UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

September 16, 2015

Lakeland Industries, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

0-15535 |

13-3115216 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

3555 Veterans Memorial Highway,

Suite C, Ronkonkoma, New York 11779-7410

(Address of principal

executive offices) (Zip Code)

Registrant’s telephone number, including

area code (631) 981-9700

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 2.02 | Results of Operations and Financial Condition |

On September 16, 2015, Lakeland Industries, Inc. (the “Company”)

issued a press release announcing its financial results for the second quarter ended July 31, 2015. A copy of the press release

is attached hereto as Exhibit 99.1.

| Item 9.01. | Financial Statements and Exhibits. |

| 99.1 | Press Release, dated September 16, 2015 |

The financial information contained in the exhibit to this Form

8-K is being furnished in accordance with Item 2.02 and shall not be deemed to be “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LAKELAND INDUSTRIES, INC. |

|

| |

|

|

| Date: September 16, 2015 |

|

|

| |

|

|

| |

/s/ Christopher J. Ryan |

|

| |

Christopher J. Ryan |

|

| |

President & CEO |

|

EXHIBIT INDEX

| Exhibit |

|

|

| Number |

|

Description |

| |

|

|

| 99.1 |

|

Press Release, dated September 16, 2015 |

Exhibit

99.1

| |

3555 Veterans Memorial Highway, Suite

C |

| |

Ronkonkoma, NY 11779 |

| |

(631) 981-9700 - www.lakeland.com |

Lakeland Industries, Inc. Reports Fiscal

2016 Second Quarter Financial Results

Net Income from Continuing Operations

Grows over 500%

Driven by Unique Operating Platform

and Overall Operations Improvements

RONKONKOMA, NY – September 16, 2015

— Lakeland Industries, Inc. (NASDAQ: LAKE), a leading global manufacturer of protective clothing for industry, healthcare

and to first responders on the federal, state and local levels, today announced financial results for its fiscal 2016 second quarter

ended July 31, 2015.

For financial reporting presentation purposes,

the operating results in Brazil are excluded from many of the statements in this announcement because the Company’s recent

determination to exit Brazil has resulted in discontinued operations accounting. Commencing with its first fiscal quarter 2016

ended April 30, 2015, historical and future financial results from the Brazilian operations are reflected as discontinued operations

in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Discontinued operations

accounting entails the reclassification of all of the financial results of the Brazil operations within the consolidated financial

results of the parent company, and a restatement of prior periods to reflect the same treatment. The global operations of Lakeland

Industries excluding Brazil are shown in financial reports as Continuing Operations. All information below has been restated to

exclude Brazil, except where noted. On July 31, 2015, the Company completed a conditional closing of the sale of its wholly-owned

Brazilian subsidiary (“Lakeland Brazil”), to Zap Comércio

de Brindes Corporativos Ltda (the “Transferee”), a company owned by an existing Lakeland Brazil manager. This

sale is pursuant to a Shares Transfer Agreement entered into on June 19, 2015. The transactions contemplated by the Shares Transfer

Agreement, which shall be deemed to have been consummated as of July 31, 2015, are subject to acceptance of the shares transfer

on the Commercial Registry by the Brazilian authorities, which is expected to be completed shortly. Although no assurances can

be given in that regard, the Company expects the Commercial Registry processing of the shares transfer will not adversely affect

the closing. Pursuant to the Shares Transfer Agreement, the Transferee

will acquire all of the shares of Lakeland Brazil owned by the Company, and effective with the fiscal 2016 third quarter

beginning August 1, 2015 the Company expects no further significant losses from discontinued operations, charges or expenses relating

to Brazil beyond the existing accrual of $900,000 which was recorded in the fiscal second quarter financial results.

