Kaiser Aluminum Corporation (NASDAQ:KALU) today reported a net loss

of $22.1 million for the quarter ended September 30, 2008,

reflecting a $43.8 million non-cash, mark-to-market loss (pretax)

on derivative positions, primarily due to declining metal prices,

as well as an adverse operating impact of the previously discussed

Anglesey outage, estimated at approximately $20 million (pretax).

Net loss per diluted share was $1.11 for the third quarter 2008.

Excluding the impact of non run-rate items, primarily the

mark-to-market loss, and the Anglesey outage, adjusted net income

and earnings per diluted share were $15.7 million and a positive

$0.77, respectively. �Operating results for the quarter were

largely in line with our expectations, as the underlying

fundamentals of our core fabricated products business generally

remained strong and consistent with market trends discussed during

our previous earnings conference call,� said Jack A. Hockema,

President, CEO and Chairman. �We continued to experience solid

demand for aerospace and defense products, but began to see the

early trends of distributor de-stocking in our rod and bar

business. Consolidated operating income was $30 million after

adjustment for non-run-rate items and the impact of the Anglesey

outage.� Consolidated net sales for the third quarter ended

September 30, 2008 were $369.2 million, increasing slightly from

net sales of $366.7 million reported in the prior year quarter. Net

sales were favorably impacted by higher realized prices in the

Fabricated Products and Primary Aluminum segments, offset by a 40

percent reduction in Primary Aluminum shipments due to the outage

at Anglesey. The Company reported a $36.5 million operating loss in

the third quarter 2008 compared to operating income of $44.0

million in the third quarter 2007. The third quarter operating loss

reflects the $43.8 million non-cash, non-run-rate mark-to-market

loss mentioned above, which essentially reversed the non-cash

mark-to-market gains reported in the first half 2008, as well as

the $20 million operating impact of the Anglesey outage. Excluding

these items, adjusted operating income for the third quarter 2008

was a positive $30 million compared to $37 million in the prior

year quarter. Year-to-Date Consolidated Financial Results For the

nine months ended September 30, 2008, consolidated net sales

increased 3 percent to $1,181.7 million compared to $1,144.0

million in the nine months ended September 30, 2007. The increase

in net sales is primarily the result of a 5 percent increase in

shipments from the Fabricated Products segment and a 5 percent

increase in Primary Aluminum pricing partially offset by a 17

percent reduction in shipments in the Primary Aluminum segment due

to the Anglesey outage. Consolidated operating income decreased to

$69.6 million compared to $139.0 million in the prior year period.

Net income of $39.8 million for the nine months ended September 30,

2008, compared to $76.6 million for the same period in 2007. The

2008 periods primarily reflect a $27 million impact due to the

outage at Anglesey, higher energy related costs and operating

inefficiencies in the rod and bar value stream that will be

addressed through the Kalamazoo investment initiative. Earnings per

diluted share were $1.95 for the nine months ended September 30,

2008, compared to $3.77 in the prior year period. Fabricated

Products Operating income for the Fabricated Products segment was

$19.5 million for the third quarter 2008 compared to $39.8 million

in the prior-year period. Adjusting for non-run-rate items,

primarily mark-to-market losses on natural gas and currency hedging

positions, operating income for the quarter would have been $33

million compared to $39 million in the prior year quarter,

reflecting stronger value-added sales which were more than offset

by cost pressures from energy and other manufacturing costs. For

the nine month period ended September 30, 2008, operating income

was $102.4 million compared to $129.3 million for the comparable

period in 2007. The 2008 period reflects stronger value-added

sales, which was more than offset by unfavorable energy related

costs, higher manufacturing costs and major maintenance expense,

and higher depreciation related to the commissioning of new

production assets. The nine month period also was impacted by non

run-rate mark-to-market losses on natural gas and currency

derivative positions. Operating income for both the quarter and

nine month periods of the prior year, 2007, reflected record

results in the Fabricated Products segment. �The final phase of our

heat treat plate expansion is now complete, providing capacity that

should lead to record heat treat plate shipments in the fourth

quarter,� said Mr. Hockema. �While we expect overall demand for

aerospace and defense applications to remain strong, the current

credit crisis creates significant uncertainty regarding U.S.

