CLEVELAND, Feb. 22 /PRNewswire-FirstCall/ -- Fourth Quarter 2009

Highlights -- Sales were $462.4 million, an increase of 4.7% from

the Third Quarter 2009 -- Operating income was $39.3 million, an

increase of 18.4% from $33.2 million in the Third Quarter 2009 --

Operating income was $43.5 million, excluding special items, an

increase of 7.7% from $40.4 million in the Third Quarter 2009 --

Net income increased 25.0% to $24.3 million, or $0.57 per diluted

share from the prior year period; excluding special items, net

income was $27.7 million, or $0.65 per diluted share -- Net cash

provided by operating activities was $250.4 million for the full

year -- Cash balance of $388.1 million as of December 31, 2009

Lincoln Electric Holdings, Inc. (the "Company") (NASDAQ:LECO) today

reported 2009 fourth quarter net income of $24.3 million, or $0.57

per diluted share, on sales of $462.4 million. Operating income for

the fourth quarter increased sequentially to $39.3 million, or 8.5%

of sales, from $33.2 million, or 7.5% of sales, in the third

quarter of 2009. Excluding special items, operating income in the

quarter was $43.5 million or 9.4% of sales. Sales were $462.4

million in the fourth quarter versus $526.2 million in the

comparable 2008 period, a decrease of 12.1%. Operating income for

the fourth quarter included pre-tax rationalization charges of $4.2

million. Net income for the fourth quarter included after-tax

rationalization charges of $3.4 million. Rationalization charges

during the 2009 fourth quarter related primarily to a facility

closure in Europe and the consolidation of certain manufacturing

operations in the Europe and Asia Pacific segments. Net income for

the fourth quarter was $24.3 million, or $0.57 per diluted share,

compared with net income of $19.5 million, or $0.46 per diluted

share, in the fourth quarter of 2008. Excluding special items, net

income was $27.7 million, or $0.65 per diluted share compared with

net income of $37.8 million, or $0.88 per diluted share in the

fourth quarter of 2008. The effective tax rate for the fourth

quarter of 2009 was 39.7% compared with 40.7% in 2008. "We are

pleased that our fourth quarter results demonstrated another

important sequential improvement in profitability," said John M.

Stropki, Chairman and Chief Executive Officer. "While the 2009

economic crisis created tremendous challenges to the organization,

our management and dedicated employees responded exceptionally

well. The quick and decisive actions we took throughout 2009 to

rationalize our operations, reduce our overall cost structure and

introduce new products to the market generated improved results

throughout 2009 and will provide solid momentum going into 2010.

"As we continue to focus on new market opportunities in this

improving but challenging economic environment, our new cost

structure positions our Company for continued improvement in our

operating results. In addition, our ongoing focus in managing the

balance sheet and reducing working capital generated $250.4 million

in operating cash flows for the year. Our strong financial position

will provide us maximum flexibility to make the necessary

investments to achieve our long-term strategic objectives." Net

cash provided by operating activities was $19.0 million in the

fourth quarter compared with $40.7 million for the comparable

period in 2008. During the fourth quarter 2009, the Company paid

$11.5 million in dividends. Sales for 2009 were $1.7 billion versus

$2.5 billion in 2008, a decrease of 30.2%. Operating income for

2009 was $93.0 million compared with $295.4 million in 2008.

