UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 18, 2015

__________________________________________

Lakeland Industries, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

0-15535 |

13-3115216 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

3555 Veterans Memorial Highway,

Suite C, Ronkonkoma, New York 11779-7410

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (631) 981-9700

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On June 18, 2015, Lakeland Industries, Inc.

(“Lakeland”) and its wholly-owned subsidiary, Lake Brasil Indústria e Comércio de Roupas e Equipamentos

de Proteção Individual Ltda. (“Lakeland Brazil” and together with Lakeland, the “Company”),

entered into an Amendment (the “Amendment”) to a Settlement Agreement, dated as of September 11, 2012 (the “Settlement

Agreement”), with two former officers (the “former officers”) of Lakeland Brazil. As part of the original Settlement

Agreement, the parties resolved all alleged outstanding claims against the Company arising from an arbitration proceeding in Brazil

involving the Company and the former officers for an aggregate amount of approximately US $8.5 million payable by the Company to

the former officers over a period of six (6) years. There currently exists a balance of US $3.750 million (the “Outstanding

Amount”) owed under the Settlement Agreement, which Outstanding Amount is to be paid by the Company in quarterly installments

of US $250,000 through December 31, 2018.

Pursuant to the Amendment, the former officers

agreed to fully and finally settle the Outstanding Amount owed by the Company for an aggregate lump-sum payment of US $3.413 million

due on June 30, 2015. Within five days of receipt of such payment, the former officers are required to provide to Lakeland Brazil

the documents needed to have their lien securing payment of the Outstanding Amount removed on certain real estate owned by Lakeland

Brazil. The Amendment also contains a general release of claims by the former officers in favor of the Company and its past or

present officers, directors, and other affiliates. Lakeland’s senior lender, Alostar Bank of Commerce, has consented to the

transactions contemplated by the Amendment.

The foregoing description in the Amendment

does not purport to be complete and is qualified in its entirety by reference to the Amendment, which is attached hereto as Exhibit

10.1 and incorporated herein by reference. A copy of the press release related to the Amendment is attached hereto as Exhibit 99.1.

| Item 9.01. | Financial Statements and Exhibits. |

| 10.1 | Amendment, dated effective as of June 18, 2015, to Settlement Agreement, dated as of September 11, 2012. |

| 99.1 | Press Release, dated June 22, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LAKELAND INDUSTRIES, INC. |

| |

|

| |

|

| |

/s/ Christopher J. Ryan |

|

| |

Christopher J. Ryan |

| |

Chief Executive Officer & |

| |

President |

Dated: June 22, 2015

EXHIBIT INDEX

Exhibit

| Number |

|

|

Description |

|

| |

|

|

| 10.1 |

|

Amendment, dated effective as of June 18, 2015, to Settlement Agreement, dated as of September 11, 2012. |

| 99.1 |

|

Press Release, dated June 22, 2015. |

Exhibit 10.1

| AMENDMENT TO THE SETTLEMENT AGREEMENT AND OTHER COVENANTS EXECUTED ON SEPTEMBER 11, 2012 |

TERMO ADITIVO AO INSTRUMENTO PARTICULAR DE TRANSAÇÃO E OUTRAS AVENÇAS CELEBRADO EM 11 DE SETEMBRO DE 2012 |

| |

|

| By virtue of this private instrument and in conformity with any and all applicable laws, the Parties hereto: |

Pelo presente instrumento particular e na melhor forma de direito, as Partes abaixo: |

| |

|

| on the one side, hereinafter jointly referred to as the "Creditors", |

de um lado e doravante denominados em conjunto simplesmente como os “Credores”, |

| |

|

| ELDER MARCOS VIEIRA DA CONCEIÇÃO, Brazilian citizen, entrepreneur, enrolled before the Brazilian Taxpayers Registry under number (C.P.F./M.F.) under number 793.295.605-63, with address at Loteamento Varandas Tropicais, S/N, Lotes 10 a 13, Downtown, City of Lauro de Freitas, State of Bahia, Brazil, hereinafter referred to as “Marcos”; and |

