UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): July 31, 2015

__________________________________________

Lakeland Industries, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

0-15535 |

13-3115216 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

3555 Veterans Memorial Highway,

Suite C, Ronkonkoma, New York 11779-7410

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (631) 981-9700

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.01. | Completion of Acquisition or Disposition of Assets. |

On July 31, 2015 (the “Closing Date”),

Lakeland Industries, Inc. (the “Company”) completed a conditional closing of the sale of its wholly-owned subsidiary,

Lake Brasil Industria E Comercio de Roupas E Equipamentos de Protecao Individual Ltda (“Lakeland Brazil”), to Zap Comércio

de Brindes Corporativos Ltda (“Transferee”), a company owned by an existing Lakeland Brazil manager. This sale is pursuant

to a Shares Transfer Agreement (the “Shares Transfer Agreement”) entered into on June 19, 2015, as previously disclosed

by the Company. The transactions contemplated by the Shares Transfer Agreement, which shall be deemed to have been consummated

as of the Closing Date, are subject to acceptance of the shares transfer on the Commercial Registry by the Brazilian authorities,

which is expected to be completed within approximately thirty days of the Closing Date. Although no assurances can be given in

that regard, the Company expects the Commercial Registry processing of the shares transfer will not adversely affect the closing.

On the Closing Date, Transferee paid R$1.00

to the Company and assumed all liabilities and obligations of Lakeland Brazil. Pursuant to the Shares Transfer Agreement, on the

Closing Date, the Company issued to Lakeland Brazil a non-interest bearing promissory note for R$582,000 (approximately US $188,000)

due and payable in two (2) installments: (i) R$288,300 (approximately US $84,000) on August 1, 2015, and (ii) R$294,500 (approximately

US $86,000) on September 1, 2015, subject to certain conditions.

The foregoing discussion

does not purport to be complete and is qualified in its entirety by reference to the Shares Transfer Agreement, which was previously

filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on June

25, 2015 and is incorporated herein by reference. A copy of the press release announcing completion of a conditional closing of

the sale of Lakeland Brazil is attached hereto as Exhibit 99.1.

| Item 9.01. | Financial Statements and Exhibits. |

| (b) | Pro Forma Financial Information. |

The unaudited condensed

consolidated pro forma financial information required by this Item is furnished as Exhibit 99.2 to this Form 8-K and is incorporated

herein by reference.

| 10.1 | Shares Transfer Agreement, dated as of June 19, 2015, by and among Lakeland Industries, Inc., Lake Brasil Industria E Comercio

de Roupas E Equipamentos de Protecao Individual Ltda, Zap Comércio de Brindes Corporativos Ltda and Jack Antunes Nemer (incorporated

by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 25, 2015). |

| 99.1 | Press Release, dated August 6, 2015. |

| 99.2 | Pro forma financial information. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LAKELAND INDUSTRIES, INC. |

| |

|

| |

|

| |

/s/ Christopher J. Ryan |

|

| |

Christopher J. Ryan |

| |

Chief Executive Officer & |

| |

President |

Dated: August 6, 2015

EXHIBIT INDEX

Exhibit

| Number |

|

Description |

| |

|

|

| 10.1 |

|

Shares Transfer Agreement, dated as of June 19, 2015, by and among Lakeland Industries, Inc., Lake Brasil Industria E Comercio de Roupas E Equipamentos de Protecao Individual Ltda, Zap Comércio de Brindes Corporativos Ltda and Jack Antunes Nemer (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 25, 2015). |

| |

|

|

| 99.1 |

|

Press Release, dated August 6, 2015. |

| |

|

|

| 99.2 |

|

Pro forma financial information. |

| |

|

|

Exhibit 99.1

| |

3555 Veterans Memorial Hwy, Suite C |

| |

Ronkonkoma, NY 11779 |

| |

(631) 981-9700 - www.lakeland.com |

Lakeland Industries Announces Conditional

Closing of Agreement to Exit From Brazil

Company Focuses on Sales Growth and Improving

Operating Performance

RONKONKOMA, NY – August 6,

2015 -- Lakeland Industries, Inc. (NASDAQ: LAKE), a leading global manufacturer of industrial protective clothing for

industry, municipalities, healthcare and to first responders on the federal, state and local levels, today announced that on

