023

2023

2023

Net Loss (Non-GAAP)

$

(4,307

)

$

(4,393

)

$

(4,459

)

$

(4,082

)

$

(17,241

)

$

(4,827

)

$

(4,771

)

$

(2,733

)

$

(1,394

)

$

(13,725

)

Weighted-average shares outstanding, basic

and diluted

15,537

15,651

16,030

16,337

15,891

17,235

17,412

17,912

18,053

17,656

Non-GAAP net loss per common share, basic

and diluted

$

(0.28

)

$

(0.28

)

$

(0.28

)

$

(0.25

)

$

(1.08

)

$

(0.28

)

$

(0.27

)

$

(0.15

)

$

(0.08

)

$

(0.78

)

Marin Software Incorporated

Reconciliation of Net Loss to Adjusted

EBITDA

Three Months Ended

Year Ended

Three Months Ended

Year Ended

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

Mar 31,

Jun 30,

Sep 30,

Dec 31,

Dec 31,

(Unaudited; in thousands)

2022

2022

2022

2022

2022

2023

2023

2023

2023

2023

Net Loss

$

(1,999

)

$

(5,374

)

$

(5,736

)

$

(5,118

)

$

(18,227

)

$

(5,783

)

$

(5,917

)

$

(4,954

)

$

(5,263

)

$

(21,917

)

Depreciation

179

199

57

12

447

11

3

3

2

19

Amortization of internally developed

software

542

431

419

418

1,810

419

426

433

423

1,701

Provision for (benefit from) income

taxes

61

75

105

64

305

48

144

2

(344

)

(150

)

Stock-based compensation

857

800

955

943

3,555

1,032

1,253

309

412

3,006

Capitalization of internally developed

software

(512

)

(408

)

(449

)

(397

)

(1,766

)

(579

)

(578

)

(354

)

(296

)

(1,807

)

Restructuring related expenses

53

59

154

—

266

—

—

1,797

24

1,821

Impairment loss on long-lived assets

—

—

—

—

—

—

—

—

3,276

3,276

Other income, net

(3,402

)

(297

)

(190

)

(190

)

(4,079

)

(225

)

(215

)

(158

)

(141

)

(739

)

Third-party subpoena-related expenses

72

99

198

72

441

84

45

36

30

195

Adjusted EBITDA

$

(4,149

)

$

(4,416

)

$

(4,487

)

$

(4,196

)

$

(17,248

)

$

(4,993

)

$

(4,839

)

$

(2,886

)

$

(1,877

)

$

(17,248

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240222874542/en/

Investor Relations, Marin Software ir@marinsoftware.com

Media Contact Wesley MacLaggan Marketing, Marin Software

(415) 399-2580 press@marinsoftware.com

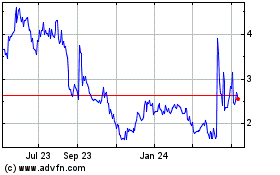

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

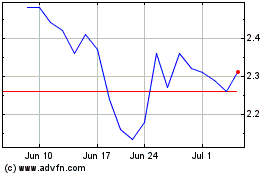

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Nov 2023 to Nov 2024