Lam Research Corporation's (NASDAQ: LRCX) highlights for the

December 2011 quarter were:

Lam Research Corporation

Financial Highlights for the Quarter Ended December 25, 2011

(in thousands, except per share data and percentages)

U.S. GAAP Non-GAAP

------------- -------------

Revenue: $ 583,981 $ 583,981

Operating Margin: 8.1% 9.2%

Net Income: $ 33,212 $ 41,013

Diluted EPS: $ 0.27 $ 0.34

Lam Research Corporation today announced financial results for

the quarter ended December 25, 2011. Revenue for the period was

$584.0 million, gross margin was $234.8 million, or 40.2%,

operating expenses were $187.3 million, and net income was $33.2

million, or $0.27 per diluted share, compared to revenue of $680.4

million, gross margin of $283.9 million, or 41.7%, operating

expenses of $184.5 million, and net income of $71.8 million, or

$0.58 per diluted share, for the September 2011 quarter. Shipments

for the December 2011 quarter were $563 million compared to $580

million during the September 2011 quarter.

In addition to U.S. Generally Accepted Accounting Principles

(GAAP) results, this commentary contains non-GAAP financial

measures. The Company's non-GAAP results for both the December 2011

and September 2011 quarters exclude the amortization of convertible

note discounts and certain costs for restructuring and impairments.

Additionally, the Company's non-GAAP results for the December 2011

quarter exclude certain acquisition related costs. Management uses

non-GAAP gross margin, operating income, operating expenses,

operating margin, net income, and net income per diluted share to

evaluate the Company's operating and financial results. The Company

believes the presentation of non-GAAP results is useful to

investors for analyzing business trends and comparing performance

to prior periods, along with enhancing the investors' ability to

view the Company's results from management's perspective. Tables

presenting reconciliations of non-GAAP results to U.S. GAAP results

are included at the end of this press release and on the Company's

web site at http://investor.lamresearch.com.

Non-GAAP net income was $41.0 million, or $0.34 per diluted

share, in the December 2011 quarter compared to non-GAAP net income

of $78.3 million, or $0.63 per diluted share, for the September

2011 quarter. Non-GAAP gross margin for the December 2011 quarter

was $234.0 million, or 40.1%, compared to non-GAAP gross margin of

$283.9 million, or 41.7%, for the September 2011 quarter. The

sequential decrease in gross margin was due to both lower factory

and field utilization as a result of the decline in business

volumes and product mix. Non-GAAP operating expenses for the

December 2011 quarter decreased to $180.4 million compared with the

September 2011 quarter of $182.8 million as a result of reductions

in variable compensation associated with the operating income

level.

The geographic distribution of shipments and revenue during the

December 2011 quarter is shown in the following table:

Region Shipments Revenue

--------------- ------------ ------------

North America 19% 18%

Europe 8% 9%

Japan 10% 14%

Korea 37% 34%

Taiwan 18% 17%

Asia Pacific 8% 8%

Cash and cash equivalents, short-term investments and restricted

cash and investments balances were $2.4 billion at the end of the

December 2011 quarter, compared to $2.2 billion at the end of the

September 2011 quarter. The increase in cash and cash equivalents,

short-term investments and restricted cash and investments balances

during the quarter was primarily due to operating activities and

the cash settlement of a stock repurchase agreement. Cash flows

from operating activities were approximately $169.0 million or 29%

of revenue during the December 2011 quarter. Deferred revenue and

deferred profit balances at the end of the December 2011 quarter

increased to $191.8 million and $117.3 million, respectively. Lam's

deferred revenue balance does not include shipments to Japanese

customers, to whom title does not transfer until customer

acceptance. Shipments to Japanese customers are classified as

inventory at cost until the time of acceptance. The anticipated

future revenue from shipments to Japanese customers was

approximately $15.5 million as of December 25, 2011.