Excluding special items in 2009, operating income was $121.3

million or 7.0% of sales. Special items for 2009, which impacted

operating income, included pre-tax rationalization charges of $29.9

million and a pension settlement gain of $1.5 million included in

selling, general and administrative expenses. Special items which

impacted net income included after-tax rationalization charges of

$23.8 million, a pension settlement gain of $1.5 million, a gain on

the sale of a property by the Company's joint venture in Turkey of

$5.7 million and a loss related to the disposal of an interest in

Taiwan of $7.9 million. Net income for 2009 was $48.6 million, or

$1.14 per diluted share, compared with net income of $212.3

million, or $4.93 per diluted share, in 2008. Excluding special

items, net income was $73.1 million, or $1.71 per diluted share,

compared with net income of $230.6 million, or $5.36 per diluted

share, in 2008. The effective tax rate for 2009 was 43.8% compared

with 29.2% in 2008. The higher effective tax rate in 2009 is

primarily due to losses at certain non-U.S. entities, including the

loss related to the disposal of an investment in Taiwan, with no

tax benefit. Net cash provided by operating activities was $250.4

million in 2009 compared with $257.4 million in 2008. During 2009,

the Company repaid $30.0 million of outstanding debt on maturity

under its Senior Unsecured Notes and paid $45.8 million in

dividends. The Company's Board of Directors declared a quarterly

cash dividend of $0.28 per share, which was paid on January 15,

2010 to holders of record as of December 31, 2009. Financial

results for the 2009 fourth quarter and full year can also be

obtained by clicking on the following link:

http://www.lincolnelectric.com/InvestorNews. A conference call to

discuss the 2009 fourth quarter financial results is scheduled for

today, Monday, February 22, 2010, at 10:00 a.m., Eastern Time. An

audio webcast of the call is accessible through the investor tab on

the Company's website at http://www.lincolnelectric.com/corporate/.

Lincoln Electric is the world leader in the design, development and

manufacture of arc welding products, robotic arc-welding systems,

plasma and oxyfuel cutting equipment and has a leading global

position in the brazing and soldering alloys market. Headquartered

in Cleveland, Ohio, Lincoln has 38 manufacturing locations,

including operations and joint ventures in 18 countries and a

worldwide network of distributors and sales offices covering more

than 160 countries. For more information about Lincoln Electric,

its products and services, visit the Company's website at

http://www.lincolnelectric.com/. The Company's expectations and

beliefs concerning the future contained in this news release are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements reflect

management's current expectations and involve a number of risks and

uncertainties. Actual results may differ materially from such

statements due to a variety of factors that could adversely affect

the Company's operating results. The factors include, but are not

limited to: general economic and market conditions; the

effectiveness of operating initiatives; currency exchange and

interest rates; adverse outcome of pending or potential litigation;

possible acquisitions; market risks and price fluctuations related

to the purchase of commodities and energy; global regulatory

complexity; and the possible effects of international terrorism and

hostilities on the Company or its customers, suppliers and the

economy in general. For additional discussion, see "Item 1A. Risk

Factors" in the Company's Annual Report on Form 10-K. Lincoln

Electric Holdings, Inc. Financial Highlights (In thousands, except

per share data) (Unaudited) Consolidated Statements of Income Fav

(Unfav) Three Months Ended December 31, to Prior Year

--------------------------------- ---------------- % of % of 2009

Sales 2008 Sales $ % ---------- ----- ---------- ----- ----------

----- Net sales $462,449 100.0% $526,186 100.0% $(63,737) (12.1%)

Cost of goods sold 327,951 70.9% 385,078 73.2% 57,127 14.8%

---------- ---------- ---------- Gross profit 134,498 29.1% 141,108

26.8% (6,610) (4.7%) Selling, general & administrative expenses

90,980 19.7% 86,200 16.4% (4,780) (5.5%) Rationalization and asset

impairment charges 4,177 0.9% 19,371 3.7% 15,194 78.4% ----------

---------- ---------- Operating income 39,341 8.5% 35,537 6.8%

3,804 10.7% Interest income 682 0.1% 2,229 0.4% (1,547) (69.4%)

Equity earnings (loss) in affiliates 1,098 0.2% (2,068) (0.4%)

3,166 153.1% Other income 1,248 0.3% 354 0.1% 894 252.5% Interest

expense (1,974) (0.4%) (3,216) (0.6%) 1,242 38.6% ----------

---------- ---------- Income before income taxes 40,395 8.7% 32,836

6.2% 7,559 23.0% Income taxes 16,050 3.5% 13,366 2.5% (2,684)

