Lam Research Corporation’s (NASDAQ: LRCX) highlights for the

March 2011 quarter were:

Lam Research Corporation Financial Highlights for

the Quarter Ended March 27, 2011 (in thousands, except per

share data and percentages) U.S. GAAP/Ongoing

Revenue: $ 809,087 Operating Margin: 24.3 %

Net Income: $ 182,240 Diluted EPS: $ 1.45

Lam Research Corporation today announced financial results for

the quarter ended March 27, 2011. Revenue for the period was

$809.1 million, gross margin was $374.0 million (46.2%),

and net income was $182.2 million, or $1.45 per diluted share,

compared to revenue of $870.7 million, gross margin of

$407.4 million (46.8%), and net income of $221.9 million,

or $1.78 per diluted share, for the December 2010 quarter.

Shipments for the March 2011 quarter were $813 million

compared to $892 million during the December 2010 quarter.

The Company’s ongoing results for the December 2010 quarter

exclude certain benefits for research and development tax credits.

There were no adjustments to U.S. GAAP results to determine

“ongoing” results for the March 2011 quarter. Management uses

ongoing operating income, ongoing operating expenses, ongoing

operating margin, ongoing net income, and ongoing net income per

diluted share to evaluate the Company’s operating and financial

results. The Company believes the presentation of ongoing results

is useful to investors for analyzing business trends and comparing

performance to prior periods, along with enhancing the investor’s

ability to view the Company’s results from management’s

perspective. A table presenting a reconciliation of ongoing net

income to results under U.S. GAAP is included at the end of this

press release and on the Company’s web site at

http://investor.lamrc.com.

Ongoing net income was $182.2 million, or $1.45 per diluted

share in the March 2011 quarter compared to ongoing net income of

$217.1 million, or $1.74 per diluted share, for the December

2010 quarter. Ongoing gross margin for the March 2011 quarter was

$374.0 million or 46.2%, compared to ongoing gross margin of

$407.4 million, or 46.8%, for the December 2010 quarter. The

sequential decrease in gross margin was primarily due to customer

mix. Ongoing operating expenses for the March 2011 quarter were

$177.0 million compared with the December 2010 quarter of

$166.3 million. This change is consistent with our plans to

increase investments in core product research and development as

well as customer-specific programs.

The geographic distribution of shipments and revenue during the

March 2011 quarter is shown in the following table:

Region Shipments Revenue North

America 23% 23% Europe 16% 18% Japan 11% 13% Korea 19% 18% Taiwan

18% 14% Asia Pacific 13% 14%

Cash and cash equivalents, short-term investments and restricted

cash and investments balances were $1.4 billion at the end of

the March 2011 quarter, compared to $1.2 billion at the end of the

December 2010 quarter. Cash flows from operating activities were

approximately $241.6 million during the March 2011 quarter.

Deferred revenue and deferred profit balances at the end of the

March 2011 quarter were $246.6 million and

$150.3 million, respectively. Lam’s deferred revenue balance

does not include shipments to Japanese customers, to whom title

does not transfer until customer acceptance. Shipments to Japanese

customers are classified as inventory at cost until the time of

acceptance. The anticipated future revenue from shipments to

Japanese customers was approximately $36.2 million as of March

27, 2011.

“Lam delivered strong performance in the March quarter providing

a solid foundation for the remainder of 2011. I am particularly

pleased with our solid cash generation performance, which

represented a return of approximately 30% of revenues. Strong

demand for smartphones, tablets and other electronic devices is

expected to drive a healthy level of investment on the part of our

customers over the course of CY’11,” said Steve Newberry, chief

executive officer and vice chairman of the board.

“These investment levels create opportunities for Lam, and we

remain committed to making the strategic investments necessary to

strengthen and grow our market position in both etch and clean. We

have increased our level of customer engagement through joint

partnerships and programs designed to improve our customers’

manufacturing productivity and address their most complex technical

challenges. These customer-centric programs coupled with

investments in core product R&D enable Lam Research to be

well-positioned for growth in the coming years.”

