NI Technology Updates Outlooks for Applied Materials, Lam Research, Novellus Systems, Tower Semiconductor, and TSMC

November 10 2009 - 10:08AM

PR Newswire (US)

PRINCETON, N.J., Nov. 10 /PRNewswire/ -- Next Inning Technology

Research (http://www.nextinning.com/), an online investment

newsletter focused on semiconductor and technology stocks,

announced it has published a special report on the emerging cloud

computing trend covering companies including Applied Materials

(NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), Novellus Systems

(NASDAQ:NVLS), Tower Semiconductor (NASDAQ:TSEM) and TSMC (NYSE:

TSM). McWilliams has displayed uncanny accuracy in predicting the

ebb and flow of the markets this year. He not only nailed the March

bottom to the day, but also predicted the exact catalysts that

would start what has been one of the most significant recovery

rallies in NASDAQ history. Following his March prediction,

McWilliams advised readers to buy the early July dip and predicted

that Intel would blow away even the highest estimate of the 36

analysts covering the stock and, in doing so, ignite a huge July

rally. Again, McWilliams was right on; so much so that one Next

Inning reader wondered if he wrote the script for the Intel Q2

conference call. Q3 was a repeat performance and has further fueled

McWilliams' nearly 200% overall return, 10 times higher than the

S&P500. To get the inside scoop on how McWilliams regularly

tops broad market performance, investors have the opportunity to

take a free 21-day test drive with Next Inning. With this,

investors will see firsthand how McWilliams has delivered a

year-to-date return of 49% and will receive real-time access to his

commentary. To take advantage of this offer, please visit the

following link:

https://www.nextinning.com/subscribe/index.php?refer=prn909

McWilliams covers these topics and more in his recent reports: --

What rumors from Taiwan point to upside for equipment manufacturers

like Lam Research and Novellus? -- Why should investors consider

sector leader Applied Materials ahead of its upcoming earnings

report? -- Tower Semiconductor is up well over 250% since

McWilliams wrote that Next Inning readers should consider it a good

speculative investment. Based on what we learned yesterday from its

calendar Q3 report, is it time to take some profits or add more

shares in anticipation of yet another spectacular run? -- Why does

McWilliams think it makes sense to pair a position in Tower

Semiconductor with one in sector leader TSMC? Founded in September

2002, Next Inning's model portfolio has returned 198% since its

inception versus 21% for the S&P 500. About Next Inning: Next

Inning is a subscription-based investment newsletter that provides

regular coverage on more than 150 technology and semiconductor

stocks. Subscribers receive intra-day analysis, commentary and

recommendations, as well as access to monthly semiconductor sales

analysis, regular Special Reports, and the Next Inning model

portfolio. Editor Paul McWilliams is a 30+ year semiconductor

industry veteran. NOTE: This release was published by Indie

Research Advisors, LLC, a registered investment advisor with CRD

#131926. Interested parties may visit adviserinfo.sec.gov for

additional information. Past performance does not guarantee future

results. Investors should always research companies and securities

before making any investments. Nothing herein should be construed

as an offer or solicitation to buy or sell any security. CONTACT:

Marcia Martin, Next Inning Technology Research, +1-888-278-5515

DATASOURCE: Indie Research Advisors, LLC CONTACT: Marcia Martin,

Next Inning Technology Research, +1-888-278-5515 Web Site:

http://www.nextinning.com/

Copyright

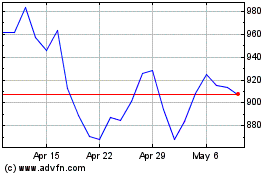

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From May 2024 to Jun 2024

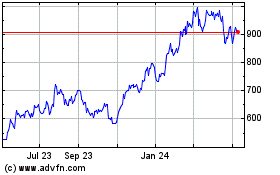

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2023 to Jun 2024