Fiscal 2016 Second Quarter Financial

Results Highlights (from Continuing Operations, unless otherwise noted)

| o | Sales

were $29.5 million (“M”) this year and $22.8M last year, an increase of 29.2%,

with a portion of the growth resulting from orders received by Lakeland due to its unique

operating platform during a period of industry capacity constraints. |

| · | Margin

Improvement and Expense Management |

| o | Gross

profit increased by 58.6% as compared to last year. |

| o | Gross

margin was 40.0%, compared to 32.6% last year, driven by a more favorable product mix

including demand for disposable and chemical garments in response to a lack of industry

capacity. |

| o | Operating

expenses worldwide increased by $0.5M and decreased as a percent of sales to 20.7% from

24.7% last year as a result of higher volume and Selling, General and Administrative

Expenses (“SGA”) largely being fixed other than freight out and commissions. |

| · | Significant

Increases in Operating Income, Adjusted EBITDA and Free Cash Flow.* |

| o | Operating

income increased to $5.7M from operating income of $1.8M last year. |

| o | Operating

income as a percentage of sales increased to 19.3% this year vs. 7.9% last year. |

| o | Adjusted

EBITDA worldwide this year was $6.1M vs. $2.1M last year. |

| o | Free

cash flow (defined as adjusted EBITDA less cash paid for taxes and less capital expenditures)

increased from $1.5M last year to $5.5M this year. |

| o | Excluded

from free cash flow is a non-cash charge of $1.2M in connection with the Discontinued

Operations in Brazil. |

| o | Net

income of $3.6M or $0.50 per share vs $0.6M and $0.09 per share for the three months

ended July 31, 2015 and 2014, respectively. |

| o | Net

loss from discontinued operations, as of July 31, 2015 of $(1.6)M or $(0.22) per share

vs. $(0.9)M and $(0.16) per share last year. |

| o | Net

income (loss) this year of $3.3M or $0.46 per share vs. $(0.4)M and $(0.07) per share

last year for the six months ended July 31, 2015 and 2014, respectively. |

| · | Balance

Sheet Strengthened |

| o | Cash

and cash equivalents decreased by $1.6M from $6.7M at end of Q4 last year to $5.1M at

end of Q2 with the payment of the arbitration settlement of $3.4M in cash while the revolver

balance held steady. |

| o | Net

book value per share at July 31, 2015 was $9.34. |

| o | Stockholders’

equity increased by 6.8% from the beginning of the fiscal year. |

* Includes non-GAAP measures – see

table included herein for reconciliation to GAAP measures

** All shares presented are Basic, unless otherwise noted.

Management’s Comments

Christopher J. Ryan, President and

Chief Executive Officer of Lakeland Industries, stated, “The second quarter of fiscal 2016 marked the second

consecutive quarter in which we reported a 500% increase in net income from continuing operations as compared with the

respective prior year periods. Free cash flow from continuing operations in the second quarter of this year increased by 267%

from the prior year, which followed a 105% increase for the first quarter. We attribute this growth to the hard work of our

growing worldwide team along with organic growth from our recurring base of customers and our unique operating platform which

has provided us with the ability to deliver large quantities of protective apparel for emergency and crisis situations where

there are global capacity shortages. Simply put, we believe that no other protective apparel manufacturer in the world can be

as responsive to market demands as Lakeland and still provide a high quality garment. We have continued to prove that we have

the ability to scale production and have the manufacturing capacity and operational expertise to respond to market demand.

Our consecutive quarterly growth rate, while not sustainable at the very high levels achieved during the first half of this

fiscal year, demonstrates the leverage in our business and our enhanced presence in a total addressable market valued at

nearly $7 billion globally.

“Lakeland’s brand is increasingly

being recognized around the world for the quality of its garments and the ability to deliver large quantities in periods of exigent

demand. In the past twelve months alone, Lakeland has responded to the Ebola crisis in West Africa and the bird flu crisis in

the United States, among other less significant events of incremental demand. Emergency requirements are nothing new to our industry

but Lakeland is now better positioned than ever to participate in this unpredictable demand as “the new go-to manufacturer”

for distributors, end users and government and military customers around the world. In turn, we are gaining market share and successfully

executing on an organic growth initiative to convert these emergency customers into recurring buyers of our broad and expanding

portfolio of protective apparel.

