CLEVELAND, Oct. 25 /PRNewswire-FirstCall/ -- Three Months Ended

September 30, 2007 * Sales increased 14.1% to $564.8 million *

Operating income increased 13.3% * Excluding non-recurring items in

2006, operating income increased 12.1% * Net income increased 14.0%

to $50.0 million * Excluding non-recurring items in 2006, adjusted

net income increased 12.3% to $50.0 million * Diluted Earnings Per

Share (EPS) were $1.15 vs. $1.02, an increase of 12.7% * Excluding

non-recurring items in 2006, Diluted EPS was $1.15 vs. $1.03 an

increase of 11.7% * Net cash provided by operating activities was

$96.7 million Nine Months Ended September 30, 2007 * Sales

increased 16.0% to $1.70 billion * Operating income increased 21.6%

* Excluding non-recurring items, operating income increased 19.7% *

Net income increased 24.3% to $153.2 million * Excluding

non-recurring items, adjusted net income increased 21.7% to $153.6

million * Diluted EPS was $3.53 vs. $2.87, an increase of 23.0% *

Excluding non-recurring items, Diluted EPS was $3.54 vs. $2.94, an

increase of 20.4% * Net cash provided by operating activities was

$204.1 million Lincoln Electric Holdings, Inc. (the "Company")

(NASDAQ:LECO) today reported that 2007 third quarter net income

increased 14.0% to $50.0 million, or $1.15 per diluted share, on

sales of $564.8 million, an increase of 14.1%. Net income in the

comparable period of 2006 was $43.9 million, or $1.02 per diluted

share, on net sales of $495.1 million. Operating income for the

2007 third quarter increased 13.3% to $67.6 million from $59.7

million in the comparable 2006 period. Net income for the 2006

third quarter includes charges of $0.7 million ($0.7 million

after-tax, or $0.01 per diluted share) related to European

rationalization actions. Excluding non-recurring items, adjusted

net income increased 12.3% to $50.0 million, or $1.15 per diluted

share in 2007 compared to $44.5 million or $1.03 per diluted share

in 2006. The 2007 third quarter effective tax rate was 28.7%

compared with 28.9% in 2006. "We had another strong quarter of

overall sales, profits and cash flow. These positive results have

been achieved despite challenges in several key market and

geographic segments," said John M. Stropki, Chairman and Chief

Executive Officer. "We continue to focus on strategically

strengthening our broad global manufacturing platform and product

line. I am very pleased with the continued impact of supply chain

improvements which resulted in record levels of operating cash

flows." Sales for the Company's North American operations were

$346.7 million in the quarter versus $330.4 million in the

comparable quarter last year, an increase of 4.9%. U.S. export

sales in the quarter increased 19.6% to $50.6 million from $42.3

million in 2006. Sales at Lincoln subsidiaries outside North

America increased to $218.1 million in the third quarter, compared

with $164.7 million in the year ago quarter. In local currencies,

international subsidiaries' sales increased 19.2%. Net income for

the first nine months of 2007 increased 24.3% to $153.2 million, or

$3.53 per diluted share. This compares with net income of $123.2

million in the same period last year, or $2.87 per diluted share.

Operating income for the nine month period increased 21.6% to

$211.3 million from $173.7 million in the 2006 period. Net income

for the first nine months of 2007 and 2006 includes non-recurring

charges related to European rationalization actions of $0.4 million

($0.4 million after-tax, or $0.01 per diluted share) and $3.0

million ($3.0 million after-tax, or $0.07 per diluted share),

respectively. Excluding non-recurring items, adjusted net income

increased 21.7% to $153.6 million, or $3.54 per diluted share in

2007 compared to $126.2 million, or $2.94 per diluted share in

2006. Sales in the first nine months of 2007 increased 16.0%, to

$1.70 billion from $1.47 billion in the 2006 comparable period. The

Company's North American operations had sales of $1.06 billion in

2007, compared with $986.3 million for the same period in 2006, an

increase of 7.1%. U.S. export sales increased 31.7% to $148.2

million, compared with $112.5 million in the comparable 2006

period. Lincoln operations outside of North America had sales of

$644.2 million, an increase of 34.3% over prior year sales of

$479.7 million. In local currencies, sales for the Company's

international operations increased 20.6%. Net cash provided by

operating activities was $96.7 million and $204.1 million for the

three month and nine month periods ending September 30, 2007,

respectively, compared with $47.8 million and $105.1 million for

the comparable periods of 2006. During 2007, the Company repaid

$40.0 million of outstanding debt under its Senior Unsecured Notes

and paid $28.3 million in dividends. The Company's Board of

Directors declared a quarterly cash dividend of $0.22, which was

paid on October 15, 2007 to holders of record as of September 28,

2007. Lincoln Electric is the world leader in the design,

development and manufacture of arc welding products, robotic

arc-welding systems, plasma and oxyfuel cutting equipment and has a

leading global position in the brazing and soldering alloys market.