ELDER MARCOS VIEIRA DA CONCEIÇÃO, brasileiro, empresário, inscrito no C.P.F./M.F. sob o nº 793.295.605-63, com endereço comercial no Loteamento Varandas Tropicais, S/N, Lotes 10 a 13, Bairro Centro, Município de Lauro de Freitas, Estado da Bahia, Brasil, doravante denominado simplesmente “Marcos”; e |

| |

|

| MÁRCIA CRISTINA VIEIRA DA CONCEIÇÃO ANTUNES, Brazilian citizen, entrepreneur, enrolled before the Brazilian Taxpayers Registry under number (C.P.F./M.F.) under number 507.932.685-91, with address at Alameda Praia de Tramandaí, nº 412, Condomínio Villa Costeira, Casa 31, Stella Mares neighborhood, City of Salvador, State of Bahia, Brazil, hereinafter referred to as “Márcia”; and |

MÁRCIA CRISTINA VIEIRA DA CONCEIÇÃO ANTUNES, brasileira, empresária, inscrita no C.P.F./M.F. sob o nº 507.932.685-91, residente e domiciliada na Alameda Praia de Tramandaí, nº 412, Condomínio Villa Costeira, Casa 31, Bairro Stella Mares, Município de Salvador, Estado da Bahia, Brasil, doravante denominada simplesmente “Márcia”; |

| |

|

| on the other side, hereinafter jointly referred to as the "Debtors", |

de outro lado e doravante denominadas em conjunto simplesmente como as “Devedoras” |

| |

|

| Lakeland Industries, Inc., Company duly organized under the laws of the State of Delaware, United States of America, with its head office located at 701 Koehler Avenue, suite 7, Ronkonkoma, NY, 117779-7410, herein represented by its Legal Representative, hereinafter referred to as “Lakeland Industries”; and |

Lakeland Industries, Inc., sociedade constituída de acordo com as leis dos Estados Unidos da América, com sede em 701, Koehler Avenue, suite 7, Ronkonkoma, NY, 117779-7410, neste ato representada por seu representante legal, doravante denominada simplesmente “Lakeland Industries”; e |

| Page 1 of 6 |

Página 1 de 6 |

| LAKE BRASIL INDÚSTRIA E COMÉRCIO DE ROUPAS E EQUIPAMENTOS DE PROTEÇÃO INDIVIDUAL LTDA. (current corporate name of the former Lakeland Brasil S.A.), a company duly organized under the laws of Brazil, with its head office located at Rua Luxemburgo, 260, Lotes 82/83 – Bloco O, Loteamento Granjas Rurais, Salvador – BA, Brazil, 41230-130, enrolled before the Brazilian Taxpayers Registry (C.N.P.J./M.F.) under the Number 04.011.170/0001-22, herein represented by its Legal Representative, hereinafter referred to as “Lake Brasil”; |

LAKE BRASIL INDÚSTRIA E COMÉRCIO DE ROUPAS E EQUIPAMENTOS DE PROTEÇÃO INDIVIDUAL LTDA. (atual denominação social da antiga Lakeland Brasil S.A.), sociedade constituída de acordo com as leis do Brasil, inscrita no C.N.P.J./M.F. sob o n° 04.011.170/0001-22, com sede na Rua Luxemburgo, nº 260, Lotes 82/83 – Bloco O, Município de Salvador, Estado da Bahia, CEP 41230-130, neste ato representada por seu representante legal, doravante denominada simplesmente “Lake Brasil”; |

| |

|

| hereinafter jointly named “Parties” or severally named “Party”. |

doravante conjuntamente designados “Partes” ou, individualmente, como “Parte”. |

| |

|

| WITNESSETH |

PREMISSAS |

| |

|

| WHEREAS Parties executed on September 11, 2012 the Settlement Agreement and Other Covenants (the "Main Agreement"), upon which they agreed to end the disputes relating to the arbitral award in the arbitration procedure No. 35/2010 filed before the Arbitration and Mediation Center of the Brazil-Canada Chamber of Commerce (the "Arbitration Proceeding"); and |