“Over the past several years we

have continued to report annual sales growth from our traditional, non-emergency activities which we view as somewhat recurring

in nature. We believe the quality of our revenues from continuing operations benefits from a growing global customer base where

we estimate that approximately 90% of sales are for recurring demand. In the second quarter, our order flow reflected the quality

and defensibility of our revenue base, which was evident despite seasonality and periodic slowdowns such as the current economic

circumstances in China and the reduced demand globally within the oil and gas industry resulting from low oil prices. We have

experienced increases in unit volume sales in most of our international businesses in the second quarter, although the impact

of this demand has been muted by the strong dollar against most foreign currencies which reduces our reported financial results.

In the US alone, sales in the fiscal 2016 second quarter of $19.5 million increased from the prior year period by 55%, driven

by approximately $4 million in orders for disposable and chemical garments in response to the bird flu epidemic. Excluding this

non-recurring demand, US sales grew by 23%. On a consolidated sales basis excluding orders relating to the bird flu epidemic,

revenues during a strong quarter increased by nearly 12% as compared to the second quarter of fiscal 2015, despite the negative

foreign currency impact.

“The turnaround strategy that we

implemented nearly three years ago, including the steps to complete our exit from Brazil that we recently announced, has been

executed with success. The strong improvement in our financial position and our exit from Brazil has provided us with the ability

to direct our attention to global organic growth initiatives. We are now in our next phase of planning which includes the development

of our management and sales teams, new product launches in response to customer demand, implementation of information systems

and technologies to enhance performance, and capital investments to accommodate increased manufacturing capacity and distribution

requirements. This plan is focused on long term growth in sales and profitability. Supported by the visibility afforded by our

recurring customer base, our goal is to deliver an approximate double digit compounded annual revenue growth rate for the foreseeable

future, which may further increase with the contributions of emergency events in any given year.”

Operating Results as Restated for Discontinued Operations ($

000)

Reconciliation to GAAP Results

| | |

Quarter Ended

July 31, 2015 | | |

Quarter Ended

July 31, 2014 | |

| Net sales from continuing operations | |

$ | 29,465 | | |

$ | 22,812 | |

| Year over year growth | |

| 29.2 | % | |

| — | |

| Gross profit from continuing operations | |

| 11,795 | | |

| 7,437 | |

| Gross profit % | |

| 40.0 | % | |

| 32.6 | % |

| Operating expenses from continuing operations | |

| 6,095 | | |

| 5,639 | |

| Operating expenses as a percentage of sales | |

| 20.7 | % | |

| 24.7 | % |

| Operating income from continuing operations | |

| 5,700 | | |

| 1,798 | |

| Operating income as a percentage of sales | |

| 19.3 | % | |

| 7.9 | % |

| Interest expense from continuing operations | |

| 210 | | |

| 517 | |

| Other (income) expense from continuing operations | |

| — | | |

| 42 | |

| Pretax income (loss) from continuing operations | |

| 5,490 | | |

| 1,239 | |

| Income tax expense (benefit) from continuing operations | |

| 1,902 | | |

| 677 | |

| Net income from continuing operations | |

| 3,588 | | |

| 562 | |

| Non-cash reclassification of Other Comprehensive Income to Statement of Operations with no impact on stockholder’s equity | |