"Lam delivered solid financial results in the December quarter

consistent with expectations, supported by initial leading edge

capacity shipments across all segments," said Martin Anstice, Lam's

president and chief executive officer. "Throughout 2011, we

executed on our long-term growth strategy by investing in the

technology and productivity solutions that address our customers'

most critical needs and position Lam to solidify and grow its

position in etch and single-wafer clean. In addition, as announced

in December, we plan to extend our product and services portfolio

and leadership in wafer fab equipment via the acquisition of

Novellus Systems. We believe that the complementary market

positions, technologies, product capabilities and leadership of

both companies will provide more comprehensive and faster solutions

to our customers and provide improved financial performance for our

shareholders," Anstice concluded.

Participants in the Solicitation

The directors and executive officers of Lam Research and

Novellus Systems, Inc. ("Novellus," and together with Lam Research

and their subsidiaries, the "Merged Company") may be deemed to be

participants in the solicitation of proxies in connection with the

approval of the proposed merger of Lam Research and Novellus (the

"Merger"). Lam Research plans to file the registration statement

that includes the joint proxy statement/prospectus with the

Securities and Exchange Commission ("SEC") in connection with the

solicitation of proxies to approve the proposed transaction.

Information regarding Lam Research's directors and executive

officers and their respective interests in Lam Research by security

holdings or otherwise is available in its Annual Report on Form

10-K filed with the SEC on August 19, 2011 and its Proxy Statement

on Schedule 14A filed with the SEC on September 19, 2011.

Information regarding Novellus Systems' directors and executive

officers and their respective interests in Novellus Systems by

security holdings or otherwise is available in its Annual Report on

Form 10-K filed with the SEC on February 25, 2011 and its Proxy

Statement on Schedule 14A filed with the SEC on April 8, 2011.

Additional information regarding the interests of such potential

participants is or will be included in the joint proxy

statement/prospectus and registration statement, and other relevant

materials to be filed with the SEC, when they become available,

including in connection with the solicitation of proxies to approve

the proposed transaction and to elect directors.

How to Find Further Information

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. In connection with the

proposed merger, Lam Research intends to file with the SEC a

registration statement on Form S-4 that will include a joint proxy

statement of Lam Research and Novellus Systems that also

constitutes a prospectus of Lam Research. Lam Research and Novellus

Systems will furnish the joint proxy statement/prospectus and other

relevant documents to their respective security holders in

connection with the proposed merger of Lam Research and Novellus

Systems. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, WE URGE

SECURITY HOLDERS AND INVESTORS TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS

THERETO) AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT LAM RESEARCH AND NOVELLUS

SYSTEMS AND THE PROPOSED MERGER. The proposals for the merger will

be made solely through the joint proxy statement/prospectus. In

addition, a copy of the joint proxy statement/prospectus (when it

becomes available) may be obtained free of charge from Lam Research

Corporation, Investor Relations, 4650 Cushing Parkway, Fremont, CA

94538-6401, or from Novellus Systems, Investor Relations, 4000

North First Street, San Jose, CA 95134. Security holders will be

able to obtain, free of charge, copies of the joint proxy

statement/prospectus and S-4 Registration Statement and any other

documents filed by Lam Research or Novellus Systems with the SEC in

connection with the proposed Merger at the SEC's website at

http://www.sec.gov, and at the companies' websites at

www.LamResearch.com and www.Novellus.com, respectively.

Caution Regarding Forward-Looking

Statements

Statements made in this press release that are not statements of

historical fact are forward-looking statements and are subject to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements relate, but are

not limited, to the anticipated revenue from shipments to Japanese

customers, the closure of our acquisition of Novellus Systems and

the benefits of that acquisition, such as faster customer solutions

and better financial performance for our shareholders. Some factors

that may affect these forward-looking statements include: the

shareholder votes on the planned Novellus acquisition, business

conditions in the consumer electronics industry, the semiconductor

industry and the overall economy; the strength of the financial

performance of our existing and prospective customers; the

introduction of new and innovative technologies; the occurrence and

pace of technology transitions and conversions; the actions of our

competitors, consumers, semiconductor companies and key suppliers

and subcontractors; and the success of research and development and

sales and marketing programs. These forward-looking statements are

based on current expectations and are subject to uncertainties and

changes in condition, significance, value and effect as well as

other risks detailed in documents filed by us with the Securities

and Exchange Commission, including specifically our report on Form

10-K for the year ended June 26, 2011 and the report on Form 10-Q

for the three months ended September 25, 2011. These uncertainties

and changes could cause actual results to vary from expectations.