CONSIDERANDO que na data de 11 de setembro de 2012 as Partes celebraram o Instrumento Particular de Transação (doravante o “Contrato Principal”), por meio do qual acordaram pôr fim às pendências relacionadas à sentença arbitral proferida no procedimento arbitral nº 35/2010 instaurado perante o Centro de Arbitragem e Mediação da Câmara de Comércio Brasil-Canadá (doravante o “Procedimento Arbitral”); e |

| |

|

| WHEREAS Parties intend to change some provisions of the Main Agreement, pursuant to the dispositions of its Section 22. |

CONSIDERANDO que as Partes têm interesse em alterar algumas das condições acordadas no Contrato Principal, nos termos do disposto em sua cláusula 22ª; |

| |

|

| NOW THEREFORE, Parties hereby agree to enter into this Amendment to the Main Agreement (the “Amendment”) upon the following terms and provisions, which are mutually agreed and accepted by Parties: |

as Partes têm entre si certo e ajustado celebrar o presente Termo Aditivo ao Contrato Principal (doravante o “Termo Aditivo”), mediante as seguintes cláusulas e condições, que reciprocamente se outorgam e aceitam, a saber: |

| |

|

| SECTION 1 - RENEGOTIATION OF PAYABLE AMOUNTS AND PAYMENT SCHEDULE |

CLAUSULA 1ª - DA RENEGOCIAÇÃO DE VALORES E FORMA DE PAGAMENTO |

| Page 2 of 6 |

Página 2 de 6 |

| 1.1. By means of this private instrument Creditors declare, acknowledge and confess that both have already received from Debtors, the total gross amount of R$5,000,000.00 (five million Brazilian Reals) and also US$2,250,000.00 (two million, two hundred and fifty thousand US dollars) as payment of the part of total amount agreed in Section 2.1 of the Main Agreement and, by virtue of this, hereby fully, irrevocably and irreversibly releases the Debtors from all those amounts already paid by them, and the Debtors, irrevocably and irreversibly releases the Creditors from the obligations indicated in the Main Agreement, until now. |

1.1. Por meio deste Instrumento os Credores declaram, reconhecem e confessam haver recebido das Devedoras, até o presente momento, o montante bruto total de R$5.000.000,00 (cinco milhões de reais) e de US$2.250.000,00 (dois milhões e duzentos e cinquenta mil dólares norte-americanos), em pagamento de parte do total pactuado na Cláusula 2.1 do Contrato Principal e, quanto a estes valores pagos, os Credores outorgam irrestrita e irrevogável quitação, bem como as Devedoras declaram terem os Credores cumprido todas as obrigações constantes do Contrato Principal exigíveis até a presente data. |

| |

|

| 1.2. Therefore, Parties grant each other a complete, general, irreversible and irrevocable release related to the obligations indicated in the Main Agreement, until now. |

1.2. Dessa forma, outorgam-se reciprocamente as Partes a mais ampla geral irrestrita e irrevogável quitação em relação às obrigações constantes do Contrato Principal exigíveis até a presente data. |

| |

|

| 1.3. The Parties recognize that remains a balance due in the total amount of US$3,750,000.00 (three million seven hundred and fifty US dollars) (the "Outstanding balance"). |

1.3. As Partes reconhecem ainda restar um saldo devedor a vencer no montante total de US$3.750.000,00 (três milhões e setecentos e cinquenta dólares norte-americanos) (doravante o “Saldo Devedor”). |

| |

|

| 1.4. By means of this Amendment, Parties agree, by mutual consent, to renegotiate the amount and the payment schedule of the Outstanding balance, which should be fully settled by a single payment in the gross amount of US$3,413,000.00 (three million four hundred thirteen US dollars), fully due on 30 June 2015, which shall be paid by the Debtors, by means of deposits into the bank accounts in name of the Creditors, as informed in Section 2.2 of the Main Agreement, at the rate of 50% (fifty percent) of the aforementioned value for each of the Creditors. |