(20.1%) Effective tax rate 39.7% 40.7% 1.0% ---------- ----------

---------- Net income $24,345 5.3% $19,470 3.7% $4,875 25.0%

========== ========== ========== Reconciliation of Net Income as

Reported to Adjusted Net Income Three Months Ended December 31,

Change ---------------------------------- ------------------- 2009

2008 $ % ---------- ---------- ---------- ----- Net income as

reported (1) $24,345 $19,470 $4,875 25.0% Special items (1) 3,382

18,313 (14,931) (81.5%) ---------- ---------- ---------- Adjusted

net income (2) $27,727 $37,783 $(10,056) (26.6%) ==========

========== ========== Basic earnings per share $0.57 $0.46 $0.11

23.9% Special items (1) 0.08 0.43 (0.35) (81.4%) ----------

---------- ---------- Adjusted basic earnings per share (2) $0.65

$0.89 $(0.24) (27.0%) ========== ========== ========== Diluted

earnings per share $0.57 $0.46 $0.11 23.9% Special items (1) 0.08

0.42 (0.34) (81.0%) ---------- ---------- ---------- Adjusted

diluted earnings per share (2) $0.65 $0.88 $(0.23) (26.1%)

========== ========== ========== Weighted average shares (basic)

42,408 42,430 Weighted average shares (diluted) 42,730 42,695 (1)

Net income in the fourth quarter of 2009 includes rationalization

charges of $2,786 ($3,298 pre-tax)and asset impairment charges of

$596 ($879 pre-tax). Net income in the fourth quarter of 2008

includes rationalization charges of $1,698 ($2,447 pre-tax)and

asset impairment charges of $16,615 ($16,924 pre-tax). (2) Adjusted

net income excluding special items and adjusted basic and diluted

earnings per share excluding special items are non-GAAP financial

measures that management believes are important to investors to

evaluate and compare the Company's financial performance from

period to period. Management uses this information in assessing and

evaluating the Company's underlying operating performance. Lincoln

Electric Holdings, Inc. Financial Highlights (In thousands, except

per share data) (Unaudited) Consolidated Statements of Income Fav

(Unfav) Twelve Months Ended December 31, to Prior Year

--------------------------------- ---------------- % of % of 2009

Sales 2008 Sales $ % ---------- ----- ---------- ----- ----------

----- Net sales $1,729,285 100.0% $2,479,131 100.0% $(749,846)

(30.2%) Cost of goods sold 1,273,017 73.6% 1,758,980 71.0% 485,963

27.6% ---------- ---------- ---------- Gross profit 456,268 26.4%

720,151 29.0% (263,883) (36.6%) Selling, general &

administrative expenses 333,395 19.3% 405,376 16.4% 71,981 17.8%

Rationalization and asset impairment charges 29,897 1.7% 19,371

0.8% (10,526) (54.3%) ---------- ---------- ---------- Operating

income 92,976 5.4% 295,404 11.9% (202,428) (68.5%) Interest income

3,462 0.2% 8,845 0.4% (5,383) (60.9%) Equity (loss) earnings in

affiliates (5,025) (0.3%) 6,034 0.2% (11,059)(183.3%) Other income

3,589 0.2% 1,681 0.1% 1,908 113.5% Interest expense (8,521) (0.5%)

(12,155) (0.5%) 3,634 29.9% ---------- ---------- ---------- Income

before income taxes 86,481 5.0% 299,809 12.1% (213,328) (71.2%)

Income taxes 37,905 2.2% 87,523 3.5% 49,618 56.7% Effective tax

rate 43.8% 29.2% (14.6%) ---------- ---------- ---------- Net

income $48,576 2.8% $212,286 8.6% $(163,710) (77.1%) ==========

========== ========== Reconciliation of Net Income as Reported to

Adjusted Net Income Twelve Months Ended December 31, Change

---------------------------------- ------------------- 2009 2008 $

% ---------- ---------- ---------- ----- Net income as reported (1)

