Lam Research Corporation (NASDAQ:LRCX) highlights for the

September 2009 quarter were:

(in thousands, except per share data and percentages)

Revenue:

$ 318,548 Operating Margin: U.S. GAAP: 9.2 % Ongoing: 2.5 %

Net Income: U.S. GAAP: $ 16,797 Ongoing: $ 4,181

Diluted EPS: U.S. GAAP: $ 0.13 Ongoing: $ 0.03

Lam Research Corporation today announced financial results for

the quarter ended September 27, 2009. Revenue for the period was

$318.5 million, gross margin was $136.8 million and net

income was $16.8 million, or $0.13 per diluted share, compared to

revenue of $217.8 million, gross margin of $67.8 million

and net loss of $(88.5) million, or $(0.70) per diluted share,

for the June 2009 quarter. Shipments for the September 2009 quarter

were $355 million compared to $246 million during the

June 2009 quarter.

The Company’s ongoing results for the September 2009 quarter

exclude certain costs for previously announced restructuring

activities and the finalization of a portion of certain liabilities

for Internal Revenue Code Section 409A related expenses. The

Company’s ongoing results for the June 2009 quarter excluded

certain costs for previously announced restructuring activities and

asset impairments, a legal judgment, a non-cash goodwill impairment

charge, certain one-time contract termination costs, a net tax

expense for valuation allowance, net tax expense on resolution of

certain tax matters, and interest and legal fees related to

Internal Revenue Code Section 409A tax expenses. Management uses

the presentation of ongoing gross margin, ongoing operating

expenses, ongoing operating income (loss), ongoing operating

margin, ongoing net income (loss), and ongoing net income (loss)

per diluted share to evaluate the Company’s operating and financial

results. The Company believes the presentation of ongoing results

is useful to investors for analyzing business trends and comparing

performance to prior periods, along with enhancing the investor’s

ability to view the Company’s results from management’s

perspective. A table presenting a reconciliation of ongoing results

to results under U.S. GAAP is included at the end of this press

release and on the Company’s web site.

Ongoing net income was $4.2 million, or $0.03 per diluted share

in the September 2009 quarter compared to ongoing net loss of

$(57.0) million, or $(0.45) per diluted share, for the June

2009 quarter. Ongoing gross margin for the September 2009 quarter

was $131.3 million or 41.2%, compared to ongoing gross margin

of $67.8 million, or 31.1%, for the June 2009 quarter. The

sequential increase in gross margin was primarily due to improved

factory and field utilization as a result of increased business

volume and a more favorable product mix. Ongoing operating expenses

for the September 2009 quarter increased to $123.3 million

compared with the June 2009 quarter of $114.3 million.

This increase was primarily the result of one-time credits against

spending realized in the June 2009 quarter, planned additional

spending on R&D programs and additional employee variable

compensation as a result of higher profit levels.

The geographic distribution of shipments and revenue during the

September 2009 quarter is shown in the following table:

Region Shipments Revenue North

America 10 % 9 % Europe 6 % 7 % Japan 18 % 18 % Korea 24 % 23 %

Taiwan 31 % 29 % Asia Pacific 11 % 14 %

Cash and cash equivalents, short-term investments and restricted

cash and investments balances were $761.2 million at the end

of the September 2009 quarter, compared to $757.8 million at the

end of the June 2009 quarter. Cash flows from operating activities

were approximately $2.7 million during the September 2009 quarter.

Deferred revenue and deferred profit balances at the end of the

September 2009 quarter were $89.7 million and

$55.6 million, respectively. Lam’s deferred revenue balance

does not include shipments to Japanese customers, to whom title

does not transfer until customer acceptance. Shipments to Japanese

customers are classified as inventory at cost until the time of

acceptance. The anticipated future revenue from shipments to

Japanese customers was approximately $23 million as of

September 27, 2009.

“Lam Research had strong shipments and revenue performance in

the September quarter, allowing the Company to return to

profitability and generate positive cash flow once again. As

business conditions improve, we continue our focus on developing

leading-edge solutions for our customers while responding rapidly

to meet their current production needs,” said Steve Newberry, Lam’s

president and chief executive officer. “As we look forward to an

improved business environment, we would like to thank our employees

for their personal sacrifice during the downturn and their

continued commitment to the success of Lam Research,” Newberry

concluded.