1.4. Por meio do presente Termo Aditivo as Partes resolvem, por mútuo consenso, repactuar o valor, a forma e o termo de adimplemento do Saldo Devedor, o qual deverá ser integralmente quitado mediante um único pagamento, no valor bruto total de US$3,413,000.00 (três milhões, quatrocentos e treze mil dólares norte-americanos), com vencimento em 30 de junho de 2015, a ser integralmente quitado pelas Devedoras, mediante depósito fracionado nas contas bancárias dos Credores informadas na Cláusula 2.2 do Contrato Principal, na proporção de 50% (cinquenta por cento) do aludido valor para cada um dos Credores. |

| |

|

| 1.5. In the event that the Debtors do not pay the amount due within the maturity date mentioned in the Section 1.4, by a single day or partial payment, this Amendment will lose all its effects, as it has never existed, re-establishing all provisions of the Main Agreement. |

1.5. Na hipótese de inadimplemento do único pagamento estabelecido no item 1.4, incluindo a mora ainda que de apenas um dia ou de apenas um dos depósitos fracionados, o presente Termo de Aditamento perderá todos os seus efeitos, como se ele nunca tivesse existido, restabelecendo-se todas as disposições do Contrato Principal. |

| Page 3 of 6 |

Página 3 de 6 |

| 1.6. Upon receipt of the total amount agreed pursuant to the provisions of Section 1.4 above, Creditors shall automatically grant to Debtors, the fullest, broadest, unrestricted, irrevocable release in relation to any obligations of the Debtors arising from the Arbitration Procedure or the Main Agreement or any other matter or event, abstaining to make any future complain against Debtors or their respective past or present officers, directors, parents, subsidiaries, affiliates, partners, employees, representatives and managers, from all types of actions, causes of action, contracts and covenants, whether express or implied, which Creditors now have, have ever had, or may at any time hereafter have Against Debtors. |

1.6. Mediante o recebimento do montante acordado nos termos do item 1.4 acima, os Credores outorgarão às Devedoras, de forma automática, a mais ampla, geral, irrestrita e irrevogável quitação em relação a toda e qualquer obrigação das Devedoras decorrentes do Procedimento Arbitral, do Contrato Principal e de qualquer outro fato ou evento, seja ele passado, presente ou futuro, para nada mais reclamar das Devedoras, seus executivos e diretores (passados ou presentes), suas controladoras, suas subsidiárias, suas afiliadas, seus sócios, seus empregados, seus representantes e seus administradores, seja a que título for, inclusive em relação a ações e causas de pedir, contratos e acordos, sejam eles escritos ou tácitos, que os Credores possam ter, ter tido ou vir a ter contra os Devedores. |

| |

|

|

1.7.

In addition, upon receipt of the total amount agreed pursuant to the provisions of Section 1.4 above, Creditors do hereby commit

to, within five (5) days from such receipt, deliver to Lake Brasil, Mr. Eduardo Fernandes Tavares, at Rua do Luxemburgo, 260, Lotes

83/84, Granjas Rurais, City of Salvador – BA, ZIP 41230-130, the correspondent Acquittance Letter, which is necessary for

revoking the mortgage constituted pursuant to the provisions Section 2.3 of the Main Agreement, in accordance to Annex A.

1.8.

In the event that the Creditors fail to comply with the obligation assumed by them under the terms of this Section 1.7, they

will automatically be subject to payment of a penalty in favor of Lake Brasil, in the amount of R$10,000.00 (ten thousand Brazilian

reals) per day for the period they remain in default with such obligation. |

1.7.

Também mediante o recebimento do montante acordado nos termos do item 1.4 acima, os Credores se comprometem a, no prazo

máximo de 5 (cinco) dias a contar do respectivo recebimento, entregar à Lake Brasil, ao Sr. Eduardo Fernandes

Tavares, na Rua do Luxemburgo, n° 260, Lotes 83/84, Granjas Rurais, Cidade de Salvador – BA, CEP 41230-130,

o Termo de Quitação necessário para a solicitação da baixa da hipoteca instituída nos

termos da Cláusula 2.3 do Contrato Principal, de acordo com a minuta constante do Anexo A.

1.8.