The Company undertakes no obligation to update the information or

statements made in this press release.

Nothing contained herein shall be deemed to be a forecast,

projection or estimate of the future financial performance of Lam

Research, Novellus Systems, or the Merged Company, following the

implementation of the Merger or otherwise. No statement in this

announcement should be interpreted to mean that the earnings per

share, profits, margins or cash flows of Lam Research or the Merged

Company for the current or future financial years would necessarily

match or exceed the historical published figures.

Lam Research Corporation is a major supplier of wafer

fabrication equipment and services to the world's semiconductor

industry, where the company has been advancing semiconductor

manufacturing for more than 30 years. As a technology and market

share leader in plasma etch and single-wafer clean, Lam Research is

leveraging its combined expertise to address some of today's most

advanced semiconductor processing challenges. Headquartered in

Fremont, Calif., Lam Research maintains a global network of service

facilities throughout North America, Asia, and Europe to meet the

complex and changing needs of its global customer base. Lam's

common stock trades on The NASDAQ Global Select MarketSM under the

symbol LRCX. Lam is a NASDAQ-100® company. For more information,

visit http://www.lamresearch.com.

Consolidated Financial Tables Follow

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data and percentages)

(unaudited)

Three Months Ended Six Months Ended

-------------------------------- ----------------------

December September December December December

25, 25, 26, 25, 26,

2011 2011 2010 2011 2010

--------- ---------- --------- ---------- ----------

Revenue $ 583,981 $ 680,436 $ 870,714 $1,264,417 $1,676,588

Cost of goods

sold 350,014 396,553 463,281 746,567 891,829

Cost of goods

sold -

restructuring

and asset

impairments (859) - - (859) -

--------- ---------- --------- ---------- ----------

Total costs of

goods sold 349,155 396,553 463,281 745,708 891,829

--------- ---------- --------- ---------- ----------

Gross margin 234,826 283,883 407,433 518,709 784,759

Gross margin

as a percent

of revenue 40.2% 41.7% 46.8% 41.0% 46.8%

Research and

development 104,024 102,559 90,477 206,583 176,830

Selling, general

and

administrative 83,256 80,200 75,852 163,456 147,994

Restructuring and

impairments - 1,725 - 1,725 (5,163)

--------- ---------- --------- ---------- ----------

Total

operating

expenses 187,280 184,484 166,329 371,764 319,661

--------- ---------- --------- ---------- ----------

Operating

income 47,546 99,399 241,104 146,945 465,098

Operating

margin as a

percent of

revenue 8.1% 14.6% 27.7% 11.6% 27.7%

Other income

(expense), net (7,785) (12,073) 1,038 (19,858) 59

--------- ---------- --------- ---------- ----------

Income before

income taxes 39,761 87,326 242,142 127,087 465,157

Income tax expense 6,549 15,488 20,286 22,037 49,577

--------- ---------- --------- ---------- ----------

Net income $ 33,212 $ 71,838 $ 221,856 $ 105,050 $ 415,580

========= ========== ========= ========== ==========

Net income per

share:

Basic net income

per share $ 0.28 $ 0.58 $ 1.80 $ 0.87 $ 3.37

========= ========== ========= ========== ==========

Diluted net

income per

share $ 0.27 $ 0.58 $ 1.78 $ 0.86 $ 3.32

========= ========== ========= ========== ==========

Number of shares

used in per share

calculations:

Basic 119,739 123,130 123,101 121,435 123,384

========= ========== ========= ========== ==========

Diluted 120,873 124,049 124,786 122,382 124,999

========= ========== ========= ========== ==========

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

December 25, September 25, June 26,

2011 2011 2011

------------- ------------- -------------

(unaudited) (unaudited) (1)