$48,576 $212,286 $(163,710) (77.1%) Special items (1) 24,522 18,313

6,209 33.9% ---------- ---------- ---------- Adjusted net income

(2) $73,098 $230,599 $(157,501) (68.3%) ========== ==========

========== Basic earnings per share $1.15 $4.98 $(3.83) (76.9%)

Special items (1) 0.57 0.43 0.14 32.6% ---------- ----------

---------- Adjusted basic earnings per share (2) $1.72 $5.41

$(3.69) (68.2%) ========== ========== ========== Diluted earnings

per share $1.14 $4.93 $(3.79) (76.9%) Special items (1) 0.57 0.43

0.14 32.6% ---------- ---------- ---------- Adjusted diluted

earnings per share (2) $1.71 $5.36 $(3.65) (68.1%) ==========

========== ========== Weighted average shares (basic) 42,391 42,648

Weighted average shares (diluted) 42,634 43,054 (1) Net income for

2009 includes rationalization charges of $23,193 ($29,018 pre-tax),

asset impairment charges of $596 ($879 pre-tax), a pension

settlement gain of $1,543 ($1,543 pre-tax) included in Selling,

general & administrative expenses, a gain on the sale of a

property by the Company's joint venture in Turkey of $5,667 ($5,667

pre-tax) included in Equity (loss) earnings in affiliates and a

loss of $7,943 ($7,943 pre-tax) on the disposal of an investment in

Taiwan included in Equity (loss) earnings in affiliates. Net income

for 2008 includes rationalization charges of $1,698 ($2,447

pre-tax) and asset impairment charges of $16,615 ($16,924 pre-tax).

(2) Adjusted net income excluding special items and adjusted basic

and diluted earnings per share excluding special items are non-GAAP

financial measures that management believes are important to

investors to evaluate and compare the Company's financial

performance from period to period. Management uses this information

in assessing and evaluating the Company's underlying operating

performance. Lincoln Electric Holdings, Inc. Financial Highlights

(In thousands) (Unaudited) Balance Sheet Highlights Selected

Consolidated Balance Sheet Data December 31, December 31, 2009 2008

---------- ---------- Cash and cash equivalents $388,136 $284,332

Total current assets 1,023,546 1,024,726 Property, plant and

equipment, net 460,061 427,902 Total assets 1,705,292 1,718,805

Total current liabilities 297,971 356,642 Short-term debt 35,867

50,693 Long-term debt 87,850 91,537 Total equity 1,085,675

1,009,973 Net Operating Working Capital December 31, December 31,

2009 2008 ---------- ---------- Trade accounts receivable $273,700

$299,171 Inventory 255,743 346,932 Trade accounts payable 100,052

124,388 ---------- ---------- Net operating working capital

$429,391 $521,715 ========== ========== Net operating working

capital to net sales (1) 23.2% 24.8% ========== ========== Invested

Capital December 31, December 31, 2009 2008 ---------- ----------

Short-term debt $35,867 $50,693 Long-term debt 87,850 91,537

---------- ---------- Total debt 123,717 142,230 Total equity

1,085,675 1,009,973 ---------- ---------- Invested capital

$1,209,392 $1,152,203 ========== ========== Total debt / invested

capital 10.2% 12.3% Return on invested capital (2) 4.3% 18.6% (1)

Net operating working capital to net sales is defined as net

operating working capital divided by annualized rolling 3 months of

sales. (2) Return on invested capital is defined as rolling 12

months of earnings excluding tax-effected interest divided by

invested capital. Lincoln Electric Holdings, Inc. Financial

Highlights (In thousands, except per share data) (Unaudited)

Consolidated Statements of Cash Flows Three Months Ended December

31, ------------------------------- 2009 2008 ---------- ----------

OPERATING ACTIVITIES: Net income $24,345 $19,470 Adjustments to

reconcile net income to net cash provided by operating activities:

Rationalization and asset impairment charges 2,940 19,371

Depreciation and amortization 14,265 14,024 Equity (earnings) loss

in affiliates, net (400) 2,595 Other non-cash items, net 3,626

13,037 Changes in operating assets and liabilities, net of effects

from acquisitions: Decrease in accounts receivable 3,330 63,084

Decrease in inventories 21,863 52,048 Decrease in accounts payable

(13,975) (55,205) Decrease in accrued pensions (8,697) (8,403) Net

change in other current assets and liabilities (29,464) (76,455)

