Domestic News Grabbing Headlines - Analyst Blog

December 15 2011 - 4:07AM

Zacks

Today’s heavy economic schedule will likely keep the markets

focused on domestic matters. The good start provided by the

positive Initial Jobless Claims report and the Empire State

manufacturing survey should help reverse the downtrend of the last

three trading sessions. Other key economic reports on deck include

the November Industrial Production report and the Philly Fed

regional manufacturing survey for December.

Of the pre-market releases, the most favorable reading was on

the Initial Jobless Claims front, which continued the positive

momentum from last week by falling to the lowest level in more than

three years. Contrary to expectations of some sort of a give-back

following last week’s big drop in initial claims, we got another

big 19K drop, taking the weekly initial claims level further down

to 366K. The four-week average is now at 388K.

It is reassuring to see that this key series has again started

moving in the right direction, which is in-line with other labor

market readings. The wholesale inflation reading was tad hotter

than expected, but broadly in-line with expectations.

In corporate news, we have better-than-expected results from

FedEx (FDX) this morning. The package delivery

giant also reaffirmed its outlook for the year, bucking recent

trend of profit warnings from a number of major firms. In other

news, Lam Research (LRCX), a maker of

semiconductor equipment, plans to buy Novellus

Systems (NVLS) in an all-stock deal valued at $3.3

billion.

FEDEX CORP (FDX): Free Stock Analysis Report

LAM RESEARCH (LRCX): Free Stock Analysis Report

NOVELLUS SYS (NVLS): Free Stock Analysis Report

Zacks Investment Research

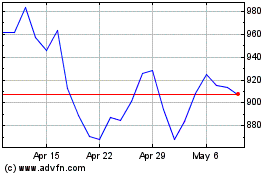

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jul 2024 to Aug 2024

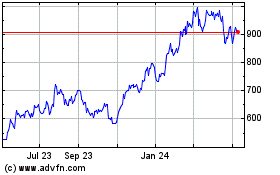

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Aug 2023 to Aug 2024