Headquartered in Cleveland, Ohio, Lincoln has 35 manufacturing

locations, including operations, manufacturing alliances and joint

ventures in 19 countries and a worldwide network of distributors

and sales offices covering more than 160 countries. For more

information about Lincoln Electric, its products and services,

visit the Company's Website at http://www.lincolnelectric.com/. The

Company's expectations and beliefs concerning the future contained

in this news release are forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements reflect management's current expectations and

involve a number of risks and uncertainties. Actual results may

differ materially from such statements due to a variety of factors

that could adversely affect the Company's operating results. The

factors include, but are not limited to: the effectiveness of

operating initiatives; currency exchange and interest rates;

adverse outcome of pending or potential litigation; possible

acquisitions; market risks and price fluctuations related to the

purchase of commodities and energy; global regulatory complexity;

and the possible effects of international terrorism and hostilities

on the Company or its customers, suppliers and the economy in

general. For additional discussion, see "Item 1A. Risk Factors" in

the Company's Annual Report on Form 10-K for the year ended

December 31, 2006. A conference call to discuss third quarter 2007

results is scheduled for today, Thursday, October 25, 2007 at 9:30

a.m. Eastern Time. An audio webcast of the call is accessible

through the Investor page on the Company's Website at

http://www.lincolnelectric.com/. Lincoln Electric Holdings, Inc.

Financial Highlights (In thousands, except per share data)

(Unaudited) Consolidated Fav (Unfav) to Statements of Income Three

Months Ended September 30, Prior Year % of % of 2007 Sales 2006

Sales $ % Net sales $564,824 100.0% $495,137 100.0% $69,687 14.1%

Cost of goods sold 405,083 71.7% 353,800 71.5% (51,283) (14.5%)

Gross profit 159,741 28.3% 141,337 28.5% 18,404 13.0% Selling,

general & administrative expenses 92,140 16.3% 81,019 16.4%

(11,121) (13.7%) Rationalization charges - 0.0% 665 0.1% 665 100.0%

Operating income 67,601 12.0% 59,653 12.0% 7,948 13.3% Interest

income 2,290 0.4% 1,607 0.3% 683 42.5% Equity earnings in

affiliates 2,263 0.4% 2,450 0.5% (187) (7.6%) Other income 819 0.1%

436 0.1% 383 87.8% Interest expense (2,866) (0.5%) (2,504) (0.5%)

(362) (14.5%) Income before income taxes 70,107 12.4% 61,642 12.4%

8,465 13.7% Income taxes 20,129 3.6% 17,787 3.5% (2,342) (13.2%)

Effective tax rate 28.7% 28.9% 0.2% Net income (1) $49,978 8.8%

$43,855 8.9% $6,123 14.0% Reconciliation of Net Income as Reported

to Adjusted Net Income Excluding Non-Recurring Items: Three Months

Ended September 30, Change 2007 2006 $ % Net income as reported (1)

$49,978 $43,855 $6,123 14.0% Non-recurring items: European

rationalization charges (after-tax) - 665 (665) (100.0%) Adjusted

net income excluding non- recurring items (2) $49,978 $44,520

$5,458 12.3% Basic earnings per share $1.16 $1.03 $0.13 12.6%

Non-recurring items (1) - 0.01 (0.01) (100.0%) Basic earnings per

share excluding non-recurring items (2) $1.16 $1.04 $0.12 11.5%

Diluted earnings per share $1.15 $1.02 $0.13 12.7% Non-recurring

items (1) - 0.01 (0.01) (100.0%) Diluted earnings per share

excluding non-recurring items (2) $1.15 $1.03 $0.12 11.7% Weighted

average shares (basic) 42,969 42,608 Weighted average shares

(diluted) 43,467 43,119 (1) Net income includes charges related to

European rationalization actions of $665 ($665 after-tax) for the

three months ended September 30, 2006. (2) Adjusted net income

excluding non-recurring items and basic and diluted earnings per

share excluding non-recurring items, non-GAAP financial measures,

are presented as management believes these financial measures are

important to investors to evaluate and compare the Company's

financial performance from period to period. Management uses this

information in assessing and evaluating the Company's underlying

operating performance. Lincoln Electric Holdings, Inc. Financial

Highlights (In thousands, except per share data) (Unaudited)