Net change in other long-term assets and liabilities 1,204 (2,860)

---------- ---------- NET CASH PROVIDED BY OPERATING ACTIVITIES

19,037 40,706 INVESTING ACTIVITIES: Capital expenditures (11,916)

(18,947) Acquisition of businesses, net of cash acquired (7,891)

(16,015) Proceeds from sale of property, plant and equipment (81)

73 ---------- ---------- NET CASH USED BY INVESTING ACTIVITIES

(19,888) (34,889) FINANCING ACTIVITIES: Net change in borrowings

(6,476) (221) Proceeds from exercise of stock options 400 81 Tax

benefit from exercise of stock options 90 312 Purchase of shares

for treasury - (19,216) Cash dividends paid to shareholders

(11,454) (10,685) ---------- ---------- NET CASH USED BY FINANCING

ACTIVITIES (17,440) (29,729) Effect of exchange rate changes on

cash and cash equivalents 460 (4,346) ---------- ----------

DECREASE IN CASH AND CASH EQUIVALENTS (17,831) (28,258) Cash and

cash equivalents at beginning of period 405,967 312,590 ----------

---------- Cash and cash equivalents at end of period $388,136

$284,332 ========== ========== Cash dividends paid per share $0.27

$0.25 Lincoln Electric Holdings, Inc. Financial Highlights (In

thousands, except per share data) (Unaudited) Consolidated

Statements of Cash Flows Twelve Months Ended December 31,

-------------------------------- 2009 2008 ---------- ----------

OPERATING ACTIVITIES: Net income $48,576 $212,286 Adjustments to

reconcile net income to net cash provided by operating activities:

Rationalization and asset impairment charges 2,940 19,371

Depreciation and amortization 56,598 56,925 Equity loss (earnings)

in affiliates, net 8,554 (3,235) Other non-cash items, net 23,691

17,611 Changes in operating assets and liabilities, net of effects

from acquisitions: Decrease in accounts receivable 60,913 30,130

Decrease (increase) in inventories 127,739 (27,845) Decrease in

accounts payable (30,364) (26,768) Decrease in accrued pensions

(39,185) (25,975) Net change in other current assets and

liabilities (12,556) 9,590 Net change in other long-term assets and

liabilities 3,444 (4,641) ---------- ---------- NET CASH PROVIDED

BY OPERATING ACTIVITIES 250,350 257,449 INVESTING ACTIVITIES:

Capital expenditures (38,201) (72,426) Additions to equity

investment in affiliates (488) - Acquisition of businesses, net of

cash acquired (25,449) (44,036) Proceeds from sale of property,

plant and equipment 557 662 ---------- ---------- NET CASH USED BY

INVESTING ACTIVITIES (63,581) (115,800) FINANCING ACTIVITIES: Net

change in borrowings (43,828) 6,423 Proceeds from exercise of stock

options 705 7,201 Tax benefit from exercise of stock options 195

3,728 Purchase of shares for treasury (343) (42,337) Cash dividends

paid to shareholders (45,801) (42,756) ---------- ---------- NET

CASH USED BY FINANCING ACTIVITIES (89,072) (67,741) Effect of

exchange rate changes on cash and cash equivalents 6,107 (6,958)

---------- ---------- INCREASE IN CASH AND CASH EQUIVALENTS 103,804

66,950 Cash and cash equivalents at beginning of period 284,332

217,382 ---------- ---------- Cash and cash equivalents at end of

period $388,136 $284,332 ========== ========== Cash dividends paid

per share $1.08 $1.00 Lincoln Electric Holdings, Inc. Segment

Highlights (In thousands) (Unaudited) The North Asia South Harris

Corporate/ America Europe Pacific America Products Elimin- Consoli-

Welding Welding Welding Welding Group ations dated ------- -------

------- ------- ------- --------- --------- Three months ended

December 31, 2009 Net sales $218,207 $85,808 $75,136 $29,974

$53,324 $- $462,449 Inter- segment sales 21,894 1,724 2,051 308

1,546 (27,523) - -------- -------- ------- ------- ------- --------

-------- Total $240,101 $87,532 $77,187 $30,282 $54,870 $(27,523)