July 31, 2015 it completed a conditional closing of the sale of its wholly-owned Brazilian subsidiary (“Lakeland

Brazil”) to a company owned by a current manager of the subsidiary. This sale is pursuant to a shares transfer

agreement previously signed on June 19, 2015 which set out the details to finalize the Company’s exit from Brazil. The

sale, which shall be deemed to have been consummated as of July 31, 2015, is subject to acceptance of the shares transfer on

the Commercial Registry by the Brazilian authorities, which is expected to be completed within approximately the next thirty

days. Although no assurances can be given in that regard, the Company expects Commercial Registry processing of the shares

transfer will not adversely affect the closing.

In exchange for receiving the shares entitling

full ownership of Lakeland Brazil, the new owner has assumed all liabilities and obligations of Lakeland Brazil, whether arising

prior to, on or after the closing date of the shares transfer. In contemplation of the shares transfer, the Company provided approximately

US$1,130,000 through August 1, 2015 to Lakeland Brazil and has agreed to provide additional amount of approximately US$95,000 on

September 1, 2015 to support certain operational costs of Lakeland Brazil. In addition, the Company has agreed to provide partial

funding in respect of certain labor court case reimbursements over the next two years. There are further bonus payments of US$150,000

conditional upon Lakeland Brazil’s new owner not declaring bankruptcy or reorganizing after 12 months from the date of share

transfer and an additional US$100,000 under similar circumstances after 24 months. The Company believes the transfer of Lakeland

Brazil and its commitment to contingency coverage relating to labor court claims over the next two years will be more than offset

by the anticipated U.S. tax benefit of approximately US$9.5 million to be gained through a worthless stock deduction for the Brazil

business that the Company will claim on its U.S. tax return for the fiscal year ended January 31, 2015.

The conditional closing of the transaction

announced today includes the transfer by Lakeland Brazil of its Brazilian land ownership to the Company. The Company’s exposure

to certain liabilities arising in connection with the prior operations of Lakeland Brazil and the Company’s claiming of the

tax deduction is more fully disclosed in the Company’s filings with the Securities and Exchange Commission. The Company estimates

that the transactions involved with the completion of its exit from Brazil will result in a loss of approximately $1.2 million

to be reflected on its income statement and an increase of approximately $46,000 to stockholders equity as a result of recording

this transaction.

Christopher J. Ryan, President and Chief

Executive Officer of Lakeland Industries, commented, “We are pleased to have completed this process which has been an extraordinary

drain on our management team. The Company may now focus all of its energy on driving organic growth in the 12 regions around the

world in which we operate. In turn, we’ll be in a better position to improve our manufacturing leverage, operating efficiencies,

profitability and cash flow. With our improved outlook and without the burden of Brazil, we’ll have a broader runway to bolster

our sales and marketing efforts and concentrate on new product innovations. We are very excited and revitalized by the completion

of this exit process as well as concluding a three year turnaround that has put Lakeland Industries in a stronger position as we

enter our next chapter of growth.

“Lakeland continues to gain brand

awareness around the world which we believe will enhance our growth prospects. We’ve proven Lakeland’s manufacturing

and delivery platform is unique, which helped us win large contracts from epidemics, including Ebola, Avian Flu, and MERS, because

we have the capability to produce and ship product quickly, meeting the demanding requirements of customers. We believe

this demonstrated an important competitive advantage in execution and reputation which is increasingly making us a go-to choice

not only for the major infectious disease emergencies that occur every year or two, but also for the many oil and chemical spills

that occur on a regular basis.