industrial demand that affects other parts of our business. As a

result, we continue to take prudent actions to maintain our strong

balance sheet and competitive position in today�s environment.�

Primary Aluminum Third quarter operating results in the Primary

Aluminum segment were negatively impacted by approximately $20

million from the Anglesey outage as well as $34.1 million of

non-cash, non-run-rate mark-to-market losses on metal and currency

derivative positions. The impact of these items resulted in an

operating loss of $44.9 million for the third quarter 2008,

compared to operating income of $13.4 million for the third quarter

2007. Additionally, the third quarter results reflect a favorable

impact of higher realized pricing offset by the impact of

unfavorable currency exchange rates net of hedging. As previously

noted, the Company was unable to offset the operating loss with

income from an insurance settlement in the third quarter, but it

expects insurance proceeds to ultimately cover losses. The timing

and amount of the insurance settlement are uncertain. Operating

income for the nine months ended September 30, 2008 was $3.8

million compared to $31.8 million in the prior year period,

primarily due to the $27 million impact of the outage at Anglesey

mentioned above, favorable realized pricing, higher power costs,

and the net impact of unfavorable currency exchange rates net of

hedging. Anglesey is anticipated to return to full production by

the end of the fourth quarter. While Anglesey continues to pursue

affordable power beyond the September 2009 contract expiration, it

additionally is evaluating other strategic alternatives, including

a potential facility shutdown. An ultimate shutdown of the

operation would have no direct impact on the Company�s core

Fabricated Products business. Corporate Highlights During the third

quarter, the Company utilized cash and revolver borrowings to fund

higher levels of working capital, investment in strategic capital

projects and the repurchase of stock under its authorized share

repurchase program. The Company has ready access to its committed

revolving credit facility to meet operating cash requirements. The

final phase of the Company�s heat treat plate expansion project at

the Trentwood facility is now complete, increasing production

capacity to meet existing aerospace contract demand and other heat

treat plate applications. The new Kalamazoo project, a core

component of the Company�s business strategy, remains on track to

begin start-up in late 2009. This investment will improve operating

efficiency and significantly improve the overall cost structure in

the rod and bar value stream. Summary Comments �Although we

continue to remain bullish on aerospace and defense demand both in

the near term and long term, the current credit crisis has

heightened the risk of a global recession,� said Mr. Hockema. �The

markets we serve are cyclic, but our businesses are well positioned

to manage through this period of economic uncertainty. Consistent

with our management approach and philosophy, we will aggressively

flex costs in response to changing market conditions. Additionally,

we will continue to maintain a strong balance sheet and a prudent

liquidity cushion to fund committed strategic investments and

preserve our financial strength until we have further clarity on

the future credit environment.� Conference Call Kaiser Aluminum

will host a conference call on November 5, 2008 at 10:00am (Pacific

Time); 12:00pm (Central Time); 1:00pm (Eastern Time), to discuss

third quarter 2008 results. To participate, call the conference

call line at 1-877-660-8922. A link to the simultaneous web cast

can be accessed on the company website at

http://investors.kaiseraluminum.com/events.cfm. A copy of a

presentation will be available for download prior to the start of

the call. A replay of the conference call will be available at the

same website location until December 5, 2008. Non-GAAP Financial

Measures The press release contains certain non-GAAP financial

measures. A �non-GAAP financial measure� is defined as a numerical

measure of a company�s financial performance that excludes or

includes amounts so as to be different than the most directly

comparable measure calculated and presented in accordance with GAAP

in the statements of income, balance sheets or statements of cash

flow of the company. Pursuant to the requirements of Regulation G,

the Company has provided reconciliation of non-GAAP financial

measures to the most directly comparable financial measure in the

accompanying tables. The non-GAAP financial measures used within

this earnings release are operating profit, net income (loss) and

earnings (loss) per diluted share, excluding non-run rate and

non-operating gains and losses. These measures are presented

because management uses this information to monitor and evaluate

financial results and trends and believes this information to also

be useful for investors. Kaiser Aluminum, headquartered in Foothill

Ranch, Calif., is a leading producer of fabricated aluminum

products, serving customers worldwide with highly-engineered

solutions for aerospace and high-strength, general engineering, and

custom automotive and industrial applications. The company�s North

American facilities annually produce more than 500 million pounds

of value-added sheet, plate, extrusions, forgings, rod, bar and

tube products, adhering to traditions of quality, innovation and

service that have been key components of our culture since the

company was founded in 1946. The company�s stock is included in the

Russell 2000� index. For more information, please visit