Na hipótese de os Credores deixarem de cumprir com a obrigação por eles assumida nos termos deste item

1.77, estes ficarão automaticamente sujeitos ao pagamento de uma multa em favor da

Lake Brasil, no valor de R$10.000,00 (dez mil reais) por dia de atraso no cumprimento integral de tal obrigação. |

| Page 4 of 6 |

Página 4 de 6 |

| SECTION 2 - GENERAL PROVISIONS |

CLAUSULA 2ª - DISPOSIÇÕES GERAIS |

| |

|

| 2.1. Any changes or alterations to the present Amendment shall only be valid and enforceable when entered into under the provisions of the law and in writing by the Parties hereto. |

2.1. Quaisquer alterações ou modificações do presente Termo Aditivo só serão válidas e eficazes se procedidas nos termos da lei e por escrito entre as Partes. |

| |

|

| 2.2. Should any provision of this Amendment be declared invalid or unenforceable, such condition shall not affect the validity and enforceability of the other provisions herein contained. |

2.2. A eventual invalidade ou ineficácia de qualquer das disposições deste Termo Aditivo não afeta a validade e eficácia das demais disposições nele contidas. |

| |

|

| 2.3. For all purposes and effects, the Parties do hereby declare that have carefully read all provisions of the present Amendment, which they fully understand and acknowledge, and that the content and extension of such provisions herein contained are perfectly clear to them. |

2.3. As Partes declaram, para todos os efeitos, ter lido atentamente todas as disposições deste instrumento, as quais foram por eles perfeitamente entendidas e assimiladas, não mantendo qualquer dúvida sobre o conteúdo e extensão das condições deste Termo Aditivo. |

| |

|

| 2.4. The Parties confirm and acknowledge all other terms and dispositions of the Main Agreement that do not contravene the dispositions of this Amendment. |

2.4. As Partes ratificam as demais cláusulas, termos e condições do Contrato Principal que não contrariem as disposições do presente Termo Aditivo. |

| |

|

| 2.5. In case of any doubt or misinterpretation, the Portuguese Language version of this Amendment shall prevail. |

2.5. Na hipótese de qualquer dúvida ou erro de interpretação, a versão em língua portuguesa deste Termo Aditivo deve prevalecer. |

| |

|

| IN WITNESS WHEREOF, the parties hereto have executed the Amendment herein in four (4) counterparts of equal content and form, in the presence of the witnesses below. |

E, por assim estarem certas e ajustadas, assinam este instrumento em 4 (quatro) vias de igual teor e forma, na presença das testemunhas abaixo. |

| |

|

| Sao Paulo, June 16th, 2015. |

São Paulo, 16 de junho de 2015 |

/s/ Elder Marcos Vieira

Da Conceicao

ELDER MARCOS VIEIRA DA CONCEIÇÃO

/s/ Marcia Cristina Vieira

Da Conceicao Antunes

MÁRCIA CRISTINA VIEIRA

DA CONCEIÇÃO ANTUNES

/s/ Gary Pokrassa –

18 June 2015

LAKELAND INDUSTRIES INC.

/s/ Eduardo Fernades Tavares

– 18 June 2015

LAKE BRASIL INDÚSTRIA

E COMÉRCIO DE ROUPAS E EQUIPAMENTOS DE PROTEÇÃO INDIVIDUAL LTDA.

| Page 5 of 6 |

Página 5 de 6 |

WITNESSES/TESTEMUNHAS:

1.

Name/Nome:

I.D./R.G.:

C.P.F./M.F.

2. ___________________________________________________

Name/Nome:

I.D./R.G.:

C.P.F./M.F.

| Page 6 of 6 |

Página 6 de 6 |

Exhibit 99.1

Lakeland Industries Announces Early Payoff

of Arbitration Settlement to Accelerate Exit From Brazil

Payoff Results in a Gain of $224,000

RONKONKOMA, NY – June 22, 2015 --

Lakeland Industries, Inc. (NASDAQ: LAKE), a leading global manufacturer of industrial protective clothing for industry, municipalities,

healthcare and to first responders on the federal, state and local levels, today announced it has successfully amended the Settlement

Agreement (the “original Settlement Agreement”) from September 11, 2012 relating to an arbitration with the former

management of its Brazil subsidiary. The amended Settlement Agreement (the “new Settlement Agreement”) includes a discounted

early payoff of the outstanding balance owed to the former management of the Brazil subsidiary pursuant to the original Settlement

Agreement.