| (1,286 | ) | |

| — | |

| Loss from discontinued operations | |

| (837 | ) | |

| (948 | ) |

| Loss before taxes for discontinued operations | |

| (2,123 | ) | |

| (948 | ) |

| Income tax expense (benefit) from discontinued operations | |

| (569 | ) | |

| — | |

| Net (loss) from discontinued operations | |

| (1,554 | ) | |

| (948 | ) |

| Net income (loss) | |

$ | 2,034 | | |

$ | (386 | ) |

| | |

| | | |

| | |

| Weighted average shares for EPS-Basic | |

| 7,145,418 | | |

| 5,924,524 | |

| Net income per share from continuing operations | |

$ | 0.50 | | |

$ | 0.09 | |

| Net loss per share from discontinued operations | |

$ | (0.22 | ) | |

$ | (0.16 | ) |

| Net income (loss) per share | |

$ | 0.28 | | |

$ | (0.07 | ) |

| | |

| | | |

| | |

| Operating income from continuing operations | |

$ | 5,700 | | |

$ | 1,798 | |

| Depreciation and amortization | |

| 228 | | |

| 258 | |

| Other income from continuing operations | |

| — | | |

| (18 | ) |

| EBITDA from continuing operations | |

| 5,928 | | |

| 2,038 | |

| Equity Compensation | |

| 127 | | |

| 25 | |

| Adjusted EBITDA | |

| 6,055 | | |

| 2,063 | |

| Cash paid for taxes (foreign) | |

| 391 | | |

| 365 | |

| Capital expenditures | |

| 167 | | |

| 149 | |

| Free cash flow | |

$ | 5,497 | | |

$ | 1,549 | |

Operating Results as Restated for Discontinued Operations ($

000)

Reconciliation to GAAP Results

| Quarterly results | |

Six-Months

Ended

July 31,

2015 | | |

Six-Months

Ended July 31,

2014 | |

| Net sales from continuing operations | |

$ | 54,284 | | |

$ | 44,570 | |

| Year over year growth | |

| 21.8 | % | |

| — | |

| Gross profit from continuing operations | |

| 21,073 | | |

| 13,942 | |

| Gross profit % | |

| 38.8 | % | |

| 31.3 | % |

| Operating expenses from continuing operations | |

| 12,154 | | |

| 11,286 | |

| Operating expenses as a percentage of sales | |

| 22.4 | % | |

| 25.3 | % |

| Operating income from continuing operations | |

| 8,919 | | |

| 2,656 | |

| Operating income as a percentage of sales | |

| 16.4 | % | |

| 6.0 | % |

| Interest expense from continuing operations | |

| 393 | | |

| 1,003 | |

| Other (income) expense from continuing operations | |

| 16 | | |

| (37 | ) |

| Pretax income (loss) from continuing operations | |

| 8,542 | | |

| 1,616 | |

| Income tax expense (benefit) from continuing operations | |

| 2,794 | | |

| 700 | |

| Net income from continuing operations | |

| 5,748 | | |

| 916 | |

| Non-cash reclassification of Other Comprehensive Income to Statement of Operations with no impact on stockholder’s equity | |

| (1,286 | ) | |

| — | |

| Loss from discontinued operations | |

| (1,868 | ) | |

| (1,302 | ) |

| Loss before taxes for discontinued operations | |

| (3,154 | ) | |

| (1,302 | ) |

| Income tax expense (benefit) from discontinued operations | |

| (669 | ) | |

| — | |

| Net (loss) from discontinued operations | |

| (2,485 | ) | |

| (1,302 | ) |

| Net income (loss) | |

$ | 3,263 | | |

$ | (386 | ) |

| | |

| | | |

| | |

| Weighted average shares for EPS-Basic | |

| 7,104,471 | | |

| 5,923,885 | |

| Net income (loss) per share from continuing operations | |

$ | 0.81 | | |

$ | 0.15 | |

| Net loss per share from discontinued operations | |

$ | (0.35 | ) | |

$ | (0.22 | ) |

| Net income (loss) per share | |

$ | 0.46 | | |

$ | (0.07 | ) |

| | |

| | | |

| | |

| Operating income from continuing operations | |

$ | 8,919 | | |

$ | 2,656 | |

| Depreciation and amortization | |

| 474 | | |

| 558 | |

| Other (income) expense from continuing operations | |

| (25 | ) | |

| 23 | |

| EBITDA from continuing operations | |

| 9,368 | | |

| 3,237 | |

| Equity Compensation | |

| 255 | | |

| 49 | |

| Inventory reserve in USA and China – discontinued product lines raw material/finished goods | |

| — | | |

| 300 | |

| PA plant shutdown costs | |

| — | | |

| 235 | |

| Adjusted EBITDA | |

| 9,623 | | |

| 3,821 | |

| Cash paid for taxes (foreign) | |

| 995 | | |

| 672 | |

| Capital expenditures | |

| 474 | | |

| 238 | |

| Free cash flow | |

$ | 8,154 | | |

$ | 2,911 | |

Financial Results Conference Call

Lakeland will host a conference call at

4:30 pm eastern today to discuss the Company's fiscal 2016 second quarter financial results. The call will be hosted by