Caution Regarding Forward-Looking Statements

Statements made in this press release that are not statements of

historical fact are forward-looking statements and are subject to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements relate, but are

not limited, to the anticipated revenue from shipments to Japanese

customers; the demand for smartphones, tablets and other electronic

devices, our customers’ investments and intentions for meeting that

demand, our commitment to strategic investments to strengthen and

grow our market position as well as the effect of any such

investments, our anticipated continued investments in customer

engagements such as joint partnerships to address technical

challenges and improve productivity solutions as well as our core

R&D programs, and our ability to meet customers’ future

technology needs and our future market position. Some factors that

may affect these forward-looking statements include: business

conditions in the consumer electronics industry, the semiconductor

industry and the overall economy; the strength of the financial

performance of our existing and prospective customers; the

introduction of new and innovative technologies; the occurrence and

pace of technology transitions and conversions; the actions of our

competitors, consumers, semiconductor companies and key suppliers

and subcontractors; and the success of research and development and

sales and marketing programs. These forward-looking statements

are based on current expectations and are subject to uncertainties

and changes in condition, significance, value and effect as well as

other risks detailed in documents filed by us with the Securities

and Exchange Commission, including specifically our report on Form

10-K for the year ended June 27, 2010 and the reports on Form

10-Q for the three months ended September 26, 2010 and

December 26, 2010. These uncertainties and changes could cause

actual results to vary from expectations. The Company undertakes no

obligation to update the information or statements made in this

press release.

Lam Research Corporation is a major provider of wafer

fabrication equipment and services to the world’s semiconductor

industry. Lam’s common stock trades on The NASDAQ Global Select

Market SM under the symbol LRCX. Lam is a NASDAQ-100 ® company. For

more information, visit www.lamresearch.com.

LAM RESEARCH CORPORATION CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (in thousands, except per share

data and percentages) (unaudited) Three

Months Ended Nine Months Ended March

27, December 26, March 28, March

27, March 28, 2011

2010 2010 2011

2010 Revenue $ 809,087 $ 870,714 $

632,763 $ 2,485,675 $ 1,438,487 Cost of goods sold 435,068 463,281

339,892 1,326,897 795,810 Cost of goods sold - 409A expense

- - - -

(5,816 ) Total costs of goods sold 435,068

463,281 339,892 1,326,897

789,994 Gross margin 374,019 407,433 292,871 1,158,778

648,493 Gross margin as a percent of revenue 46.2 % 46.8 % 46.3 %

46.6 % 45.1 % Research and development 96,880 90,477 81,845 273,710

235,215 Selling, general and administrative 80,143 75,852 61,933

228,137 174,163 Restructuring and asset impairments - - - (5,163 )

8,012 409A expense - - -

- (38,590 ) Total operating expenses

177,023 166,329 143,778

496,684 378,800 Operating income 196,996

241,104 149,093 662,094 269,693 Operating margin as a percent of

revenue 24.3 % 27.7 % 23.6 % 26.6 % 18.7 % Other income, net

1,663 1,038 1,616 1,722

1,190 Income before income taxes 198,659

242,142 150,709 663,816 270,883 Income tax expense 16,419

20,286 30,408 65,996

64,211 Net income $ 182,240 $ 221,856

$ 120,301 $ 597,820 $ 206,672 Net

income per share: Basic net income per share $ 1.47 $ 1.80

$ 0.94 $ 4.84 $ 1.63 Diluted net income

per share $ 1.45 $ 1.78 $ 0.94 $ 4.78 $

1.61 Number of shares used in per share calculations: Basic

123,674 123,101 127,307

123,482 127,127 Diluted 125,293

124,786 128,587 125,097

128,368

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands)

March 27, December 26,

June 27, 2011 2010 2010

(unaudited) (unaudited) (1) ASSETS Cash and

cash equivalents $ 942,710 $ 729,060 $ 545,767 Short-term

investments 312,879 303,038 280,690 Accounts receivable, net

637,795 689,400 499,890 Inventories 355,734 333,874 318,479

Deferred income taxes 45,934 47,380 46,158 Other current assets

77,722 76,993 65,677

Total current assets

2,372,774 2,179,745 1,756,661 Property and equipment, net 251,954

229,769 200,336 Restricted cash and investments 165,248 165,244

165,234 Deferred income taxes 29,578 28,030 26,218 Goodwill and

intangible assets 221,146 225,671 236,906 Other assets

107,795 104,758 102,037 Total assets $

3,148,495 $ 2,933,217 $ 2,487,392 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities $ 667,391 $ 689,871 $