“Our existing product lines are suitable

for most every need within the industrial protective apparel industry. We have proven that we are among the leaders in product

quality while possessing the ability to ramp up production based on market demand. Additionally,

now that that we have the time to focus on them, a number of new initiatives being implemented -- including end-user market

diversification and upgraded information systems and inventory management procedures -- are expected to deliver further benefits

to our profitability and ability to serve our customers better. These are the results we are looking to achieve that will

ultimately lead to building more shareholder value.”

About Lakeland Industries, Inc.:

Lakeland Industries, Inc. (NASDAQ: LAKE)

manufactures and sells a comprehensive line of safety garments and accessories for the industrial protective clothing market.

The Company’s products are sold by a direct sales force and through independent sales representatives to a network of over

1,000 safety and mill supply distributors. These distributors in turn supply end user industrial customers such as chemical/petrochemical,

automobile, steel, glass, construction, smelting, janitorial, pharmaceutical and high technology electronics manufacturers, as

well as hospitals and laboratories. In addition, Lakeland supplies federal, state, and local government agencies, fire and police

departments, airport crash rescue units, the Department of Defense, the Centers for Disease Control and Prevention, and many other

federal and state agencies. For more information concerning Lakeland, please visit the Company online at www.lakeland.com.

Contacts:

| Lakeland Industries |

Darrow Associates |

| 631-981-9700 |

631-367-1866 |

| Christopher Ryan, CJRyan@lakeland.com |

Jordan Darrow, jdarrow@darrowir.com |

# # #

“Safe Harbor” Statement under

the Private Securities Litigation Reform Act of 1995: Forward-looking statements involve risks, uncertainties and assumptions as

described from time to time in Press Releases and Forms 8-K, registration statements, quarterly and annual reports and other reports

and filings filed with the Securities and Exchange Commission or made by management. All statements, other than statements of historical

facts, which address Lakeland’s expectations of sources or uses for capital or which express the Company’s expectation

for the future with respect to financial performance or operating strategies can be identified as forward-looking statements. As

a result, there can be no assurance that Lakeland’s future results will not be materially different from those described

herein as “believed,” “projected,” “planned,” “intended,” “anticipated,”

“estimated” or “expected,” or other words which reflect the current view of the Company with respect to

future events. We caution readers that these forward-looking statements speak only as of the date hereof. The Company hereby expressly

disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change

in the Company’s expectations or any change in events conditions or circumstances on which such statement is based.

Exhibit 99.2

PROFORMA CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

Presented below is the unaudited proforma

condensed consolidated financial data of Lakeland Industries, Inc. (the “Company”) and its operating subsidiaries as

of and for the periods indicated. The unaudited proforma condensed consolidated statement of income for the fiscal year ended January

31, 2015 was derived from the audited statements contained in the Annual Report on Form 10-K for the period presented, and the

unaudited proforma condensed consolidated statement of income for the three months ended April 30, 2015 was derived from the unaudited

Statement of Income presented in the Quarterly Report on Form 10-Q for such period. The unaudited proforma condensed consolidated

Balance Sheet as of April 30, 2015 was derived from the unaudited Balance Sheet presented in the quarterly report on form 10-Q

for such period.

The transaction being presented is the conditional

closing (subject to the acceptance of the shares transferred on the commercial registry by the Brazilian government) on July 31,

2015 of the sale of its wholly-owned subsidiary, Lake Brasil Industria E Comercio de Roupas E Equipamentos de Protecao Individual

Ltda (“Lakeland Brazil”), to Zap Comércio de Brindes Corporativos Ltda (“Transferee”), a company

owned by an existing Lakeland Brazil manager. This sale is pursuant to a Shares Transfer Agreement (the “Shares Transfer

Agreement”) entered into on June 19, 2015, as previously disclosed by the Company. For more complete details of the transaction,

reference is made to the Shares Transfer Agreement, which was previously filed as Exhibit 10.1 to the Company’s Current Report

on Form 8-K filed with the Securities and Exchange Commission on June 25, 2015.