ASSETS

Cash and cash equivalents $ 1,506,928 $ 1,339,318 $ 1,492,132

Short-term investments 712,856 713,087 630,115

Accounts receivable, net 462,243 523,240 590,568

Inventories 373,130 396,301 396,607

Deferred income taxes 78,479 78,330 78,435

Other current assets 79,215 81,740 85,408

------------- ------------- -------------

Total current assets 3,212,851 3,132,016 3,273,265

Property and equipment, net 272,409 266,411 270,458

Restricted cash and investments 165,217 165,239 165,256

Deferred income taxes 4,184 4,718 3,892

Goodwill and intangible assets 207,568 212,087 216,616

Other assets 115,918 117,870 124,380

------------- ------------- -------------

Total assets $ 3,978,147 $ 3,898,341 $ 4,053,867

============= ============= =============

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities $ 593,605 $ 591,981 $ 680,759

------------- ------------- -------------

Long-term debt, convertible notes,

and capital leases $ 749,078 $ 743,252 $ 738,488

Income taxes payable 115,616 116,509 113,582

Other long-term liabilities 57,104 56,717 51,193

Stockholders' equity 2,462,744 2,389,882 2,469,845

------------- ------------- -------------

Total liabilities and

stockholders' equity $ 3,978,147 $ 3,898,341 $ 4,053,867

============= ============= =============

(1) Derived from audited financial statements

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended Six Months Ended

--------------------------------- ---------------------

December September December December December

25, 25, 26, 25, 26,

2011 2011 2010 2011 2010

---------- ---------- --------- ---------- ---------

CASH FLOWS FROM

OPERATING

ACTIVITIES:

Net income $ 33,212 $ 71,838 $ 221,856 $ 105,050 $ 415,580

Adjustments to

reconcile net

income to net

cash provided by

(used for)

operating

activities:

Depreciation and

amortization 22,372 21,360 18,663 43,732 36,611

Deferred income

taxes (633) - (3,039) (633) (3,822)

Restructuring

and impairment

charges, net (859) 1,725 - 866 (5,163)

Equity-based

compensation

expense 18,224 17,744 12,759 35,968 25,768

Income tax

benefit on

equity-based

compensation

plans 470 659 (918) 1,129 4,165

Excess tax

benefit on

equity-based

compensation

plans (204) (1,951) 711 (2,155) (3,228)

Amortization of

convertible

note discount 6,671 6,593 - 13,264 -

Impairment of

investment - 1,724 - 1,724 -

Loss on equity

method

investment 202 - - 202 -

Other, net 881 1,423 (1,600) 2,304 (3,564)

Changes in

operating

assets and

liabilities: 88,680 (34,215) (62,849) 54,465 (25,020)

---------- ---------- --------- ---------- ---------

Net cash

provided by

operating

activities 169,016 86,900 185,583 255,916 441,327

---------- ---------- --------- ---------- ---------

CASH FLOWS FROM

INVESTING

ACTIVITIES:

Capital

expenditures and

intangible assets (26,682) (15,732) (38,025) (42,414) (57,155)

Net

sales/maturities

(purchases) of

available-for-

sale securities (4,194) (85,259) (1,160) (89,453) (25,666)

Purchase of equity

method investment (10,740) - - (10,740) -

Receipt of loan

payments 8,375 - - 8,375 -

Proceeds from sale

of assets 2,677 - 1,544 2,677 1,544

Transfer of

restricted cash

and investments 3 17 - 20 (10)

---------- ---------- --------- ---------- ---------

Net cash used

for investing

activities (30,561) (100,974) (37,641) (131,535) (81,287)

---------- ---------- --------- ---------- ---------

CASH FLOWS FROM

FINANCING

ACTIVITIES:

Principal payments

on long-term debt

and capital lease

obligations (1,576) (1,564) (78) (3,140) (3,411)

