Lam Research Corporation (Nasdaq:LRCX) today announced earnings for

the quarter ended June 26, 2005. Revenue for the period was $353.8

million, and net income was $66.5 million, or $0.47 per diluted

share, compared to revenue of $349.3 million and net income of

$59.5 million, or $0.41 per diluted share, for the March 2005

quarter. Gross margin was $175.9 million and operating expenses

were $93.3 million for the June 2005 quarter compared to gross

margin of $174.6 million and operating expenses of $95.9 million

for the March 2005 quarter. The Company believes the presentation

of ongoing results, which excludes certain special items, is useful

for analyzing ongoing business trends. In the June 2005 quarter,

there were no significant differences between the ongoing results

and the results under U.S. Generally Accepted Accounting Principles

(GAAP). The March 2005 quarter ongoing presentation removed the

effects of a tax refund, which was recorded in selling, general and

administrative expenses as well as additional liabilities for

unoccupied facilities included in prior restructuring plans. Tables

presenting reconciliations of ongoing performance to results under

U.S. GAAP are included at the end of this press release and on the

Company's web site. Ongoing gross margin for the June 2005 quarter

was 49.7 percent of revenue compared to 50.0 percent of revenue in

the March 2005 quarter. In the period, ongoing operating expenses

increased as planned to $93.3 million from $89.7 million in March

2005, primarily due to accelerated R&D investments. Other

income increased due to higher interest income and foreign currency

gains. Ongoing net income increased to $66.5 million, or $0.47 per

diluted share, in the June 2005 quarter compared with ongoing net

income of $64.1 million, or $0.44 per diluted share, for the March

2005 quarter. New orders recorded in backlog remained flat

sequentially at $315 million. The geographic distribution of new

orders as well as revenue during the June quarter is shown in the

following table: -0- *T Region New Orders Revenue -------------

---------- ------- North America 9% 16% Europe 12% 17% Japan 28%

14% Korea 16% 21% Asia Pacific 35% 32% *T Cash, short-term

investments and restricted cash balances increased to $894.3

million at the end of June, and cash flows from operations were

$134 million during the quarter. Deferred revenue and deferred

profit balances were $150.5 million and $89.7 million,

respectively. At the end of the period, unshipped orders in backlog

were approximately $351 million, and the anticipated future revenue

value of orders shipped from backlog to Japanese customers that are

not recorded as deferred revenue was approximately $53 million. "We

are pleased with the results for this quarter," stated Steve

Newberry, president and chief executive officer for Lam. "We

continue to execute to our market share and profitability

objectives, despite what has remained a challenging industry

environment. "We have made significant strides during the June

quarter in advancing our position at leading-edge applications

among our global customer base. Customers are selecting Lam based

on our extensive production experience and our expertise with new

and more challenging integration processes. Our commitment to

providing superior products and services plays an important role in

our customers' continuous efforts to increase productivity and

yield on their leading-edge devices. "We delivered another quarter

marked by strong cash generation and market share success. I

commend the entire team here at Lam for delivering value for our

customers and shareholders," Newberry concluded. Statements made in

this press release which are not statements of historical fact are

forward-looking statements and are subject to the safe harbor

provisions created by the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements relate, but are not

limited, to our future financial performance, our future plans for

products and services, our ability to execute to market share and

profitability objectives, and our future ability to develop and

produce leading-edge applications and expertise that meet our

customers' productivity and yield objectives. Some factors that may

affect these forward-looking statements include: changing business

conditions in the semiconductor industry and our plans for reacting

to those changes, changing customer demands, our competitors'

development of new technologies that could affect our market share,

the success of our research and development programs, and our

ability to develop and retain personnel with expertise needed for

our success and valued by our customers. These forward-looking

statements are based on current expectations and are subject to

uncertainties and changes in condition, significance, value and

effect as well as other risks detailed in documents filed with the

Securities and Exchange Commission, including specifically the

reports on Form 10-K for the year ended June 27, 2004, and the Form

10-Q for the quarter ended March 27, 2005, which could cause actual

results to vary from expectations. The Company undertakes no

obligation to update the information or statements made in this

press release. Lam Research Corporation is a major supplier of

wafer fabrication equipment and services to the world's

semiconductor industry. Lam's common stock trades on the Nasdaq

National Market under the symbol LRCX. The Company's World Wide Web

address is http://www.lamrc.com. Consolidated Financial Tables

Follow -0- *T LAM RESEARCH CORPORATION CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (in thousands, except per share data and