Statements made in this press release which are not statements

of historical fact are forward-looking statements and are subject

to the safe harbor provisions created by the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements

relate, but are not limited, to the anticipated revenue from

shipments to Japanese customers, Lam’s focus on developing leading

edge solutions while responding to customer production needs, and

Lam’s projections for future business conditions and an improved

business environment. Some factors that may affect these

forward-looking statements include: business conditions in the

semiconductor industry and the overall economy, and the efficacy of

Lam’s plans for reacting to those conditions, changing customer

demands, the actions of Lam’s competitors, and the challenges

presented by the development and marketing of new products. These

forward-looking statements are based on current expectations and

are subject to uncertainties and changes in condition,

significance, value and effect as well as other risks detailed in

documents filed with the Securities and Exchange Commission,

including specifically the report on Form 10-K for the year ended

June 28, 2009, which could cause actual results to vary from

expectations. The Company undertakes no obligation to update the

information or statements made in this press release.

Lam Research Corporation is a major provider of wafer

fabrication equipment and services to the world’s semiconductor

industry. Lam’s common stock trades on The NASDAQ Global Select

Market SM under the symbol LRCX. Lam is a NASDAQ-100 ® company. For

more information, visit www.lamresearch.com.

LAM RESEARCH CORPORATION CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (in thousands, except per share

data and percentages) (unaudited)

Three Months Ended September 27, June 28,

September 28, 2009 2009

2008 Total revenue $ 318,548 $

217,764 $ 440,361 Cost of goods sold 187,233 150,007 254,203 Cost

of goods sold - restructuring and asset impairments - - 3,048 Cost

of goods sold - 409A expense (5,455 ) -

- Total cost of goods sold 181,778 150,007 257,251 Gross

margin 136,770 67,757 183,110 Gross margin as a percent of revenue

42.9 % 31.1 % 41.6 % Research and development 71,199 67,491 81,563

Selling, general and administrative 52,119 47,248 68,299 Goodwill

impairment - 7,179 - Restructuring and asset impairments 2,093

5,396 15,968 409A expense (17,893 ) 982 761 Legal judgment -

4,647 - Total operating expenses

107,518 132,943 166,591

Operating income (loss) 29,252 (65,186 ) 16,519 Operating margin as

a percent of revenue 9.2 % -29.9 % 3.8 % Other income (expense),

net (368 ) 2,869 9,017 Income

(loss) before income taxes 28,884 (62,317 ) 25,536 Income tax

expense 12,087 26,173 16,663

Net income (loss) $ 16,797 $ (88,490 ) $ 8,873

Net income (loss) per share: Basic net income (loss) per share $

0.13 $ (0.70 ) $ 0.07 Diluted net income (loss) per

share $ 0.13 $ (0.70 ) $ 0.07 Number of shares used

in per share calculations: Basic 126,774

126,273 125,527 Diluted 127,890

126,273 126,819

LAM RESEARCH

CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (in

thousands) September 27, June 28,

2009 2009 (unaudited)

(1)

ASSETS Cash and cash equivalents $ 361,163 $ 374,167 Short-term

investments 215,031 205,221 Accounts receivable, net 325,756

253,585 Inventories 220,083 233,410 Deferred income taxes 49,140

69,043 Other current assets 61,128 60,401 Total

current assets 1,232,301 1,195,827 Property and equipment, net

211,348 215,666 Restricted cash and investments 185,010 178,439

Deferred income taxes 24,451 17,007 Goodwill and intangible assets

254,847 260,787 Other assets 87,148 84,145 Total

assets $ 1,995,105 $ 1,951,871 LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities $ 336,911 $ 340,763 Long-term

debt and capital leases $ 35,787 $ 40,886 Income taxes payable

105,925 102,999 Other long-term liabilities 12,722 14,134

Stockholders' equity 1,503,760 1,453,089 Total

liabilities and stockholders' equity $ 1,995,105 $ 1,951,871

1 Derived from audited financial statements

LAM RESEARCH

CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands) (unaudited)

Three Months Ended September 27, June

28, September 28, 2009

2009 2008 CASH FLOWS FROM

OPERATING ACTIVITIES: Net income (loss) $ 16,797 $ (88,490 ) $

8,873

Adjustments to reconcile net

income (loss) to net cash provided by (used for) operating

activities:

Depreciation and amortization 17,681 17,694 17,896 Deferred income

taxes 12,482 19,913 (12,407 ) Equity-based compensation expense

13,958 13,358 15,408 Income tax benefit on equity-based

compensation plans (89 ) (1,173 ) 5,039 Excess tax benefit on

equity-based compensation plans (368 ) (237 ) (4,269 ) Goodwill

impairment - 7,179 - Restructuring and asset impairments 2,093

5,396 19,016 Other, net 1,159 2,535 2,665 Changes in operating

asset accounts (61,009 ) (34,295 ) (9,089 )