Christopher J. Ryan, Lakeland’s President and CEO, and Teri W. Hunt, Lakeland’s Acting Chief Financial Officer. Investors

can listen to the call by dialing 888-347-6609 (Domestic) or 412-902-4291 (International) or 855-669-9657 (Canada), Pass

Code 10071831.

For a replay of this call through

September 23, 2015, dial 877-344-7529 (Domestic) or 412-317-0088 (International) or 855-669-9658 (Canada), Pass Code 10071831.

About Lakeland Industries, Inc.:

Lakeland Industries, Inc. (NASDAQ:

LAKE) manufactures and sells a comprehensive line of safety garments and accessories for the industrial protective clothing market.

The Company’s products are sold by a direct sales force and through independent sales representatives to a network of over

1,000 safety and mill supply distributors. These distributors in turn supply end user industrial customers such as chemical/petrochemical,

automobile, steel, glass, construction, smelting, janitorial, pharmaceutical and high technology electronics manufacturers, as

well as hospitals and laboratories. In addition, Lakeland supplies federal, state, and local government agencies, fire and police

departments, airport crash rescue units, the Department of Defense, the Centers for Disease Control and Prevention, and many other

federal and state agencies. For more information concerning Lakeland, please visit the Company online at www.lakeland.com.

Contacts:

| Lakeland Industries |

Darrow Associates |

| 631-981-9700 |

631-367-1866 |

| Christopher Ryan, CJRyan@lakeland.com |

Jordan Darrow, jdarrow@darrowir.com |

| Teri W. Hunt, TWHunt@lakeland.com |

|

# # #

“Safe Harbor” Statement under

the Private Securities Litigation Reform Act of 1995: Forward-looking statements involve risks, uncertainties and assumptions

as described from time to time in Press Releases and Forms 8-K, registration statements, quarterly and annual reports and other

reports and filings filed with the Securities and Exchange Commission or made by management. All statements, other than statements

of historical facts, which address Lakeland’s expectations of sources or uses for capital or which express the Company’s

expectation for the future with respect to financial performance or operating strategies can be identified as forward-looking

statements. As a result, there can be no assurance that Lakeland’s future results will not be materially different from

those described herein as “believed,” “projected,” “planned,” “intended,” “anticipated,”

“estimated” or “expected,” or other words which reflect the current view of the Company with respect to

future events. We caution readers that these forward-looking statements speak only as of the date hereof. The Company hereby expressly

disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change

in the Company’s expectations or any change in events conditions or circumstances on which such statement is based.

Non-GAAP Financial Measures

To supplement its consolidated financial

statements, which are prepared and presented in accordance with Generally Accepted Accounting Principles (GAAP), the Company uses

the following non-GAAP financial measures: EBITDA, Adjusted EBITDA and Free Cash Flow. The presentation of this financial information

is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented

in accordance with GAAP. The Company uses these non-GAAP financial measures for financial and operational decision making and

as a means to evaluate period-to-period comparisons. The Company believes that they provide useful information about operating

results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency

with respect to key metrics used by management in its financial and operational decision making. The non-GAAP financial measures

used by the Company in this press release may be different from the methods used by other companies.

For more information on the non-GAAP financial

measures, please see the Reconciliation of GAAP to non-GAAP Financial Measures tables in this press release. These accompanying

tables include details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the

related reconciliations between these financial measures.