The unaudited proforma condensed consolidated

statements of income show the effect of the sale as if it happened on the first day of the period being presented; the unaudited

proforma condensed consolidated balance sheet shows the effect of the sale as if it happened on April, 30, 2015 and they are presented

for illustrative purposes only.

| LAKELAND INDUSTRIES, INC. and SUBSIDIARIES |

| PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET |

| April 30, 2015 |

| ($000's) |

| ASSETS | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Current assets | |

As Reported at April 30, 2015 (1) | | |

Remove Brazil Discontinued Ops (2) | | |

Accrue Cost to Dispose (3) | | |

Reclass other Comprehensive income to

P&L (4) | | |

Write Off InterCo AR from Brazil (5) | | |

Reverse Writeoff of Partial InterCo (Real Estate) (6) | | |

Assets Held for Sale net Deferred Gain (7) | | |

Accrue Tax Effect of additional costs to dispose (8) | | |

Buyout of Arbitration Award (9) | | |

Tax Effect on Extinguishment of Debt (10) | | |

Proforma Balance Sheet | |

| Cash and cash equivalents | |

$ | 8,721 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 8,721 | |

| Accounts receivable, net of allowance for doubtful accounts of $538 at April 30, 2015 | |

| 14,769 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 14,769 | |

| Inventories, net of reserves of approximately $2,460 at April 30, 2015 | |

| 39,495 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 39,495 | |

| Deferred income taxes | |

| 1,015 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 896 | | |

| - | | |

| (81 | ) | |

| 1,830 | |

| Assets of discontinued operations in Brazil | |

| 6,447 | | |

| (6,447 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Assets held for sale (Brazil real estate) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 882 | | |

| - | | |

| - | | |

| - | | |

| 882 | |

| Prepaid VAT tax | |

| 1,216 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,216 | |

| Other current assets | |

| 3,184 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,184 | |

| Total Current Assets | |

| 74,847 | | |

| (6,447 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| 882 | | |

| 896 | | |

| - | | |

| (81 | ) | |

| 70,097 | |

| Property and equipment, net | |

| 10,311 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 10,311 | |

| Deferred income tax, noncurrent | |

| 13,101 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 13,101 | |

| Prepaid VAT and other taxes | |

| 173 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 173 | |

| Security deposits | |

| 86 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 86 | |

| Intangibles, prepaid bank fees and other assets, net | |

| 141 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 141 | |

| Goodwill | |

| 871 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 871 | |

| Total assets | |

$ | 99,530 | | |

$ | (6,447) | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 882 | | |

$ | 896 | | |

$ | 0 | | |

$ | (81 | ) | |

$ | 94,780 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDER'S EQUITY | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accounts payable | |

$ | 8,512 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 8,512 | |

| Accrued compensation and benefits | |

| 854 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 854 | |

| Other accrued expenses | |

| 1,798 | | |

| - | | |

| 300 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,098 | |

| Liabilities of discontinued operation in Brazil | |

| 6,692 | | |

| (9,814 | ) | |

| 2,155 | | |

| - | | |

| 3,122 | | |

| (337 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,818 | |

| Current maturity of long-term debt | |

| 50 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 50 | |

| Current maturity of accrued arbitration award | |

| 1,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,000 | ) | |

| - | | |

| - | |

| Short-term borrowing | |

| 3,446 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,446 | |

| Borrowing under revolving credit facility | |

| 8,666 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,413 | | |

| - | | |

| 12,079 | |

| Total current liabilities | |

| 31,018 | | |

| (9,814 | ) | |

| 2,455 | | |

| - | | |

| 3,122 | | |

| (337 | ) | |

| - | | |

| - | | |

| 2,413 | | |

| - | | |

| 28,857 | |

| Accrued arbitration award, less current portion | |

| 2,637 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,637 | ) | |

| - | | |

| - | |

| Long-term portion of Canada loan | |

| 830 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 830 | |

| VAT taxes payable long-term | |

| 130 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 130 | |

| Total liabilities | |

| 34,615 | | |

| (9,814 | ) | |

| 2,455 | | |

| - | | |

| 3,122 | | |

| (337 | ) | |

| - | | |

| - | | |

| (224 | ) | |

| - | | |

| 29,817 | |

| Stockholder's equity | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Preferred stock, $.01 par; authorized 1,500,0000 shares (none issued) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Common stock, $.01 par; authorized 10,000,000 shares, issued 7,428,220; outstanding 7,071,779 at April 30, 2015 | |