Consolidated Statements of Income Nine Months Ended September 30, %

of % of 2007 Sales 2006 Sales Net sales $1,700,505 100.0%

$1,466,041 100.0% Cost of goods sold 1,213,880 71.4% 1,048,171

71.5% Gross profit 486,625 28.6% 417,870 28.5% Selling, general

& administrative expenses 274,977 16.2% 241,126 16.4%

Rationalization charges 396 0.0% 3,006 0.2% Operating income

211,252 12.4% 173,738 11.9% Interest income 5,439 0.3% 4,201 0.3%

Equity earnings in affiliates 7,418 0.4% 4,974 0.3% Other income

1,863 0.1% 985 0.0% Interest expense (8,379) (0.4%) (7,343) (0.5%)

Income before income taxes 217,593 12.8% 176,555 12.0% Income taxes

64,366 3.8% 53,332 3.6% Effective tax rate 29.6% 30.2% Net income

(1) $153,227 9.0% $123,223 8.4% Lincoln Electric Holdings, Inc.

Financial Highlights (In thousands, except per share data)

(Unaudited) Consolidated Statements of Income Fav (Unfav) to Prior

Year $ % Net sales $234,464 16.0% Cost of goods sold (165,709)

(15.8%) Gross profit 68,755 16.5% Selling, general &

administrative expenses (33,851) (14.0%) Rationalization charges

2,610 86.8% Operating income 37,514 21.6% Interest income 1,238

29.5% Equity earnings in affiliates 2,444 49.1% Other income 878

89.1% Interest expense (1,036) (14.1%) Income before income taxes

41,038 23.2% Income taxes (11,034) (20.7%) Effective tax rate 0.6%

Net income (1) $30,004 24.3% Reconciliation of Net Income as

Reported to Adjusted Net Income Excluding Non-Recurring Items: Nine

Months Ended September 30, Change 2007 2006 $ % Net income as

reported (1) $153,227 $123,223 $30,004 24.3% Non-recurring items:

European rationalization charges (after-tax) 396 3,006 (2,610)

(86.8%) Adjusted net income excluding non- recurring items (2)

$153,623 $126,229 $27,394 21.7% Basic earnings per share $3.57

$2.90 $0.67 23.1% Non-recurring items (1) 0.01 0.07 (0.06) (85.7%)

Basic earnings per share excluding non-recurring items (2) $3.58

$2.97 $0.61 20.5% Diluted earnings per share $3.53 $2.87 $0.66

23.0% Non-recurring items (1) 0.01 0.07 (0.06) (85.7%) Diluted

earnings per share excluding non-recurring items (2) $3.54 $2.94

$0.60 20.4% Weighted average shares (basic) 42,875 42,468 Weighted

average shares (diluted) 43,373 42,960 (1) Net income includes

charges related to European rationalization actions of $396 ($396

after-tax) for the nine months ended September 30, 2007 and $3,006

($3,006 after-tax) for the nine months ended September 30, 2006.

(2) Adjusted net income excluding non-recurring items and basic and

diluted earnings per share excluding non-recurring items, non-GAAP

financial measures, are presented as management believes these

financial measures are important to investors to evaluate and

compare the Company's financial performance from period to period.

Management uses this information in assessing and evaluating the

Company's underlying operating performance. Lincoln Electric

Holdings, Inc. Financial Highlights (In thousands) (Unaudited)

Balance Sheet Highlights Selected Consolidated Balance Sheet Data

September 30, December 31, 2007 2006 Cash and cash equivalents

$223,220 $120,212 Total current assets 997,867 829,410 Net

property, plant and equipment 420,563 389,518 Total assets

1,626,432 1,394,579 Total current liabilities 356,610 338,288

Short-term debt 12,053 47,134 Long-term debt 114,586 113,965 Total

shareholders' equity 1,033,519 852,976 Net Operating Working

Capital September 30, December 31, 2007 2006 Trade accounts

receivable $353,316 $298,993 Inventory 355,977 351,144 Trade

accounts payable 140,203 142,264 Net operating working capital

$569,090 $507,873 Net operating working capital % to net sales

25.8% 25.8% Total Debt September 30, December 31, 2007 2006

Short-term debt $12,053 $47,134 Long-term debt 114,586 113,965

Total debt 126,639 161,099 Equity 1,033,519 852,976 Total

$1,160,158 $1,014,075 Total debt/capitalization 10.9% 15.9% Return

on invested capital 22.1% 19.9% Lincoln Electric Holdings, Inc.