LAKELAND INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

July 31,

2015 and January 31, 2015

| | |

July 31, | | |

January 31, | |

| | |

2015 | | |

2015* | |

| | |

($000’s) | | |

($000’s) | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 5,065 | | |

$ | 6,709 | |

| Accounts receivable, net of allowance for doubtful accounts of $446 and $484 at July 31, 2015 and January 31, 2015, respectively | |

| 15,711 | | |

| 13,277 | |

| Inventories, net of reserves of approximately $2,605 and $2,454 at July 31, 2015 and January 31, 2015, respectively | |

| 41,902 | | |

| 37,092 | |

| Deferred income taxes | |

| 84 | | |

| 1,144 | |

| Assets of discontinued operations in Brazil | |

| — | | |

| 6,335 | |

| | |

| | | |

| | |

| Prepaid VAT tax | |

| 1,657 | | |

| 1,717 | |

| Other current assets | |

| 2,773 | | |

| 2,361 | |

| Total current assets | |

| 67,192 | | |

| 68,635 | |

| Property and equipment, net | |

| 9,696 | | |

| 10,144 | |

| Assets held for sale | |

| 881 | | |

| — | |

| Deferred income tax, noncurrent | |

| 13,101 | | |

| 13,101 | |

| Prepaid VAT and other taxes | |

| 173 | | |

| 173 | |

| Security deposits | |

| 80 | | |

| 113 | |

| Intangibles, prepaid bank fees and other assets, net | |

| 141 | | |

| 171 | |

| Goodwill | |

| 871 | | |

| 871 | |

| Total assets | |

$ | 92,135 | | |

$ | 93,208 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 8,508 | | |

$ | 7,763 | |

| Accrued compensation and benefits | |

| 1,047 | | |

| 1,120 | |

| Other accrued expenses | |

| 1,696 | | |

| 1,462 | |

| Liabilities of discontinued operations in Brazil | |

| 753 | | |

| 6,574 | |

| Current maturity of long-term debt | |

| 50 | | |

| 50 | |

| Current maturity of accrued arbitration award | |

| — | | |

| 1,000 | |

| Short-term borrowing | |

| 2,746 | | |

| 2,611 | |

| Borrowings under revolving credit facility | |

| 8,897 | | |

| 5,642 | |

| Total current liabilities | |

| 23,697 | | |

| 26,222 | |

| Accrued arbitration award, less current portion | |

| — | | |

| 2,870 | |

| Long-term portion of Canada loan | |

| 759 | | |

| 800 | |

| VAT taxes payable long term | |

| 118 | | |

| 60 | |

| Total liabilities | |

| 24,574 | | |

| 29,952 | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $.01 par; authorized 1,500,000 shares (none issued) | |

| — | | |

| — | |

| Common stock, $.01 par; authorized 10,000,000 shares, Issued 7,590,235 and 7,414,037; outstanding 7,233,794 and 7,057,596 at July 31, 2015 and January 31, 2015 respectively | |

| 76 | | |

| 74 | |

| Treasury stock, at cost; 356,441 shares at July 31, 2015 and January 31, 2015 | |

| (3,352 | ) | |

| (3,352 | ) |

| Additional paid-in capital | |

| 64,130 | | |

| 64,594 | |

| Retained earnings | |

| 7,917 | | |

| 4,654 | |

| Accumulated other comprehensive loss | |

| (1,210 | ) | |

| (2,714 | ) |

| Total stockholders' equity | |

| 67,561 | | |

| 63,256 | |

| Total liabilities and stockholders' equity | |

$ | 92,135 | | |

$ | 93,208 | |

* Restated for discontinued operations

Numbers may not add due to rounding

LAKELAND INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(UNAUDITED)