percentages) Three Months Ended Twelve Months Ended

----------------------------------- --------------------- June 26,

March 27, June 27, June 26, June 27, 2005 2005 2004 2005 2004

----------- ----------- ----------- ----------- ---------

(unaudited) (unaudited) (unaudited) (unaudited) (1) Total revenue

$353,767 $349,337 $329,572 $1,502,453 $935,946 Cost of goods sold

177,908 174,767 170,369 738,361 506,548 Cost of goods sold -

restruc- turing recoveries - - - - (1,651) ----------- -----------

----------- ----------- --------- Total cost of goods sold 177,908

174,767 170,369 738,361 504,897 Gross margin 175,859 174,570

159,203 764,092 431,049 Gross margin as a percent of revenue 49.7%

50.0% 48.3% 50.9% 46.1% Research and develop- ment 49,474 47,226

49,961 194,115 170,479 Selling, general and admini- strative 43,854

34,518 40,711 164,774 146,063 Restruc- turing charges, net - 14,201

- 14,201 8,327 ----------- ----------- ----------- -----------

--------- Total operat- ing expenses 93,328 95,945 90,672 373,090

324,869 Operating income 82,531 78,625 68,531 391,002 106,180 Other

income, net 6,171 643 1,676 8,120 4,470 ----------- -----------

----------- ----------- --------- Income before income taxes 88,702

79,268 70,207 399,122 110,650 Income tax expense 22,176 19,817

17,552 99,781 27,662 ----------- ----------- -----------

----------- --------- Net income $66,526 $59,451 $52,655 $299,341

$82,988 =========== =========== =========== =========== =========

Net income per share: Basic $0.48 $0.42 $0.39 $2.17 $0.63

=========== =========== =========== =========== =========

Diluted(2) $0.47 $0.41 $0.38 $2.10 $0.59 =========== ===========

=========== =========== ========= Number of shares used in per

share calcu- lations: Basic 138,208 139,967 134,414 137,727 131,776

=========== =========== =========== =========== =========

Diluted(2) 142,518 144,756 139,820 142,417 144,928 ===========

=========== =========== =========== ========= (1) Derived from

audited financial statements. (2) Diluted net income per share for

the twelve months ended June 27, 2004 includes the assumed

conversion of convertible 4% notes. Accordingly, interest expense,

net of taxes, of $3.2 million must be added back to net income for

computing diluted earnings per share. LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) June 26, March

27, June 27, 2005 2005 2004 (unaudited) (unaudited) (1) -----------

----------- ----------- Assets: Cash, cash equivalents and short-

term investments $809,253 $726,292 $429,472 Accounts receivable,

net 232,005 257,496 245,508 Inventories 110,051 120,353 108,249

Other current assets 93,527 79,739 113,159 ----------- -----------

----------- Total current assets 1,244,836 1,183,880 896,388

Property and equipment, net 41,082 43,167 42,444 Restricted cash

85,038 112,468 112,468 Other assets 77,859 143,506 147,326

----------- ----------- ----------- Total assets $1,448,815

$1,483,021 $1,198,626 =========== =========== ===========

Liabilities and stockholders' equity: Current liabilities $379,133

$375,352 $376,606 ----------- ----------- ----------- Other

long-term liabilities $2,786 $3,318 $9,554 Stockholders' equity

1,066,896 1,104,351 812,466 ----------- ----------- -----------

Total liabilities and stockholders' equity $1,448,815 $1,483,021

$1,198,626 =========== =========== =========== (1) Derived from

audited financial statements. Reconciliation of U.S. GAAP Net

Income to Ongoing Net Income (in thousands, except per share data

and percentages) Three Months Ended ----------------------------

June 26, March 27, 2005 2005 -------------- ------------- U.S. GAAP

net income $66,526 $59,451 Pre-tax net tax refund - operating

expenses - (7,962) Pre-tax net restructuring charges - operating

expenses - 14,201 Tax benefit on net restructuring charges and net

tax refund - (1,560) -------------- ------------- Ongoing net

income $66,526 $64,130 ============== ============= Ongoing net

income per diluted share $0.47 $0.44 ============== =============

Number of shares used for diluted per share calculation 142,518

144,756 Income tax rate 25% 25% Reconciliation of U.S. GAAP Gross

Margin, Operating Expenses and Operating Income to Ongoing Gross

Margin, Operating Expenses and Operating Income (in thousands)

Three Months Ended ---------------------------- June 26, March 27,

2005 2005 -------------- ------------- U.S. GAAP gross margin

$175,859 $174,570 Restructuring recoveries - cost of goods sold - -

-------------- ------------- Ongoing gross margin $175,859 $174,570

U.S. GAAP operating expenses $93,328 $95,945 Net tax refund -

operating expenses - 7,962 Net restructuring charges - operating

expenses - (14,201) -------------- ------------- Ongoing operating

expenses $93,328 $89,706 -------------- ------------- Ongoing

operating income $82,531 $84,864 ============== ============= *T

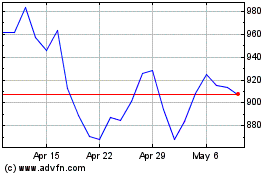

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

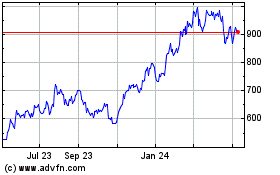

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jul 2023 to Jul 2024