| 74 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 74 | |

| Treasury stock, at cost; 356,441 shares at April 30, 2015 | |

| (3,352 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,352 | ) |

| Additional paid-in capital | |

| 64,680 | | |

| (24,162 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 40,518 | |

| Retained earnings | |

| 5,883 | | |

| 26,243 | | |

| (2,455 | ) | |

| - | | |

| (3,122 | ) | |

| 337 | | |

| 882 | | |

| 896 | | |

| 224 | | |

| (81 | ) | |

| 28,807 | |

| Accumulated other comprehensive loss | |

| (2,370 | ) | |

| 1,286 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,084 | ) |

| | |

| 64,915 | | |

| 3,367 | | |

| (2,455 | ) | |

| - | | |

| (3,122 | ) | |

| 337 | | |

| 882 | | |

| 896 | | |

| 224 | | |

| (81 | ) | |

| 64,963 | |

| | |

$ | 99,530 | | |

| (6,447 | ) | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 882 | | |

$ | 896 | | |

$ | 0 | | |

$ | (81 | ) | |

$ | 94,780 | |

| 1 |

As reported in the quarterly report on Form 10Q as of April 30, 2015. |

| 2 |

To remove the Brazil assets and liabilities per the Brazil balance sheet as of April 30, 2015. |

| 3 |

Estimated amounts the Company is contractually obligated to pay the buyer plus estimated professional and other fees to dispose. |

| 4 |

Other Comprehensive Income on the books of the Brazilian subsidiary as reclassified to P&L. |

| 5 |

To write off the receivables from Brazil held by Lakeland and its subsidiaries which will not be collected. |

| 6 |

To reflect a portion of the intercompany accounts which will be collected via sale of Brazil real estate. |

| 7 |

To reflect the Brazil real estate which has been sold to the US parent company in exchange for satisfaction of several intercompany accounts. |

| 8 |

To accrue tax benefits for additional costs to dispose which were not accrued and not included in the $9.5 million tax benefit for the worthless stock deduction to be claimed on the company's FY 15 US tax returns. |

| 9 |

To reflect the Settlement Agreement reached on June 18, 2015 with two former officers of Lakeland Brazil. |

| 10 |

To reflect the tax impact of #9 above. |

| 11 |

There are contingent "bonus payments" of $150,000 after 12 months and $100,000 after 24 months from the closing date to be paid if the buyer has not declared bankruptcy or reorganization. Such payments have not been reflected herein due to the contingent nature of these payments. |

| 12 |

Included in the "as reported" for FY 15 and Q1 FY 16 was a US tax benefit of $9.5 million resulting from the worthless stock deduction to be claimed on the Company's FY 15 US tax return. This has not been reflected in the discontinued operations since it is a USA tax benefit and was derived from the fact that the Brazil operations were deemed to be worthless during FY 15 and not as a result of the sale. Further, this tax benefit was included in the historic financial statements for FY 15. |

| PRO FORMA CONDENSED STATEMENT OF INCOME (to reflect sale of Brazil ) (unaudited) |