Three and Six Months Ended July

31, 2015 and 2014

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

July 31, | | |

July 31, | |

| | |

($000’s)

except for share information | | |

($000’s)

except for share information | |

| | |

2015 | | |

2014* | | |

2015 | | |

2014* | |

| Net sales from continuing operations | |

$ | 29,465 | | |

$ | 22,812 | | |

$ | 54,284 | | |

$ | 44,570 | |

| Cost of goods sold from continuing operations | |

| 17,670 | | |

| 15,375 | | |

| 33,211 | | |

| 30,628 | |

| Gross profit from continuing operations | |

| 11,795 | | |

| 7,437 | | |

| 21,073 | | |

| 13,942 | |

| Operating expenses from continuing operations | |

| 6,095 | | |

| 5,639 | | |

| 12,154 | | |

| 11,286 | |

| Operating profit from continuing operations | |

| 5,700 | | |

| 1,798 | | |

| 8,919 | | |

| 2,656 | |

| Other income (loss), net from continuing operations | |

| — | | |

| (42 | ) | |

| 16 | | |

| (37 | ) |

| Interest expense from continuing operations | |

| 210 | | |

| 517 | | |

| 393 | | |

| 1,003 | |

| Income before taxes from continuing operations | |

| 5,490 | | |

| 1,239 | | |

| 8,542 | | |

| 1,616 | |

| Income tax expense from continuing operations | |

| 1,902 | | |

| 677 | | |

| 2,794 | | |

| 700 | |

| Net income from continuing operations | |

$ | 3,588 | | |

$ | 562 | | |

$ | 5,748 | | |

$ | 916 | |

| Non-cash reclassification of Other Comprehensive Income to Statement of Operations (no impact on stockholder’s equity) | |

| (1,286 | ) | |

| — | | |

| (1,286 | ) | |

| — | |

| Loss from operations from discontinued operations | |

| (322 | ) | |

| (948 | ) | |

| (1,253 | ) | |

| (1,302 | ) |

| Loss from disposal of discontinued operations | |

| (515 | ) | |

| — | | |

| (515 | ) | |

| — | |

| Loss before taxes for discontinued operations | |

| (2,123 | ) | |

| (948 | ) | |

| (3,054 | ) | |

| (1,302 | ) |

| Income tax benefit from discontinued operations | |

| (569 | ) | |

| — | | |

| (569 | ) | |

| — | |

| Net loss from discontinued operations | |

| (1,554 | ) | |

| (948 | ) | |

| (2,485 | ) | |

| (1,302 | ) |

| Net income (loss) | |

$ | 2,034 | | |

$ | (386 | ) | |

$ | 3,263 | | |

$ | (386 | ) |

| Net income (loss) per common share – Basic: | |

| | | |

| | | |

| | | |

| | |

| Income from continuing operations | |

$ | 0.50 | | |

$ | 0.09 | | |

$ | 0.81 | | |

$ | 0.15 | |

| Loss from discontinued operations | |

$ | (0.22 | ) | |

$ | (0.16 | ) | |

$ | (0.35 | ) | |

$ | (0.22 | ) |

| Net income (loss) | |

$ | 0.28 | | |

$ | (0.07 | ) | |

$ | 0.46 | | |

$ | (0.07 | ) |

| Net income (loss) per common share – Diluted: | |

| | | |

| | | |

| | | |

| | |

| Income from continuing operations | |

$ | 0.50 | | |

$ | 0.09 | | |

$ | 0.79 | | |

$ | 0.15 | |

| Loss from discontinued operations | |

$ | (0.22 | ) | |

$ | (0.16 | ) | |

$ | (0.34 | ) | |

$ | (0.22 | ) |

| Net income (loss) | |

$ | 0.28 | | |

$ | (0.07 | ) | |

$ | 0.45 | | |

$ | (0.07 | ) |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 7,145,418 | | |

| 5,924,524 | | |

| 7,104,471 | | |

| 5,923,885 | |

| Diluted | |

| 7,167,123 | | |

| 5,924,524 | | |

| 7,191,469 | | |

| 5,923,885 | |

*Restated for discontinued operations

Numbers may not add due to rounding

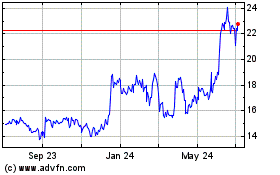

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jun 2024 to Jul 2024

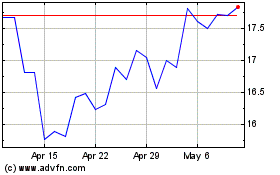

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jul 2023 to Jul 2024