558,657 Long-term debt and capital leases $ 15,949 $

16,524 $ 17,645 Income taxes payable 116,911 118,323 110,462 Other

long-term liabilities 25,088 23,720 32,493 Stockholders' equity

2,323,156 2,084,779 1,768,135 Total

liabilities and stockholders' equity $ 3,148,495 $ 2,933,217 $

2,487,392 1 Derived from audited financial statements

LAM RESEARCH CORPORATION CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (in thousands)

(unaudited) Three Months Ended

Nine Months Ended March 27, December

26, March 28, March 27, March

28, 2011 2010

2010 2011 2010

CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 182,240 $

221,856 $ 120,301 $ 597,820 $ 206,672 Adjustments to reconcile net

income to net cash provided by (used for) operating activities:

Depreciation and amortization 18,176 18,663 17,872 54,787 53,737

Deferred income taxes (733 ) (3,039 ) 640 (4,555 ) 22,351

Restructuring charges, net - - - (5,163 ) 8,012 Equity-based

compensation expense 12,456 12,759 10,917 38,224 38,134 Income tax

benefit on equity-based compensation plans 15,327 (918 ) 477 19,492

691 Excess tax benefit on equity-based compensation plans (11,878 )

711 (370 ) (15,106 ) (973 ) Other, net 746 (1,600 ) 1,210 (2,818 )

2,542 Changes in operating assets and liabilities: 25,259

(62,849 ) (41,781 ) 239

(145,886 ) Net cash provided by operating activities 241,593

185,583 109,266 682,920

185,280 CASH FLOWS FROM INVESTING

ACTIVITIES: Capital expenditures and intangible assets (35,769 )

(38,025 ) (10,823 ) (92,924 ) (23,548 ) Net sales/maturities

(purchases) of available-for-sale securities (11,068 ) (1,160 )

(3,238 ) (36,734 ) (14,029 ) Purchase of other investments (417 ) -

- (417 ) (961 ) Proceeds from sale of assets - 1,544 - 1,544 -

Transfer of restricted cash and investments (4 ) -

19,629 (14 ) 13,155 Net

cash provided by (used for) investing activities (47,258 )

(37,641 ) 5,568 (128,545 )

(25,383 ) CASH FLOWS FROM FINANCING ACTIVITIES: Principal

payments on long-term debt and capital lease obligations (1,038 )

(78 ) (17,820 ) (4,449 ) (20,424 ) Net proceeds from issuance of

long-term debt - - - - 336 Excess tax benefit on equity-based

compensation plans 11,878 (711 ) 370 15,106 973 Cash paid in

advance for stock repurchase contracts - (50,000 ) - (50,000 ) -

Treasury stock purchases (8,617 ) (4,151 ) (72,240 ) (157,563 )

(75,172 ) Reissuances of treasury stock 6,521 - 5,518 13,676 11,279

Proceeds from issuance of common stock 5,980

3,407 1,441 10,222 7,823

Net cash provided by (used for) financing activities

14,724 (51,533 ) (82,731 ) (173,008 )

(75,185 ) Effect of exchange rate changes on cash 4,591

4,370 (900 ) 15,576 2,490

Net increase in cash and cash

equivalents

213,650 100,779 31,203 396,943 87,202 Cash and cash equivalents at

beginning of period 729,060 628,281

430,166 545,767 374,167

Cash and cash equivalents at end of period $ 942,710 $

729,060 $ 461,369 $ 942,710 $ 461,369

Reconciliation of U.S. GAAP Net Income to Ongoing Net

Income (in thousands, except per share data)

(unaudited) Three Months Ended

Three Months Ended March 27, December

26, 2011 2010 U.S. GAAP net income $ 182,240 $

221,856 Net tax benefit of R&D credit - (4,763 )

Ongoing net income $ 182,240 $ 217,093 Ongoing net income

per diluted share $ 1.45 $ 1.74 Number of shares used for

diluted per share calculation 125,293 124,786

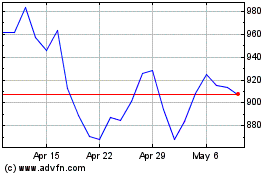

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From May 2024 to Jun 2024

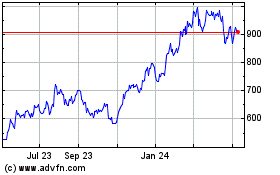

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2023 to Jun 2024