Excess tax benefit

on equity-based

compensation

plans 204 1,951 (711) 2,155 3,228

Net cash received

in settlement

(paid in advance

for) stock

repurchase

contracts 51,005 (75,000) (50,000) (23,995) (50,000)

Treasury stock

purchases (20,642) (72,053) (4,151) (92,695) (148,946)

Reissuances of

treasury stock

related to

employee stock

purchase plan - 8,858 - 8,858 7,155

Proceeds from

issuance of

common stock 1,311 164 3,407 1,475 4,242

---------- ---------- --------- ---------- ---------

Net cash

provided by

(used for)

financing

activities 30,302 (137,644) (51,533) (107,342) (187,732)

---------- ---------- --------- ---------- ---------

Effect of exchange

rate changes on

cash (1,147) (1,096) 4,370 (2,243) 10,985

Net increase

(decrease) in

cash and cash

equivalents 167,610 (152,814) 100,779 14,796 183,293

Cash and cash

equivalents at

beginning of

period 1,339,318 1,492,132 628,281 1,492,132 545,767

---------- ---------- --------- ---------- ---------

Cash and cash

equivalents at

end of period $1,506,928 $1,339,318 $ 729,060 $1,506,928 $ 729,060

========== ========== ========= ========== =========

Reconciliation of U.S. GAAP Net Income to Non-GAAP Net Income

(in thousands, except per share data)

(unaudited)

Three Months Three Months

Ended Ended

------------- -------------

December 25, September 25,

2011 2011

------------- -------------

U.S. GAAP net income $ 33,212 $ 71,838

Pre-tax non-GAAP items:

Restructuring and impairments - cost of

goods sold (859) -

Restructuring and impairments - operating

expenses - 1,725

Acquisition costs - operating expenses 6,860 -

Amortization of convertible note discount -

other income (expense), net 6,671 6,593

Impairment of investment - other income

(expense), net - 1,724

Net tax benefit on non-GAAP items (4,871) (3,615)

------------- -------------

Non-GAAP net income $ 41,013 $ 78,265

============= =============

Non-GAAP net income per diluted share $ 0.34 $ 0.63

============= =============

Number of shares used for diluted per share

calculation 120,873 124,049

Reconciliation of U.S. GAAP Gross Margin, Operating Expenses and Operating

Income to Non-GAAP Gross Margin,

Operating Expenses and Operating Income

(in thousands, except percentages)

(unaudited)

Three Months Three Months

Ended Ended

------------- -------------

December 25, September 25,

2011 2011

------------- -------------

U.S. GAAP gross margin $ 234,826 $ 283,883

Pre-tax non-GAAP items:

Restructuring and impairments - cost of

goods sold (859) -

------------- -------------

Non-GAAP gross margin $ 233,967 $ 283,883

============= =============

U.S. GAAP gross margin as a percentage of

revenue 40.2% 41.7%

Non-GAAP gross margin as a percentage of

revenue 40.1% 41.7%

U.S. GAAP operating expenses $ 187,280 $ 184,484

Pre-tax non-GAAP items:

Restructuring and impairments - operating

expenses - (1,725)

Acquisition costs - operating expenses (6,860) -

------------- -------------

Non-GAAP operating expenses $ 180,420 $ 182,759

============= =============

Non-GAAP operating income $ 53,547 $ 101,124

============= =============

Non-GAAP operating margin as a percent of

revenue 9.2% 14.9%

Lam Research Corporation Contact: Shanye Hudson Director,

Investor Relations Phone: 510-572-4589 e-mail:

shanye.hudson@lamresearch.com

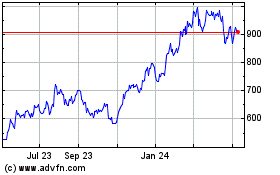

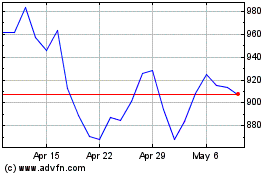

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jul 2023 to Jul 2024