Net cash provided by (used for) operating activities 2,704

(58,120 ) 43,132 CASH FLOWS FROM

INVESTING ACTIVITIES: Capital expenditures and intangible assets

(5,832 ) (5,848 ) (15,151 ) Acquisitions of businesses, net of cash

acquired - - (2,427 ) Net sales (purchases) of available-for-sale

securities (9,775 ) 93,056 6,980 Purchase of other investments (961

) - - Transfer of restricted cash and investments (6,571 ) (44,458

) (16,128 ) Other - 2,000 -

Net cash provided by (used for) investing activities

(23,139 ) 44,750 (26,726 ) CASH FLOWS

FROM FINANCING ACTIVITIES: Principal payments on long-term debt and

capital lease obligations (1,915 ) (911 ) (2,390 ) Net proceeds

from issuance of long-term debt 284 - 127 Excess tax benefit on

equity-based compensation plans 368 237 4,269 Treasury stock

purchases (2,356 ) (3,197 ) (2,755 ) Reissuances of treasury stock

5,761 6,271 7,584 Proceeds from issuance of common stock

2,256 6,287 3,150 Net cash

provided by financing activities 4,398 8,687

9,985 Effect of exchange rate changes on cash

3,033 4,202 (13,496 ) Net increase (decrease) in cash and cash

equivalents (13,004 ) (481 ) 12,895 Cash and cash equivalents at

beginning of period 374,167 374,648

732,537 Cash and cash equivalents at end of period $

361,163 $ 374,167 $ 745,432

Reconciliation

of U.S. GAAP Net Income (Loss) to Ongoing Net Income (Loss)

(in thousands, except per share data) (unaudited)

Three Months Ended Three Months Ended

September 27, June 28, 2009

2009 U.S. GAAP net income (loss) $ 16,797 $

(88,490 ) Pre-tax non-ongoing items: Goodwill impairment -

operating expenses - 7,179 Legal judgment - operating expenses -

4,647 Restructuring and asset impairments - operating expenses

2,093 5,396 409A expense - cost of goods sold (5,455 ) - 409A

expense - operating expenses (17,893 ) 982 One-time contract

termination costs - operating expenses - 413 Net tax expense

(benefit) on non-ongoing items 8,639 (4,556 ) Net tax expense on

resolution of certain tax matters - 3,637 Net tax expense for

valuation allowance - 13,787 Ongoing

net income (loss) $ 4,181 $ (57,005 ) Ongoing net income

(loss) per diluted share $ 0.03 $ (0.45 ) Number of shares

used for diluted per share calculation 127,890 126,273

Reconciliation of U.S. GAAP Gross Margin, Operating

Expenses and Operating Income (Loss) to Ongoing Gross Margin,

Operating Expenses and Operating Income (Loss) (in

thousands, except percentages) (unaudited)

Three Months Ended Three Months Ended September

27, June 28, 2009

2009 U.S. GAAP gross margin $ 136,770 $ 67,757

Pre-tax non-ongoing items: Pre-tax 409A expense - cost of goods

sold (5,455 ) - Ongoing gross margin $ 131,315

$ 67,757 U.S. GAAP gross margin as a percent of

revenue 42.9 % 31.1 % Ongoing gross margin as a percent of revenue

41.2 % 31.1 % U.S. GAAP operating expenses $ 107,518 $ 132,943

Pre-tax non-ongoing items: Goodwill impairment - operating expenses

- (7,179 ) Legal judgment - operating expenses - (4,647 )

Restructuring and asset impairments - operating expenses (2,093 )

(5,396 ) One-time contract termination costs - operating expenses -

(413 ) 409A expense - operating expenses 17,893

(982 ) Ongoing operating expenses $ 123,318 $ 114,326

Ongoing operating income (loss) $ 7,997 $ (46,569 )

Ongoing operating margin as a percent of revenue 2.5 % -21.4 %

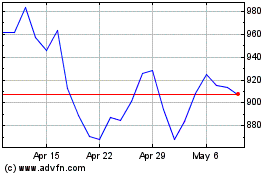

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From May 2024 to Jun 2024

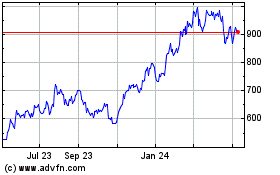

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2023 to Jun 2024