| FY 15 ($ 000) (except for share and per share data) |

| | |

as reported (1)(5) | | |

Brazil as reported | | |

as restated for discontinued operations | | |

to reflect loss on sale (3) | | |

gain on extinguishment of arbitration award debt (4) | | |

pro forma interest on arbitration buyout (2) | | |

Pro forma statement of Income (1)(5) | |

| Net Sales from Continuing Operations | |

$ | 99,733 | | |

$ | 6,315 | | |

$ | 93,418 | | |

| - | | |

| - | | |

| - | | |

$ | 93,418 | |

| Gross Profit from Continuing Operations | |

| 33,712 | | |

| 2,013 | | |

| 31,699 | | |

| - | | |

| - | | |

| - | | |

| 31,699 | |

| Operating expenses from Continuing Operations | |

| 28,755 | | |

| 4,017 | | |

| 24,738 | | |

| - | | |

| - | | |

| - | | |

| 24,738 | |

| Operating income from Continuing Operations | |

| 4,957 | | |

| (2,004 | ) | |

| 6,961 | | |

| - | | |

| - | | |

| - | | |

| 6,961 | |

| Interest expense from Continuing Operations | |

| 2,352 | | |

| 636 | | |

| 1,716 | | |

| - | | |

| - | | |

| 213 | | |

| 1,929 | |

| Other (income) expense from Continuing Operations | |

| 2,544 | | |

| 197 | | |

| 2,347 | | |

| - | | |

| - | | |

| - | | |

| 2,279 | |

| Pretax income (loss) from Continuing operations | |

| 61 | | |

| (2,837 | ) | |

| 2,898 | | |

| - | | |

| - | | |

| (213 | ) | |

| 2,754 | |

| Income tax benefit from Continuing Operations | |

| (8,337 | ) | |

| (149 | ) | |

| (8,188 | ) | |

| - | | |

| - | | |

| (78 | ) | |

| (8,199 | ) |

| Net Income from Continuing Operations | |

$ | 8,399 | | |

$ | (2,688 | ) | |

$ | 11,087 | | |

| - | | |

| - | | |

$ | (135 | ) | |

$ | 10,952 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares for EPS basic | |

| 6,214,303 | | |

| - | | |

| 6,214,303 | | |

| - | | |

| - | | |

| - | | |

| 6,214,303 | |

| Weighted average shares for EPS diluted | |

| 6,325,525 | | |

| - | | |

| 6,325,525 | | |

| - | | |

| - | | |

| - | | |

| 6,325,525 | |

| Net income per share from continuing operations - basic | |

$ | 1.35 | | |

| - | | |

$ | 1.78 | | |

| - | | |

| - | | |

| - | | |

$ | 1.76 | |

| Net income per share from continuing operations - diluted | |

$ | 1.33 | | |

| - | | |

$ | 1.75 | | |

| - | | |

| - | | |

| - | | |

$ | 1.73 | |

| Notes: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| 1. Included in the "as reported" for FY 15 was a US tax benefit of $9.5 million resulting from the worthless stock deduction to be claimed on the Company's FY 15 US tax return. This has not been reflected in the discontinued operations since it is a USA tax benefit and was derived from the fact that the Brazil operations were deemed to be worthless during FY 15 and not as a result of the sale. Further, this tax benefit was included in the historic financial statements for FY 15. |

| 2. Interest expense has been included on a proforma basis to reflect the $3.4 million borrowed from the revolver in Q2 to fund the buyout, at 6.25%, as if the transaction had occurred at the beginning of the fiscal period. |

| 3. Loss on sale of $1.381 million is after including a reclassification of $1.2 million from other

comprehensive income to loss from discontinued operations. The reclassification adjustment had no impact on

shareholder equity and thus shareholder equity has increased by $48,000 as a result of the sale before other proforma

adjustments. This has not been reflected in the proforma statement since the proforma statement shows only income

from continuing operations. There will be small rounding differences between the P&L and Balance Sheet proformas. |

| 4. Gain on extinguishment of arbitration debt was $224,000 pretax. A proforma tax impact of

