Kaiser Aluminum Announces Initial Quarterly Dividend Payment

June 27 2007 - 8:00AM

Business Wire

Kaiser Aluminum (NASDAQ:KALU) today announced that its Board of

Directors has declared an initial quarterly cash dividend payment

of $0.18 per share on the company�s outstanding common stock. This

initial dividend will be payable on August 17, 2007 to shareholders

of record at the close of business on July 27, 2007. �We are

pleased that our shareholders will be able to participate more

directly in the company�s profits through this cash dividend,� said

Jack A. Hockema, chairman, president and CEO of Kaiser Aluminum.

�With confidence in our financial strength, Kaiser�s board is

comfortable introducing a dividend while continuing to pursue

significant investments in initiatives for the long-term growth of

the company. Additionally, we believe a dividend will allow our

stock to be attractive to a broader range of investors.� Kaiser

Aluminum is a leading producer of fabricated aluminum products for

aerospace and high-strength, general engineering, and automotive

and custom industrial applications. The company has more than 2,000

employees and 11 plants in North America and produces more than 500

million pounds annually of value-added sheet, plate, extrusions,

forgings, rod, bar and tube. For more information, please visit

www.kaiseraluminum.com. F-1075 Certain statements in this release

relate to future events and expectations and, as a result,

constitute forward-looking statements involving known and unknown

risks and uncertainties that may cause actual results, performance

or achievements of the company to be different from those expressed

or implied in the forward-looking statements. Important factors

that could cause actual results to differ materially from those in

the forward-looking statements include: (a) the effectiveness of

management's strategies and decisions; (b) adverse changes in

economic or aluminum industry conditions generally; (c) adverse

changes in the markets served by the company, including the

aerospace, defense, general engineering, automotive, distribution

and other markets; (d) the company�s inability to achieve the level

of cash generation, margin improvements, cost savings, or earnings

or revenue growth anticipated by management; (e) the impact of the

company�s future earnings, financial condition, capital

requirements and other factors on its ability to pay future

dividends and any decision by the company�s board of directors in

that regard; and (f) the other risk factors summarized in the

company's Form 10-K for the year ended December 31, 2006 and other

reports filed with the Securities and Exchange Commission.

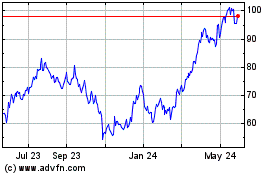

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Jun 2024 to Jul 2024

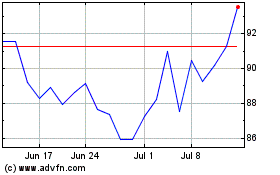

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Jul 2023 to Jul 2024