www.kaiseraluminum.com. This press release contains statements

based on management�s current expectations, estimates and

projections that constitute �forward-looking statements� within the

meaning of the Private Securities Litigation Reform Act of 1995

involving known and unknown risks and uncertainties that may cause

actual results, performance or achievements of the company to be

materially different from those expressed or implied. Kaiser

Aluminum cautions that such forward-looking statements are not

guarantees of future performance or events and involve significant

risks and uncertainties and actual events may vary materially from

those expressed or implied in the forward-looking statements as a

result of various factors. These factors include: (a) changes in

economic or aluminum industry business conditions generally,

including supply, demand and credit conditions; (b) changes in the

markets served by the company, including aerospace, defense,

general engineering, automotive, distribution and other markets,

including changes impacting the volume, price or mix of products

sold by the company; (c) the company�s ability to complete its

expansion and other organic growth projects as planned and by

targeted completion dates; (d) the company�s ability to effectively

address energy related costs and operating inefficiencies through

surcharges and other initiatives; (e) the company�s ability to meet

contractual commitments and obligations to supply products meeting

required specifications;(f) customer performance; (g) uncertainty

with respect to the future operation of Anglesey, including

Anglesey�s ability to successfully restore capacity and assert

insurance claims for the financial losses of Anglesey and its

owners resulting from the recent outage; as well as Anglesey�s

ability to secure power beyond the expiration of the current power

contract in the context of declining metal prices, continuing high

power prices and potentially significant pension funding

obligations driven by the financial market crisis; (h) changes in

competitive factors in the markets served by the company; (i)

developments in technology used by the company, its competitors or

its customers; (j) changes in accounting that may affect the

company�s reported earnings, operating income or results; and (k)

other risk factors summarized in the company�s reports filed with

the Securities and Exchange Commission, including the company's

Form 10-K for the year ended December 31, 2007. As more fully

described in these reports, �non-run-rate� items are items that,

while they may occur from period to period, are particularly

material to results, impact costs primarily as a result of external

market factors and may not occur in future periods if the same

level of underlying performance were to occur. All information in

this release is as of the date of the release. The company

undertakes no duty to update any forward-looking statement to

conform the statement to actual results or changes in the company�s

expectations. KAISER ALUMINUM CORPORATION AND SUBSIDIARY COMPANIES

� STATEMENTS OF CONSOLIDATED INCOME (LOSS)(1)(2) (Unaudited) (In

millions of dollars except share and per share amounts) � � �

Quarter Ended September 30, � Nine Months Ended September 30, �

2008 � 2007 2008 � 2007 Net sales $ 369.2 � $ 366.7 � $ 1,181.7 � $

1,144.0 � Costs and expenses: Cost of products sold, excluding

depreciation 383.7 303.3 1,044.2 954.4 Depreciation and

amortization 3.6 3.0 10.8 8.3 Selling, administrative, research and

development, and general 19.8 17.8 58.3 56.0 Other operating

(benefits) charges, net (1.4 ) (1.4 ) (1.2 ) (13.7 ) Total costs

and expenses 405.7 � 322.7 � 1,112.1 � 1,005.0 � Operating income

(loss) (36.5 ) 44.0 69.6 139.0 Other income (expense): Interest

expense (.3 ) (1.0 ) (.8 ) (2.2 ) Other income (expense), net (.2 )

1.8 � 1.0 � 4.1 � Income (loss) before income taxes (37.0 ) 44.8

69.8 140.9 Income tax benefit (provision) 14.9 � (20.0 ) (30.0 )

(64.3 ) Net income (loss) $ (22.1 ) $ 24.8 � $ 39.8 � $ 76.6 �

Earnings per share � Basic: Net income (loss) per share $ (1.11 ) $

1.24 � $ 1.99 � $ 3.83 � Earnings per share � Diluted: Net income

(loss) per share $ (1.11 ) $ 1.22 � $ 1.95 � $ 3.77 � Weighted

average number of common shares outstanding (000): Basic 19,995 �

20,026 � 20,032 � 20,010 � Diluted 19,995 � 20,326 � 20,377 �

20,291 � � (1) The consolidated financial statements include the

statements of the Company and its wholly owned subsidiaries and a

49% interest in Anglesey Aluminium Limited (�Anglesey�), which owns

an aluminum smelter in the United Kingdom. � (2) Please refer to

the Company�s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2008 for additional detail regarding the items in the

table. KAISER ALUMINUM CORPORATION AND SUBSIDIARY COMPANIES �

SELECTED OPERATIONAL AND FINANCIAL INFORMATION (1)(2) (Unaudited)

(In millions of dollars except shipments and average realized

third-party sales price) � � Quarter Ended September 30, � Nine

Months Ended September 30, 2008 � 2007 2008 � 2007 Shipments

(millions of pounds): Fabricated Products 135.3 135.2 435.6 413.1

Primary Aluminum 24.2 � 40.0 � 98.0 � 118.6 � 159.5 175.2 533.6

531.7 Average Realized Third Party Sales Price (per pound):

Fabricated Products $2.48 $2.34 $2.40 $2.39 Primary Aluminum $1.42

$1.26 $1.41 $1.34 Net Sales: Fabricated Products $334.9 $316.2

$1,043.3 $985.3 Primary Aluminum 34.3 � 50.5 � 138.4 � 158.7 �

Total Net Sales $369.2 $366.7 $1,181.7 $1,144.0 Segment Operating

(Loss) Income: Fabricated Products $19.5 $39.8 $102.4 $129.3

Primary Aluminum (44.9 ) 13.4 3.8 31.8 Corporate and Other (12.5 )