Following the satisfaction of all regularly

scheduled payments of the original Settlement Agreement to date, the Company has agreed to complete the payoff of the new Settlement

Agreement by June 30, 2015, which will satisfy the remaining US$3,750,000 balance under the original Settlement Agreement. The

payoff amount of the new Settlement Agreement is US$3,413,000, resulting in a gain of $224,000 after allowing for imputed interest

on the original Settlement Agreement. As part of the original Settlement Agreement, all alleged outstanding claims against the

Company arising from an arbitration proceeding in Brazil involving the Company and the former management of the Brazil subsidiary

were settled for an aggregate of approximately US$8,500,000, which was payable by the Company over a period of six years. Prior

to the new Settlement Agreement, the remaining amount owed under the original Settlement Agreement was to be paid in quarterly

installments of US$250,000 through December 31, 2018.

The Amendment to the original Settlement

Agreement contains a general release of claims by the former management of the Brazil subsidiary in favor of the Company and its

past or present officers, directors, and other affiliates, as well as other closing conditions. Lakeland’s senior lender,

Alostar Bank of Commerce, has consented to the transactions contemplated by the Amendment.

Christopher J. Ryan, President and Chief

Executive Officer of Lakeland Industries, commented, “The payoff and satisfaction of the Arbitration Settlement clears an

essential hurdle in our path for a complete exit from Brazil. As a result, we have effectively removed a major uncertainty with

a potentially exploding default provision resulting from the arbitration and saved $337,000 in future payments. With our exit from

Brazil expected to be complete by the end of July, we’ll be able to further sharpen our focus on organic growth initiatives,

enhancing profitability and driving free cash flow generation from continuing operations.”

About Lakeland Industries, Inc.:

Lakeland Industries, Inc. (NASDAQ: LAKE)

manufactures and sells a comprehensive line of safety garments and accessories for the industrial protective clothing market.

The Company’s products are sold by a direct sales force and through independent sales representatives to a network of over

1,000 safety and mill supply distributors. These distributors in turn supply end user industrial customers such as chemical/petrochemical,

automobile, steel, glass, construction, smelting, janitorial, pharmaceutical and high technology electronics manufacturers, as

well as hospitals and laboratories. In addition, Lakeland supplies federal, state, and local government agencies, fire and police

departments, airport crash rescue units, the Department of Defense, the Centers for Disease Control and Prevention, and many other

federal and state agencies. For more information concerning Lakeland, please visit the Company online at www.lakeland.com.

Contacts:

| Lakeland Industries |

Darrow Associates |

| 631-981-9700 |

631-367-1866 |

| Christopher Ryan, CJRyan@lakeland.com |

Jordan Darrow, jdarrow@darrowir.com |

| Gary Pokrassa, GAPokrassa@lakeland.com |

|

# # #

“Safe Harbor” Statement under

the Private Securities Litigation Reform Act of 1995: Forward-looking statements involve risks, uncertainties and assumptions as

described from time to time in Press Releases and Forms 8-K, registration statements, quarterly and annual reports and other reports

and filings filed with the Securities and Exchange Commission or made by management. All statements, other than statements of historical

facts, which address Lakeland’s expectations of sources or uses for capital or which express the Company’s expectation

for the future with respect to financial performance or operating strategies can be identified as forward-looking statements. As

a result, there can be no assurance that Lakeland’s future results will not be materially different from those described

herein as “believed,” “projected,” “planned,” “intended,” “anticipated,”

“estimated” or “expected,” or other words which reflect the current view of the Company with respect to

future events. We caution readers that these forward-looking statements speak only as of the date hereof. The Company hereby expressly

disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change

in the Company’s expectations or any change in events conditions or circumstances on which such statement is based.

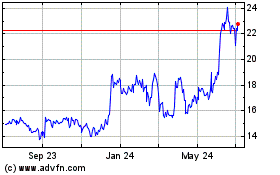

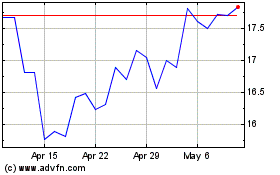

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lakeland Industries (NASDAQ:LAKE)

Historical Stock Chart

From Jul 2023 to Jul 2024