$82,000 was included. This has not been reflected in the proforma statement of income since the proforma statement

of income shows only income from continuing operations. |

| 5. There are contingent "bonus payments" of $150,000 after 12 months and $100,000 after 24 months from the closing date to be paid if the buyer has not declared bankruptcy or reorganization. Such payments have not been reflected herein due to the contingent nature of these payments. |

| PRO FORMA CONDENSED STATEMENT OF INCOME (to reflect sale of Brazil ) (unaudited) |

| Q1 FY 16 ($ 000) (except for share and per share data) |

| | |

as reported - restated for discontinued operations (1)(5) | | |

to reflect loss on sale (3) | | |

gain on extinguishment of arbitration award debt (4) | | |

pro forma interest on arbitration buyout (2) | | |

Pro forma statement of Income (5) | |

| Net Sales from Continuing Operations | |

$ | 24,819 | | |

| - | | |

| - | | |

| - | | |

$ | 24,819 | |

| Gross Profit from Continuing Operations | |

| 9,279 | | |

| - | | |

| - | | |

| - | | |

| 9,279 | |

| Operating expenses from Continuing Operations | |

| 6,059 | | |

| - | | |

| - | | |

| - | | |

| 6,059 | |

| Operating income from Continuing Operations | |

| 3,220 | | |

| - | | |

| - | | |

| - | | |

| 3,220 | |

| Interest expense from Continuing Operations | |

| 183 | | |

| - | | |

| - | | |

| 53 | | |

| 236 | |

| Other (income) expense from Continuing Operations | |

| 15 | | |

| - | | |

| - | | |

| - | | |

| 15 | |

| Pretax income (loss) from Continuing operations | |

| 3,052 | | |

| - | | |

| - | | |

| (53 | ) | |

| 2,999 | |

| Income tax expense (benefit) from Continuing Operations | |

| 892 | | |

| - | | |

| - | | |

| (19 | ) | |

| 873 | |

| Net Income from Continuing Operations | |

$ | 2,160 | | |

| - | | |

| - | | |

$ | (34 | ) | |

$ | 2,126 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares for EPS basic | |

| 7,062,144 | | |

| - | | |

| - | | |

| - | | |

| 7,062,144 | |

| Weighted average shares for EPS diluted | |

| 7,235,385 | | |

| - | | |

| - | | |

| - | | |

| 7,235,385 | |

| Net income per share from continuing operations - basic | |

$ | 0.31 | | |

| - | | |

| - | | |

| - | | |

$ | 0.30 | |

| Net income per share from continuing operations - diluted | |

$ | 0.30 | | |

| - | | |

| - | | |

| - | | |

$ | 0.29 | |

| Notes: |

|

|

| |

|

|

| 1. Included in the "as reported" for FY 15 was a US tax benefit of $9.5 million resulting from the worthless stock deduction to be claimed on the Company's FY 15 US tax return. This has not been reflected in the discontinued operations since it is a USA tax benefit and was derived from the fact that the Brazil operations were deemed to be worthless during FY 15 and not as a result of the sale. Further, this tax benefit was included in the historic financial statements for FY 15. |

| 2. Interest expense has been included on a proforma basis to reflect the $3.4 million borrowed from the revolver in Q2 to fund the buyout, at 6.25%, as if the transaction had occurred at the beginning of the fiscal period. |

| 3. Loss on sale of $1.381 million is after including a reclassification of $1.2 million from other comprehensive income to loss from discontinued operations. The reclassification adjustment had no impact on shareholder equity and thus shareholder equity has increased by $48,000 as a result of the sale before other proforma adjustments. This has not been reflected in the proforma statement since the proforma statement shows only income from continuing operations. |

| 4. Gain on extinguishment of arbitration debt was $224,000 pretax. A proforma tax impact of $82,000 was included. This has not been reflected in the proforma statement since the proforma statement shows only income from continuing operations. |

| 5. There are contingent "bonus payments" of $150,000 after 12 months and $100,000 after 24 months from the closing date to be paid if the buyer has not declared bankruptcy or reorganization. Such payments have not been reflected herein due to the contingent nature of these payments. |

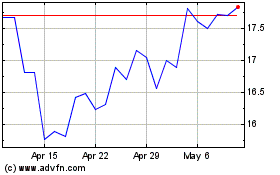

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jun 2024 to Jul 2024

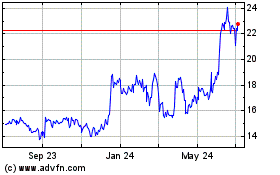

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jul 2023 to Jul 2024