$462,449 ======== ======= ======= ======= ======= ======== ========

EBIT (1) $41,668 $1,641 $(4,207) $3,554 $(108) $(861) $41,687 As a

percent of total sales 17.4% 1.9% (5.5%) 11.7% (0.2%) 9.0% Special

items (2) $195 $1,010 $1,876 $- $1,096 $- $4,177 EBIT, as adjusted

(1) $41,863 $2,651 $(2,331) $3,554 $988 $(861) $45,864 As a percent

of total sales 17.4% 3.0% (3.0%) 11.7% 1.8% 9.9% Three months ended

December 31, 2008 Net sales $286,287 $108,801 $48,064 $26,593

$56,441 $- $526,186 Inter- segment sales 30,910 1,905 1,170 8 1,677

(35,670) - -------- -------- ------- ------- ------- --------

-------- Total $317,197 $110,706 $49,234 $26,601 $58,118 $(35,670)

$526,186 ======== ======== ======= ======= ======= ========

======== EBIT (1) $54,588 $(851) $(16,304) $2,554 $(5,087) $(1,077)

$33,823 As a percent of total sales 17.2% (0.8%) (33.1%) 9.6%

(8.8%) 6.4% Special items (2) $818 $2,052 $15,582 $- $919 $-

$19,371 EBIT, as adjusted (1) $55,406 $1,201 $(722) $2,554 $(4,168)

$(1,077) $53,194 As a percent of total sales 17.5% 1.1% (1.5%) 9.6%

(7.2%) 10.1% Twelve months ended December 31, 2009 Net sales

$858,180 $346,383 $208,280 $99,171 $217,271 $- $1,729,285 Inter-

segment sales 85,630 8,725 4,051 308 7,739 (106,453) - --------

-------- -------- ------- -------- --------- ---------- Total

$943,810 $355,108 $212,331 $99,479 $225,010 $(106,453) $1,729,285

======== ======== ======== ======= ======== ========= ==========

EBIT (1) $124,158 $(6,531) $(27,977) $10,120 $(4,886) $(3,344)

$91,540 As a percent of total sales 13.2% (1.8%) (13.2%) 10.2%

(2.2%) 5.3% Special items (3) $10,386 $4,335 $9,607 $528 $5,774 $-

$30,630 EBIT, as adjusted (1) $134,544 $(2,196) $(18,370) $10,648

$888 $(3,344) $122,170 As a percent of total sales 14.3% (0.6%)

(8.7%) 10.7% 0.4% 7.1% Twelve months ended December 31, 2008 Net

sales$1,313,881 $538,570 $230,661 $116,061 $279,958 $- $2,479,131

Inter- segment sales 127,087 15,649 3,522 37 8,568 (154,863) -

---------- -------- -------- -------- -------- --------- ----------

Total $1,440,968 $554,219 $234,183 $116,098 $288,526 $(154,863)

$2,479,131 ========== ======== ======== ======== ======== =========

========== EBIT (1) $242,830 $53,946 $(7,322) $9,984 $9,299

$(5,618) $303,119 As a percent of total sales 16.9% 9.7% (3.1%)

8.6% 3.2% 12.2% Special items (2) $818 $2,052 $15,582 $- $919 $-

$19,371 EBIT, as adjusted (1) $243,648 $55,998 $8,260 $9,984

$10,218 $(5,618) $322,490 As a percent of total sales 16.9% 10.1%

3.5% 8.6% 3.5% 13.0% (1) The primary profit measure used by

management to assess segment performance is earnings before

interest and income taxes ("EBIT"), as adjusted. Segment EBIT is

adjusted for special items such as the impact of rationalization

activities, certain asset impairment charges and gains or losses on

disposals of assets. (2) Special items includes the impacts of

rationalization activities and asset impairment charges. (3)