(10.6 ) (37.8 ) (35.8 ) Other Operating Benefits (Charges), Net 1.4

� 1.4 � 1.2 � 13.7 � Total Operating (Loss) Income $(36.5 ) $44.0

$69.6 $139.0 Net (Loss) Income $(22.1 ) $24.8 $39.8 $76.6 Capital

Expenditures, (net of change in accounts payable) $22.7 $15.4 $61.0

$43.1 � (1) The consolidated financial statements include the

statements of the Company and its wholly owned subsidiaries and a

49% interest in Anglesey Aluminium Limited (�Anglesey�), which owns

an aluminum smelter in the United Kingdom. � (2) Please refer to

the Company�s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2008 for additional detail regarding the items in the

table. KAISER ALUMINUM CORPORATION AND SUBSIDIARY COMPANIES � �

CONDENSED CONSOLIDATED BALANCE SHEETS (1)(2) (Unaudited) (In

millions of dollars) � � September 30, 2008 December 31, 2007

Assets Current assets(3) 467.9 454.6 Investments in and advances to

unconsolidated affiliate 37.6 41.3 Property, plant, and equipment �

net 272.8 222.7 Net assets in respect of VEBAs 135.0 134.9 Deferred

tax assets � net 246.5 268.6 Other assets 50.5 � 43.1 � Total $

1,210.3 � $ 1,165.2 � Liabilities & Stockholders� Equity

Current liabilities 170.6 165.4 Long-term liabilities 54.4 57.0

Revolving Credit Facility 34.7 ? Commitments and contingencies �

Stockholders� equity: Common stock .2 .2 Additional capital 957.1

948.9 Retained earnings 142.4 116.1 Common stock owned by Union

VEBA subject to transfer restrictions, at reorganization value

(116.4 ) (116.4 ) Treasury stock, at cost, 572,700 shares at

September 30, 2008 (28.1 ) ? Accumulative other comprehensive

income (loss) (4.6 ) (6.0 ) Total stockholders� equity 950.6 �

942.8 � Total $ 1,210.3 � $ 1,165.2 � � (1) The consolidated

financial statements include the statements of the Company and its

wholly owned subsidiaries and a 49% interest in Anglesey Aluminium

Limited (�Anglesey�), which owns an aluminum smelter in the United

Kingdom. � (2) Please refer to the Company�s Quarterly Report on

Form 10-Q for the quarter ended September 30, 2008 for additional

detail regarding the items in the table. � (3) Includes Cash and

cash equivalents of $1.1 and $68.7, Inventories of $269.2 and

$207.6, and net Trade receivables of $115.4 and $96.5 at September

30, 2008, and December 31, 2007, respectively. Reconciliation of

Non-GAAP Measures � The following table presents a reconciliation

of non-GAAP measures presented in the earnings release for the

quarter ended September 30, 2008: � � � Fabricated Products �

Primary Aluminum � Corporate � Consolidated GAAP operating income

(loss) $ 19.5 $ (44.9 ) $ (11.1 ) $ (36.5 ) Mark to market losses

9.7 34.1 ? 43.8 Anglesey fire impact ? 20.1 ? 20.1 Other

non-run-rate items(1) 3.9 ? � (1.6 ) 2.3 � Total adjustments 13.6

54.2 (1.6 ) 66.2 Operating income (loss), excluding no-run-rate and

non-operating gains and losses $ 33.1 $ 9.3 � $ (12.7 ) $ 29.7 � �

GAAP net income $ (22.1 ) Total adjustments (net of tax) 37.8 � Net

income, excluding no-run-rate and non-operating gains and losses $

15.7 � Diluted loss per share (GAAP) $ (1.11 ) Diluted income per

share, excluding no-run-rate and non-operating gains and losses $

.77 � � (1) Other non-run-rate items represent non-cash LIFO

charges and metal gains (losses) for the Fabricated Products

segment and primarily bad debt recoveries from pre-emergence

write-offs for the Corporate segment.

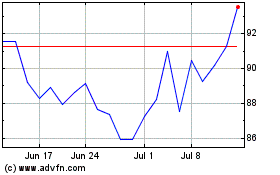

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From May 2024 to Jun 2024

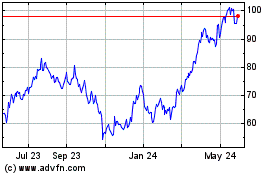

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Jun 2023 to Jun 2024