Financial Highlights (In thousands, except per share data)

(Unaudited) CONSOLIDATED STATEMENTS OF CASH FLOWS Three Months

Ended September 30, 2007 2006 OPERATING ACTIVITIES: Net income

$49,978 $43,855 Adjustments to reconcile net income to net cash

provided by operating activities: Rationalization charges - 665

Depreciation and amortization 13,263 12,832 Equity earnings of

affiliates, net (1,544) (1,950) Other non-cash items, net 414 3,273

Changes in operating assets and liabilities net of effects from

acquisitions: Decrease in accounts receivable 18,574 7,378 Decrease

(increase) in inventories 30,077 (5,554) (Decrease) in accounts

payable (27,861) (20,981) Contributions to pension plans (1,897)

(3,259) (Decrease) increase in accrued pensions (110) 3,758 Net

change in other current assets and liabilities 17,161 9,616 Net

change in other long-term assets and liabilities (1,400) (1,872)

NET CASH PROVIDED BY OPERATING ACTIVITIES 96,655 47,761 INVESTING

ACTIVITIES: Capital expenditures (16,137) (21,057) Acquisition of

businesses, net of cash acquired (1,688) (407) Proceeds from sale

of property, plant and equipment 406 218 NET CASH USED BY INVESTING

ACTIVITIES (17,419) (21,246) FINANCING ACTIVITIES: Net change in

borrowings (1,467) (110) Proceeds from exercise of stock options

2,527 1,330 Tax benefit from the exercise of stock options 2,265

796 Purchase of treasury shares - (126) Cash dividends paid to

shareholders (9,446) (8,101) NET CASH USED BY FINANCING ACTIVITIES

(6,121) (6,211) Effect of exchange rate changes on cash and cash

equivalents 2,124 180 INCREASE IN CASH AND CASH EQUIVALENTS 75,239

20,484 Cash and cash equivalents at beginning of the period 147,981

125,427 Cash and cash equivalents at end of period $223,220

$145,911 Cash dividends paid per share $0.22 $0.19 Lincoln Electric

Holdings, Inc. Financial Highlights (In thousands, except per share

data) (Unaudited) CONSOLIDATED STATEMENTS OF CASH FLOWS Nine Months

Ended September 30, 2007 2006 OPERATING ACTIVITIES: Net income

$153,227 $123,223 Adjustments to reconcile net income to net cash

provided by operating activities: Rationalization charges 396 3,006

Depreciation and amortization 39,096 35,817 Equity earnings of

affiliates, net (5,531) (3,541) Other non-cash items, net (10,276)

5,751 Changes in operating assets and liabilities net of effects

from acquisitions: (Increase) in accounts receivable (35,185)

(48,422) Decrease (increase) in inventories 17,841 (54,982)

(Decrease) increase in accounts payable (13,332) 6,843

Contributions to pension plans (12,292) (19,656) Increase in

accrued pensions 915 12,395 Net change in other current assets and

liabilities 69,672 48,356 Net change in other long-term assets and

liabilities (424) (3,699) NET CASH PROVIDED BY OPERATING ACTIVITIES

204,107 105,091 INVESTING ACTIVITIES: Capital expenditures (45,777)

(53,318) Acquisition of businesses, net of cash acquired (6,102)

(502) Proceeds from sale of property, plant and equipment 607 859

NET CASH USED BY INVESTING ACTIVITIES (51,272) (52,961) FINANCING

ACTIVITIES: Net change in borrowings (37,439) (5,083) Proceeds from

exercise of stock options 7,589 10,282 Tax benefit from the

exercise of stock options 5,001 3,847 Purchase of treasury shares -

(126) Cash dividends paid to shareholders (28,271) (24,178) NET

CASH USED BY FINANCING ACTIVITIES (53,120) (15,258) Effect of

exchange rate changes on cash and cash equivalents 3,293 1,032

INCREASE IN CASH AND CASH EQUIVALENTS 103,008 37,904 Cash and cash

equivalents at beginning of period 120,212 108,007 Cash and cash

equivalents at end of period $223,220 $145,911 Cash dividends paid

per share $0.66 $0.57 DATASOURCE: Lincoln Electric Holdings, Inc.

CONTACT: Investors, Joseph P. Kelley, +1-216-383-8346, , or Media,

Roy L. Morrow, +1-216-383-4893, , both of Lincoln Electric

Holdings, Inc. Web site: http://www.lincolnelectric.com/

Copyright

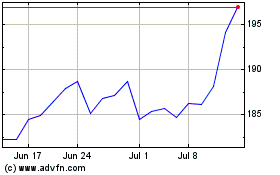

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Jul 2024 to Jul 2024

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Jul 2023 to Jul 2024