Special items includes the impacts of rationalization activities,

asset impairment charges, a gain on the sale of a property, a

pension settlement gain and a loss on the disposal of an

investment. Lincoln Electric Holdings, Inc. Change in Net Sales by

Segment (In thousands) (Unaudited) Fourth Quarter Change in Net

Sales by Segment Change in Net Sales due to:

------------------------------------------ Net Sales Foreign Net

Sales 2008 Volume Acquisitions Price Exchange 2009 ----------

-------- ------------ ---------- --------- ---------- Operating

Segments North America Welding $286,287 $(58,806) $- $(11,819)

$2,545 $218,207 Europe Welding 108,801 (18,952) - (10,126) 6,085

85,808 Asia Pacific Welding 48,064 (7,611) 32,813 (2,781) 4,651

75,136 South America Welding 26,593 (2,276) - 3,299 2,358 29,974

The Harris Products Group 56,441 (7,793) - 3,676 1,000 53,324

---------- ---------- ---------- ---------- ---------- ----------

Consoli- dated $526,186 $(95,438) $32,813 $(17,751) $16,639

$462,449 ========== ========== ========== ========== ==========

========== % Change North America Welding (20.5%) - (4.1%) 0.9%

(23.8%) Europe Welding (17.4%) - (9.3%) 5.6% (21.1%) Asia Pacific

Welding (15.8%) 68.3% (5.8%) 9.7% 56.3% South America Welding

(8.6%) - 12.4% 8.9% 12.7% The Harris Products Group (13.8%) - 6.5%

1.8% (5.5%) ---------- ---------- ---------- ---------- ----------

Consolidated (18.1%) 6.2% (3.4%) 3.2% (12.1%) ========== ==========

========== ========== ========== Full Year Change in Net Sales by

Segment Change in Net Sales due to:

------------------------------------------ Net Sales Foreign Net

Sales 2008 Volume Acquisitions Price Exchange 2009 ----------

-------- ------------ ---------- ---------- ---------- Operating

Segments North America Welding $1,313,881 $(456,826) $- $15,912

$(14,787) $858,180 Europe Welding 538,570 (130,235) 5,242 (22,510)

(44,684) 346,383 Asia Pacific Welding 230,661 (68,447) 54,638

(5,471) (3,101) 208,280 South America Welding 116,061 (23,831) -

13,117 (6,176) 99,171 The Harris Products Group 279,958 (59,196)

13,570 (14,178) (2,883) 217,271 ---------- --------- ---------

---------- ---------- ---------- Consoli- dated $2,479,131

$(738,535) $73,450 $(13,130) $(71,631)$1,729,285 ==========

========= ========= ========== ========== ========== % Change North

America Welding (34.8%) - 1.2% (1.1%) (34.7%) Europe Welding

(24.2%) 1.0% (4.2%) (8.3%) (35.7%) Asia Pacific Welding (29.7%)

23.7% (2.4%) (1.3%) (9.7%) South America Welding (20.5%) - 11.3%

(5.3%) (14.6%) The Harris Products Group (21.1%) 4.8% (5.1%) (1.0%)

(22.4%) ---------- ---------- ---------- ---------- ----------

Consolidated (29.8%) 3.0% (0.5%) (2.9%) (30.2%) ==========

========== ========== ========== ========== DATASOURCE: Lincoln

Electric Holdings, Inc. CONTACT: Media: Roy L. Morrow,

+1-216-383-4893, , or Investors: Earl L. Ward, +1-216-383-5067, Web

Site: http://www.lincolnelectric.com/

Copyright

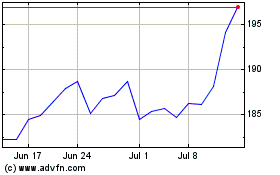

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Jul 2024 to Jul 2024

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Jul 2023 to Jul 2024