Current Report Filing (8-k)

December 10 2019 - 5:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): December 10, 2019

LIFEWAY FOODS, INC.

(Exact name of registrant as specified in

its charter)

|

ILLINOIS

|

|

000-17363

|

|

36-3442829

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

6431 Oakton St. Morton Grove, IL

|

|

60053

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

(847) 967-1010

(Registrant’s telephone number,

including area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock

|

LWAY

|

Nasdaq

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b 2 of this chapter). Emerging growth company ☐

If any emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On December 10, 2019, Lifeway entered into the Second Modification

to the Amended and Restated Loan and Security Agreement, as amended, (the “Second Modification”) with its existing

lender. The Second Modification amends the Amended and Restated Loan and Security Agreement, as amended, by redefining the “Borrowing

Base” and further clarifying the definitions of “Eligible Accounts” and “Eligible Inventory.” The

Second Modification also addresses the calculation of interest after the potential discontinuance of LIBOR and its replacement

with a replacement benchmark interest rate.

The Amended and Restated Loan and Security Agreement, as amended,

continues to provide Lifeway with a revolving line of credit up to a maximum of $9 million (the “Revolving Loan”) with

an incremental facility not to exceed $5 million (the “Incremental Facility” and together with the Revolving Loan,

the “Loans”) after the Second Modification. The Loans’ provisions for events of default and other customary representations,

including financial covenants requiring us to achieve a minimum EBITDA threshold for each of the fiscal quarters through December

31, 2019, and maintain a fixed charge coverage ratio of no less than 1.25 to 1.0 each of the fiscal quarters ending through the

expiration date, remain substantively unchanged from the Amended and Restated Loan and Security Agreement, as amended.

The foregoing description of the Second Modified Revolving Credit

Facility does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Modification,

which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Lifeway had outstanding borrowings of approximately $2.78 million

at the time of the modification.

Item 8.01 Other Events

As previously disclosed, on November 1, 2017,

Lifeway’s Board approved an increase in the aggregate amount under our previously announced 2015 stock repurchase

program (the “2017 Repurchase Plan Amendment”), by adding to (i.e., exclusive of the shares previously authorized

under the 2015 stock repurchase program) the authorization the lesser of $5.185 million or 625,000 shares. Approximately

180,000 shares remain in the 2017 Repurchase Plan Amendment’s authorization. We intend to continue to execute

transactions pursuant to this authorization from time to time in the open market or by private negotiation, in accordance

with all applicable securities laws and regulations, including Rule 10b-18 of the Securities Exchange Act of 1934 (the

“Exchange Act”).

Effective December 10, 2019, Lifeway’s Audit and Corporate

Governance Committee of its Board of Directors authorized Lifeway to enter into a written trading plan under Rule 10b5-1 of the

Exchange Act to effect the repurchase of the approximately 180,000 shares remaining under the 2017 Repurchase Plan Amendment. Adopting

a trading plan that satisfies the conditions of Rule 10b5-1 allows a company to repurchase its shares at times when it might otherwise

be prevented from doing so due to self-imposed trading blackout periods or pursuant to insider trading laws. Under any Rule 10b5-1

trading plan, Lifeway’s third-party broker, subject to Securities and Exchange Commission regulations regarding certain price,

market, volume and timing constraints, would have authority to purchase Lifeway’s common stock in accordance with the terms

of the plan. Lifeway may from time to time enter into Rule 10b5-1 trading plans to facilitate the repurchase of its

common stock pursuant to the 2017 Repurchase Plan Amendment.

Lifeway cannot predict when or if it will repurchase any shares

of common stock pursuant to the 2017 Repurchase Plan Amendment as such repurchases will depend on a number of factors, including

constraints specified in any Rule 10b5-1 trading plans, price, general business and market conditions, and alternative investment

opportunities. Information regarding share repurchases will be available in Lifeway’s periodic reports on Form

10-Q and 10-K filed with the Securities and Exchange Commission as required by the applicable rules of the Exchange Act.

This report contains forward-looking information, as that term

is defined under the Exchange Act, including information regarding purchases by Lifeway of its common stock pursuant to any Rule

10b5-1 trading plans. By their nature, forward-looking information and statements are subject to risks, uncertainties, and contingencies,

including changes in price and volume and the volatility of Lifeway’s common stock; constraints specified in any Rule 10b5-1

trading plans, Lifeway’s general business and market conditions, and such other factors as discussed throughout Part I, Item

1 “Business”; Part I, Item 1A “Risk Factors”; and Part II, Item 7 “Management's Discussion and Analysis

of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the year ended December 31, 2018

and that are described from time to time in our filings with the SEC.. Lifeway does not undertake to update any forward-looking

statements or information, including those contained in this report.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits

|

No.

|

Description

|

|

Form

|

Period Ending

|

Exhibit

|

Filing Date

|

|

|

|

|

|

|

|

|

|

10.1

|

Second Modification to Amended and Restated Loan and Security Agreement dated as of December 10, 2019 among Lifeway Foods, Inc., Fresh Made, Inc., The Lifeway Kefir Shop, LLC, Lifeway Wisconsin, Inc., and CIBC Bank USA, as Lender.

|

|

Filed Herewith

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 10, 2019

|

|

|

|

|

|

|

|

LIFEWAY FOODS, INC.

|

|

|

|

By:

|

/s/ Douglas A. Hass

|

|

|

|

|

Name: Douglas A. Hass

Title: General Counsel and Corporate Secretary

|

|

|

|

|

|

|

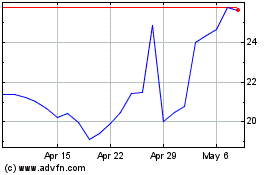

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

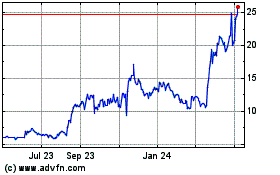

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Jul 2023 to Jul 2024